How To Make A Spread Bet

🛑 👉🏻👉🏻👉🏻 INFORMATION AVAILABLE CLICK HERE👈🏻👈🏻👈🏻

By Michael Taylor / August 26, 2020 April 23, 2021 / 9 minutes of reading

Despite the fact that spread betting is a popular method amongst traders, most traders lose money because they don’t properly understand certain aspects of spread betting or how to spread bet effectively and profitably.

In this guide to spread betting for beginners, you’ll learn how to spread bet in 6 simple steps, which even experienced and already profitable spread bet traders must abide by.

Spread betting is a leveraged product that simply mimics the underlying asset, or the price of an asset.

We can use spread betting to speculate on price movements (prices rising and falling) in a wide range of markets such as stocks, bonds, commodities, indices, as well as forex.

Another advantage of financial spread betting is that all gains are free from Capital Gains Tax, meaning that any trader who makes a profit from spread betting keeps 100% of their wins.

These are the UK tax laws, however, this may vary in your particular country under local law. This is different to CFDs which are not exempt from Capital Gains Tax. However, both spread betting and CFD trading can be high risk and traders can suffer heavily from big market moves.

IMPORTANT: If you’re a spread betting beginner, I recommend you read my article on what is spread betting before you move on to step 2. I cover everything from how spread betting works, definitions, examples, and much more.

Finding a reputable spread betting broker is incredibly important.

Many spread bettors don’t realise that some spread bet trading platforms are actually incentivised to see clients lose money.

It’s a well-known fact that most traders lose money when trading with spread bets. A reputable spread bet provider will hedge the market risk.

For example, if you place a spread bet to buy on a company for 1,000 shares – the broker would need to find another client who had sold 1,000 shares in order to net the exposure off otherwise the broker would be exposed to your P&L.

If you were to continually make money, and the broker did not hedge either internally or by actively buying and selling in the financial market, the broker would be losing money.

However, as so many traders lose, there are brokers out there who do not hedge this market risk because they take the other side of the trade.

For example, when Johnny the punter buys the FTSE 100 and sells at a loss, the broker sold the FTSE 100 high and bought low by taking the opposite side of Johnny’s trades and profiting from his loss.

Brokers that profit from clients in this way may help their clients to lose quicker, so they can make more money.

This is done by causing errors on the platform, spiking the buy price and sell price artificially, and other underhanded deeds. This is why finding a reputable spread bet broker is necessary unless you’re happy to be taken for a ride.

Read my article and comparison guide on the best spread betting brokers to help inform your decision. I find and review the top spread betting brokers in the UK and provide my thoughts on each.

I use IG Index as my spread bet provider. They are authorised to provide spread betting and CFDs by the Financial Conduct Authority (FCA) in the UK financial markets.

The company was founded in 1974 by Stuart Wheeler and is the market leader in the UK and many markets, with a global presence. IG Index is listed on the London Stock Exchange, therefore, there’s greater transparency over its accounts.

More importantly, IG Index does not profit from client losses.

This is clearly stated on the IG Index website:

Many reputable spread bet providers will offer a demo account so you can get used to the User Interface and ensure that we know what we’re doing before we switch over to the live account with real money.

Lots of traders like to jump right in with spread betting, but because they don’t know what they’re doing or how to use the platform they often end up losing.

IG Index offers a spread bet demo platform, which looks like this:

We can clearly see that at the top this displays “DEMO” in bold red font, and where we can switch our accounts in the top left next to the IG logo, it also says Demo-SpreadBet.

The demo account is also light, compared to the live black version.

We can use the demo account to test opening tickets and placing spread bet trades, as well as testing out trading strategies and ideas.

Spread betting offers a wide range of markets to trade, but that doesn’t mean we should trade all of them available.

Successful traders and spread betters focus on one spread betting market and become competent in that security type before broadening their skillset.

Financial markets vary from security to security, and a trader who spread bets successfully in stocks won’t necessarily be able to trade successfully in oil.

It takes time to learn and understand each spread betting market and how particular prices rise and fall and react to certain events. By focusing on one security, we vastly increase our chances of success in spread betting.

Enter your email to receive my free UK stock trading handbook, packed with professional techniques to manage risk and consistently profit.

One of the advantages of spread betting is leverage.

Leverage means we can make our capital go further as we can put up a certain amount of margin on the trade, meaning we don’t need the full amount of capital to fund a position. For retail investor accounts, this is often 20%.

This means that to fund a £20,000 position we may only need to put up a minimum of £4,000. However, just because we can does not necessarily mean that we should.

The main reason many spread bet traders go bust and lose money is because they can’t handle their leverage. They take oversized positions, or stake sizes, and end up blowing their accounts.

For example, if the £20,000 position would go up by 20% to £24,000 and we closed it – our capital would jump from £4,000 in our account to £8,000.

This would be a 100% return! It’s for this reason that spread betting is attractive, as leverage acts as a magnifier.

However, this also works the other way…

If the share price or the position of £20,000 went to £16,000, then we would receive what is known as ‘margin call’ – a call from the spread bet provider asking us to put up more capital or our position will be forcibly closed out.

It is possible to lose our entire account by overexposure.

Always make sure you calculate the exposure you’re taking. Position size sensibly, and use stop losses to protect yourself. You can use my free spread betting calculator to quickly calculate your position size.

A stop loss is an automatic trigger that closes a position at a certain point. It is designed to protect our positions from moving too far against us and costing us money.

One advantage of spread betting is that we can set stop losses on every security that we trade.

In UK stocks, we have the option to place stop losses on SETS stocks when trading shares. But on the SETSqx platform, which is market maker driven, there is no option to place a stop loss order.

If we trade spread bets (and CFDs) on SETSqx stocks we do have the option to use stop losses.

Successful spread bet traders use stop losses effectively to minimise their downside and protect themselves from losses so that they can live to trade another day.

Here is how to set a stop loss on IG Index:

You can set a guaranteed stop loss before opening the position, but I prefer to first open the position to ensure that the liquidity is there and the position can be opened, and then I input the stop loss.

In this example, I have opened a position at 27.068p and I am putting my stop loss in “Stop Level” at 23p.

If the bid ticks down to 23p, my position will be closed and I will be stopped out. This ensures that if the price continues to fall, my losses will be capped at 23p.

Successful spread betting is possible if you are willing to put the work in.

The best traders are rational and ruthless. They exercise discipline. They are never uncertain because they plan in advance and know what they want to see in the price of an asset and how they will act. They have strict strategies that they follow.

Spread bet trading can be high risk, but with IG Index you at least have a fair playing field. You can also use the demo account for as long as you wish to learn the platform and backtest trading strategies and ideas.

Remember to use stop losses too. Trading is about cutting losses and running winners. Many spread bet traders lose because they succumb to their emotions, and one should consider their own individual circumstances before they start trading.

Spread betting is tax-free, but it is also not easy either.

Remember, most traders in the UK stock market lose money. For you to be in the minority that can profit consistently from their trading account, you will need to take trading seriously and put in the time and effort.

Position size sensibly, and don’t let your emotions rule your account. Stay in control and practice your risk management. Good luck!

Spread betting is not to be confused with CFDs. Like spread bets, CFDs avoid stamp duty but they are complex instruments that are not suitable for everyone. However, anyone wishing to start trading should consider their own individual circumstances. To learn how trading CFDs works, you can visit my article here.

I use technical analysis to trade the UK stock market, and if you want to learn how to trade profitably, then I’d recommend reading my free books.

Additionally, my UK Online Stock Trading Course is a comprehensive online course that teaches those who are serious about learning to trade correctly and profitably.

Michael Taylor is a full-time UK stock market trader. He is the founder of Shifting Shares, has a weekly trading column at Investors' Chronicle, and has given a talk at a TEDx conference. Follow Michael on Twitter!

Subscribe to the Shifting Shares email list for exclusive content. Free ebooks. No spam. No nonsense.

Shifting Shares 2021 © All Rights Reserved

Start typing and press enter to search

Search …

www.actionnetwork.com/education/point-sp…

How do you make a point spread in Minecraft?

How do you make a point spread in Minecraft?

Click on the spread you want to bet in the game module (it will be lined up with the team you want to bet). Head to the bet slip on the right side of the page (on your phone, it will pop up automatically). Click “Login to Place Bet” and login, then submit your bet. Loading... How Are Point Spreads Made?

www.actionnetwork.com/education/point-sp…

In fact, some successful professional bettors exclusively utilize point spread bets to make up their winning strategy. In this guide, we’re going to walk you through all the details you need to know to understand point spreads, make point spread bets, and hopefully start turning a nice profit with them.

www.thesportsgeek.com/sports-betting/stra…

What happens if you bet against the spread?

What happens if you bet against the spread?

When it comes to point spread betting, and you bet against the spread, it won’t be enough for the favorite to win the game outright. The favorite would have to win by more than a specified amount of points or goals (the spread) in order for that team to cover the point spread.

www.oddsshark.com/sports-betting/point-s…

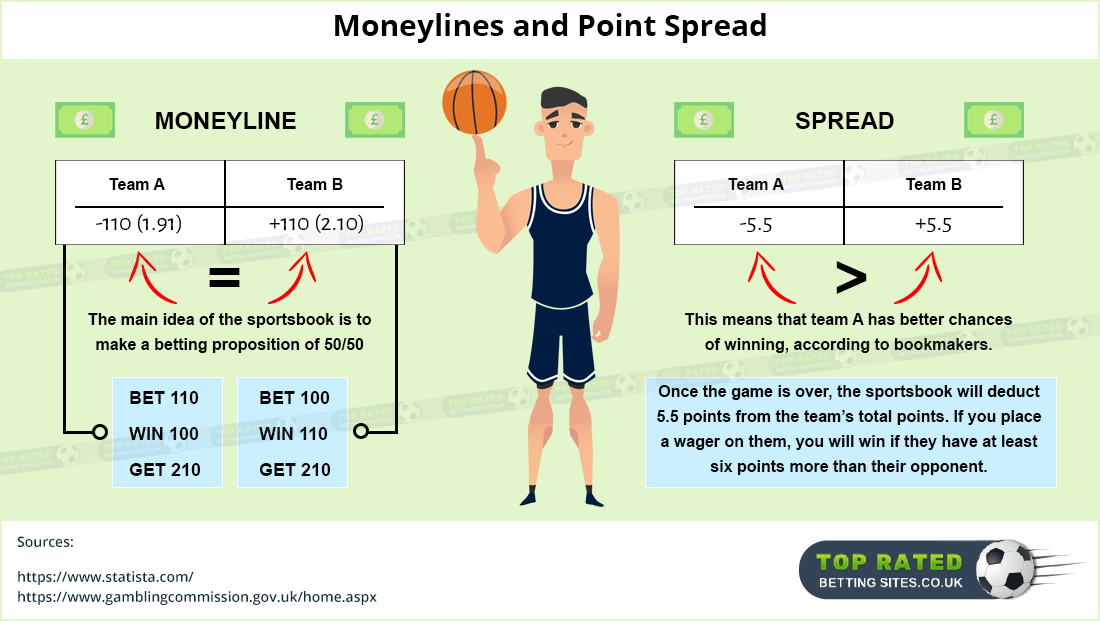

What ' s The difference between Moneyline and point spread bets?

What ' s The difference between Moneyline and point spread bets?

Remember, with moneyline bets, it does not matter by how many points a team wins, just that they win. With point spread bets, though, they rarely will change the payouts (as you will see in the next section).

www.thesportsgeek.com/sports-betting/stra…

https://capital.com/how-to-spread-bet

Перевести · Open a spread bet. Once you have chosen the market you would like to trade today, you will have to decide which direction to choose. Whether you believe the price is going to go up and open a long position (Buy), or you think the price will go down and take a short position (Sell). To open a spread bet …

https://www.shiftingshares.com/how-to-spread-bet

Перевести · 26.08.2020 · In this guide to spread betting for beginners, you’ll learn how to spread bet in 6 simple steps, which even experienced and already profitable spread bet traders must abide by. How to spread bet in 6 steps. Understand the basics of spread betting; Find a reputable spread bet broker ; Try a demo spread betting account; Choose your market to spread bet; Decide on your spread bet size; Set your stop loss on open spread bets

How does spread betting work? - MoneyWeek Investment Tutorials

How to Make Money Spread Betting the Financial Markets

Making Money: Using Spread Betting to Trade

https://www.bettingpros.com/articles/how-to-make-a-bet-against-the-spread-at-a-sportsbook

Перевести · 21.03.2020 · Steps to Making a Bet Against the Spread Look over all spreads for the leagues you wish to bet on. Identify your best bets (favorites or underdogs). Choose the side you wish to bet on.

https://www.actionnetwork.com/education/point-spread

Перевести · 02.02.2021 · How Do I Make a Spread Bet? It’s easy to bet point spreads at a book like FanDuel or DraftKings. Here’s how it works: Navigate to your desired sport. Click on the spread you want to bet in the game module (it will be lined up with the team you want to bet).

https://www.bettingpros.com/articles/how-to-make-a-bet-against-the-spread-online

Перевести · Steps to Making a Bet Against the Spread Online Look over all spreads for the leagues you wish to bet on. Identify your best bets (favorites or underdogs). Choose the side you wish to bet on.

https://tradingbrokers.com/how-to-spread-bet

Перевести · In order to spread bet online, you will need a broker account and trading platform to execute your trade positions through to the markets. When choosing a broker, there are a …

https://www.oddsmonkey.com/blog/matched-betting/how-to-spread-bet

Перевести · The best way to think of it is like this: Your friend challenges you to a penalty shoot out competition and says he bets you won’t get more than 5 goals out of 10 penalties. For every …

https://www.thesportsgeek.com/sports-betting/strategy/point-spread

Перевести · The way you do this is by predicting how the lines are going to move and then deciding if you should bet now, not bet at all, or wait for the line to move more in your favor. Remember, once you make a point spread bet…

Не удается получить доступ к вашему текущему расположению. Для получения лучших результатов предоставьте Bing доступ к данным о расположении или введите расположение.

Не удается получить доступ к расположению вашего устройства. Для получения лучших результатов введите расположение.

Doggystyle Close Up Porn

Rachel Lesbians

Lesbian Hd Online

German Aggressor

German Grandpa

How to spread bet | Capital.com

How To Spread Bet (Beginner’s Guide) - Shifting Shares

How to Make a Bet Against the Spread at a Sportsbook ...

Point Spread in Sports Betting: Definition, Examples, How ...

How to Make a Bet Against the Spread Online | BettingPros

How To Spread Bet 2021 - Trading Brokers

How to spread bet | Buy, sell and suitable sports for ...

Point Spread Betting Strategy - How Point Spread Bets Works

How To Make A Spread Bet

/GettyImages-6427-000194-59684fec5f9b582c356699cf.jpg)