How Financial Spread Betting Works

🛑 👉🏻👉🏻👉🏻 INFORMATION AVAILABLE CLICK HERE👈🏻👈🏻👈🏻

We use cookies to personalise content and ads, to provide social media features and to analyse our traffic. We also share information about your use of our site with our marketing partners, social media, advertising and analytics partners who may combine it with other information that you’ve provided to them or that they’ve collected from your use of their services. You consent to our cookies if you continue to use our website.

Don’t have time to read the Guide now? Request a PDF version.

Some traders and investors are a bit reluctant to venture into the world of financial spread betting, simply because it’s a financial product that they’re unfamiliar with.

However, the fact is the spread betting process is one of the simplest types of financial trading there is, much less complex than, for example, the practice of writing options.

We’re moving on to Part II of the guide where we explain what spread betting is and how it works. In this chapter, we’re going to show you exactly how spread betting works, complete with examples of spread bets.

Before we get into that though, let’s briefly recap exactly what spread betting is.

Spread betting refers to speculating on the direction of a financial market without actually owning the underlying security. It involves placing a bet on the price movement of a security.Investopedia

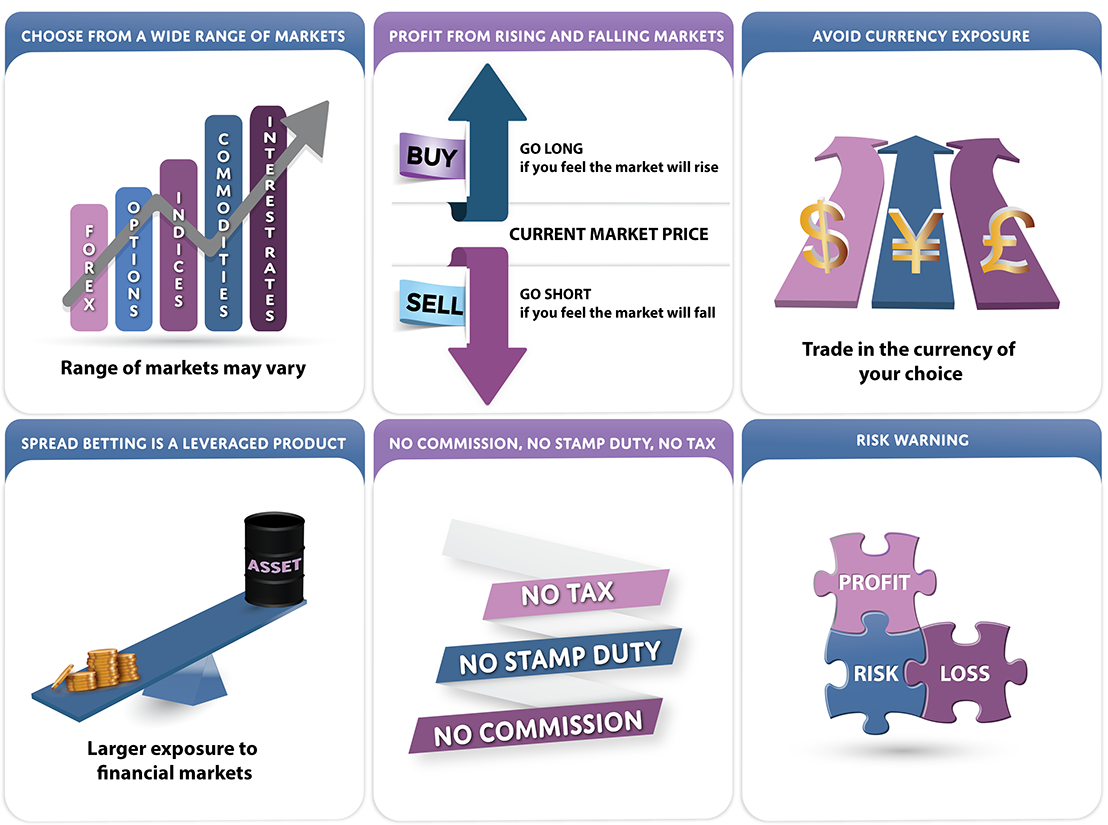

Profits are made from betting correctly on which direction the price of a given financial asset will move – up or down. You do not have to predict an exact price the asset will attain – just the direction the market price will move in.

The primary attraction of financial spread betting is the opportunity to generate large profits with only a small investment. This is because spread betting is a highly leveraged product. In order to place a spread bet, you only need to put up a small margin deposit, as little as about 3% of the value of the underlying financial asset.

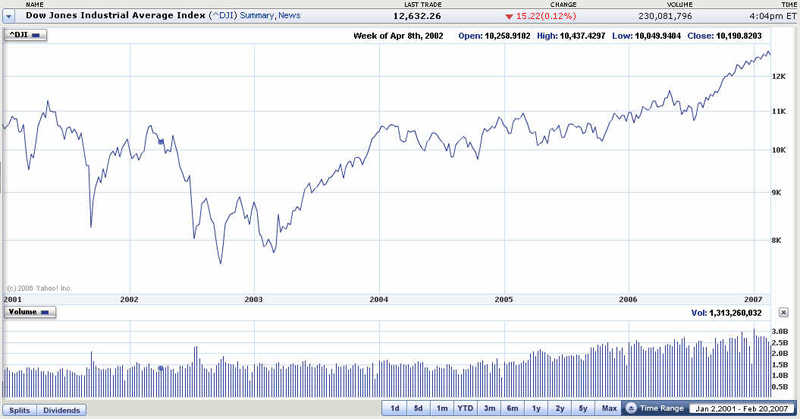

You can pretty much spread bet any financial market out there so long as it has a verifiable price.

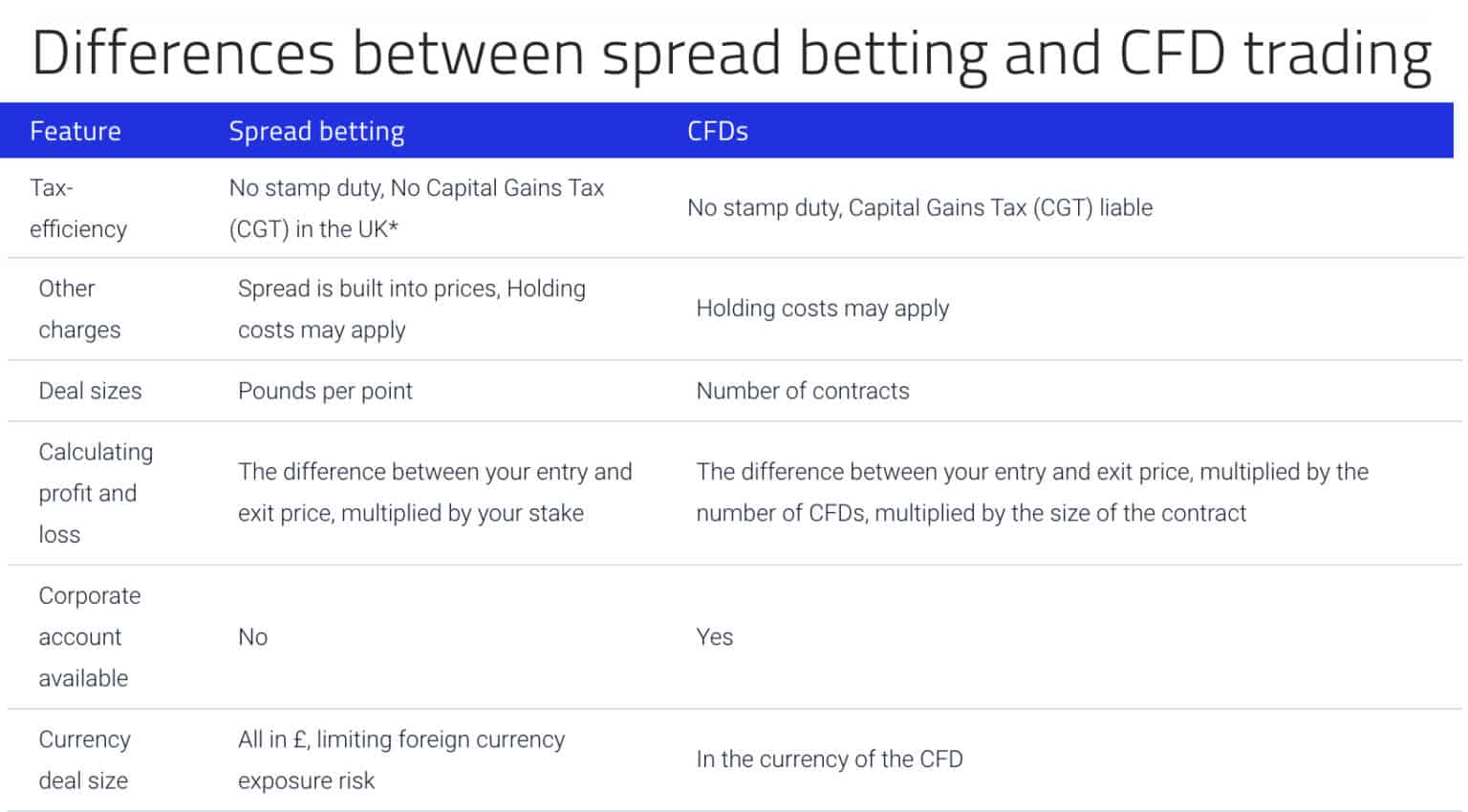

Spread bets do not incur any commission fees. The majority of the costs to trade are included in the spread.

Because traders stake in their base currency they do not have to assume the currency risk of the instrument they are speculating on. This is a bit technical for this part of the guide but trust us, its a big advantage.

Profits from spread betting do not normally attract stamp duty, income tax or capital gains tax in the UK. Spread betting is tax-free because it’s considered by the tax man to be betting, not investing.

This tax-free treatment has made spread betting very popular in the UK, where it is authorised and regulated by the Financial Conduct Authority (FCA).

The first move required to begin spread betting is to open an account with one of the many spread betting brokers. If you’re new to spread betting and want to try out some of your trading strategies before risking real money, you can open a spread betting demo account to practice trade in.

Because spread betting is so highly leveraged, you can start betting with just a small amount of capital. Therefore, many financial spread betting brokers only require a minimal deposit to open an account and begin trading.

You can open a spread betting account at some financial spread betting brokers with as little as £100. However, you should set your expectations of a reasonable rate of return – remember the best traders at hedge funds are probably happy with a 25% annual return on capital.

You can open a spread betting account at some financial spread betting brokers with as little as £100

In short, you’ll probably be in a better position to begin trading if you open your spread betting account with more than just the minimum required initial deposit.

Keep in mind that spread betting is speculation, so you should be sure to fully understand the risks involved and only spread bet with money that you can afford to lose.

Spread betting companies offer a variety of spread betting platforms for you to place your bets through. The most common types of betting platforms are as follows:

Web-based trading platforms. With a browser or web-based platform, you trade through a direct internet/web connection, usually through the spread betting company’s website.

Downloadable trading platforms. These trading platforms are software programs that you download. They frequently offer a number of advanced features beyond what’s available through most web-based trading platforms – such as the ability to access more technical analysis charting tools and templates.

Mobile trading apps. Because more and more traders want the ability to bet “on the go”, using their smartphone, more and more spread betting firms offer a mobile trading app. Although mobile trading apps typically offer a limited number of features, they can easily be used to enter, modify, or close trades, and to access price, market news, and other information.

It’s very important to familiarise yourself with how your chosen trading platform works – how to enter and exit bets, how to use available research and trading tools, how to modify your bets (e.g. change your stop-loss price), and how to calculate your margin requirement for a bet.

You don’t want to be caught in a rapidly moving market, fumbling around trying to figure out how to enter or exit a bet. To be an effective spread bettor, you need to be able to react quickly to changing market conditions.

You sometimes have literally only seconds to exit a trade with a profit before the market turns sharply against you and hands you a loss.

In addition to providing the means to enter, modify, and exit spread bets, spread betting companies also provide a number of other services to their clients, including the following:

There are thousands of possible spread bets available at any moment within the trading day. Spread betting offers a very wide range of financial markets to choose from. Most spread betting brokers offer other types of financial trading as well, such as trading CFDs. Among the most popular markets to spread bet on are:

Spread betting offers you access to global financial markets – you can spread bet on stocks and other financial assets traded on exchanges in New York, Hong Kong, or Tokyo just as easily as trading on local London trading exchanges.

Since it’s impossible to be an expert on every financial market, or to keep up with the latest information on every traded asset, most spread bettors specialise in betting on just one or two types of financial instrument. You can use your spread betting broker’s research tools to find the markets that you’re most interested in and most comfortable betting on.

You might be particularly good at stock share trading, or you might prefer spread betting forex.

For any traded asset, the market price is always quoted showing the spread, which is the difference between the buy price (the ask, or offer, price) and the sell price (the bid price).

If you are betting on the price of an asset going up, then you buy or ‘go long’ the asset at the buy/ask price, which will always be the highest of the two prices quoted as the spread. You are trying to profit from an increase in price, but you can also lose from a fall in price.

If you are betting on the price of the asset going down, then you sell short at the sell/bid price, which will always be the lower price quoted in the spread. You are trying to profit from a fall in price, but you can also lose from an increase in price.

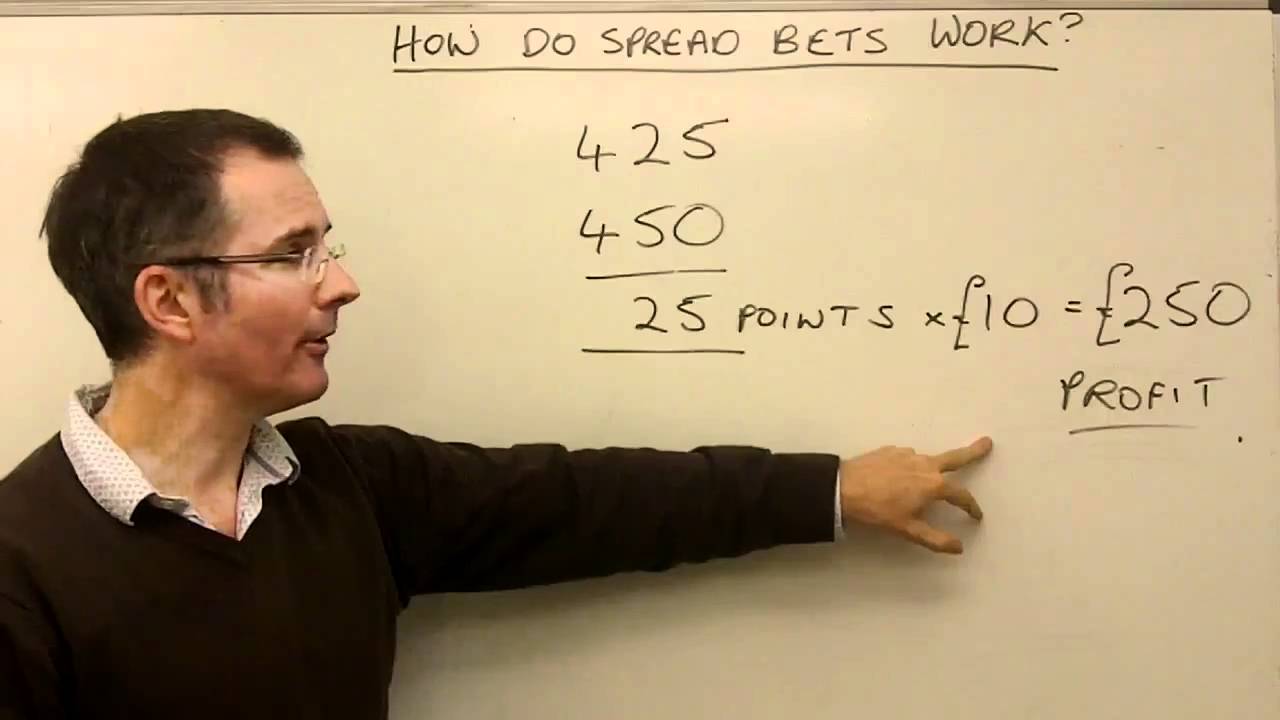

Let’s look at an example to see how spread betting works in practice.

For example: a spread bet on a stock price

Whenever you place a spread bet, you have to choose your stake size. Your stake size is basically how much you’re willing to bet per point of price movement of the asset you’re trading. If your stake size is £5, then you make a £5 profit for every point the market moves in your favour.

Likewise, you’d lose £5 for every point the market moves against your position.

Your stake size also determines how much margin you must put up to place your spread bet.

To place your spread bet, you have to put up the required margin percentage (which, of course, varies depending on what financial asset you’re trading and your broker, for the Tesco trade it was 20%) multiplied by the notional value of the underlying asset. The larger your bet, the more margin required for the trade.

There are two types of spread bets, in terms of how long the bet is good for:

These are quite rare nowadays. A daily funded bet expires at the end of the trading day; if you have not already closed out your bet before then, it will be closed out at the closing price of the day.

Now the standard and the one used in the Tesco example (you’ll see it specified in the deal tickets above after the name of the market), a rolling daily bet does not expire at the end of the day. It “rolls over” to the next trading day, and will remain open until you close it out, you are stopped out of the trade, your bet is closed out by the spread betting company due to insufficient margin, or the trade is closed out by hitting a chosen “take profit” level. The spread betting company charges an overnight funding fee.

You can control your risk level and set take-profit levels with the use of stop-loss orders and limit orders. Learning to manage your bets well once you have them in place is a key part of learning how to spread bet successfully.

You place a stop-loss order at a price level that represents a certain amount of loss, in case the market moves against you. This will limit your potential loss on the bet to an amount you are comfortable with. With a standard stop-loss order, if the market hits your stop price, then your bet will automatically be closed out at the best available market price.

So, for our Tesco example, when going short the stop-loss order is set above the market price – a ten-point stop loss would be set at 238.99 pence. We staked £10 per point, so if the trade moved against us, the stop loss triggered and filled at that level it would be a £100 loss.

This does not guarantee that your order will be filled at the exact price level of your stop-loss, only that it will be filled at the best price available. If the market is moving rapidly or is closed but reopens at a price that then triggers your order, your bet might be closed out at a substantially different price. This fluctuation in order fill price is known as “slippage”.

If you want to be assured of avoiding market slippage, then you can pay a small premium to place a “guaranteed stop-loss order”. With a guaranteed stop-loss, you are guaranteed to have your bet closed at the exact stop-loss price level you specified in your order.

You can set a limit order to automatically close out your spread bet if the asset you’re trading reaches a certain level of profitability. In the example above of selling short Tesco, you could have set a limit order to close out your stock spread bet at, for example, 210.00. If the ask price fell to at least that level, your spread bet would automatically be closed out, thus locking in 19.61 points of profits – or in monetary terms £196.10. In our example, we closed the trade out before the limit order level was reached.

If you ever get confused with the terminology, here’s how to remember how limit and stop orders work:

The process of spread betting is simple…it’s making sure you bet the right way that’s the challenging part.

Learn the skills needed to trade the markets on our Trading for Beginners course.

1st September - Wednesday at 1130 GMT

I am happy to receive more information from My Trading Skills.

If you are human, leave this field blank.

My Trading Skills® is a registered trademark and trading name of PMJ Publishing Limited. The material on this website is for general educational purposes only and users are bound by the sites terms and conditions. Any discussions held, views and opinions expressed and materials provided are for general information purposes and are not intended as investment advice or a solicitation to buy or sell financial securities. Any person acting on this information does so entirely at their own risk. Trading is high risk, it does not guarantee any return and losses can exceed deposits. My Trading Skills®, its employees and directors shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein. Trading may not be suitable for you and you must therefore ensure you understand the risks and seek independent advice. The information on this site is not directed at residents of the United States or any particular country outside the UK and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

© 2021 Copyright PMJ Publishing Limited. All rights reserved.

The My Trading Skills Community is a social network, charting package and information hub for traders. Access to the Community is free for active students taking a paid for course or via a monthly subscription for those that are not.

Spread betting refers to speculating on the direction of a financial market without actually owning the underlying security. It involves placing a bet on the price movement of a security. Investopedia Profits are made from betting correctly on which direction the price of a given financial asset will move – up or down.

mytradingskills.com/spread-betting-guide/how-it-works

What is spread betting and how does it work?

What is spread betting and how does it work?

What is spread betting? Spread betting is a tax-free financial derivative that allows traders to take a position on a security. This can be in the form of stocks and shares, as well indices, commodities, and even bonds. The big difference between buying stocks and spread betting stocks is that when spread betting we don’t own the underlying asset.

www.shiftingshares.com/what-is-spread-be…

Is it risky to trade CFDs and spread betting?

Is it risky to trade CFDs and spread betting?

Trading is Risky. 65% of retail investor accounts lose money when trading CFDs and spread bets with this provider. Financial spread betting is leveraged trading. It provides traders and investors the opportunity to trade the financial markets without ever taking ownership of the underlying asset.

What happens when you bet on the stock market?

What happens when you bet on the stock market?

The more the market moves in your direction you have predicted, the greater your profit. Conversely, when the market moves against you, the more you lose. The danger is that the loss may exceed your deposit margin. The fees are in the spread - so watch the spread. There is no CGT, stamp duty, explicit trading commissions.

Do you pay tax on your spread betting profits?

Do you pay tax on your spread betting profits?

Spread Betting: Reduce Taxes On Your UK Trading Profits! The late Benjamin Franklin is remembered for once famously saying, "There are two things you can be sure of in life - death and taxes!" When an opportunity to make money and not pay any tax on the profit comes along, it's fair to say that most people would take a second glance.

https://www.financial-betting.com/course/spread-betting-works

What is Financial Spread Betting. Financial trading is a little more flexible than that, however. Because if, during the day as the FTSE changes, you decide that you wish to take your profit (or cut your loss) there and then, …

https://mytradingskills.com/spread-betting-guide/how-it-works

The primary attraction of financial spread betting is the opportunity to generate large profits with only a small investment. This is because spread betting is a highly leveraged product. In order to place a spread bet, you only need to put up a small margin deposit, as little as about 3% of the value of the underlying financial asset.

How Financial Spread Betting Works: Spread Trading Examples

Introduction to Financial Spread Betting How Spread Betting works

YouTube › Vince Stanzione Making Money From Trading

How Financial Spread Betting Works: Spread Trading Examples

Introduction to Financial Spread Betting How Spread Betting works

https://www.independentinvestor.com/spread-betting

Making a Spread Bet. When making a financial spread bet, a trader will decide on a certain amount of money to risk. For example, say you want to bet £10 per point on a certain financial product because you think it will …

https://goodmoneyguide.com/a-quick-guide-to-how-financial-spread-betting-the-markets-works

Financial spread betting works by customers placing a bet on a stock instead of actually buying or selling the shares. A spread betting broker will provide quotes or prices based around the actual price of the stock in …

https://m.youtube.com/watch?v=mhM7KQWpFxs

28.10.2011 · Spread Betting Examples http://www.spread-betting.com/spread-trading-examples Probably the best way to see how spread betting works …

https://www.legitgamblingsites.com/blog/what-is-financial-spread-betting-and-why...

10.04.2018 · Financial spread betting is trying to predict the direction of the price of a given stock or another asset for profit. You see financials, unlike sports, only have two possible outcomes.

https://ecattrade.com/spread-betting

Financial spread betting has three major components: Bet Size – The size of the bet determines the size of the loss or profit.. Bet Duration – This determines how long a position will be left open before it expires.. Spread – The spread …

https://www.shiftingshares.com/what-is-spread-betting

23.04.2020 · Spread betting works by placing a ‘bet’ on the spread – the difference between the buy and sell price. Spread betting is a popular way of trading because it also enables traders to position …

Не удается получить доступ к вашему текущему расположению. Для получения лучших результатов предоставьте Bing доступ к данным о расположении или введите расположение.

Не удается получить доступ к расположению вашего устройства. Для получения лучших результатов введите расположение.

Pump My Ass Full Of Cum

Long Russian Solo Porn Hd Xxx

Grace Jones Private Life

Sexy Girls Naked Damplips

Mommy Fuck Com

How Financial Spread Betting Works | Financial-Betting.com

Beginner's Overview: How Does Spread Betting Work? - My ...

Financial Spread Betting and How Spread Betting Works

A quick guide to how financial spread betting the markets ...

Financial Spread Betting - Understanding How it Works

Spread Betting & How It Works - Your Complete Guide in 2021

Spread Betting Explained: What is Spread Betting & How ...

How Financial Spread Betting Works