How To Short Cryptocurrency

by Tradingene

Buy and hold is not the only option for making money with cryptocurrency. Moreover, this strategy suffers a lot during the downtrends. Today I’d like to share with you some ways in which you can benefit from the falling crypto market by shorting it.

Short-selling is a trading strategy where a speculator bets against a market, expecting a fall in price. In other words, you “sell” an asset now and buy it back at a point in the future when the price has fallen.

Here are several ways of shorting the market.

Futures

The first and the most traditional way is futures contracts. When you sell futures, you agree to sell an asset in the future for a price determined today. If the price goes down, you earn, because you fixed the price in advance. The big plus of futures markets is regulation and you can be sure that a profit will end up in your pocket. Besides, the futures market has the lowest fees and spread. The bad side of the cryptocurrency futures market is the requirement for a high minimum deposit and the limited choice of cryptocurrencies. In fact, today you are limited to BTC. CME group announced that they will launch ETH futures later this year. Leverage is usually limited to 4x.

CFD (Contract for Difference)

This instrument is very similar to futures contracts. Here, the mechanics are virtually the same, but fees and leverage differ, both being larger than in the case of futures.

BitMEX

BitMEX is a really interesting case. Here you’ll find a concept known as crypto-contracts.

Crypto-contracts are so similar to futures contracts that market participants even call them that way.

However, crypto-contracts are far less regulated, because they’re still considered to be a crypto-product on a crypto-exchange and your deposit is held in BTC. So, for the faithful crypto-enthusiasts that prefer holding the deposit in BTC rather than USD, BitMEX can be a good choice when shorting the market.

Leverage can reach up to 100x, which I’d say is a financial suicide, and the fees are 0,075% per trade and 0,15% per round-trip, which is less than other margin trading crypto-exchanges, but still much higher than in traditional markets. Besides, with BitMEX you can earn money by simply opening and holding a position because BitMEX pays you (or charges) depending on the side you take. So occasionally, shorting on BitMEX can be even more profitable.

Margin Trading

Margin Trading is available on several exchanges, with Bitfinex having the most liquidity. Margin trading uses a slightly different methodology. You can hold any cryptocurrency on your exchange wallet, and it serves as a type of guarantee (known in financial terms as the initial or maintenance margin). When you trade on margin, there is no real flow of crypto-assets through your account, and you are simply getting market exposure without exchanging anything.

This option is great if you hold a long-term cryptocurrency investment, for example EOS, and want to short another cryptocurrency, for example ETH or XRP.

The leverage of margin trading is usually 3.3x and the fees are 0.2% for a trade and 0.4% per round trip, which is substantial. All in all, it’s better not to trade this market actively because the fees can easily kill your profit.

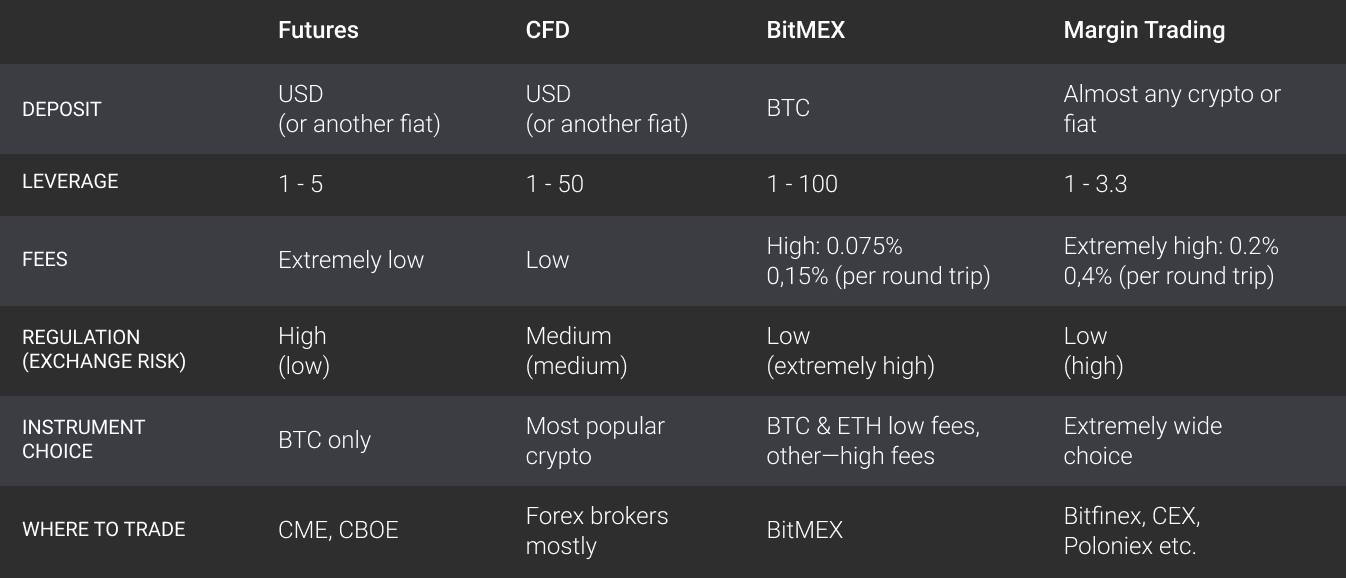

Here is the comparison table that will help you to drill into the difference between all of the options.

As you see, all shorting options have their own pros and cons, and you should identify the one that suits you best. But there is no doubt that short selling gives you much greater flexibility. That is why all our algorithms use margin trading to profit from both - uptrends and downtrends. And now you can use that strategy in your trading as well.

The article by Ruslan Mikhailov, CFTe, FRM

Head of Trading and Market Research at Tradingene. The Marketplace for Trading Algorithms.