How Financial Spread Betting Works

👉🏻👉🏻👉🏻 ALL INFORMATION CLICK HERE 👈🏻👈🏻👈🏻

Financial Spread Betting and How Spread Betting Works

Copyright© 2021 Independent Investor. All rights reserved.

Terms of Service and Privacy Policy .

We use cookies to ensure we give you the best experience on our website. By clicking the OK button you agree to the use of cookies as per our Privacy Policy.

OK

Independent Investor is a news and educational portal covering latest events in the world of trading and investment. Our team of dedicated writers work hard to bring the facts to our readers on a daily basis. Information on this website is for informative purposes only. Financial spread betting, forex and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 74-89% of retail investor accounts lose money when trading CFDs, forex, and spread betting . You should consider whether you can afford to take the high risk of losing your money. Independent Investor offers an unbiased and independent broker comparison service, but we may receive compensation from listed brokers.

Home

» Blog » What Is Financial Spread Betting And Why Should You Consider It

Sign up for our newsletter for the best gambling site bonus offers available!

© 2015-2021 legitgamblingsites.com. All Rights Reserved. Please check your local laws before gambling online.

I’ve mentioned in other blog posts that there’s more than one way to make money betting on the price of stocks and other assets.

Often, those who approach financials for the first time or who are relatively new to “the markets,” as they are called by those who actively trade them, can feel utterly flabbergasted by the different ways to make (and lose) money.

It can be difficult enough just to get your head around the differences between stocks, bonds, currencies, commodities, funds, derivatives, and the other types of things you can buy and sell.

However, this feeling of having a learning curve ahead can be even further intensified when you learn that there are as many ways to buy and sell things as there are types of things to buy and sell.

Like everything, the best way to approach this subject is one step at a time. It’s important to seize the opportunities these financial instruments bring and not to let the slight learning curve involved put you off.

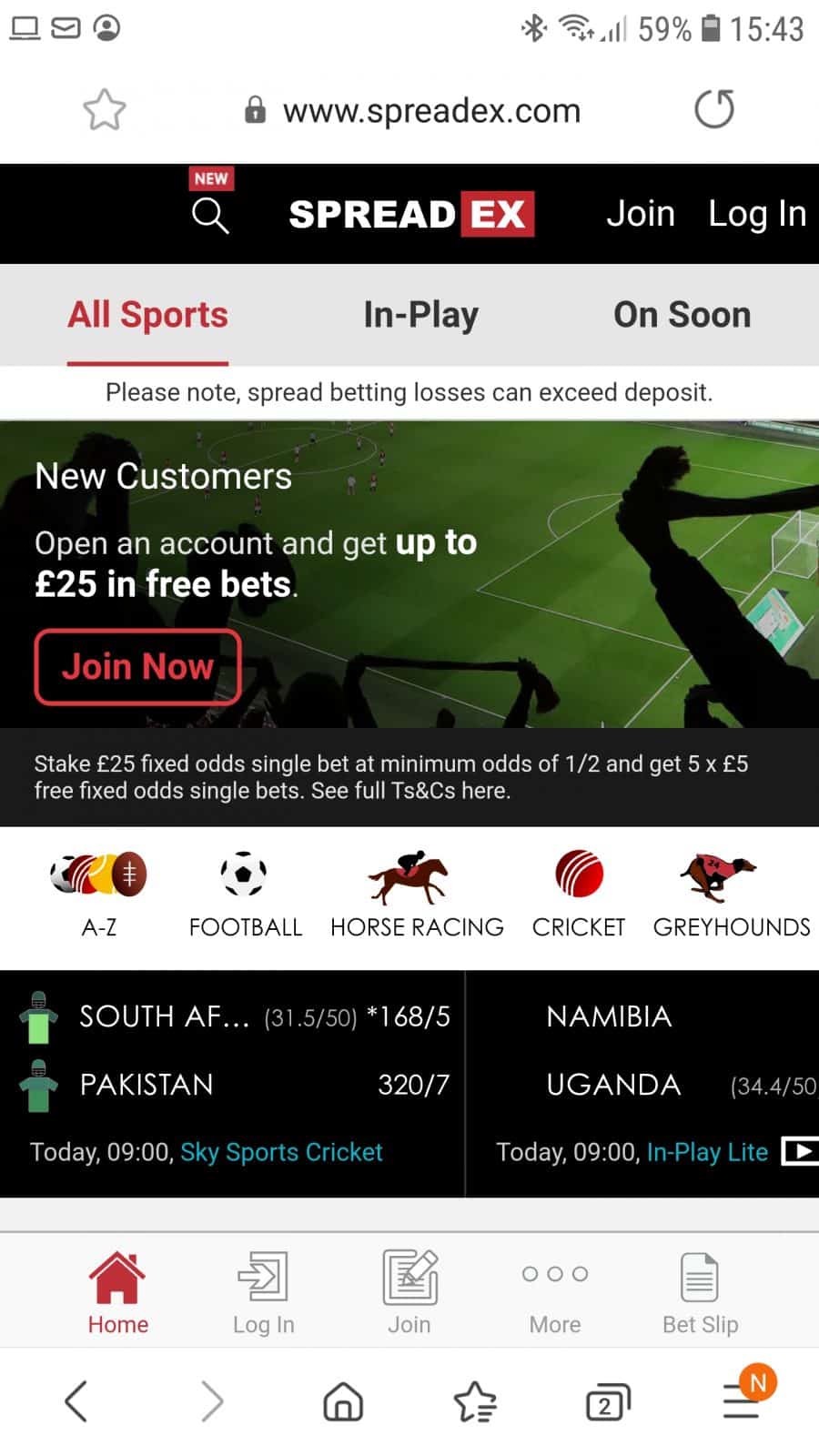

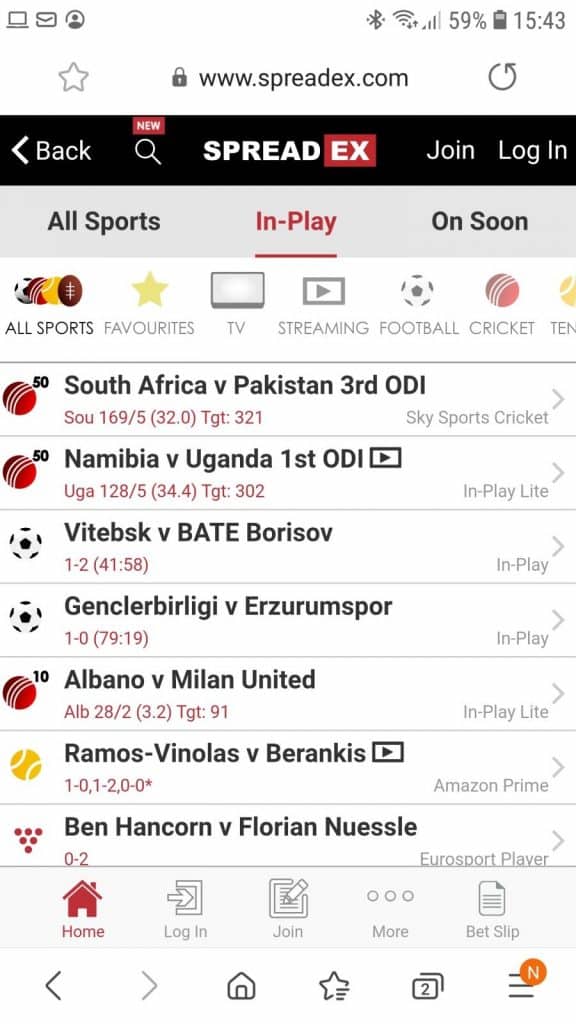

In this post, I’m going to zero in on spread betting as an instrument to bet on the financial markets. As you’ll see, this might be the best way of all to get in on the non-stop, 24/7 action the global financial markets offer.

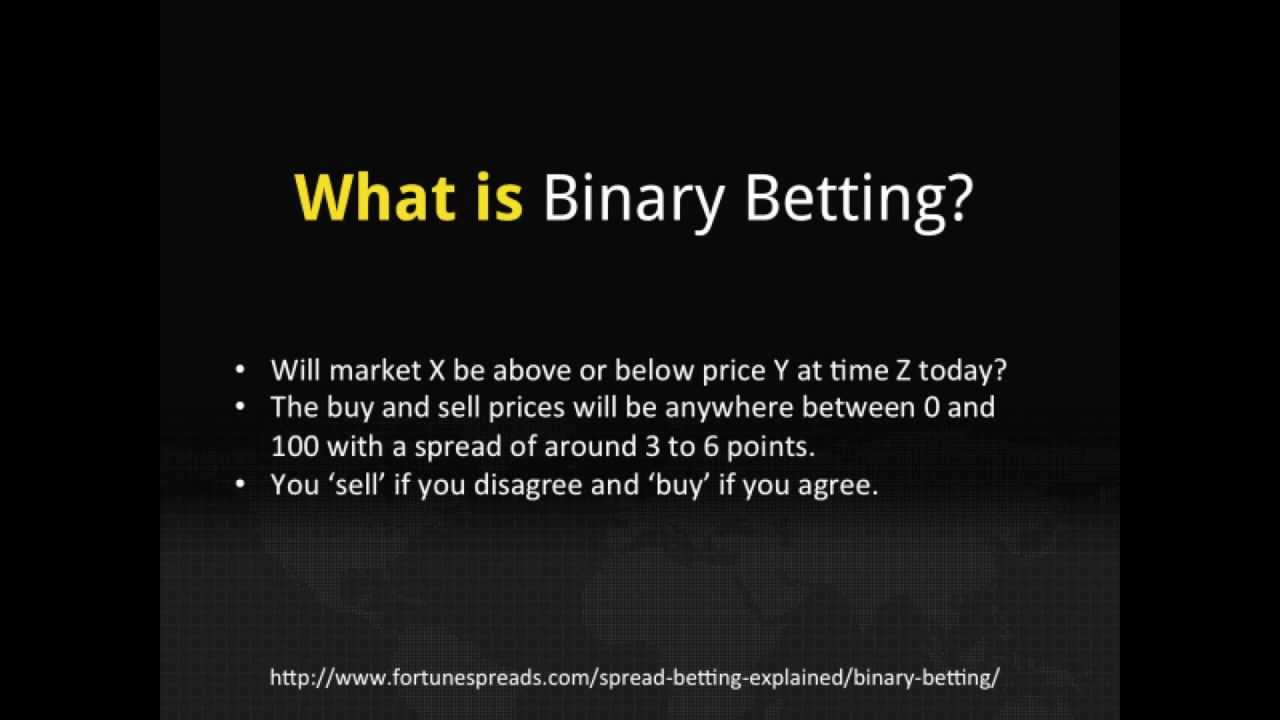

Financial spread betting is trying to predict the direction of the price of a given stock or another asset for profit.

You see financials, unlike sports, only have two possible outcomes. Eventually:

This is one of the things I like best about betting on financial markets.

The fact that there are only two possible outcomes allows me as a spread bettor to attempt to predict the price direction, based on various factors I feel are relevant. I can then place spread bets and make a lot of money if I’m right.

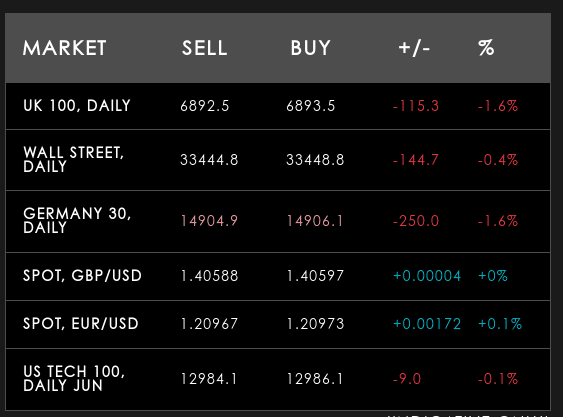

A Quick Example Of a Spread Betting Opportunity

Let’s say US President Donald Trump is about to announce a US corporate tax cut of 10%.

I can reasonably predict that stock prices will rally in the days and weeks that follow, so I might place a spread bet that the price of Apple (AAPL) will climb as investors bail in and try to take advantage of the extra profits Apple will make as a result of the tax cut.

However, let’s say I have neither the time nor the inclination to actually purchase Apple stock through a broker. Perhaps I don’t have the capital to buy even one share in Apple, or maybe I need to act extremely quickly since 10 seconds can make all the difference when it comes to financial trading.

This is where spread betting is ideal. Using this trading method, I can bet on the direction of the price within seconds, and ride the wave all the way up (or down) until I’m ready to cash out.

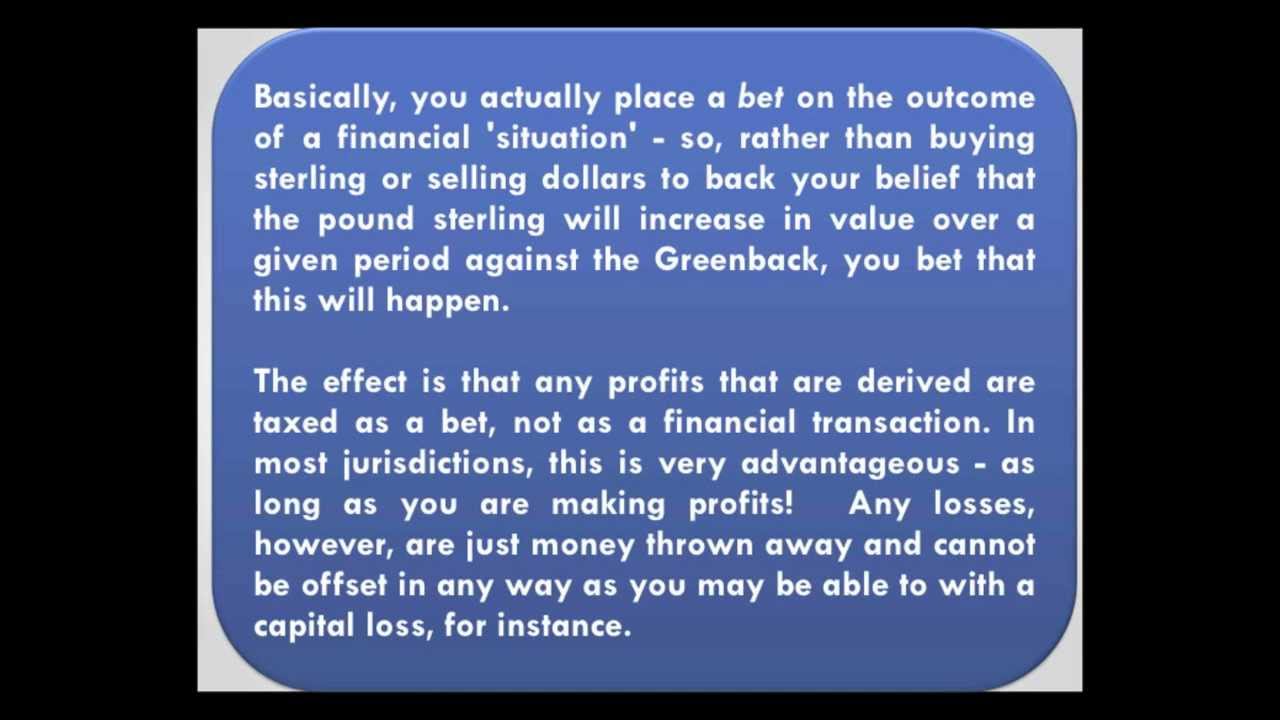

The key difference between spread betting and buying a stock or share (or any other asset you might trade) is that you never actually buy or sell anything!

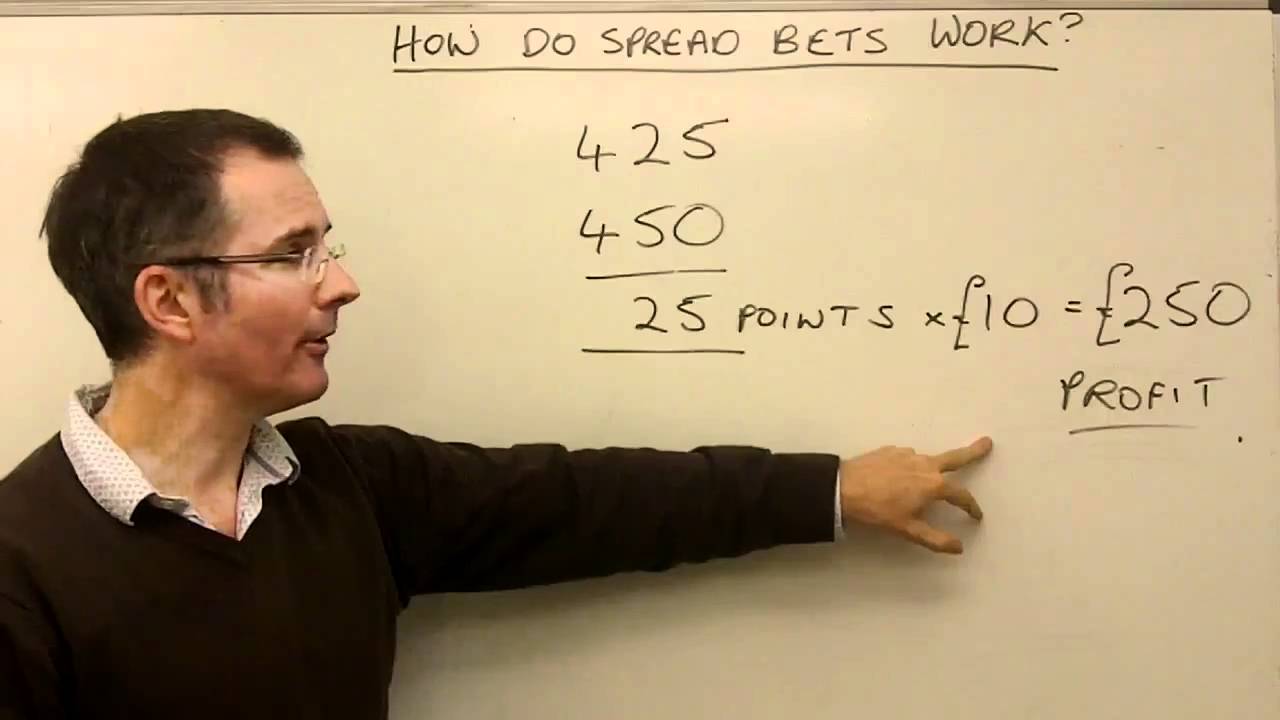

Yes, you read that correctly. When you place a spread bet you set a value per unit, let’s say $1 per 1 cent, that an asset will move in a given direction.

Using this example of $1 bet for every 1 cent of price movement and applying it to Apple stocks again, for every 1 cent Apple stock prices rise I will profit $1, assuming I am betting on the price rising.

This can lead to dramatic profits in mere seconds. You could bet that the New York Stock Exchange will fall in value at a rate of $100 per point, right before a piece of terrible economic news is released, and you could make tens of thousands in seconds if you’re right.

This last example nicely illustrates that it’s possible to make money on the price of an asset falling as well as rising. That’s one of the great things about spread betting because as the old saying goes:

“The bull goes up the stairs, and the bear goes out the window”.

Bad news and the subsequent collapses in price happen much, much faster than prices climb. Some people have made their fortunes spread betting by capitalizing on these situations.

I’ve been trading financial markets since I was a teenager (longer ago than I care to think about), and I can safely say that spread betting is my favorite way to get involved in whatever’s happening in the world financial markets.

I don’t mean to paint spread betting as some magical solve all which guarantees you endless supplies of cash. There are some downsides to it, and I’ll look at those a little later.

What I am saying is that there are several advantages to spread betting over using other ways to trade financial markets. These include:

You can place a spread bet in a split second when you spot an opportunity.

The best spread betting platforms will have one-click (or one-tap) trading which means you can place your bets within less than a second if you’re quick off the mark.

I’ve watched stock prices collapse 20% in seconds countless times after weak earnings reports have been released at the end of a quarter.

That couple of seconds can mean huge profits or losses, and spread bettors have to be lightning fast to catch these movements.

While you can buy and sell stocks, commodities, and other assets fairly quickly, spread betting is the fastest way to place trades I have encountered yet.

Because you can bet a certain value per point or cent, you can reap massive rewards by correctly predicting the direction of a bet.

You could start out with $500 and walk away with tens of thousands quite easily. A tanking stock, or stock index, falls extremely quickly, and if you’ve placed your bets on time, you can ride it all the way down, making cash hand over fist while others are trying to bail out of their positions.

Whereas you might buy a stock and watch it double if you’re lucky, you can make thousands of times your money in a few hours by spread betting if you call it right.

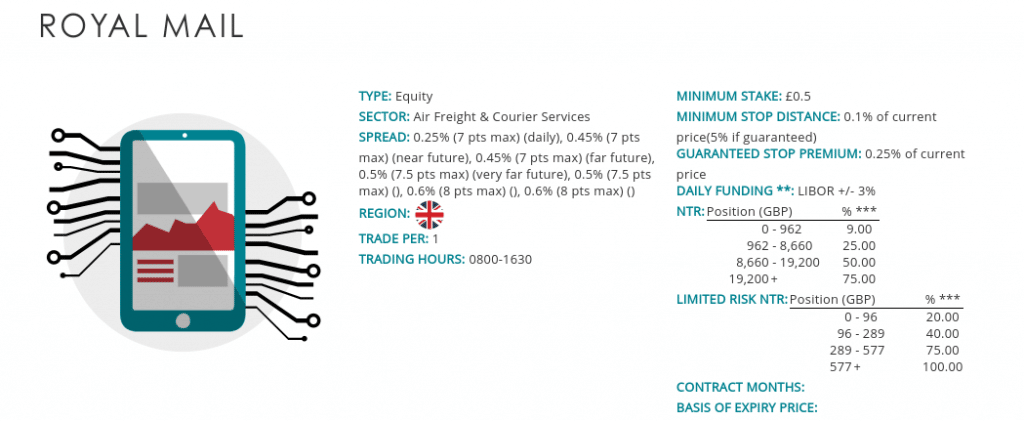

Keep in mind that there are some limits placed on the value you can bet per point or cent based on your total available capital. I’ll talk more about that in the FAQs section below.

Even still, it’s unreal how much money can be made from a well-timed spread bet. It can be a little like winning a jackpot while playing slots. One minute you have a few hundred, the next you have tens of thousands!

Of all the financial instruments I’ve played with, I found spread betting easiest to grasp.

It’s simple when you think about it. All you have to do is pick a direction (up or down), and hope you’re right. When the price moves in your favor, all you have to do is pick a point to cash out at. If it moves the other way, all you have to do is pick (or pre-set) a point at which to cut your losses.

There are a couple of other things to understand before you go diving in, such as the concept of margin. However, that’s a simple enough concept, too, and I’ll explain it before this post is done.

Someone, I know who made a lot of money spread betting once compared it to a coin toss. You’re either wrong, or you’re right, and that’s it. The main difference is there’s a lot more money to be made by spread betting than by betting on coin tosses, which are almost always double or nothing bets.

I’d like to say up front that I do not recommend betting on margin unless you absolutely know what you are doing.

Betting on margin is betting with borrowed money, and in the world of spread betting, you can borrow 100:1 on some platforms. That means that if you deposit $10,000, you can borrow $1,000,000 to bet with.

This makes it possible to make millions in seconds if you get a spread bet right, but it also drives the risk factor through the roof. If you bet on margin and lose, you could be left holding the bag for a LOT of money you don’t have.

Betting on margin can also see your initial capital wiped out in milliseconds. It often happens in spread betting that things go the wrong way before they turn around and go the way you thought they would.

If you bet on margin, you could lose thousands of dollars in the blink of an eye, whereas if you hadn’t “geared up” you would have been able to absorb the losses before things turned around and went your way.

You’ve got to be careful when making use of leverage. Ask yourself the question “What if I’m wrong?” before placing trades. That’s usually enough to sober most up before taking this type of risk.

While there are risks, margin allows traders who get that gut feeling to pounce on the opportunity they feel has presented itself. This is what makes spread betting so lucrative when it goes well.

Nothing in life is all roses and sunshine, and spread betting is no exception. There are some risks associated with this form of betting on financials.

There are two words I want you to engrave into your brain before you even think about making your first spread bet – STOP LOSS!

A stop loss is a risk management tool that allows you to predetermine when you close a trade.

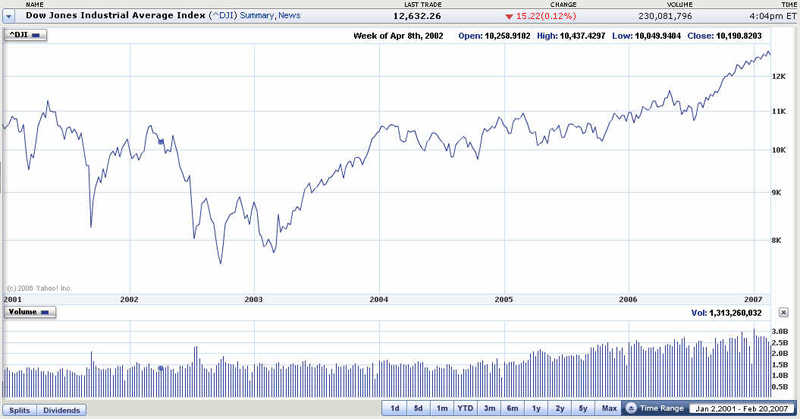

Let’s say the Dow Jones Industrial Average (DJIA) is trading at 25,000 points and you believe it will climb further. You could set your bet to cash out when it reaches 27,000, and you would make nice money if it did.

However, you should also set a stop loss before placing the trade. You might decide that if it drops to 24,000, you’ve likely got it wrong and you’re willing to take the loss that 1,000 points would bring (which depends on how much you bet per point) and cut your losses.

If you don’t put a stop loss in place, you could end up losing much more money than you thought possible. Let’s say you place the above bet without a stop loss, and something drastic happens which causes the bottom to fall out of the market. 25,000 points is a long way down, and there’s no telling where the market might stop bleeding out.

While it’s likely your trade would close out at some point due to insufficient capital, there are no guarantees. I’d rather not take that risk.

Risk management is an essential point of any financial betting strategy. However, when it comes to spread betting, you need to use it more than ever. Stocks can only go to zero, but when spread betting you could end up in the red.

More than once in my life as a spread bettor I have been right but still lost money.

How is that possible? Because of one of two things:

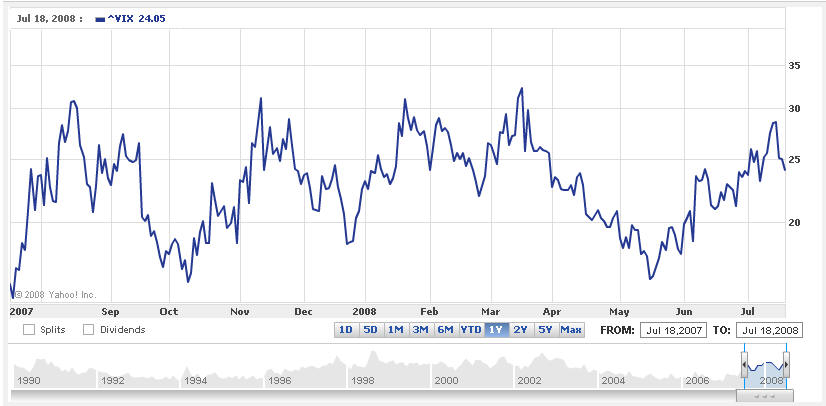

By far the biggest cause of losing while being right is market volatility, in my experience.

You see, there’s always the possibility that the price will move in the wrong direction before turning around and going exactly the way you bet it would. When you have a stop loss in place, which you always should, this can get triggered, closing the trade before you get to see your bet pay off.

This has happened to me more times than I like to think about. It’s partly because in spread betting the biggest opportunities are also the most tumultuous times, and traders around the world are going mad selling, buying, and causing prices to swing around wildly.

This can be mitigated somewhat by keeping in mind three things:

While all of these are important, number three is crucial. I can tell you from experience that the S&P 500 stock market moves very slowly and calmly up and down, whereas at times the DJIA price movements are enough to induce whiplash just by looking at the trading screen.

Since you can trade stocks, bonds, indices, commodities like gold and oil, and even currencies through spread betting, it pays to take some time to watch the markets for a while, noticing which assets move most violently, and avoiding those unless you have the capital to absorb temporary losses.

While spread betting is hugely popular in the UK, Europe, and lots of other places, it’s not allowed in the USA because the government considers it to be online gambling.

US traders can get in on similar action by options trading. That’s a whole other article for another day, though.

Before coming to a close, I want to briefly cover some questions I often receive from people who are thinking about getting into spread betting.

Spread betting is one of those things where you can make vast sums of money, and lose it just as quickly. It’s an exhilarating ride, and it certainly isn’t for the faint of heart.

If you think spread betting is something you would like to try, I recommend taking some time to build your knowledge base first. This has only touched on the fundamentals of spread betting , and there’s more you need to learn before you take the next step.

As with all areas of life, knowledge is power. Take your time to learn how to pick a spread betting platform, some of the ins and outs of how spread betting works, and some of the popular spread betting strategies, and you’ll be much more likely to make money when you do place a bet.

Whatever you decide, I wish you the best of luck. If you do make several million on a spread bet, feel free to come back to this post, email the editor, and she’ll happily pass along my address where you can send a gratitude check!

Stay safe out there, and remember, always bet responsibly.

https://www.independentinvestor.com/spread-betting/

https://www.legitgamblingsites.com/blog/what-is-financial-spread-betting-and-why-should-you-consider-it/

Pee Sex Vk

Go Ahead And Film My Hard Penis

Vintage Creampie Video

Financial Spread Betting and How Spread Betting Works

Financial Spread Betting - Understanding How it Works

A quick guide to how financial spread betting the markets ...

Beginner's Overview: How Does Spread Betting Work? - My ...

How Financial Spread Betting Works: Spread Trading ...

How Does Financial Betting Work - Financial Spread Betting

Financial Spread Betting for a Living

What Is Spread Betting? - Investopedia

Spread Betting Explained | What is spread betting & How do ...

How Financial Spread Betting Works