Getting The The Future of Digital Payments: How AI-powered payment systems are transforming the way we handle money. To Work

Artificial Intelligence (AI) has arised as a transformative innovation across several industries, and the insurance field is no exception. Insurance carriers are considerably leveraging AI to improve their procedures, particularly in claims processing, underwriting, and risk assessment. Through using the energy of AI, insurance companies can boost productivity, accuracy, and client fulfillment while reducing price and mitigating threats.

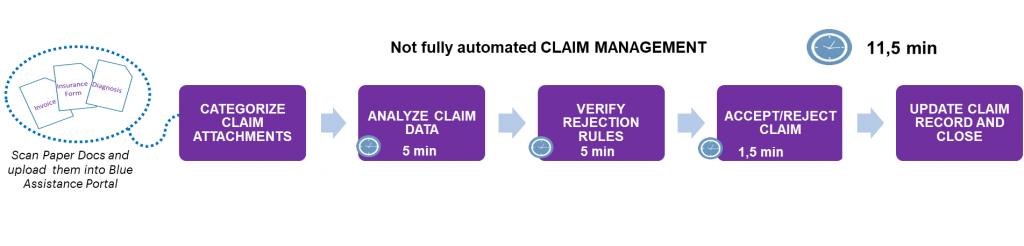

Case handling is a critical element of the insurance business that calls for cautious examination of policy protection and precise judgment of case validity. Generally, professes handling involved hands-on evaluation and evaluation of records such as policy agreements, crash reports, health care records, and repair service price quotes. This process was time-consuming and prone to individual errors.

Along with AI-powered technologies like natural language processing (NLP), insurance firms can easily automate parts of the case handling workflow. NLP algorithms can extract appropriate information from disorderly data resources such as insurance claim forms or collision reports. By instantly examining these documentations for vital information like time, places, styles of harm or personal injuries stated, AI bodies can easily aid case adjusters in helping make faster choices.

Furthermore, equipment finding out formulas enable insurance firms to identify designs in historical record related to deceitful insurance claim. Through determining irregularities or doubtful activities within huge datasets extra properly than humans ever before might personally analyze them alone—AI-powered bodies can easily help stop insurance policy fraudulence properly.

Underwriting is an additional essential place where AI is improving the insurance policy yard. Typically underwriters have count on manual methods that include evaluating an applicant's threat profile page located on numerous elements like age demographics; credit score past; steering documents; medical condition(s); etc.—and after that determining necessary superiors accordingly.

AI innovations automate this procedure through evaluating extensive quantities of record quickly—such as social media messages or openly on call online information—to examine an candidate's threat profile page accurately. I Found This Interesting learning styles educated on historical information may pinpoint patterns that individual underwriters might overlook—leading to even more precise risk evaluations and fairer costs rates for customers.

Furthermore; anticipating analytics tools powered by AI enable insurance carriers to anticipate future claims and predict prospective reductions precisely. These insights aid insurance carriers allocate resources more efficiently, set appropriate gets, and enhance their threat profiles.

Threat evaluation is a necessary part of the insurance policy business. Insurance providers must assess risks associated along with insuring a certain individual, residential property, or company. Customarily, this procedure included manual evaluation and expert judgment—a time-consuming and individual strategy.

AI-based danger evaluation bodies leverage huge record analytics to analyze dangers in real-time along with more rate and precision. By continually keeping track of different information sources—such as climate patterns, financial indicators, market trends—AI systems can easily supply insurance companies along with very early alerts about possible dangers or adjustments in risk accounts for particular policies or areas.

Furthermore; AI-powered chatbots are increasingly being used by insurance companies to boost consumer solution and interaction. These online associates can take care of regimen concerns coming from insurance policy holders about their protection information; assert standing updates; quality settlement reminders etc.—all without individual interference.

In verdict, Artificial Intelligence is reinventing the insurance industry through streamlining claims handling, underwriting methods, and risk assessments. Through automating wearisome duties typically executed manually—AI innovations improve efficiency; reduce expense; improve reliability; avoid frauds & mitigate risks while supplying better client take ins generally. As AI continues to evolve rapidly—the insurance policy business will definitely unquestionably watch additional innovation and transformation in the coming years