How To Win Spread Bet

⚡ ALL INFORMATION CLICK HERE 👈🏻👈🏻👈🏻

How To Win Spread Bet

The margin for UK 100 trading is 5 percent, which means you would deposit £1,413.25 (£5 x 5653 x 5%) to open a trade.

© 2020 Capital Com SV Investments Ltd Regulations Terms and Policies

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

By using the Capital.com website you agree to the use of cookies .

Learn how to spread bet with Capital.com. Read our ultimate spread betting trading guide and explore the real examples to build your own trading strategy.

Learn how to spread bet with Capital.com . Follow our step-by-step spread betting guide covering everything you need to know from opening an account to making your first bet. Read the detailed examples and build your own spread betting strategy.

Financial spread betting is another popular type of derivatives trading that enables traders to speculate on a wide range of markets, including forex , shares , commodities and indices . A tax-free derivative product, spread betting is available for residents of the UK and Ireland.

As with CFD trading , when you spread bet, you decide whether the price of an asset is likely to go up or down and take a long or a short position accordingly. Spread betting is flexible as you can potentially profit from rising or falling markets.

Having downloaded the Capital.com AI-powered app you get a trusted spread-betting partner ensuring you get the ultimate trading experience. At Capital.com you can open an account in just a few minutes.

Verify your identity, make an initial deposit with a credit/debit card or via bank transfer, and voilá – you are good to open your first trade.

Getting deeper into trading you’ll encounter various spread betting strategies. Although you may find them effective, only practice will show what works best for you. Building a trading plan, you will have to develop your own approach, considering the following parameters:

Some of the benefits of making your own trading strategy is to eliminate emotional trades and add a clear structure to your decision-making process.

Capital.com spread betting app gives you access to more than 2,000 popular markets, including forex, stocks, indices, commodities and cryptocurrencies.

There is an AI-powered newsfeed full of analytical articles and info-rich videos, earnings reports and IPO announcements; an economic calendar with a full schedule of global economic events that could move markets and may help you find your next trade.

Advanced charts, drawing tools and 70+ technical indicators will enable you to conduct a thorough technical analysis of the selected market and spot the best levels to enter and exit trades.

Effective risk management tools, including instant price alerts, stop-loss and take profit orders, and negative balance protection will help you to protect your capital and minimise risks.

Once you have chosen the market you would like to trade today, you will have to decide which direction to choose. Whether you believe the price is going to go up and open a long position (Buy), or you think the price will go down and take a short position (Sell).

To open a spread bet you also need to define the size of your position. In spread betting, the amount you want to bet per point of the asset’s price movement is your stake.

Please, never forget to manage your risk before entering the market. Remember that many traders feel it is important to place stop-loss and take-profit orders to reduce the risks associated with derivatives trading.

When you feel ready, open a short or a long position on the chosen market. Track the performance of your trade to close it in profit, or with a minimum loss if the market turns against you.

How to spread bet in practice? Let’s take a closer look at spread betting trading through several examples with different outcomes for traders.

In our example, Sainsbury's stock (SBRY) is trading at 202.7/203.5, where 202.7 is the sell price and 203.5 is the buy price. The spread in this example is 0.8.

Spread betting trades on the Sainsbury’s stock are executed in £x per penny price movement.

For example, if the SBRY price moves up or down by 50 pence (50 points) you would make or lose 50x your stake depending on whether you had sold or bought to open the position.

Let’s say you believe that the Sainsbury’s stock’s price will appreciate and decide to open a buy position – going long at £10 per point. Let’s assume that the margin rate for Sainsbury is 20 percent. This means you will deposit only 20 percent of the full trade’s value. In this example the total position is £10 x 203.5, which gives an overall exposure to Sainsbury's of £2,035.50. Position margin will be 20% of this amount, which means that £407.10 will be allocated from your account against this trade.

Assuming your prediction was correct and the Sainsbury’s shares jump sharply in value in the next couple of days to 253.5/254.3, you decide to exit your buy bet by selling at 253.5, which is the new sell price.

In this case the price has moved in your favour by 50 points (253.5 – 203.5), which means your profit will be £500 (50 x £10).

Unfortunately, in spread betting like in any other type of trading, you can’t always be right. Losses are an inevitable part of trading and your goal is to minimise the risks by developing an effective risk management strategy.

Looking back at our example, let’s assume your buying spread bet was incorrect. Instead of rallying further, Sainsbury’s stock went down by 50 points to 153.5/154.3. To exit your trade you decide to close it by exiting at the sell price of 153.5.

The market moved against you by 50 points (203.5 - 153.5). In this case you will bear a loss of £500 (50 x £10).

If you want to spread bet on indices, you could choose the UK 100. Let’s assume it is trading at 5653/5654. You believe the index price will go down and decide to open a sell position on the UK 100 at £5 per point.

If your forecast is right and the price falls down to 5602/5603, you may decide to close your sell bet by buying at 5603.

In this case the price moved 50 points (5653-5603) in your favour. To calculate your profit you should multiply your stake by the number of points. The profit from this trade will be £250 (£5 x 50).

If your prognosis is wrong and the price of the UK 100 index goes up, you will make a loss. Let’s assume the price reaches 5702/5703 and you feel that the price will continue to rise. To limit your loss, you decide to close the trade by buying at 5703, which is the new buy price.

In this case the price moves 50 points (5703-5653) against you, which means a loss of £250(£5 x 50).

The stop-loss order is the number-one risk management tool to prevent the market from moving against you too far. Many traders view it as absolutely essential, as markets can move very sharply. If you can’t constantly follow markets, the stop-loss and take-profit orders can give you some freedom and confidence to manage your profits and losses.

Once you have opened a spread bet, you can watch its performance and the possible profit or loss in real time. You can exit the trade any time the market is open. When you tap the “close” button your order is executed and your profit or loss is reflected on your account balance. Try how to spread bet in practice, and learn more about its benefits, with Capital.com .

*Tax laws are subject to change and depend on individual circumstances. Tax law may differ in a jurisdiction other than the UK.

Bitcoin price drops Don't miss your trading opportunities

Start trading global markets by creating an account

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% of retail investor accounts lose money when trading CFDs with this provider . You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Please read our Risk Disclosure statement .

Risk warning: transactions with non-deliverable over-the-counter instruments are a risky activity and can bring not only profit but also losses. The size of the potential loss is limited to the size of the deposit. Past profits do not guarantee future profits. Use the training services of our company to understand the risks before you start operations.

Capital Com (UK) Limited is registered in England and Wales with company registration number 10506220. Authorised and regulated by the Financial Conduct Authority (FCA), under register number 793714. Capital Com SV Investments Limited is regulated by Cyprus Securities and Exchange Commission (CySEC) under license number 319/17. Capital Com SV Investments Limited, company Registration Number: 354252, registered address: 28 Octovriou 237, Lophitis Business Center II, 6th floor, 3035, Limassol, Cyprus.

Closed joint-stock company “Capital Com Bel” is regulated by National Bank of the Republic of Belarus, registered by Minsk city executive committee 19.03.2019 with company registration number 193225654. Address: 220030, the Republic of Belarus, Minsk, Internatsionalnaya street 36/1, office 823. Certificate of inclusion in the register of forex companies No. 16 dated 16.04.2019.

How to Spread Bet on Shares, Forex and More | Spread Bet Calculator | IG UK

How to spread bet | Capital.com

Spread betting tutorial | A step by step guide to spread betting

What is Spread Betting and How Does it Work? | CMC Markets

Spread Betting | How to Bet On Sports Guide

Spread betting tutorial | Step by step guide

Word up! Jenna makes sure we say it right with engaging copy and a handful of monkey puns thrown in for good measure.

Matched betting is one of the best ways to make money online , and at OddsMonkey we have all the tools and resources you need to get started. Find out how you can easily turn bookmaker offers into tax free profits today.

Address: 15 Parsons Court, Aycliffe Business Park, County Durham, DL5 6ZE

Email : support@oddsmonkey.com

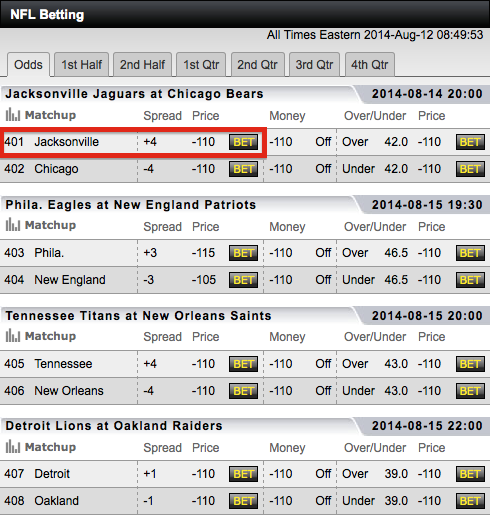

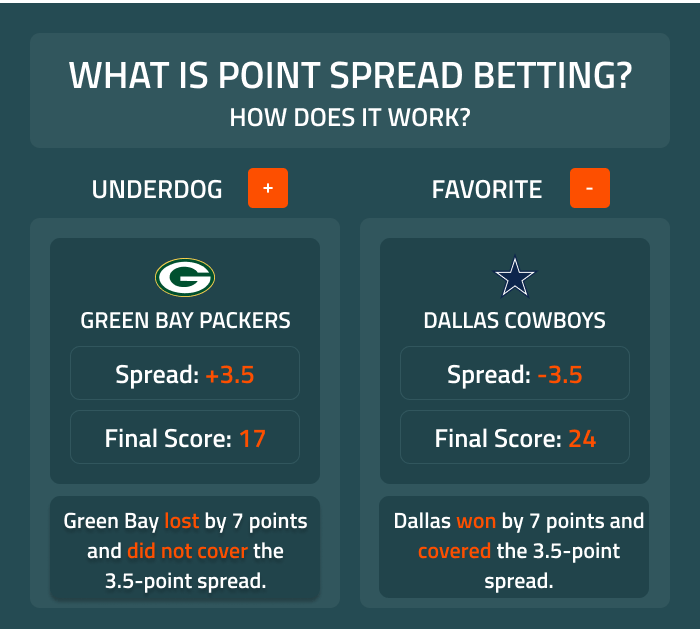

You’ve probably heard about spread betting, but may have been put off by how complicated it looks. But, it’s one of the most exciting methods of betting. This is because the more right you are, the more money you could win. And, well, the more wrong you are, the more money you could lose. But if you have the appetite for big wins, and can stomach the risk of big losses, this spread betting tutorial will help.

If you aren’t 100% sure what spread betting is, read our full guide here .

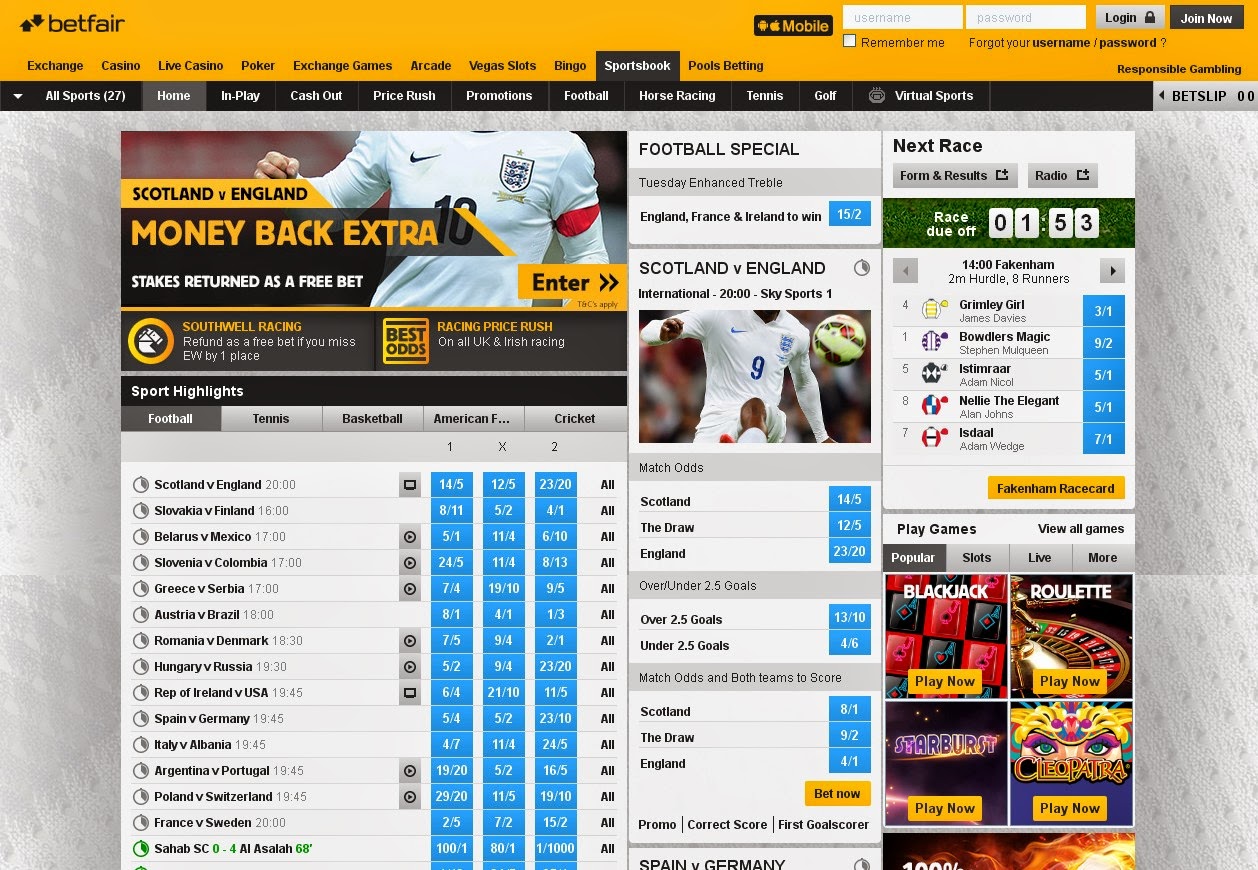

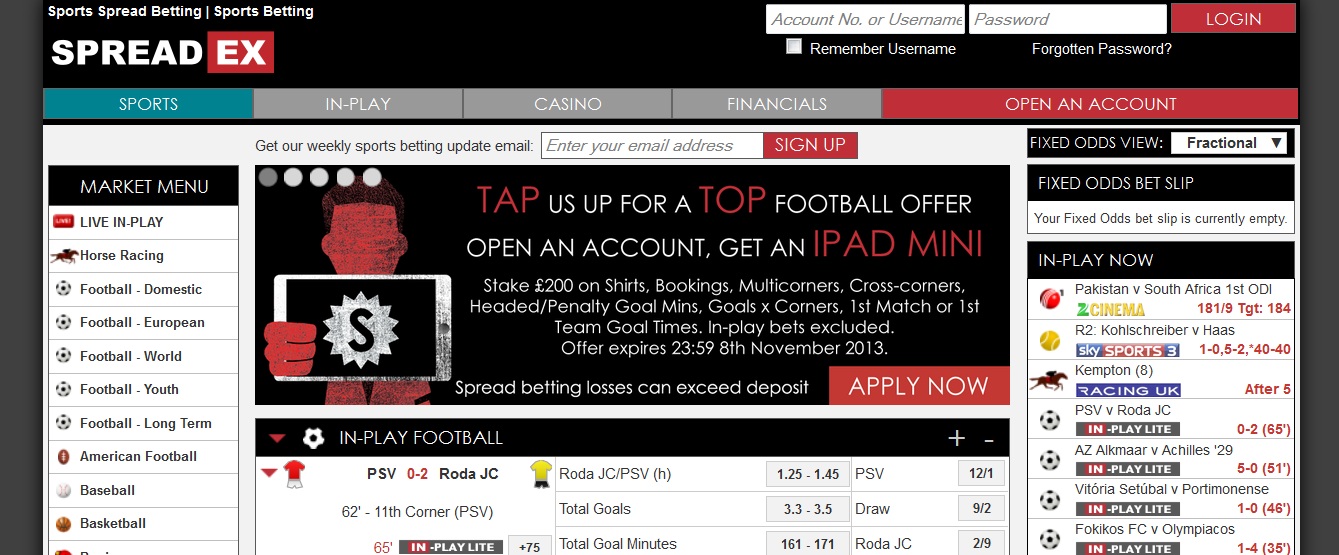

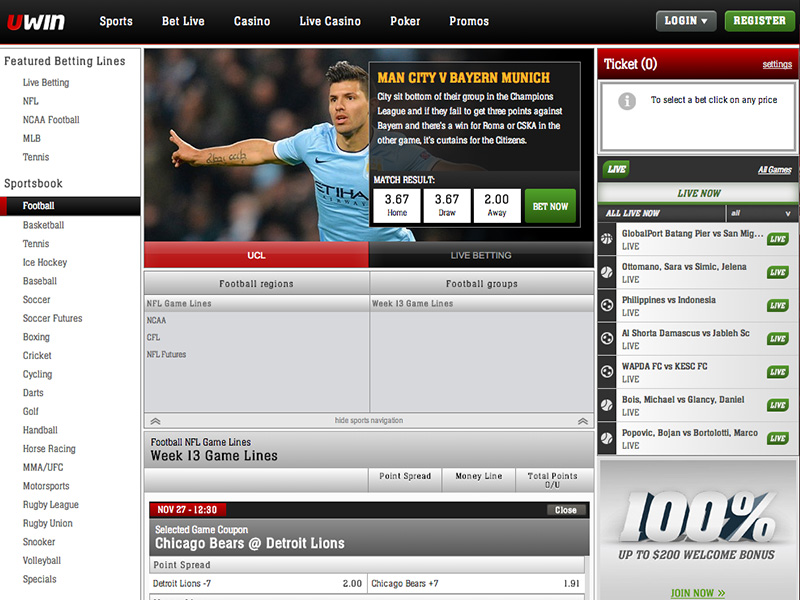

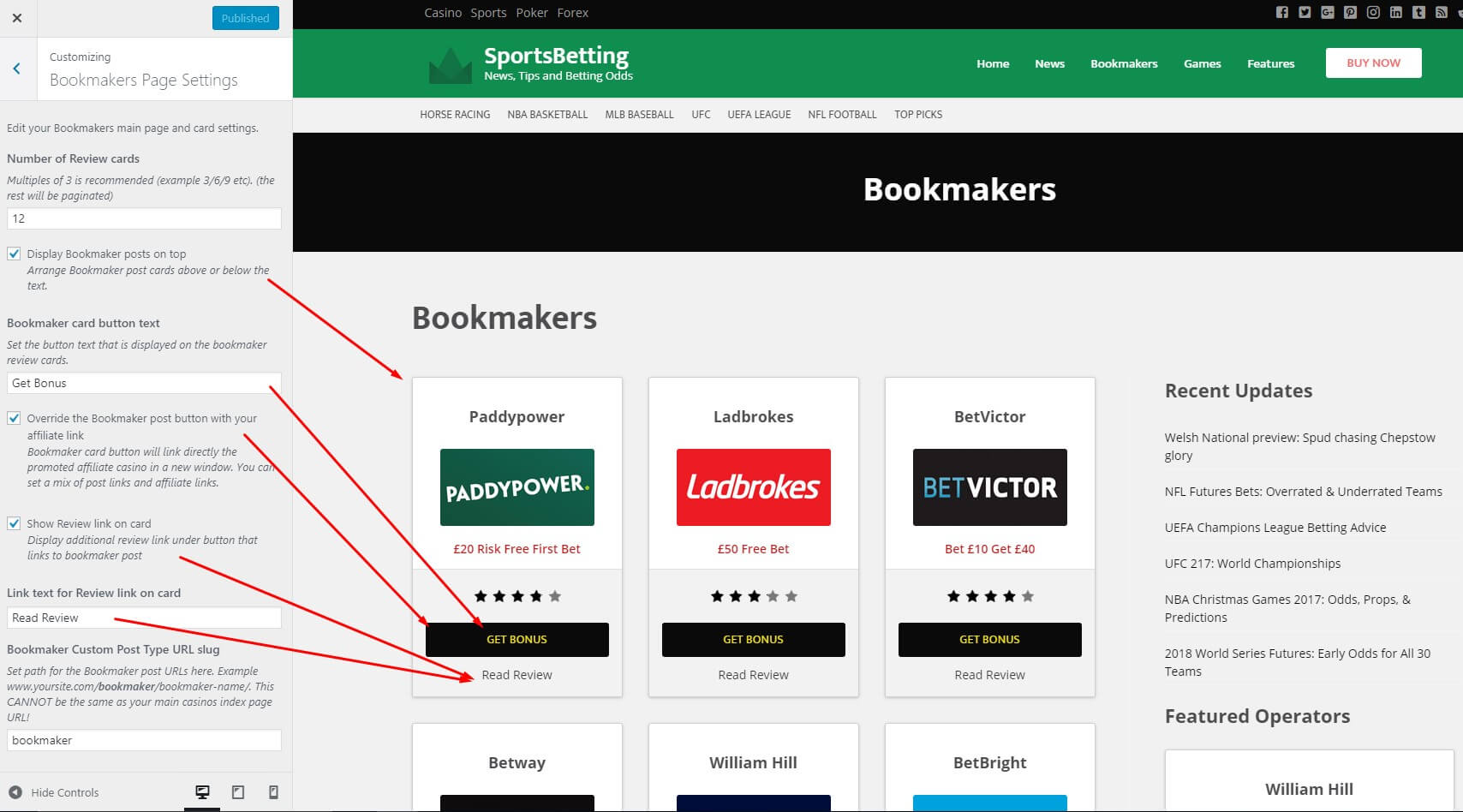

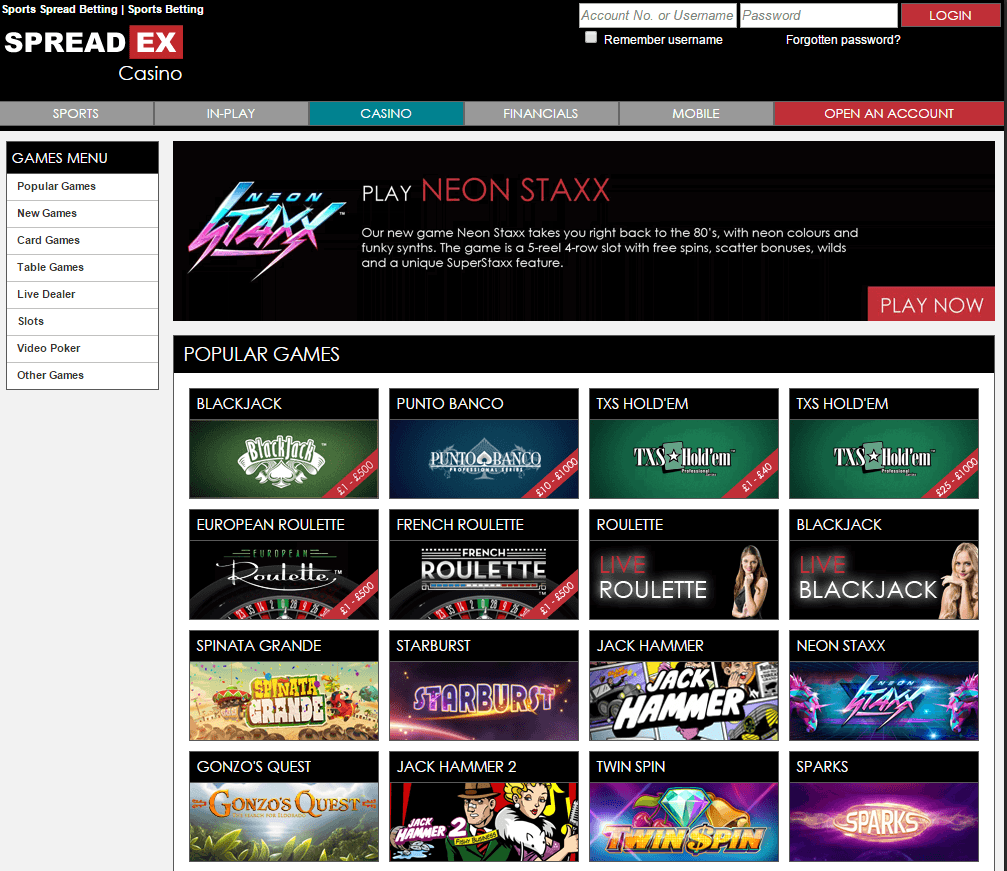

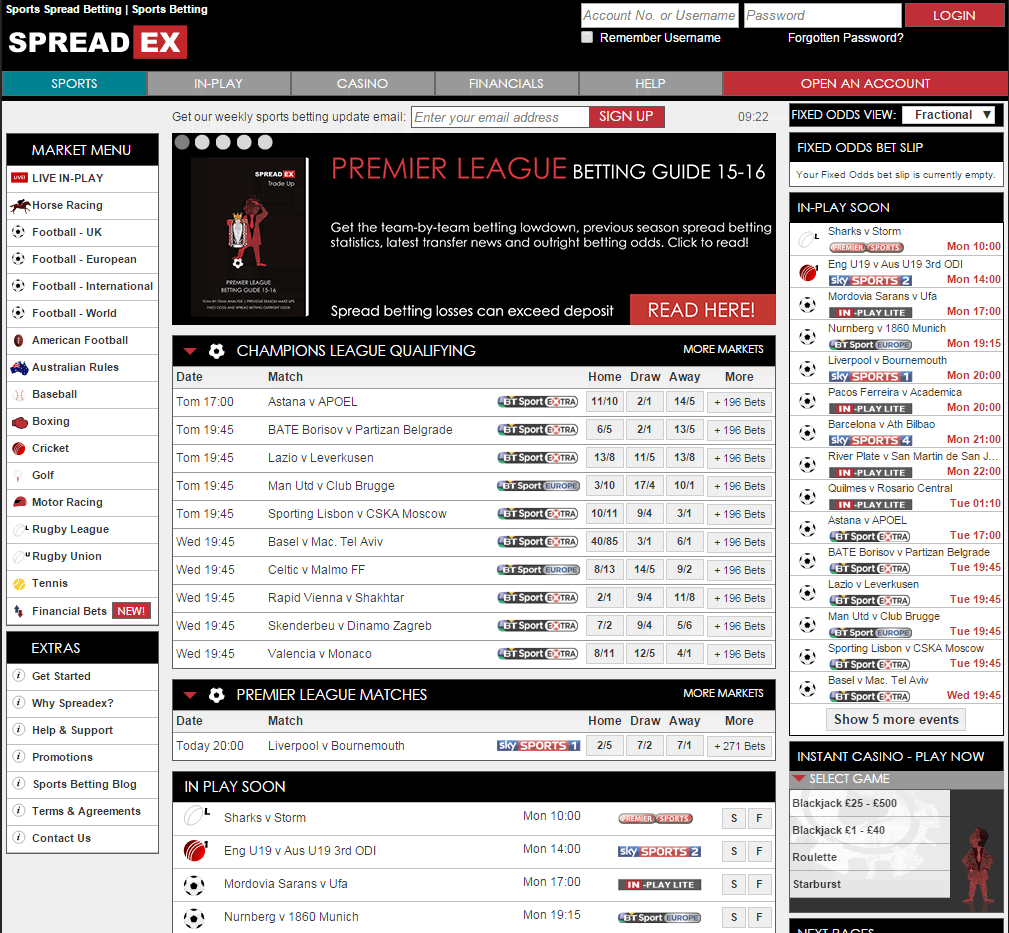

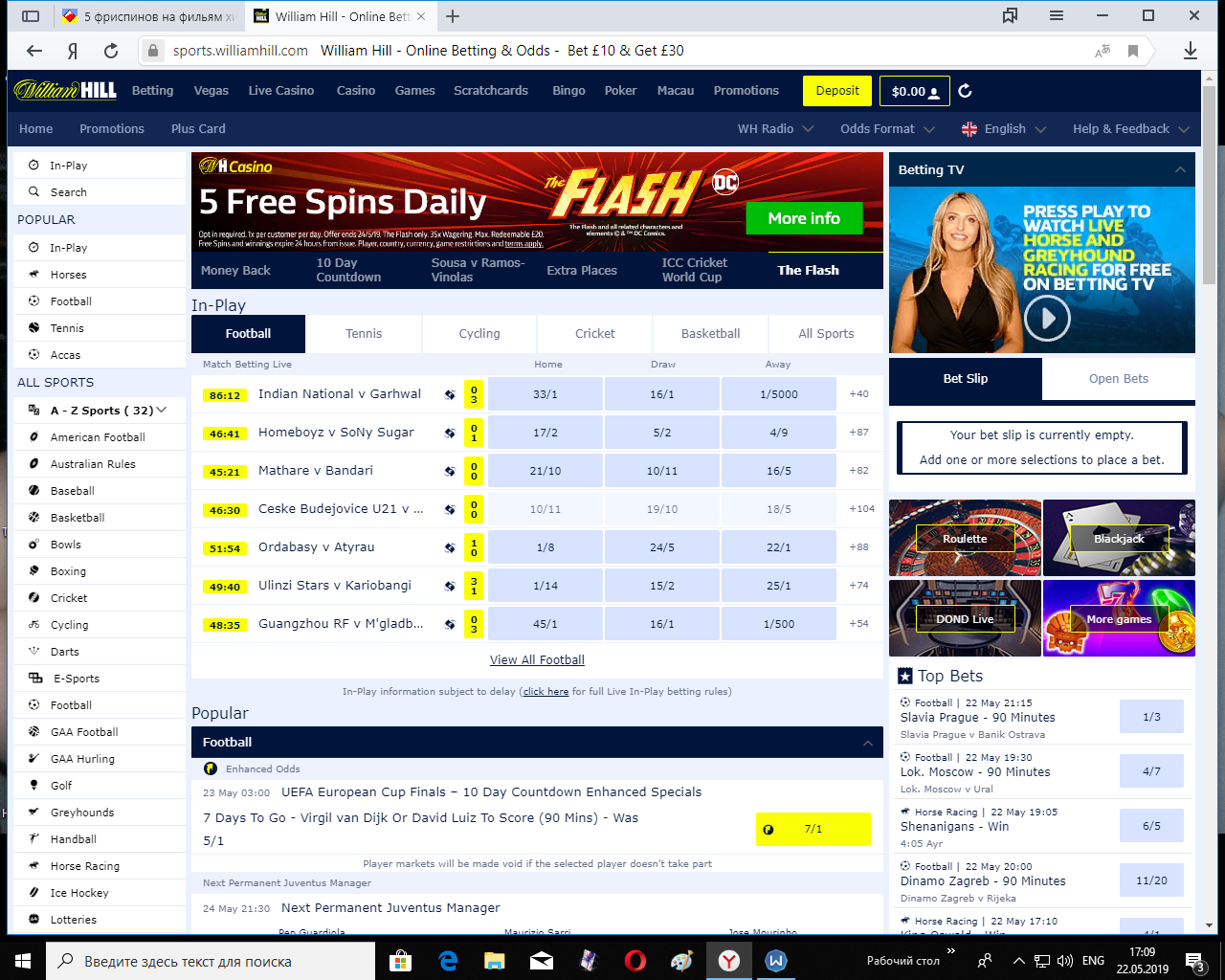

There are numerous spread betting sites, with Sporting Index and Spread Ex being the most popular. This post will use Sporting Index because they allow you to open a demo account, which can be very helpful for beginners.

One thing to be wary of is the type of full account you open. Sporting Index offer both a deposit account, and a credit account. A deposit account is where you play with your own money and with a credit account, you borrow it.

We’d recommend you open up a deposit account, especially as a beginner.

You can even get free bets for spread betting accounts to help you get off to a good start.

Using Sporting Index as an example, they have numerous different sports available. So like traditional betting, it is best to stick with the sports you know best. And then you need to explore.

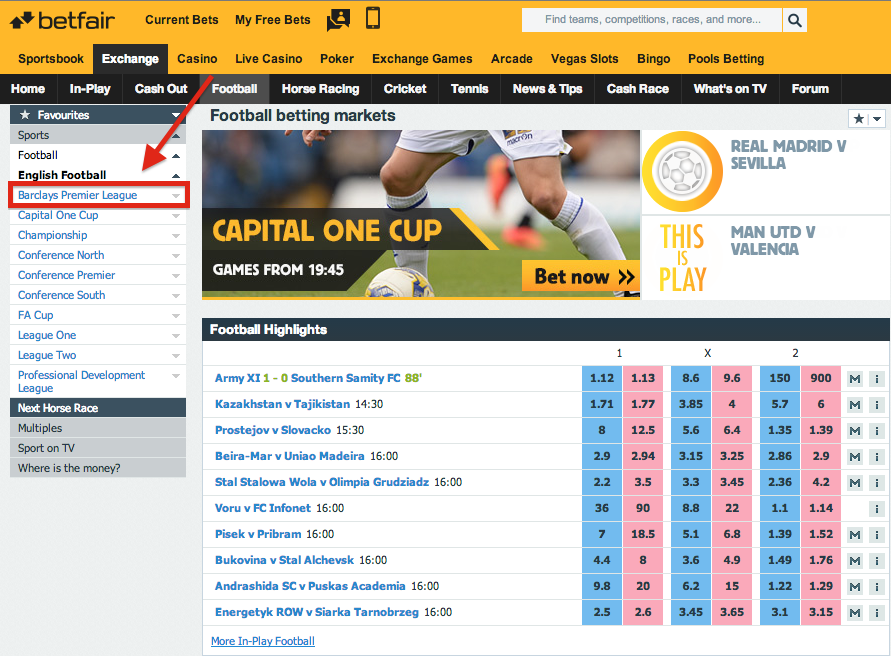

For the purpose of the walkthrough, let’s start with football. One of the most popular markets for spread betting on football is the ‘Premier League Points’ spread.

As you can see, every team is given a points spread. Your goal is to spot a team that you feel will either do significantly better than the number in the blue box. Or, significantly worse than the number in the red box.

If you feel Tottenham will repeat last season’s tally of 86 points, you’ll notice that is 11.5 points higher than the current spread.

Once you have decided on the bet you would like to place, you must choose the right option. If you want to sell, you click the red box. And if you want to buy, you click the blue box. In this case, we think Tottenham will do better than the spread, so we click buy.

Once you click on this selection, it will add it to the bet slip, as seen below:

Now, you must remember what your stake represents. The stake isn’t your total bet. It is the number you are willing to bet per point.

So to add your stake into the betslip, just type it in the box, as seen below.

At this stake, if Tottenham finish the season on 86 points, you will win (86-74.5) x 10 = £110.50. This is the difference between the actual points tally, and the spread you bought at, timesed by your stake.

Obviously, this could go the other way. So if Tottenham finished on 50 points it would be (74.5-50) x 10 = £245. That is how much you will have lost.

By now you have chosen your bet, input the stake, and made a calculation of your risk, just hit the big shiny button saying ‘place bet’. Oh, and cross your fingers, scream at the matches on the TV, and hope your bet wins!

We hope this spread betting tutorial has been of use. Remember: always calculate your potential losses before placing your bets.

Download our matched betting glossary to make sure you’ve got the lingo down.

Looking for ways to make money online?

There are only 46 days until the biggest festival of the year is here for matched bettors – Cheltenham Festival. It is the time of

Serena Williams has won everything the game of tennis has to offer but victory at this year’s Australian Open will hand her two new records.

Does any other TV event signify Winter more than the annual return of Dancing on Ice? We think not and it is nearly upon us

Can you guess these 18 Christmas songs from just emojis? 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. 15.

We are a crack team of software developers and experienced Matched Bettors, dedicated to helping you earn a sustainable, tax free income every month.

Matched Betting isn’t Gambling, but it is only for over 18’s. If you do have any concerns about gambling please contact

Double Anal Penetration Hd

Batsa Hard Video Sex

Vintage Oral Porn

Nudist Zone Xyz

Solo Tease Girls Download Hd