Guide How to Stake TON Within Tonkeeper Wallet

Tonkeeper TeamTS staking is an infinitely scalable decentralized application that allows everybody to easily participate in TON validation and earn a share of network fees. It also greatly increases the decentralization of the TON network, which helps block more coins for staking and makes it easier for many validators to join the network.

The TON blockchain network, like most other modern blockchain protocols, uses the Proof-of-Stake consensus algorithm, where validators stake native tokens and receive rewards for securing the network. Staking is a responsible task requiring validators to invest significant amounts of money into infrastructure and tokens. But users can earn the same staking rewards without effort thanks to liquid staking services like Tonstakers.

In this article, we are going to look at two problems that liquid staking solves - High minimum stake amount and lockup period. And in this feature, we will cover the liquid staking protocols available in Tonkeeper wallet and explain TON liquid staking concept.

We will also show how users can optimally stake TON through Tonkeeper to achieve the highest APY. For example, by staking 10,000 TON at the date of this article, you could passively earn over 500 TON considering the APY (and that's without considering TON price changes!).

What is Staking in Crypto

Let's start by reminding the basics. Blockchains are secure because there is value backing that security. In Proof-of-Stake this is a literal value: to become a validator and get a right to validate transactions, publish the blocks, and earn rewards a validator has to put some amount of tokens at stake. In The Open Network, the minimum amount is 300,000 TON or ~$1,377,000 at the time of writing.

Those tokens are held at stake. If the validator is being dishonest, e.g. tries to double spend or is constantly missing blocks, the network will automatically slash their stake — that's blockchains' equivalent of a fine for misbehavior.

Honest validators earn TON for each block they produce or validate. The more TON they stake, the more blocks they produce and the more TON they earn. They can expect to earn 4-6% APY on their stake.

Why does the network reward crypto staking?

Because in PoS blockchains the truth is what the validators with >66% of the total stake call truth. A bad actor can accumulate enough coins to get those 66% of staked tokens and hijack the network. So, the more tokens are staked by honest participants, the more money the bad actor has to spend to make his plans work, up to the point where the attack is not economically viable. This is why each PoS blockchain tries to get as many tokens staked as they can because it strengthens the chain's security.

To sum up, being a validator means not earning rewards on idle, but securing the protocol and taking responsibility.

What is Liquid Staking in Crypto

Staking has one important limitation — the lockup period. Validators can't withdraw their staked TON during a validation cycle that lasts for ~34 hours. While the period isn't that long compared to other chains, some users might not want to give up control of their funds for a day. That's a point to hold in mind.

Next, the minimum stake is big. A user with just 299,000 TON can't launch the validator without buying or borrowing additional Toncoins.

High minimum stake amount and lockup period are two problems the liquid staking solves.

A liquid staking provider is a service that accepts users' tokens through a smart contract and provides them to other validators. Those tokens are added to validators’ stakes and generate staking rewards that are later distributed to liquid staking users. As those validators have the minimum stakes already, the minimum amount of tokens to start with liquid staking can be as low as 1 TON. For the network, it helps to accumulate even more TON in staking, thus boosting security and putting more tokens out of active circulation positively affecting the chain’s economy. In addition, liquid staking providers support a healthier and more resilient ecosystem by efficiently utilizing staked tokens to secure the network, thereby contributing to the stability of the blockchain economy.

The second problem - lock-up - is solved by issuing separate tokens called Liquid Staking Tokens (LST). These tokens give their holders the right to exchange them at any time for deposited TONs plus accumulated rewards from the provider's pool.

Also, those staked TONs can be used in other protocols. Their holders can swap them for other tokens, use them as collateral to take a loan, provide them to liquidity pools, and many more.

The staked TON are held by a smart contract, not by someone's wallet. It means that staked TON owners control their funds and the provider cannot use them elsewhere.

In conclusion, TON Liquid Staking allows regular users to:

- Stake from 1 TON instead of 300,000 TON and earn as much as regular validators.

- Withdraw their TON at any time without waiting ~34 hours.

- Use LST tokens representing staked TON in other projects at the same time to maximize yield.

This is why liquid staking pools are popular in most PoS chains: they lower the barriers to participating in staking and increase the network’s security.

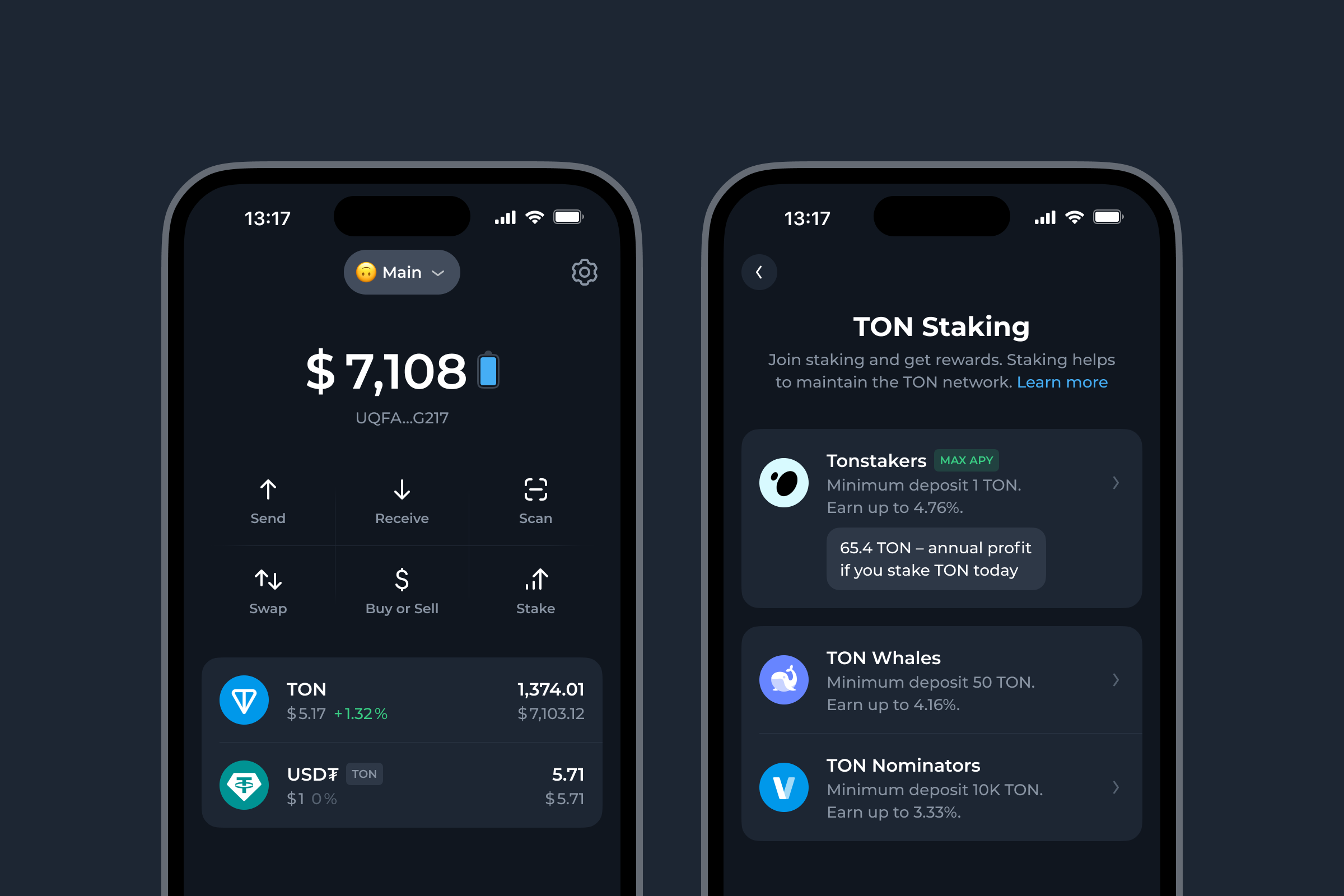

TON Liquid Staking Protocols Integrated in Tonkeeper Wallet

Tonkeeper wallet has integrated 3 TON liquid staking platforms:

1. Tonstakers

2. TON Whales

3. TON Nominators

They have different purposes and staking conditions and we will explain their differences here.

Before staking on any platform, you need to have TON in your Tonkeeper, which you can purchase using a card or through P2P transactions via the wallet’s integrated services.

TON Liquid Staking with Tonstakers

Tonstakers is the biggest liquid staking pool in TON ecosystem. More than 50 thousand users locked $194M in Tonstakers pool and currently are earning 4.73% APY.

APY - 4.76%

Minimum Deposit - 1 TON

Users receive Tonstakers TON (tsTON) tokens for their staked TON and can trade them on Ston.fi DEX. tsTON represents the user's share in Tonstakers pool, meaning that each tsTON rises in value in TON equivalent with each validation cycle in blockchain, as the pool accumulates rewards.

Tonstakers is open source, meaning that everyone can check the contracts' code and be sure that there are no backdoors or bugs that can put the staked coins at risk. More on that, Tonstakers have been audited by Certik, a top-ranked blockchain security company, and scored 94.5 out of 100 — excellent security.

Also, Tonstakers liquid staking protocol has a bug bounty campaign running with $100,000 reserved for white hackers who will help to discover vulnerabilities.

Tonstakers was among the first TON liquid staking protocols, built in partnership with TON Core developers.

TON Whales Staking

Whales is not a particularly liquid staking provider, but a full-fledged TON hub with services like Tonhub wallet, blockchain explorer, and discussion boards for the community.

APY - 4.16%

Minimum Deposit - 50 TON

The brand name is self-explaining: with only 8,900 members Ton Whales has 33 million TON (~$170 million) staked through Whales Nominators and Whales Club pools which have ~34 hours lockup periods.

The Liquid Staking pool is currently in beta, providing 4.16% APY with 50 TON as a minimum deposit to participate.

Whales is open source, but the contracts for the liquid staking pool aren't published on GitHub yet. Also, it didn't undergo any audit.

Its token wsTON is trading only on DeDust exchange.

TON Nominators Staking

TON Nominators is a service designed to provide TON to particular validators. While the users have more control over who they want to lend tokens to, it also creates more responsibility to choose the right validator based on its stats.

APY - 3.33%

Minimum Deposit - 10,000 TON

TON Nominators allows users to pool their tokens together and lend them to selected validators, often exceeding their original stake 10x.

Nominators pools work more like delegations instead of liquid staking, which creates some barriers. E.g. the minimum amount to stake is 10,000 TON with a lockup period of more than 30 hours for the validation cycle to end. Also, the validators have fees, resulting in 3.39% APY instead of 4% or more.

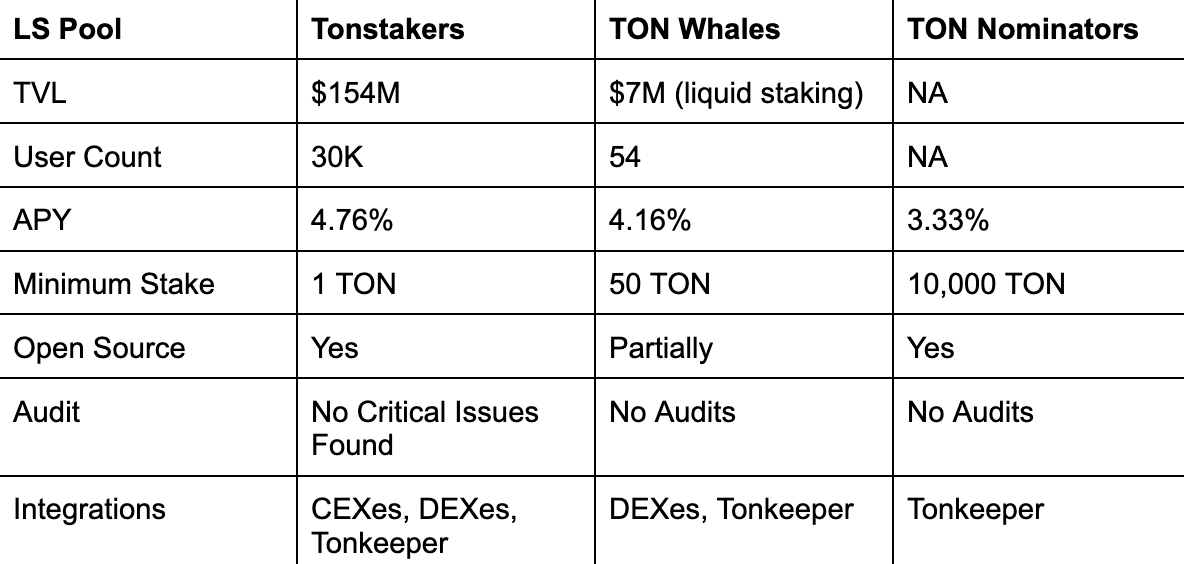

TON Liquid Staking Pools Compared

As the liquid staking providers use the same concept, they mostly differ in details, integrations, and community support. Here’s a quick take:

From our point of view, the Tonstakers lead the board. It has the biggest TVL, user count, and average APY, and published its code with no critical issues found in security audits. Also, it’s the most convenient to use in Tonkeeper wallet, making it just a few taps to stake TON.

Staking is beneficial for long-term holders, as it allows them to earn 4.7% more TON on top of TON they are holding anyway. So if you are holding, consider to stake what you won’t use right now.