How Repo Works

𝕲𝖊𝖗𝖍𝖆𝖗𝖉 𝕾𝖈𝖍𝖗𝖆𝖉𝖊𝖗Repo

A repo transaction involves the sale of assets together with an agreement to repurchase them on a specified future date at a prearranged price. Market participants use repos for many reasons, including financing their portfolios, using cash as collateral to borrow securities, and as a safer alternative to uninsured deposits. Central banks also use repos to implement their monetary policy.

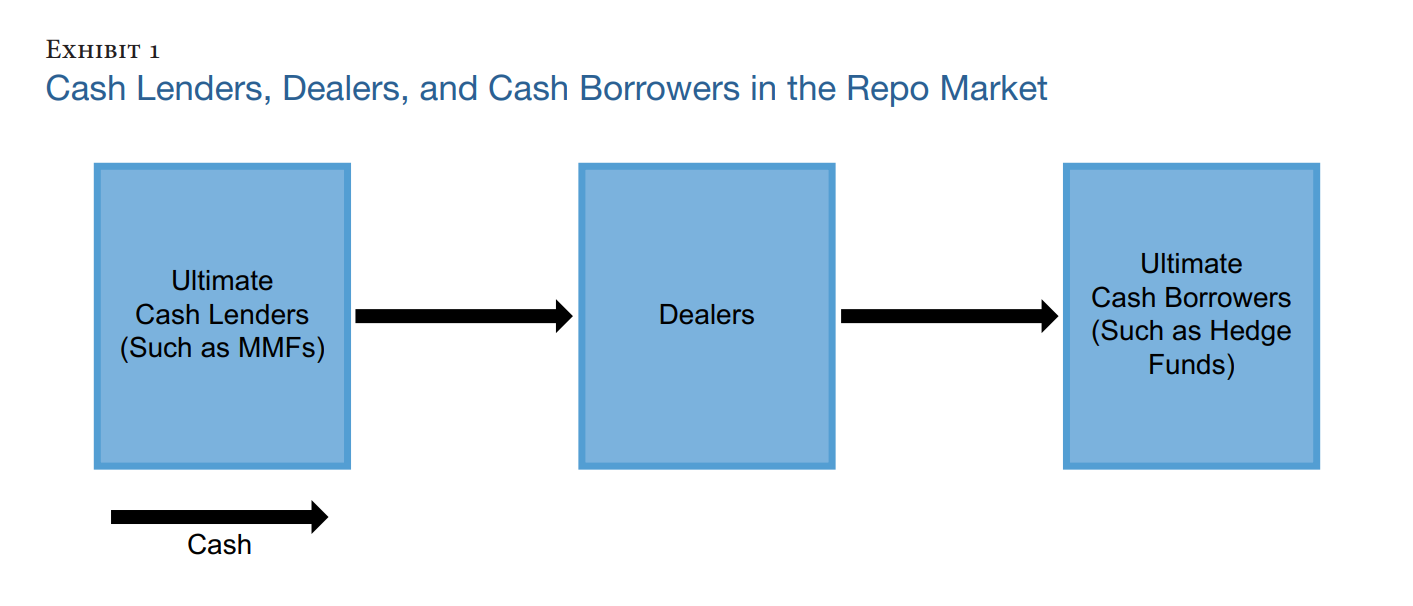

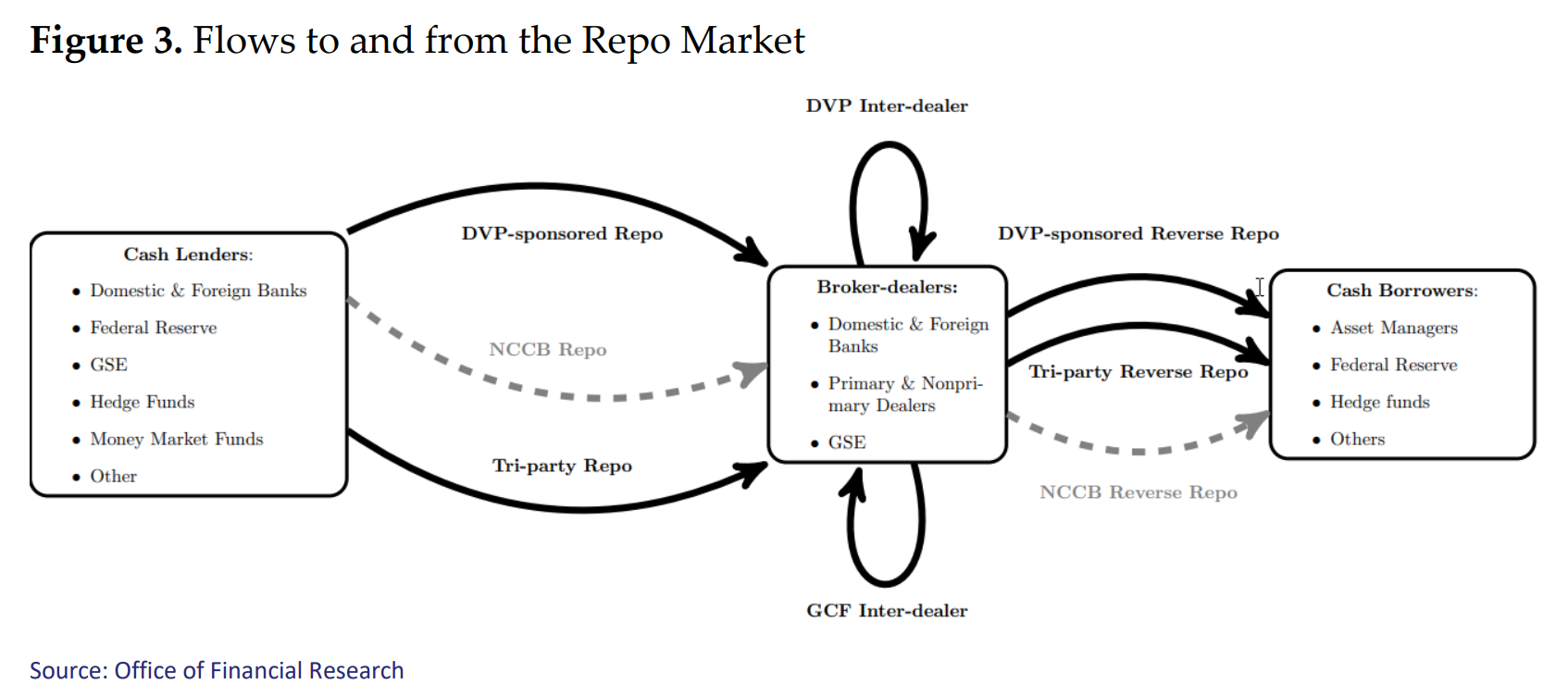

Repo transactions are, in many respects, similar to collateralized loans. In the United States, the repo market allows the transfer of cash from cash lenders, such as money market funds (MMFs), to cash borrowers, such as hedge funds.

The Repo Market

As shown in Exhibit 1, broker-dealers (or dealers, for short) play a key role in that market as they intermediate between the ultimate cash lenders and borrowers. Dealers may be subsidiaries of bank holding companies with commercial banking subsidiaries that are DIs or may be stand-alone entities without affiliated commercial banks.

A significant share of dealers’ activity involves is “'matched book' intermediation". A dealer’s book is “matched” if the maturity and collateral of a dealer’s repo borrowing is the same as the maturity and collateral of its repo lending. Dealers also commonly engage in maturity transformation — by lending at a longer term than the one at which they borrow — as well as collateral transformation — by lending against collateral of lower quality than the one against which they borrow. By intermediating, dealers earn the spread between their borrowing rate and their lending rate. Some dealers can be net cash borrowers if they fund their proprietary inventory of securities in the repo market.

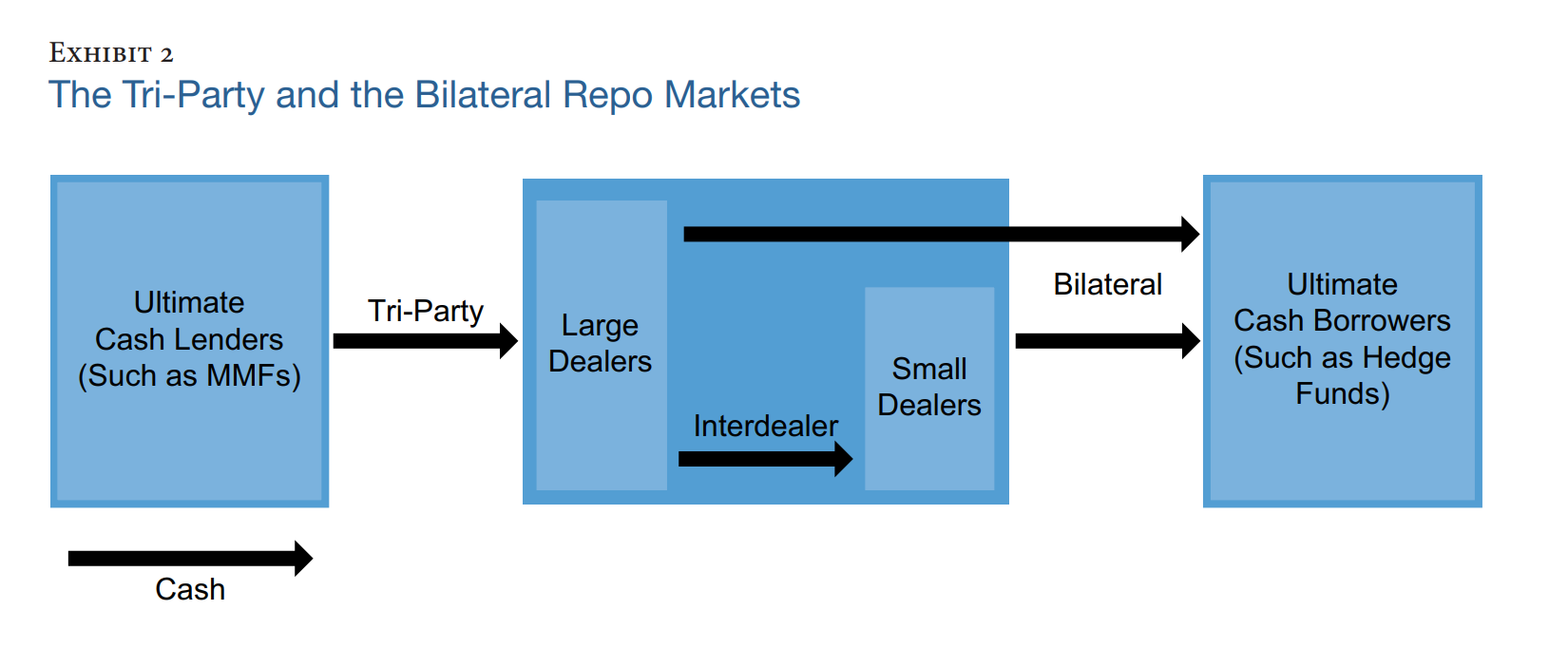

The repo market dealers primarily use to borrow cash from ultimate cash lenders is the tri-party repo (TPR) market. This market owes its name to the role played by a third-party agent, Bank of New York Mellon (BNYM). BNYM provides a number of services to market participants, including asset servicing, collateral management, and facilitation of settlement.

In contrast, ultimate cash borrowers typically obtain cash in the bilateral repo market. In that market, cash investors and collateral providers perform a direct exchange, without the benefits of the settlement services of a third party.

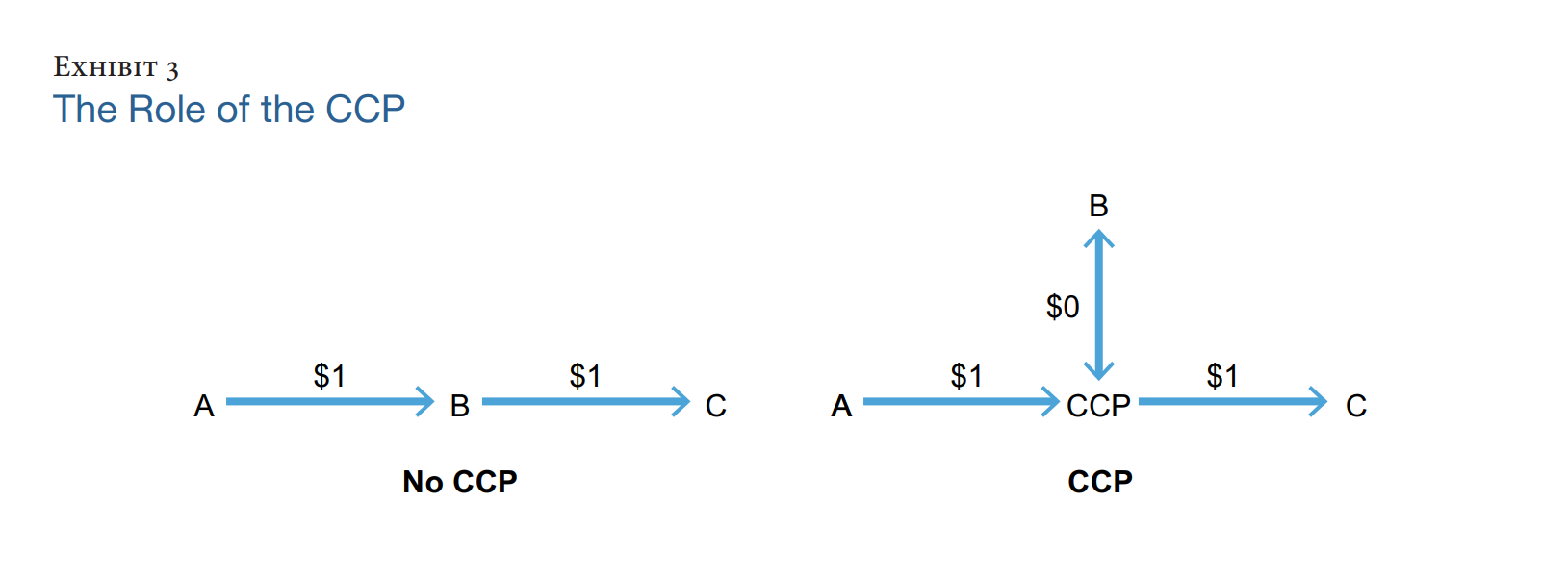

Exhibit 2 expands on Exhibit 1 by including a representation of the interdealer market. Interdealer repos backed by government securities are cleared by FICC, which plays the role of the central counterparty (CCP). CCPs reduce risk in the markets they clear by “novating” trades, becoming the buyer to every seller and the seller to every buyer. For example, if two members of a CCP, A and B, trade with each other, the CCP will replace the trade between A and B with two trades: one between A and the CCP and the other between the CCP and B.

The interdealer market has two components:

1) the GCF (General Collateral Financing) Repo market, which settles on the tri-party platform of BNYM.

2) a bilateral market called the FICC DvP (“delivery versus payment”) market.

Like tri-party repo, GCF Repo is a market for general collateral (i.e., General Collateral Financing, GCF), whereas the FICC DvP also allows for specific securities to be traded. Small dealers that borrow from large dealers in the interdealer market often lend to ultimate cash borrowers in the bilateral repo market.

...

Anatomy of the Repo Rate Spikes in September 2019 (financialresearch.gov)