How Do Spread Betting Companies Work

🛑 👉🏻👉🏻👉🏻 INFORMATION AVAILABLE CLICK HERE👈🏻👈🏻👈🏻

We use cookies to personalise content and ads, to provide social media features and to analyse our traffic. We also share information about your use of our site with our marketing partners, social media, advertising and analytics partners who may combine it with other information that you’ve provided to them or that they’ve collected from your use of their services. You consent to our cookies if you continue to use our website.

Spread betting refers to speculating on the direction of a financial market without actually owning the underlying security. It involves placing a bet on the price movement of a security. Investopedia

The primary attraction of financial spread betting is the opportunity to generate large profits with only a small investment. This is because spread betting is a highly leveraged product . In order to place a spread bet, you only need to put up a small margin deposit, as little as about 3% of the value of the underlying financial asset.

You can pretty much spread bet any financial market out there so long as it has a verifiable price.

Spread bets do not incur any commission fees. The majority of the costs to trade are included in the spread.

Because traders stake in their base currency they do not have to assume the currency risk of the instrument they are speculating on. This is a bit technical for this part of the guide but trust us, its a big advantage.

Profits from spread betting do not normally attract stamp duty, income tax or capital gains tax in the UK. Spread betting is tax-free because it’s considered by the tax man to be betting, not investing.

You can open a spread betting account at some financial spread betting brokers with as little as £100

For example: a spread bet on a stock price

These are quite rare nowadays. A daily funded bet expires at the end of the trading day; if you have not already closed out your bet before then, it will be closed out at the closing price of the day.

Now the standard and the one used in the Tesco example (you’ll see it specified in the deal tickets above after the name of the market), a rolling daily bet does not expire at the end of the day. It “rolls over” to the next trading day, and will remain open until you close it out, you are stopped out of the trade, your bet is closed out by the spread betting company due to insufficient margin, or the trade is closed out by hitting a chosen “take profit” level. The spread betting company charges an overnight funding fee.

Some traders and investors are a bit reluctant to venture into the world of financial spread betting , simply because it’s a financial product that they’re unfamiliar with.

However, the fact is the spread betting process is one of the simplest types of financial trading there is, much less complex than, for example, the practice of writing options.

We’re moving on to Part II of the guide where we explain what spread betting is and how it works. In this chapter, we’re going to show you exactly how spread betting works, complete with examples of spread bets.

Before we get into that though, let’s briefly recap exactly what spread betting is.

Profits are made from betting correctly on which direction the price of a given financial asset will move – up or down. You do not have to predict an exact price the asset will attain – just the direction the market price will move in.

This tax-free treatment has made spread betting very popular in the UK, where it is authorised and regulated by the Financial Conduct Authority (FCA).

The first move required to begin spread betting is to open an account with one of the many spread betting brokers. If you’re new to spread betting and want to try out some of your trading strategies before risking real money, you can open a spread betting demo account to practice trade in.

Because spread betting is so highly leveraged, you can start betting with just a small amount of capital. Therefore, many financial spread betting brokers only require a minimal deposit to open an account and begin trading.

You can open a spread betting account at some financial spread betting brokers with as little as £100. However, you should set your expectations of a reasonable rate of return – remember the best traders at hedge funds are probably happy with a 25% annual return on capital.

In short, you’ll probably be in a better position to begin trading if you open your spread betting account with more than just the minimum required initial deposit.

Keep in mind that spread betting is speculation, so you should be sure to fully understand the risks involved and only spread bet with money that you can afford to lose.

Spread betting companies offer a variety of spread betting platforms for you to place your bets through. The most common types of betting platforms are as follows:

Web-based trading platforms. With a browser or web-based platform, you trade through a direct internet/web connection, usually through the spread betting company’s website.

Downloadable trading platforms. These trading platforms are software programs that you download. They frequently offer a number of advanced features beyond what’s available through most web-based trading platforms – such as the ability to access more technical analysis charting tools and templates.

Mobile trading apps. Because more and more traders want the ability to bet “on the go”, using their smartphone, more and more spread betting firms offer a mobile trading app. Although mobile trading apps typically offer a limited number of features, they can easily be used to enter, modify, or close trades, and to access price, market news, and other information.

It’s very important to familiarise yourself with how your chosen trading platform works – how to enter and exit bets, how to use available research and trading tools, how to modify your bets (e.g. change your stop-loss price), and how to calculate your margin requirement for a bet .

You don’t want to be caught in a rapidly moving market, fumbling around trying to figure out how to enter or exit a bet. To be an effective spread bettor, you need to be able to react quickly to changing market conditions.

You sometimes have literally only seconds to exit a trade with a profit before the market turns sharply against you and hands you a loss.

In addition to providing the means to enter, modify, and exit spread bets, spread betting companies also provide a number of other services to their clients, including the following:

There are thousands of possible spread bets available at any moment within the trading day. Spread betting offers a very wide range of financial markets to choose from. Most spread betting brokers offer other types of financial trading as well, such as trading CFDs . Among the most popular markets to spread bet on are:

Spread betting offers you access to global financial markets – you can spread bet on stocks and other financial assets traded on exchanges in New York, Hong Kong, or Tokyo just as easily as trading on local London trading exchanges.

Since it’s impossible to be an expert on every financial market, or to keep up with the latest information on every traded asset, most spread bettors specialise in betting on just one or two types of financial instrument. You can use your spread betting broker’s research tools to find the markets that you’re most interested in and most comfortable betting on.

You might be particularly good at stock share trading, or you might prefer spread betting forex.

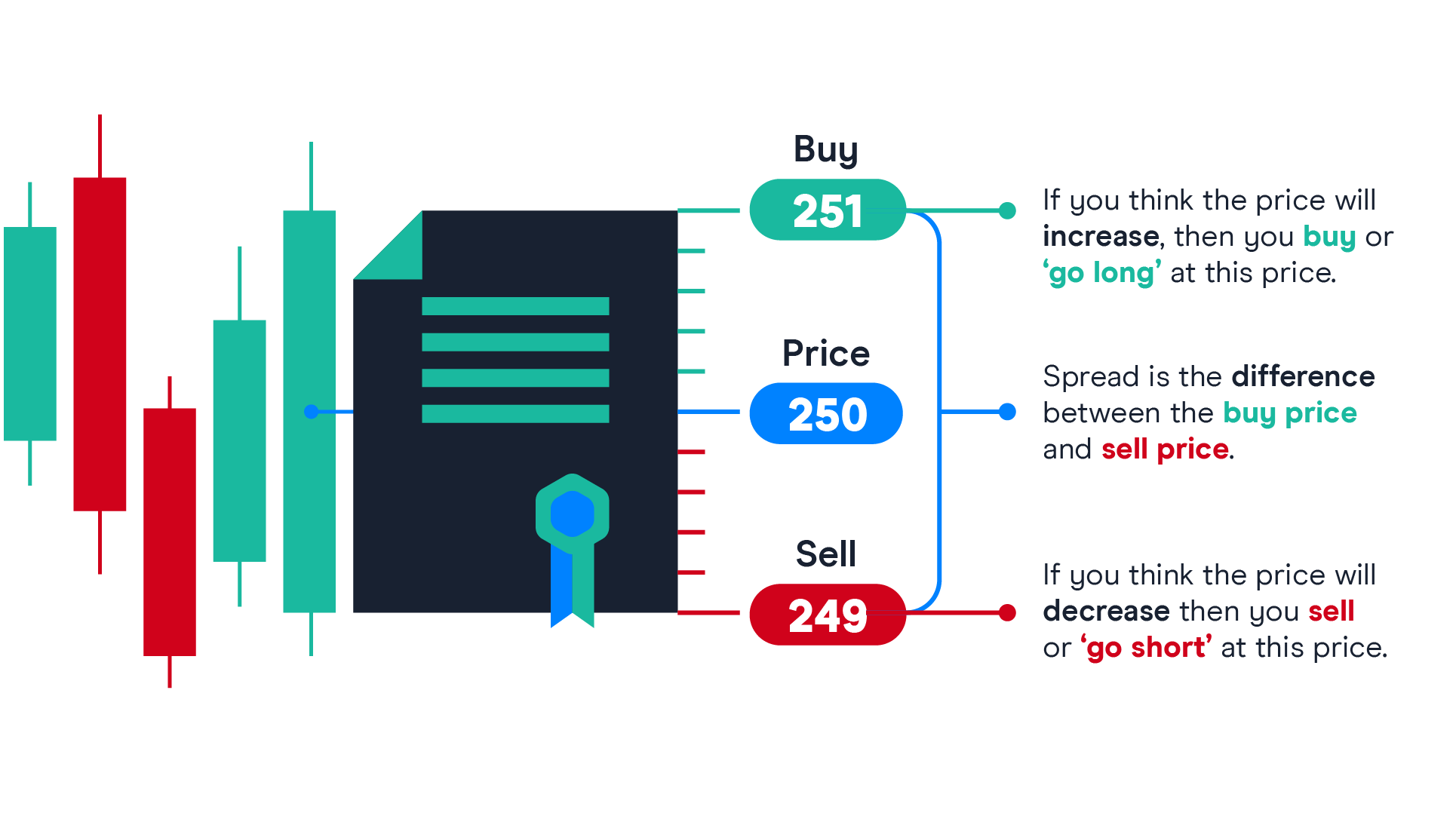

For any traded asset, the market price is always quoted showing the spread, which is the difference between the buy price (the ask, or offer, price) and the sell price (the bid price).

If you are betting on the price of an asset going up, then you buy or ‘go long’ the asset at the buy/ask price, which will always be the highest of the two prices quoted as the spread. You are trying to profit from an increase in price, but you can also lose from a fall in price.

If you are betting on the price of the asset going down, then you sell short at the sell/bid price, which will always be the lower price quoted in the spread. You are trying to profit from a fall in price, but you can also lose from an increase in price.

Let’s look at an example to see how spread betting works in practice.

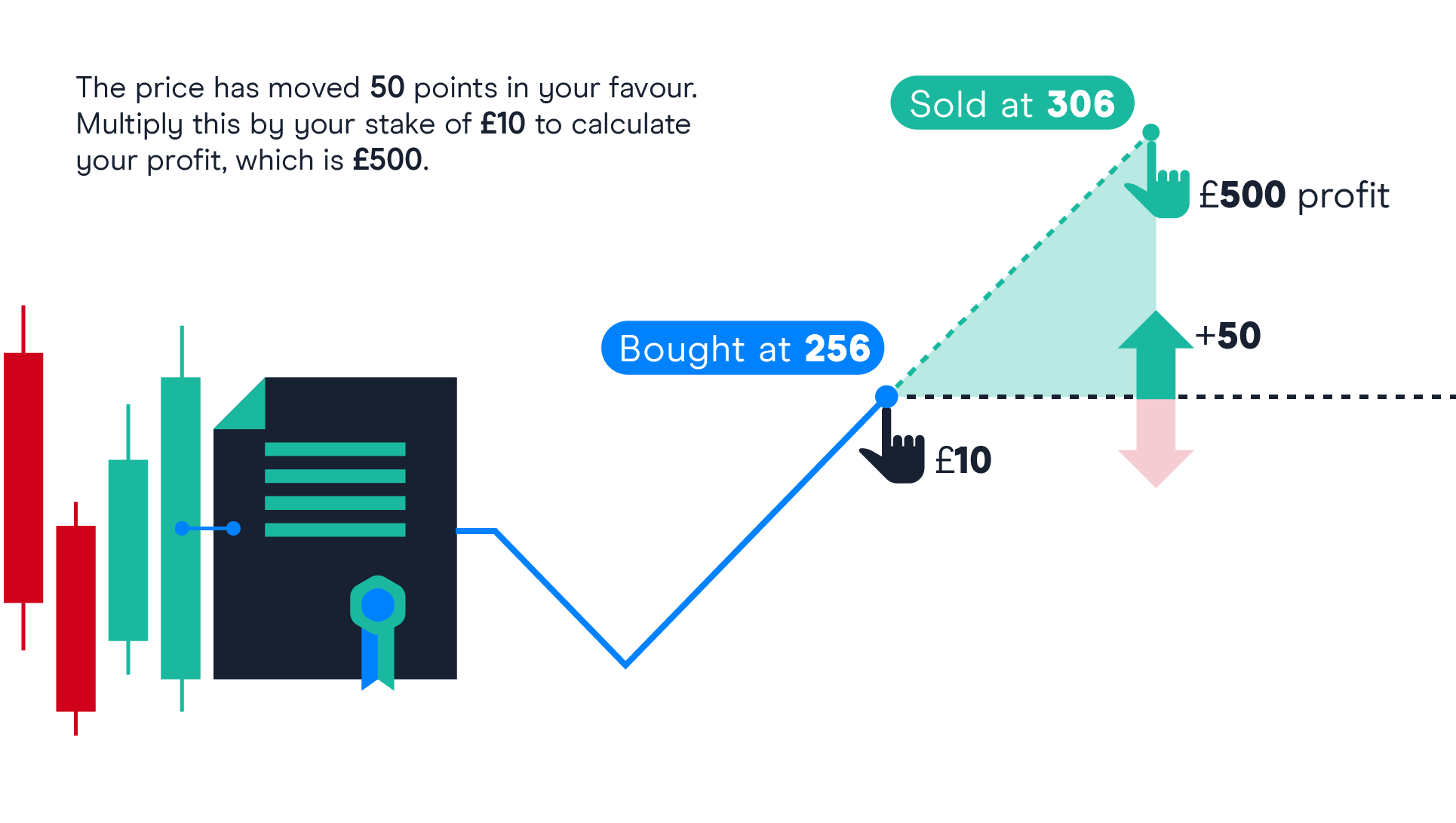

Whenever you place a spread bet, you have to choose your stake size. Your stake size is basically how much you’re willing to bet per point of price movement of the asset you’re trading. If your stake size is £5, then you make a £5 profit for every point the market moves in your favour.

Likewise, you’d lose £5 for every point the market moves against your position.

Your stake size also determines how much margin you must put up to place your spread bet.

To place your spread bet, you have to put up the required margin percentage (which, of course, varies depending on what financial asset you’re trading and your broker, for the Tesco trade it was 20%) multiplied by the notional value of the underlying asset. The larger your bet, the more margin required for the trade.

There are two types of spread bets, in terms of how long the bet is good for:

You can control your risk level and set take-profit levels with the use of stop-loss orders and limit orders. Learning to manage your bets well once you have them in place is a key part of learning how to spread bet successfully.

You place a stop-loss order at a price level that represents a certain amount of loss, in case the market moves against you. This will limit your potential loss on the bet to an amount you are comfortable with. With a standard stop-loss order, if the market hits your stop price, then your bet will automatically be closed out at the best available market price.

So, for our Tesco example, when going short the stop-loss order is set above the market price – a ten-point stop loss would be set at 238.99 pence. We staked £10 per point, so if the trade moved against us, the stop loss triggered and filled at that level it would be a £100 loss.

This does not guarantee that your order will be filled at the exact price level of your stop-loss, only that it will be filled at the best price available. If the market is moving rapidly or is closed but reopens at a price that then triggers your order, your bet might be closed out at a substantially different price. This fluctuation in order fill price is known as “slippage”.

If you want to be assured of avoiding market slippage, then you can pay a small premium to place a “guaranteed stop-loss order” . With a guaranteed stop-loss, you are guaranteed to have your bet closed at the exact stop-loss price level you specified in your order.

You can set a limit order to automatically close out your spread bet if the asset you’re trading reaches a certain level of profitability. In the example above of selling short Tesco, you could have set a limit order to close out your stock spread bet at, for example, 210.00. If the ask price fell to at least that level, your spread bet would automatically be closed out, thus locking in 19.61 points of profits – or in monetary terms £196.10. In our example, we closed the trade out before the limit order level was reached.

If you ever get confused with the terminology, here’s how to remember how limit and stop orders work:

The process of spread betting is simple…it’s making sure you bet the right way that’s the challenging part.

Learn the skills needed to trade the markets on our Trading for Beginners course.

My Trading Skills® is a registered trademark and trading name of PMJ Publishing Limited. The material on this website is for general educational purposes only and users are bound by the sites terms and conditions. Any discussions held, views and opinions expressed and materials provided are for general information purposes and are not intended as investment advice or a solicitation to buy or sell financial securities. Any person acting on this information does so entirely at their own risk. Trading is high risk, it does not guarantee any return and losses can exceed deposits. My Trading Skills®, its employees and directors shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein. Trading may not be suitable for you and you must therefore ensure you understand the risks and seek independent advice. The information on this site is not directed at residents of the United States or any particular country outside the UK and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

© 2021 Copyright PMJ Publishing Limited. All rights reserved.

Spread betting explained: How does spread betting work

Rating

Select Range

9 or higher

8 or higher

7 or higher

6 or higher

5 or higher

Lower than 5

Languages

Select Language Albanian Arabic Azerbaijani Belarusian Belgian Brazilian Bulgarian Burmese Catalan Chinese Croatian Czech Dannish Dutch English Estonian Filipino Finnish French Georgian German Greek Hebrew Hungarian Icelandic Indian Indonesian Irani Iraqi Italian Japanese Kazakh Korean Latvian Lithuanian Macedonian Malay Malaysian Mandarin Mongolian Norwegian Polish Portuguese Romanian Russian Serbian Slovak Slovenian Spanish Swahili Swedish Taiwanese Thai Turkish Ukranian Uzbek Vietnamese Tajik

Currency

Select Currency Albanian Lek Argentine Peso Armenian Dram Australian Dollar Azarbaijani Manat Bangladeshi Taka Belarusian Ruble Bitcoin Brazilian Real British Pound Bulgarian Lev Canadian Dollar Central Africa Franc Chilean Peso Chinese Yuan Colombian Peso Croatian Kuna Czech Koruna Danish Krone Dogecoin Ethereum Euro FYROM Denar Georgian Lari Guarani Paraguay Hong Kong Dollar Hungarina Forint Icelandic Krona Indian Rupee Indonesian Rupiah Iranian Rial Iraqi Dinar Japanese Yen Kazakhstan Tenge Kenyan Shilling Kirgystan Som Korean Won Litecoin Malaysian Ringgit Mexican Peso Moldovan Leu Mozambican Metical New Taiwan Dollar New Zealand Dollar New sol Peru Nigerian Naira Norwegian Krone Pakistani Rupee Philippine Peso Polish Zloty Romanian New Leu Russian Ruble Serbian Dinar Singaporean Dollars South African Rand South Korean Won Swedish Krona Swiss Franc Tajikistani Somoni Thai Baht Transnistria Tunisian Dinar Turkish Lira Turkmenistani Manat UAE Dirham US Dollar Ukrainian Hryvnia Uzbekistan Som Vietnamese Dong Qatari Riyal Saudi Riyal Omani Rial Bahraini Dinar Kuwaiti Dinar

Deposit Methods

Select Payment AMEX Apple Pay Astropay AstroPay India Bank Wire Bitcoin Cash Boku Cardano Dash Dogecoin EcoPayz ecoPayz India EFT Entropay EOS EPS Ethereum Euteller Gift Cards (US) Giropay Google Pay iDeal iDebit IMPS Instadebit Interac Jeton Litecoin M-Pesa Mastercard Monero Monese Money Order Monzo Muchbetter Multibanco N26 Neosurf Neteller Neteller India Payeer Payoneer Paypal Paysafecard Paysera Paytm Perfect Money Person to Person PhonePe POLi Przelewy24 QIWI Revolut Ripple Skrill Skrill India Sofort Stellar (XLM) Sticpay Tether TransferWise Tron Trustly UnionPay UPI India USDC VISA WebMoney Western Union Zcash Zimpler

Withdawal Methods

Select Payment AMEX Apple Pay Astropay AstroPay India Bank Wire Bitcoin Cash Boku Cardano Dash Dogecoin EcoPayz ecoPayz India EFT Entropay EOS EPS Ethereum Euteller Gift Cards (US) Giropay Google Pay iDeal iDebit IMPS Instadebit Interac Jeton Litecoin M-Pesa Mastercard Monero Monese Money Order Monzo Muchbetter Multibanco N26 Neosurf Neteller Neteller India Payeer Payoneer Paypal Paysafecard Paysera Paytm Perfect Money Person to Person PhonePe POLi Przelewy24 QIWI Revolut Ripple Skrill Skrill India Sofort Stellar (XLM) Sticpay Tether TransferWise Tron Trustly UnionPay UPI India USDC VISA WebMoney Western Union Zcash Zimpler

Payout

Select Range

94% - 97%

94% - 97%

Lower than 94%

© Copyright Bookmakers . All rights reserved. Created by SilkTech

Home »

Betting Guide »

Advanced betting »

Spread betting explained: How does spread betting work

The sports betting market was heavily influenced by its financial counterpart from its very beginning. The complete betting terminology, including most slang phrases, is directly derived from stockbrokers. Even the basic algorithm philosophy, that helps bookmakers adjust their odds, is based on the long-term research of stock market shares.

Spread betting is a different type of wagering compared to fixed odds betting or Asian Handicaps and bears a higher resemblance to the various financial markets. This betting method requires the bettor to think and act exactly like if he was in a stock exchange. His daily routine includes trading goals, cards and corner kicks as if they were shares, foreign currency or any kind of goods, where prices have continuous ups and downs.

When you think of a stock exchange, you create the mental image of the hustle-and-bustle of stockbrokers with their constant orders about “sell” or “buy”, where a lot of money is at stake. That's pretty much the case with sports spread betting. Placing spread bets means that you expect to gain profit, however, not with the classic “win” or “lose” scenario. It's far more complex than that. Your profit is influenced from the initial spread line and the final score of the match. The higher the winning difference, the more money you will make . Unfortunately, the opposite scenario also applies: The bigger the losing difference, the more money you will lose.

Just like in stock markets, this bet type requires two different lines, a “buy” one and a “sell” one. The “buy” line is always bigger than the “sell” line and the difference between them is the “spread”, as described in financial language. In betting terminology, the “spread” is actually the vig, the money any online bookmaker is guaranteed to earn, similarly to fixed odds betting.

You don’t have to deal with odds or Asian Handicap lines that require time consuming evaluations,. It might look like AH betting, as you choose between two spread betting lines, but when you “buy” or “sell” a specific line you take the risk of a huge win or a huge loss. You don’t know exactly how much you’ll win before the start of an event, while you also cannot predict your losses in any way.

Compared to bargaining with shares, currencies or oil prices in financial markets, in sports betting you deal with various outcomes in sports. From goals, corner kicks or yellow cards in football betting, to points and rebounds in basketball (e.g. NBA betting lines) and games or sets in tennis. Spread betting is constantly gaining more attention among bettors and is offered on many different sports by an ever increasing number of online bookmakers.

As mentioned above, the bookie always offers two lines in spread bett

https://mytradingskills.com/spread-betting-guide/how-it-works

https://www.bookmakers.bet/14041/spread-betting/

Brazzers Zo Rlama Sexx

Sexyhippies S Bio And Free Webcam

Small Boy Fuck Women

Beginner's Overview: How Does Spread Betting Work? - My ...

Spread Betting Explained | What is spread betting & How do ...

How do Spread Betting Companies Make Money? | Good …

How does Spread Betting Work? : Trading Guides - SpreadCo

How Does Spread Betting Work? - Market Business News

How does a spread betting company make its money?

How do Spread Betting Companies make money?

How do spread betting COMPANIES work? — boards.ie - Now …

How do Spread Betting Companies make money?

How Do Spread Betting Companies Make Money | Crazy TAJIKS ...

How Do Spread Betting Companies Work