How I Use SMT Divergences

Omid_Mrj

What is an SMT?

An SMT (Smart Money Tool) is a crack in correlation between correlated pairs,

I use SMT divergences when I trade FX pairs like EUR/USD, GBP/USD and DXY

SMT’s can also be used with

-BTC/ETH

-XXXUSD/ DXY

-ES/YM/NQ

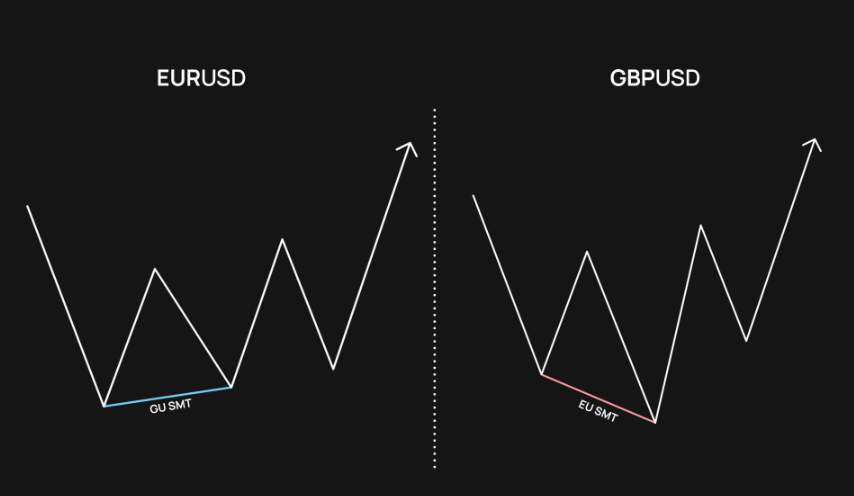

Here is a chart of EUR/USD and GBP/USD, as we can see both of them have the same anatomy

When EU makes a lower low so does GU, when EU makes a higher high so does GU, so on and so forth. They both have the same structure

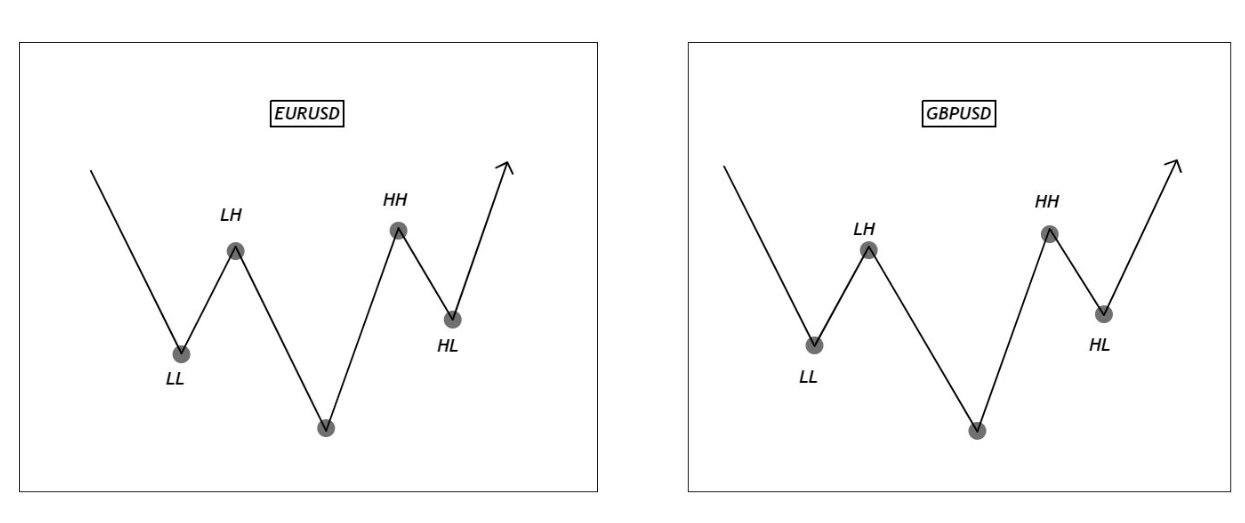

Now, as we can see here,

EU fails to make a lower low whereas GU does make a lower low.

This is an SMT Divergence, so if I seen this on a trading day I would choose to take longs on EU rather than GU, because the SMT signals to us that EU is the stronger pair

How I use SMT divergences

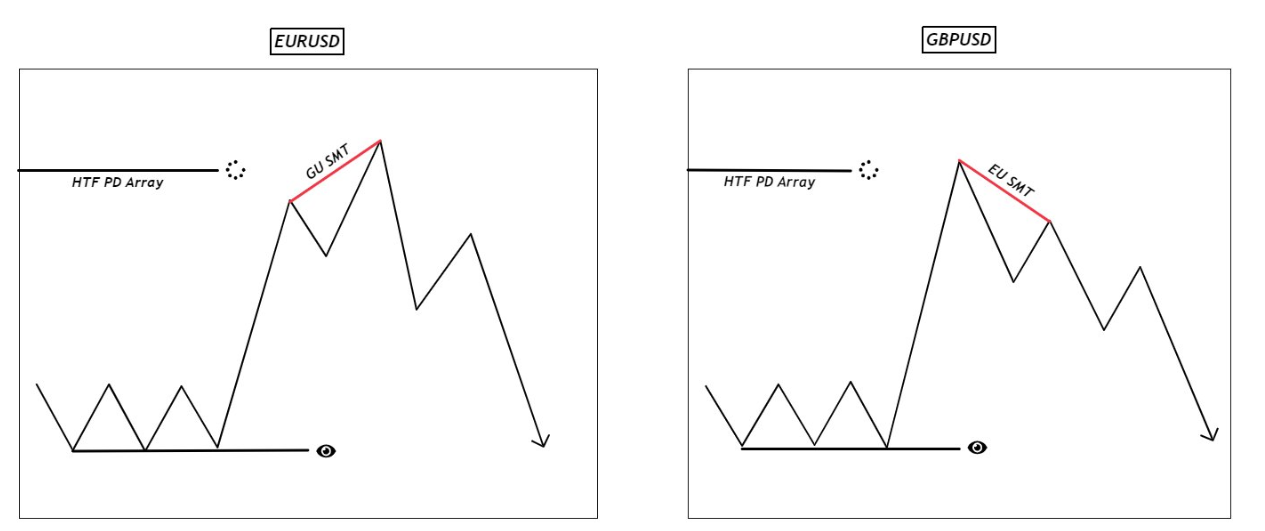

I use SMT divergences only as a confluence to my trades, so before I would even check to see if an SMT is present I make sure 2 criteria are met as always which is

-Price has tapped into a HTF PD array

-A clear target

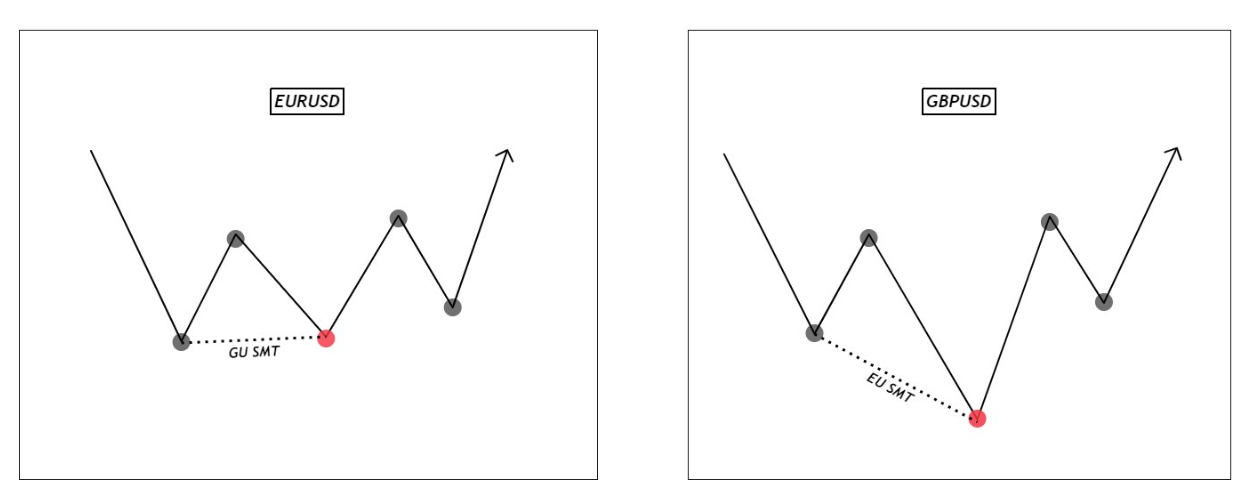

Here is an annotated example

In both of these cases above I would choose to trade GU,

As in the bullish example it failed to make a lower low whereas EU did (Shows GU strength for Longs)

In the bearish example it failed to make a higher high compared to EU (Shows GU weakness for shorts)

SMT Example

And as we can see we had a bearish SMT on EU showing weakness against GU

EU moved 20 pips more to the downside than GU did, identifying this SMT would allow us to capture a bigger price movement in turn potentially making more profit.

For reference here as some trade wins integrating SMT divergences