Learn everything about GEOs: Philippines

@leadgidIn today’s article about financial offers geographics, we’ll talk about the Philippines and its great potential. We’ll look at the economy, labor forces, people’s income, and their views on loans in this sunny country.

Economics

The economy of this country is currently ranking 29th on the list of GDP by country and 13th in Asia. The Philippines is an industrial country with a rapidly evolving market. Agriculture is the base of the economy over there, although right now experts mark a shift from agriculture to service and manufacture. The purchasing power in 2020 gets abreast of $1.01 trillion.

The list of export products consists of electronics, alimentary goods, clothing, brass, petrochemicals, fruits, and natural oils. Key trading partners are South Korea, Germany, Japan, the USA, China, and some others.

The Philippines’ economy is one of the most high-developing economies in Asia. Although it doesn’t eliminate such typical problems as, for example, the vast difference between citizen’s income and corruption rates, which prevents the country’s economy from even faster progress. Nevertheless, the government tries to do all it can to liquidate these problems and invests in the county’s infrastructure.

Jobs and salaries

It’s hard to find a good job, so there are a lot of recruiting agencies finding people jobs for money. Many people get themselves jobs through their friends and acquaintances, this method works best. It lets employers know that the person they’re hiring is trustworthy since one of their employees confirms their competency.

About a third of the population works in agriculture, over 50% of the people find employment in the service sector and about 16% is in the sector of the industry. Of course, an ordinary citizen cannot count on high salaries, in 2020 an average salary estimated at 25-30k Philippine peso or $490-590. So it depends on a person’s occupation. CEOs and managers get $5 000-6 000, financiers and IT specialists get around $1 000-1 200 a month. Doctors are also paid better, depending on the hospital they work at. There’s no free health care, almost all of the hospitals are private, and the doctors get $1 000-1 500 on average. Though it doesn’t concern the capital, since income levels there are much higher.

Engineers and constructors earn $600-700, migrant workers are also valued and got somewhat $1000. Teachers, auto mechanics, service technicians, and waiters earn no more than $600 per month. People are not very keen to work and don’t like to repay their debts a lot.

To have a decent life, 2 adults and 2 children need around $1 300, and it’s possible combining the incomes of those adults, but not in every case. This is before taxes, which makes people take out loans.

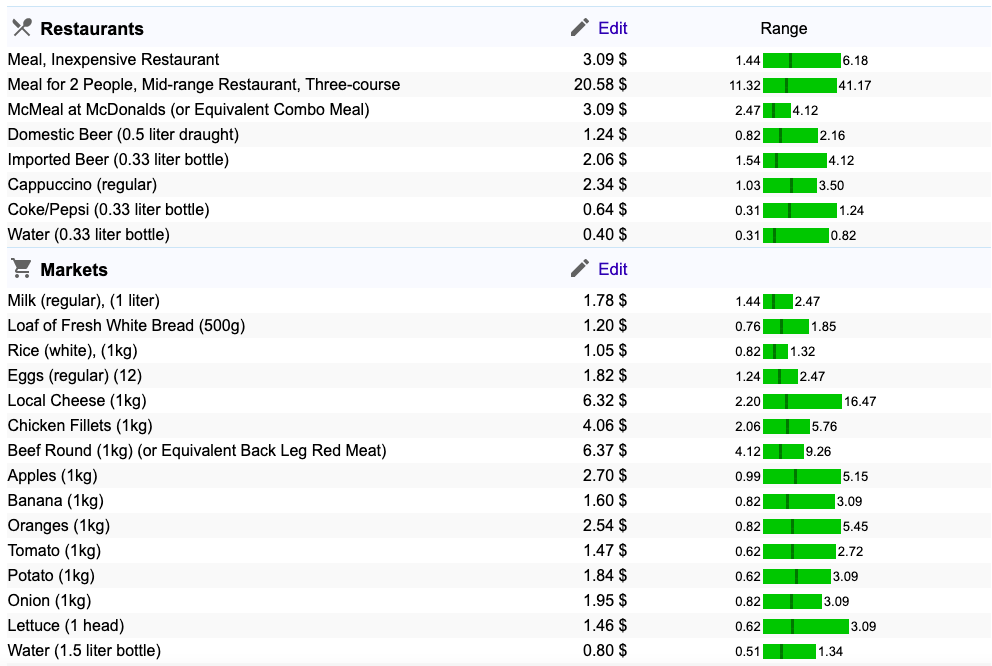

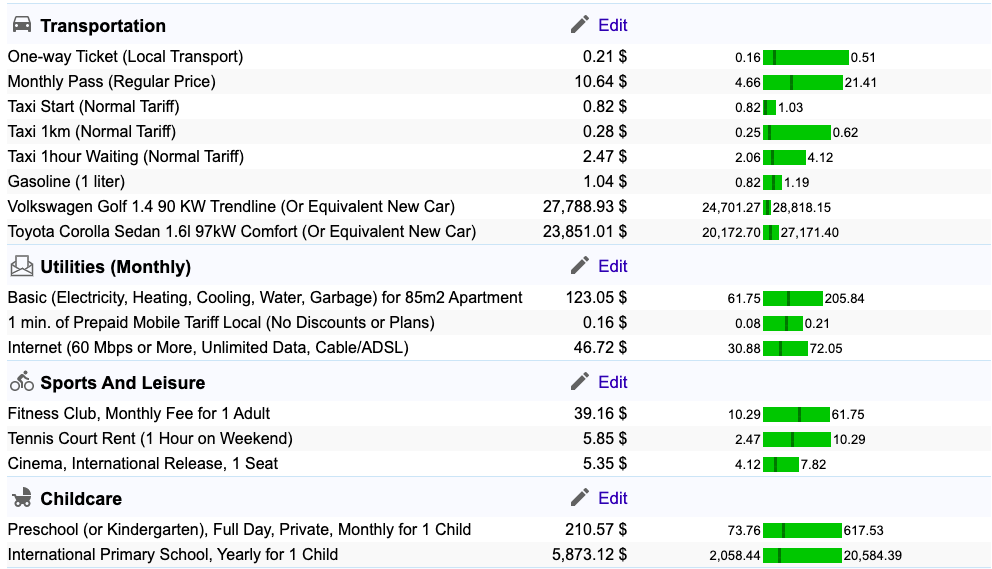

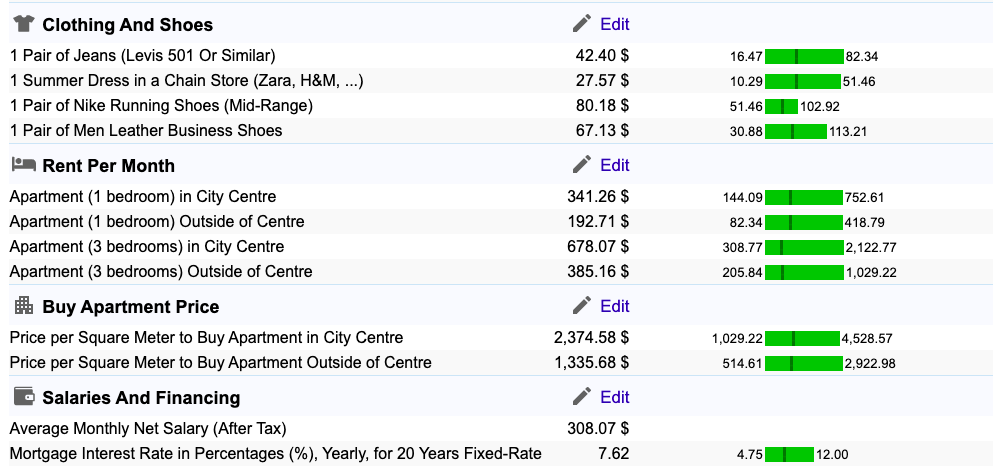

Average Filippino prices, according to numbeo.com:

Loans and borrowings

Car and house loans are broadly advertised. Furthermore, microloans are everywhere there, since it is very rare anywhere else in the world to see ATMs that give out loans.

A person chooses the amount they want to loan, enters their digital passport, and sees their credit score and history on the screen, and how much money that person may be granted. Usually, it’s around 100-1 000 Philippine peso or $2-20.

Next, they have to put their finger to leave a fingerprint (even though many places in the Philippines don’t even accept non-cash payments) and choose either cash or credit card transfer.

Those ATMs always get lines of people, even at night, since they function 24/7 and are regularly restocked with cash.

But the most fascinating thing is that these loans are granted under 0% interest, which means that people return as much money as they were given, although payback periods are very short. And if one does not repay in time, they will be charged 10% of the sum they took daily. Meaning that having taken a 1000 Philippine peso loan and not paid in time, in a couple of months a person may have to repay with their apartment or something else even bigger and more valuable.

Since there’s no interest limitation, a person might end up with a debt impossible to repay. Most people understand this, but still, continue to borrow money. And some even know they won’t be able to repay their debts on time, and pay 100-1 000 times more in the future anyway.

People take loans for everything they can: to buy food, to pay for their transportation, or anything else. Bank borrowings have more benefits and are controlled better, although the situation is similar to microloans. Accommodations, businesses, cars, and even tiny houses are got in a mortgage. Generally speaking, people get loans for everything that costs more than 3-5 monthly salaries.

In conclusion

The majority of the Philippines population practically lives in debt, and microloans are more than common. The Philippines is a perfect GEO, especially for financial offers. Hope you found this information useful. Good luck, see you next time!