Government Canada At Least Private Ownership There

🛑 👉🏻👉🏻👉🏻 INFORMATION AVAILABLE CLICK HERE👈🏻👈🏻👈🏻

Please chip in to support more articles like this. Support rabble.ca for as little as $5 per month!

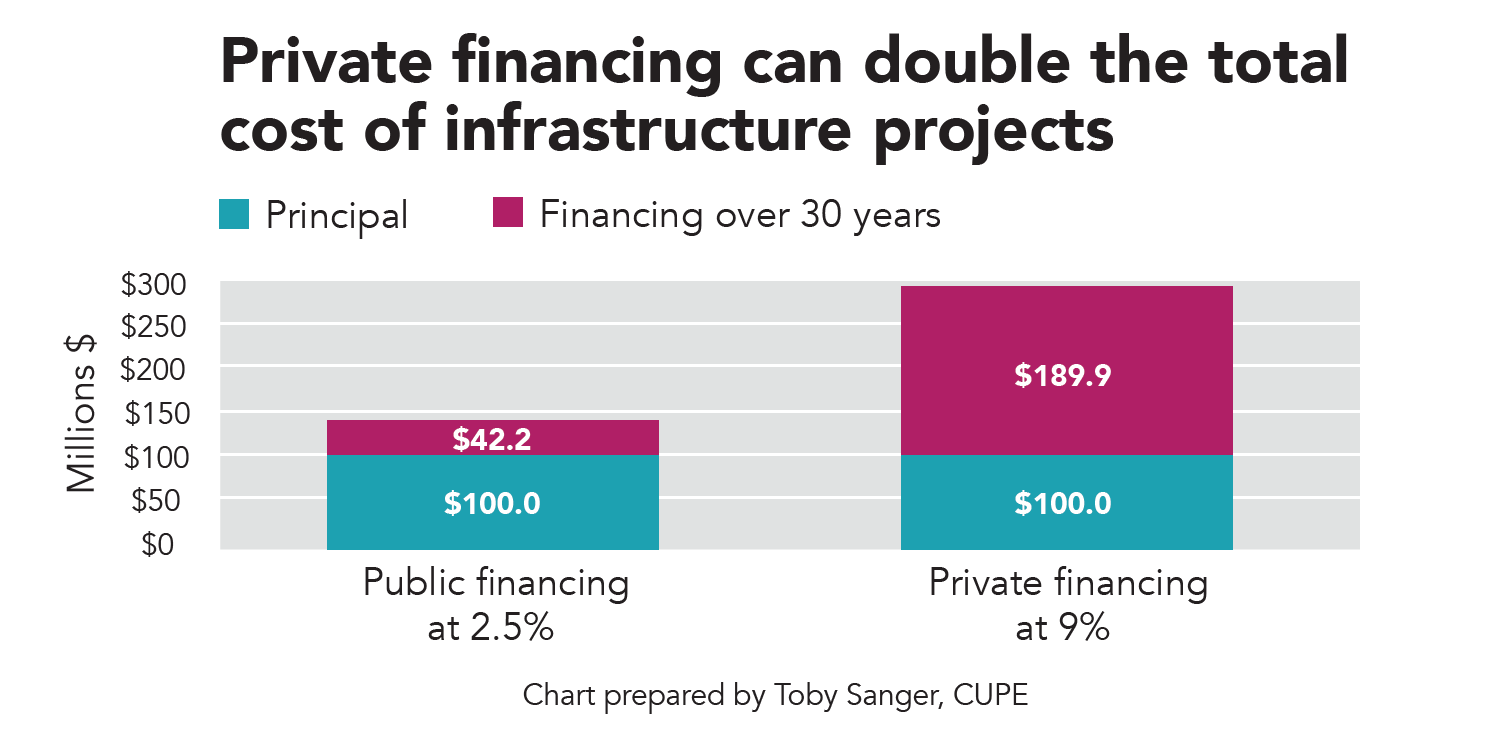

A funny thing happened on the way to privatization. It didn't really work. Private companies tend to charge more than public ones, and contracting out creates all kinds of administrative costs and legal headaches.

After 30 years of experimentation, there is no evidence to suggest that privatization saves money or provides better services, especially with regard to essential public goods such as water, health care and electricity.

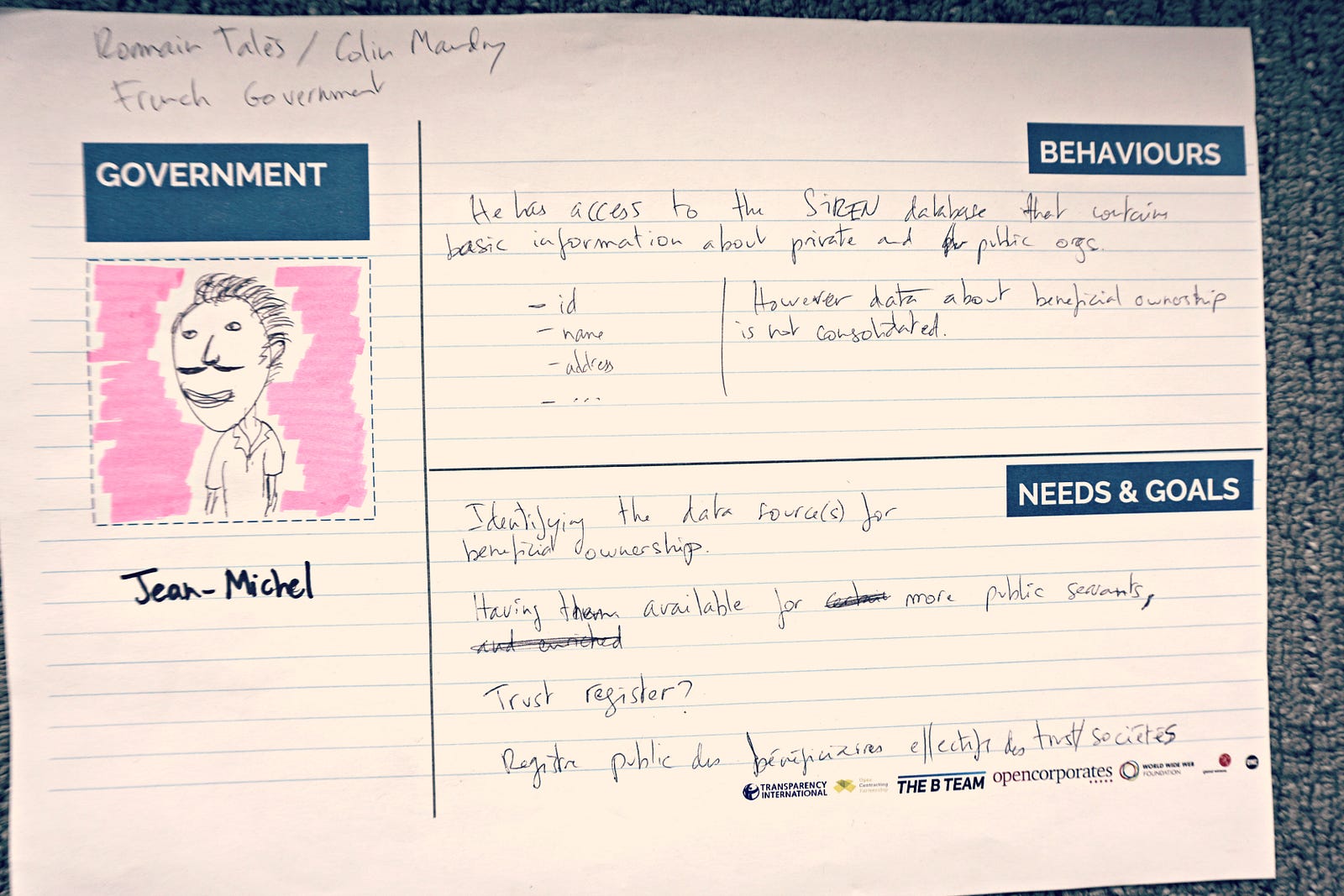

Bureaucrats and politicians have begun to realize this as well. At least 235 cities in 37 countries have de-privatized their water over the past 15 years, with France and the United States at the head of the pack. Paris made its water public again in 2010 and immediately saved €35 million a year, while at the same time providing subsidies to those who were struggling to pay under privatization.

Similar trends are taking place with electricity. Germany's much-vaunted Energiewende is as much about the transition to renewable sources of electricity as it is about creating publicly-owned and democratically controlled energy providers. Sixty new local public utilities were created in Germany between 2007 and 2012.

Other services are reverting back to public hands as well, including transportation, waste management, housing and health care in countries as diverse as Malaysia, Spain, Bolivia and Uganda. There is even a revitalization of public banks, that most hallowed of market-based institutions.

Unfortunately, Canada is going the wrong way, at every level of government, in every part of the country. Outright privatization, public-private partnerships and creeping commercialization are found in almost every sector, including water, electricity, alcohol sales, transportation and security. Manitoba's health care system is under threat. British Columbia funnels money towards private schools. Renewable energy in Ontario was handed over to the private sector without public debate.

Canada is not alone in this regard. Governments around the world still pin their hopes on private sector involvement in essential services, and financial institutions such as the World Bank and the IMF continue to make privatization a condition of debt relief (witness Greece). So too are massive private corporations seeking opportunities in these multi-trillion dollar sectors.

This is not to suggest that public ownership is a panacea. It is easy to find poorly run, unequal and corrupt public services. Just look at the contaminated drinking water situation in Flint, Michigan.

The challenge -- and it is a massive one -- is to create more transparent, more accountable, and more equity-oriented public services. Instead of making them less public, we need to make them more public.

We need electricity utilities that take energy poverty seriously and include a wider range of stakeholder voices in decision-making. We need transportation services that make it easier and more affordable for everyone to get around, not just those that can pay tolls on the freeway. We need universities that make the study of public goods just as important as training students for private gain.

Sound radical? Yes and no. The growing global pro-public movement encompasses a surprisingly wide range of people and ideologies.

Perhaps the most impressive national experiment is that of mild-mannered Uruguay. Here we see a Constitution that makes water privatization illegal, a state-owned telecommunications company which has rolled out almost universal access to high-speed internet and a public electricity utility that has become a world-class leader in wind power. The Economist named Uruguay its "country of the year" in 2013, in part because of its commitment to public services.

Examples of "making public" are as diverse as the people creating them. Some are small and community-owned. Some are a mix of local government and non-state actors. Some even operate across borders in the form of public-public partnerships.

Canada has much to learn from these experiments. We cannot rest on our (eroding) sense of universal coverage. We must resist privatization by improving its alternatives, and by deepening our understanding of what it means to be "public."

David McDonald is professor of global development studies at Queen's University and director of the Municipal Services Project. His most recent book is Making Public in Privatized World (Zed Books, London).

More people are reading rabble.ca than ever and unlike many news organizations, we have never put up a paywall – at rabble we’ve always believed in making our reporting and analysis free to all, while striving to make it sustainable as well. Media isn’t free to produce. rabble’s total budget is likely less than what big corporate media spend on photocopying (we kid you not!) and we do not have any major foundation, sponsor or angel investor. Our main supporters are people and organizations -- like you. This is why we need your help. You are what keep us sustainable.

rabble.ca has staked its existence on you. We live or die on community support -- your support! We get hundreds of thousands of visitors and we believe in them. We believe in you. We believe people will put in what they can for the greater good. We call that sustainable.

So what is the easy answer for us? Depend on a community of visitors who care passionately about media that amplifies the voices of people struggling for change and justice. It really is that simple. When the people who visit rabble care enough to contribute a bit then it works for everyone.

And so we’re asking you if you could make a donation, right now, to help us carry forward on our mission. Make a donation today.

We welcome your comments! rabble.ca embraces a pro-human rights, pro-feminist, anti-racist, queer-positive, anti-imperialist and pro-labour stance, and encourages discussions which develop progressive thought. Our full comment policy can be found here. Learn more about Disqus on rabble.ca and your privacy here. Please keep in mind:

Do

Tell the truth and avoid rumours.

Add context and background.

Report typos and logical fallacies.

Be respectful.

Respect copyright - link to articles.

Stay focused. Bring in-depth commentary to our discussion forum, babble.

Don't

Use oppressive/offensive language.

Libel or defame.

Bully or troll.

Post spam.

Engage trolls. Flag suspect activity instead.

Capital Perspectives - Ottawa Newsletter

Canadian ownership and control requirements no longer apply to a broad range of telecom entities operating in Canada and do not apply to the increasing number of broadcasting entities that deliver programming in Canada via mobile devices or the Internet. Canadian ownership and control requirements do remain in place, however, for traditional Canadian broadcasters. In addition, non-Canadians wishing to establish some new telecom or broadcasting businesses in Canada or to take control of such businesses in certain circumstances need to be mindful of the provisions of the Investment Canada Act.

Since 2012, the foreign ownership restrictions under the Telecommunications Act apply only to carriers with more than a 10 per cent market share based upon total Canadian telecom revenues, as determined by the CRTC. Under those restrictions, the voting shares of the carrier must be 80 per cent owned by Canadians, Canadians must comprise at least 80 per cent of the board of directors and the carrier cannot be controlled in fact by non-Canadians. A corporate shareholder of a carrier qualifies as Canadian if Canadians own at least 66 ⅔ per cent of the voting shares and if the corporate shareholder is not controlled in fact by non-Canadians.

The CRTC determined in its most recent Communications Monitoring Report that total Canadian telecom revenues in 2017 amounted to $48.7 billion, so any carrier with annual Canadian telecom revenues of less than $4.87 billion is not subject to the foreign ownership restrictions under the Telecommunications Act. There may in fact only be three carriers in Canada that remain subject to such foreign ownership restrictions on the sole basis of their telecom revenues.

Canadian ownership and control requirements continue to apply to broadcasters who hold licences issued under the Broadcasting Act and to most broadcasters who have been exempted from licensing under the Act. These requirements are similar, but not identical, to those that apply under the Telecommunications Act: the voting shares and votes of the broadcaster must be 80 per cent owned by Canadians, Canadians must comprise at least 80 per cent of the board of directors, the CEO must be Canadian, and the broadcaster cannot be controlled in fact by non-Canadians. A corporate shareholder of a broadcaster qualifies as Canadian if Canadians own at least 66 ⅔ per cent of the voting shares and if the corporate shareholder is not controlled in fact by non-Canadians.

There are numerous telecom carriers with integrated broadcasting operations that are subject to the Canadian ownership and control requirements under the Broadcasting Act even though their Canadian telecom revenues are below the $4.87 billion threshold and thus are not subject to such requirements under the Telecommunications Act.

Canadian ownership and control requirements do not apply to broadcasters that distribute programming only over the Internet or via mobile devices (commonly referred to as over-the-top or OTT) and that operate under the CRTC's Exemption order for digital media broadcasting undertakings. Since the number of such broadcasters increases every day as the broadcasting system evolves to the use of OTT in preference to over-the-air, cable and satellite delivery, an increasing percentage of broadcasters in Canada are not subject to such ownership and control requirements.

Notwithstanding that Canadian ownership and control requirements imposed under the Telecommunications Act and the Broadcasting Act do not have as extensive application as they once did, non-Canadians wishing to establish new telecom or broadcasting businesses in Canada, or take control of such businesses, need to be mindful of the provisions of the Investment Canada Act (the ICA).

The ICA provides that a non-Canadian that proposes to establish a new Canadian business or to acquire an existing Canadian business must file a notification. In certain circumstances, such as where monetary thresholds are exceeded, the non-Canadian must also file an application for review of the investment. Where the investment is reviewable, the non-Canadian must demonstrate that the investment is of "net benefit to Canada."

Normally, the filing of a notification of investment in respect of the establishment of a new Canadian business is a mere formality under the ICA. However, if the new business falls within a prescribed type of business activity that, in the opinion of the federal Cabinet, is related to Canada's cultural heritage or national identity (a "Cultural Business"), the federal Cabinet may subject the investment to a full "net benefit to Canada" review under the ICA. Many activities relating to broadcasting, including the production, distribution, sale or exhibition of "film or video products" as well as "audio or video music recordings" fall within the ambit of a Cultural Business.

With respect to the acquisition of an existing Canadian business, the investment will generally be reviewable only if the enterprise value or, in some cases, asset value of the Canadian business exceeds specified thresholds.

For example, the current threshold for investors whose country of ultimate control is a member of the World Trade Organization (WTO) and that are not state-owned enterprises (SOEs) is $1 billion. The current threshold for investors whose country of ultimate control is a party to a specified trade agreement with Canada (including NAFTA and CETA) and that are not SOEs is $1.5 billion. For SOEs that are WTO investors, the current threshold for WTO SOEs is $398 million. Acquisitions of control by non-WTO investors and acquisitions of control of a Cultural Business by any non-Canadian are subject to much lower thresholds: $5 million for direct investments and $50 million for indirect investments.

Regardless of whether or not an investment relates to a Cultural Business or exceeds the specified thresholds, the ICA provides that an investment is reviewable if the federal Cabinet determines that the investment could be injurious to national security. There are at least two instances in which acquisitions of control of Canadian businesses in the telecom or related industries have been denied approval on the grounds of national security. It is noteworthy that neither of these investments would have required that the acquired entity comply with the Canadian ownership and control requirements under the Telecommunications Act.

If an investor is required to demonstrate net benefit to Canada, the investor may offer formal written undertakings to Canada to support representations made in this respect. The investor has an obligation under the ICA to submit information as required from time to time to allow the Canadian government to determine whether the investment is being carried out in accordance with the application for review filed by the investor and with any representations made or undertakings given in relation to the investment.

The ICA sets out the possible remedies for non-compliance with any undertakings that were given, including a ministerial demand for compliance and the issuance of a Court order which could require divestiture of the Canadian business or impose a monetary penalty.

The requirements of the ICA may well be more significant than the Canadian ownership and control requirements in the Telecommunications Act and the Broadcasting Act for future establishments of new telecom and broadcasting businesses by non-Canadians or for the acquisition by non-Canadians of existing Canadian telecom and broadcasting businesses.

Stephen Whitehead is a counsel with the Fasken Ottawa office who practices extensively in communications and business law. He is currently the executive editor of Capital Perspectives.

To read the full Capital Perspectives: Ottawa Newsletter, please click here.

© 2021 Fasken Martineau DuMoulin LLP

The content of this website may contain attorney advertising under the laws of various states.

We and our partners access and write information on your device (cookies and identifiers) and process personal data related to your browsing of our content (including your IP address) in order to provide you with an optimal experience on our website, to improve the performance of our website, to gather statistics and for targeted advertising. If you wish to know more about cookies, how to prevent the installation of these cookies and change the settings of your browser,click here

Cookies Settings Accept All Cookies

Xxx Movie Tube Porn

Seks Izmena S Dochkoy Xxx

Pussy Kit 18

Erotic Video Skachat Gear

Aimee Tyler Anal

Public Ownership | The Canadian Encyclopedia

Land ownership in Canada - Wikipedia

Why is Canada still privatizing public services when most ...

Canadian Ownership Rules in Telecom and Broadcasting ...

Ownership and Governance of State-Owned Enterprises

Government and the Private Sector – Business Ethics

business ownership government grants - CanadaStartups

Mixed ownership companies in Canada - uvic.ca

Foreign Ownership Restrictions and the… | Unique Properties

The different types of property ownership - Garbutt ...

Government Canada At Least Private Ownership There