Get This Report about "Maximize Your Savings: Tips for Using a Novated Lease FBT Calculator Effectively"

Tax obligation planning can easily be a complex and time-consuming task for many people and businesses. With the ever-changing tax obligation regulations and requirements, it is critical to keep on best of your tax obligations while optimizing your savings. One area where income tax planning can come to be especially challenging is in relation to Fringe Benefits Tax (FBT) calculations, especially when it comes to novated leases. The good news is, with the assistance of a novated lease FBT personal digital assistant, you can streamline this method and guarantee correct computations.

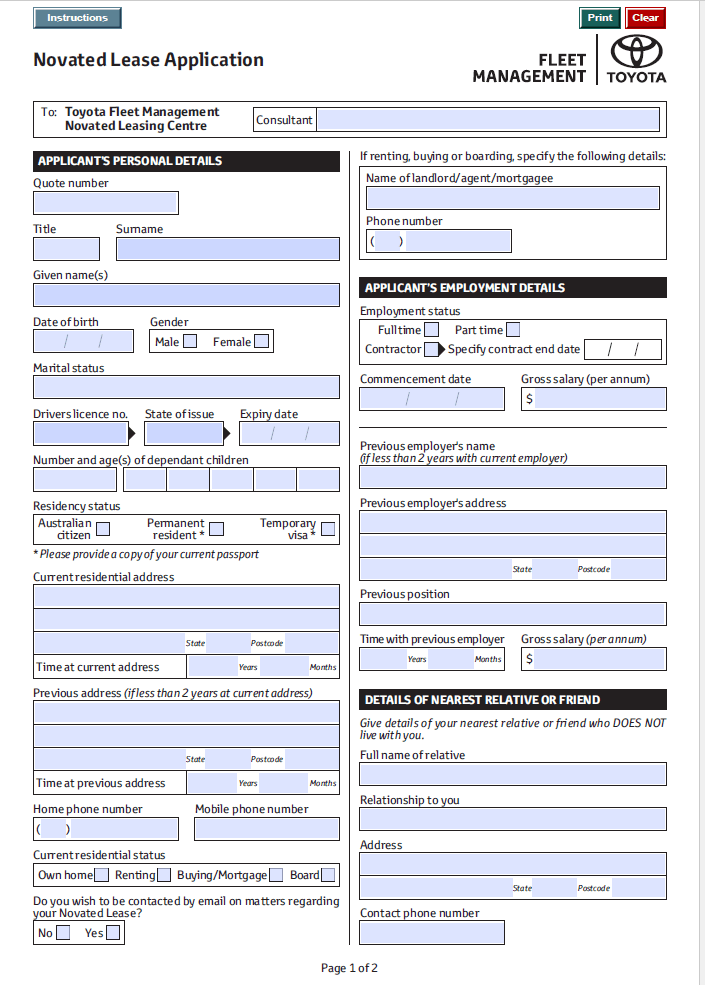

A novated lease is an agreement between an employee, their company, and a financing provider where the staff member leases a car making use of their pre-tax compensation. The company takes on the task for helping make lease remittances on behalf of the employee, which are deducted from their income package prior to income tax. This arrangement gives a number of perks, including possible income tax cost savings.

Nevertheless, when it comes to FBT computations for novated leases, several individuals discover themselves overwhelmed through intricate strategies and considerable documentation. This is where a novated lease FBT calculator ends up being important.

A novated lease FBT personal digital assistant is an on the web device that assists you determine the taxable worth of your novated lease edge advantage for FBT purposes. Through www.vehiclesolutions.com.au as the cost of the lorry, its grow older, gas type, range traveled per year, and other appropriate particulars right into the personal digital assistant's fields, it are going to produce correct FBT estimations in a issue of seconds.

One vital advantage of utilizing a novated lease FBT calculator is its ability to streamline complicated calculations. The calculator immediately uses relevant legislative regulations such as legal rates and thresholds to make sure exact results. This eliminates hands-on errors that may occur when attempting to determine FBT liability personally.

Additionally, using a novated lease FBT calculator spares substantial opportunity reviewed to hands-on calculations. Instead of spending hours poring over spread sheets or speaking to tax obligation experts for aid along with complicated methods, people may simply get in their details into the on the web tool and get immediate outcome. This allows for reliable tax planning and decision-making.

In enhancement to streamlining the FBT estimation process, a novated lease FBT personal digital assistant likewise aids people maximize their tax obligation savings. Through changing various guidelines within the calculator, such as altering the lease condition or choosing a various vehicle type, people can determine how these improvements affect their FBT responsibility. This allows them to make informed decisions that align with their tax obligation program goals.

For occasion, if an person realizes that their existing novated lease arrangement is leading in a higher FBT responsibility, they can use the personal digital assistant to explore alternative possibilities. They can adjust parameters such as the expense of the lorry or its fuel performance to find a configuration that reduces their FBT responsibility while still meeting their transportation requirements.

Moreover, a novated lease FBT personal digital assistant provides individuals with valuable knowledge into how different variables affect their income tax obligations. By imagining these influences with interactive charts and charts generated through the calculator, people obtain a much better understanding of how modifications in variables such as range traveled or gas intake impact their total income tax position.

It's essential to keep in mind that while a novated lease FBT calculator streamlines the computation procedure and gives important insights, it is still necessary to speak to along with specialist consultants when helping make considerable financial choices. Tax laws and rules are subject to modification, and individual instances might differ. As a result, seeking personalized advice ensures conformity with current legislation and optimizes potential savings.

In final thought, streamlining tax planning with a novated lease FBT calculator gives substantial benefits for people and organizations as well. Through automating complex computations, saving opportunity, improving tax savings, and delivering important ideas into numerous variables' influence on tax obligation commitments, these calculators enable reliable tax planning. However, it is vital to bear in mind that professional insight need to consistently be looked for for personalized direction in navigating the complexities of taxes legislations and rules.