How our tax codes let the rich get richer: 'We need better tax Things To Know Before You Buy

US billionaire tax proposal seems to unite Democrats - Reuters for Dummies

When they do, they get paid and they get taxed. The federal government considers nearly every dollar workers earn to be "income," and companies take taxes straight out of their incomes. The Bezoses of the world have no requirement to be paid an income. Bezos' Amazon earnings have actually long been set at the middle-class level of around $80,000 a year.

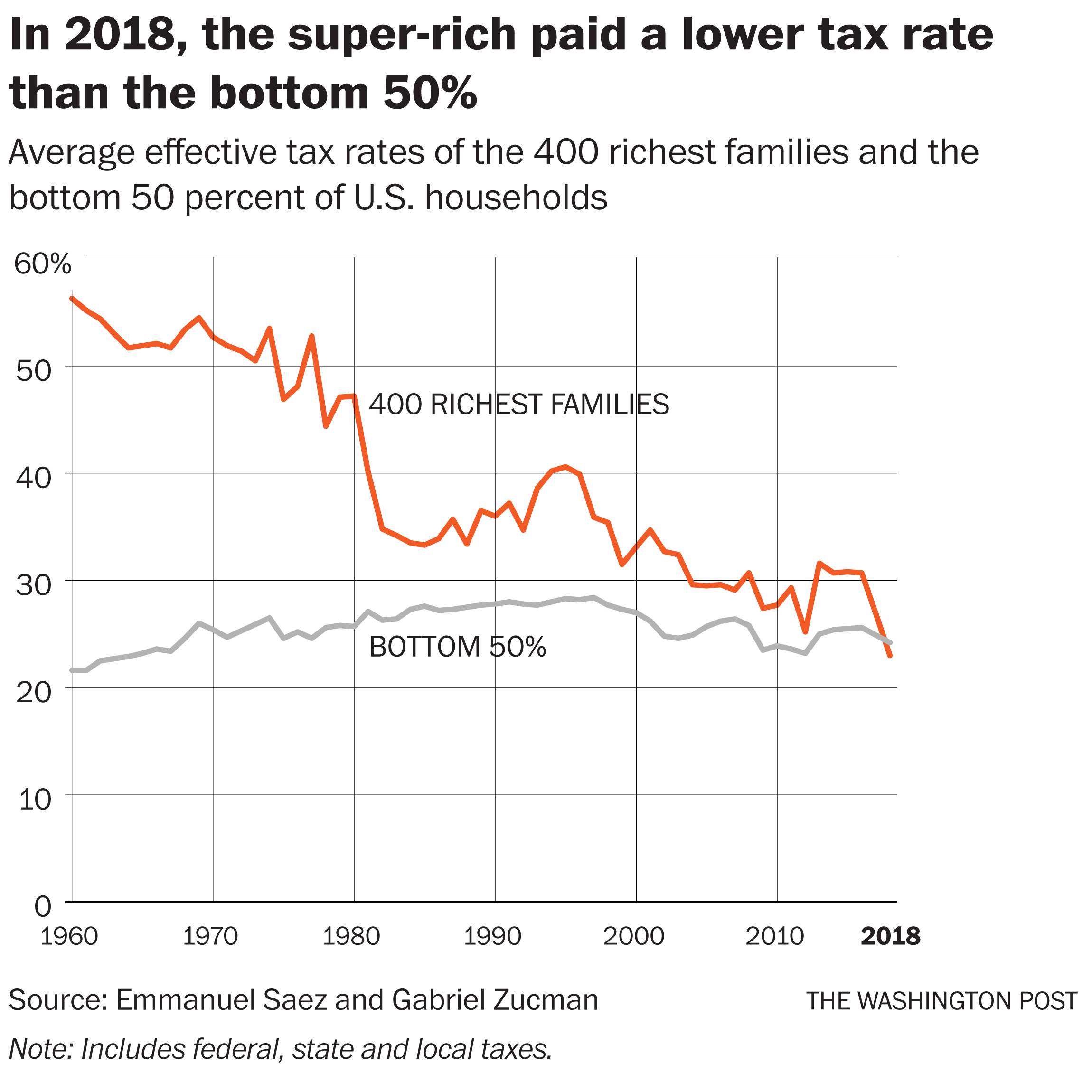

Steve Jobs took $1 in salary when he went back to Apple in the 1990s. Facebook's Zuckerberg, Oracle's Larry Ellison and Google's Larry Page have all done the exact same. Yet this is not the self-effacing gesture it seems: Wages are taxed at a high rate. The top 25 wealthiest Americans reported $158 million in earnings in 2018, according to the internal revenue service information.

What could the US afford if it raised billionaires' taxes? We do the math - US taxation - The Guardian

What could the US afford if it raised billionaires' taxes? We do the math - US taxation - The GuardianA Biased View of Taxes and the rich: America's history of favoritism and

1% of what they listed on their tax kinds as their overall reported earnings. The rest primarily originated from dividends and the sale of stock, bonds or other financial investments, which are taxed at lower rates than salaries. The ultrawealthy typically hang on to shares in the business they have actually established. Buffett, for example, has actually famously kept his stock in Berkshire Hathaway, the conglomerate that owns Geico, Duracell and stakes in American Express and Coca-Cola.

From 2015 through 2018, he reported annual income varying from $11. 6 million to $25 million. That might seem like a lot, however Buffett ranks as approximately the world's sixth-richest person he's worth $110 billion since Forbes' estimate in May 2021. At how billionaires pay less taxes in 2015 reported higher earnings than him, according to internal revenue service information.

Are US Billionaires Really Paying A Lower Tax Rate Than Working People? Probably Not- Tax Policy Center

Are US Billionaires Really Paying A Lower Tax Rate Than Working People? Probably Not- Tax Policy Center US billionaires paid lower tax rate than working class last year, researchers say - The Boston Globe

US billionaires paid lower tax rate than working class last year, researchers say - The Boston GlobeAll About Trump's 2017 Tax Cuts Helped Super-rich Pay Lower Rate

Berkshire does not pay a dividend, the sum (a piece of the profits, in theory) that lots of companies pay each quarter to those who own their stock. Buffett has constantly argued that it is better to use that cash to find investments for Berkshire that will further improve the worth of shares held by him and other financiers.