How Young Professionals Can Better Manage Their Finances?

Isshu

The current COVID pandemic has become one of the most challenging yet informative learning experiences in the youngster’s life. This pandemic has been a lesson for everyone. Within the few months of the pandemic, there was a huge loss in jobs, and the economy crashed badly. Besides the health risk, industries, as well as companies, had to tackle various economic consequences. This pandemic has made it necessary for nearly everyone to manage their expenses better and more thoughtfully. If you are a young professional and willing to find ways that can help you manage the expenses, then keep reading to have an idea about how it can be done:

Maintain Separate Bank Accounts

As a young professional, it is the need of an hour to maintain two different accounts. Maintaining two accounts, one for the salary and expenses while the other for the savings, will help you track how much you are saving and how much you can spend. Try to transfer some amount for saving in your other account as soon as your salary gets credited.

Track Expenses Everyday

It is highly essential to keep track of your finances to know where it is going. It is the best way to know about your expenses. You must try to keep an everyday track of these expenses to know where you are spending the most and what are unnecessary expenses that can be stopped. This will help to give you a picture of how your finances look to prevent you from the month-end crunch.

Manage the Debts in a Better Way

As a young salaried professional, there are chances that you are already paying some existing debts like an education loan, vehicle loan, or some other sort of loan. Therefore, it is essential to manage your debts well and make timely EMI payments. Furthermore, it would help you if you cut down the unnecessary expenses. If you have more than one debt, prefer focusing on the costlier loan first while paying the minimum balance of the other ones. With all these tips, you can manage your debt and finances effectively.

Create Saving Goals

Without a sufficient amount of savings, you will probably find yourself in a cash crunch situation. Therefore, it is essential to have saving goals. In addition, saving up in advance will help you meet your goals quicker than the expected time.

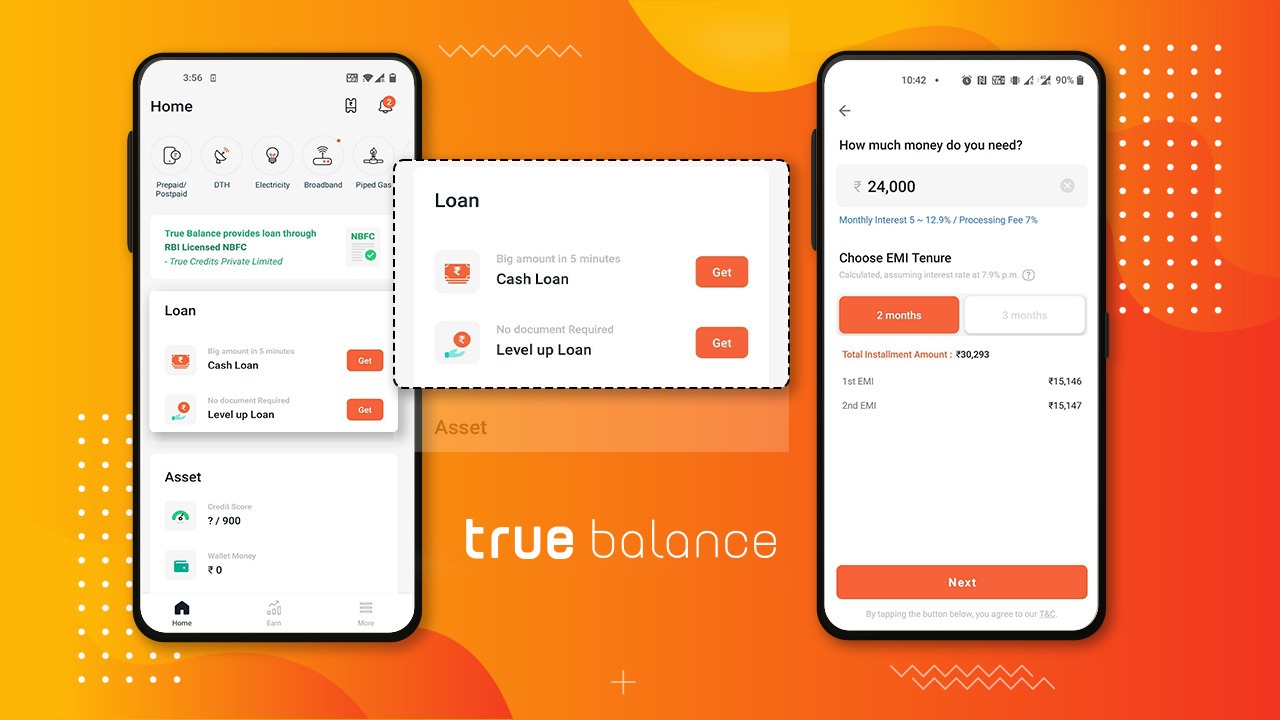

If you do not have sufficient funds and want cash for emergencies, you can apply for a personal loan. TrueBalance is the best loan app that lets borrowers borrow an amount up to INR 50,000 without pleading for any collateral in return. The personal loan interest rate that is charged by lenders on this loan app is 5% which is comparatively less than that charged by other loan apps. Moreover, this loan app accepts and disburses loans in the borrower's account in just 5 minutes, which is amazing! For a personal loan, you can apply via TrueBalance app at any hour of the day as the services are 24*7 hours available. Download TrueBalance app for a safe and instant loan.