Get This Report on "Maximizing Your Savings with a Novated Lease FBT Calculator"

Browsing the Complexity of Novated Leases: The Part of an FBT Personal digital assistant

Novated leases have come to be more and more well-liked in latest years as a means for workers to fund their autos. This kind of leasing setup makes it possible for people to lease a car through their company, along with the lease settlements being subtracted coming from their pre-tax compensation. While novated Additional Info supply many perks, they additionally come with complicated tax implications that may be challenging to navigate. This is where an FBT personal digital assistant participates in a important job.

FBT, or Fringe Benefits Tax, is a tax established on companies for supplying certain edge advantages to their employees, including novated leases. The quantity of FBT payable depends on numerous aspects, such as the value of the automobile and how it is utilized. Working out FBT by hand can easily be a time-consuming and error-prone method due to the complicated attributes of the income tax guidelines. This is where an FBT personal digital assistant happens in convenient.

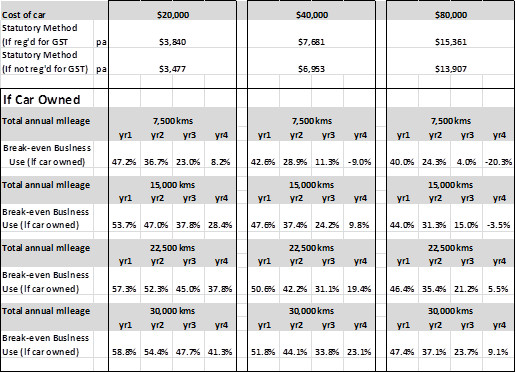

An FBT calculator is a device exclusively made to streamline and improve the process of calculating Fringe Benefits Tax for novated leases. These personal digital assistants utilize up-to-date income tax costs and policies delivered through income tax authorizations to make sure accurate calculations are helped make. Through getting in applicable info such as the worth of the motor vehicle, its use designs, and various other appropriate particulars right into the personal digital assistant, users can easily swiftly establish their potential FBT responsibility.

One key benefit of using an FBT calculator is that it assists individuals produce informed choices about whether a novated lease is fiscally feasible for them. By suggestionsing different situations in to the personal digital assistant – such as varying automobile worths or use patterns – individuals can see how these factors impact their prospective FBT liability. This permits them to review various possibilities and select one that best suits their requirements.

Furthermore, an FBT personal digital assistant also helps employers in dealing with their commitments related to delivering novated leases as fringe advantages. It aids them precisely compute and disclose their FBT obligations to income tax authorities, reducing the threat of inaccuracies or penalties. This is specifically crucial as FBT compliance is a legal criteria that companies need to attach to.

In addition to determining FBT liability, some advanced FBT personal digital assistants likewise offer various other valuable features. For instance, they may deliver insights in to the potential tax obligation savings associated with novated leases matched up to traditional vehicle financing procedures. They may also consist of tools for approximating running costs such as energy expenses and routine maintenance costs, aiding customers produce even more informed selections regarding their overall car budget.

It's worth keeping in mind that while an FBT personal digital assistant may simplify the process of calculating Fringe Benefits Tax for novated leases, it is not a substitute for expert insight. Income tax legislations and policies can be complex and subject to adjustment, so it's regularly suggested to consult with along with a qualified tax expert or expert when helping make financial choices related to novated leases.

In final thought, getting through the intricacy of novated leases demands careful factor to consider of Fringe Benefits Tax ramifications. An FBT personal digital assistant offers as an important resource in this regard by simplifying the procedure of figuring out potential FBT responsibilities. Whether you are an employee thinking about a novated lease or an company handling your responsibilities, making use of an FBT personal digital assistant may aid you create informed decisions while ensuring conformity along with tax obligation rules.