Fxcm Spread Betting

⚡ ALL INFORMATION CLICK HERE 👈🏻👈🏻👈🏻

Fxcm Spread Betting

Popular Searches

Deposit Funds

Spread Costs

Spread Betting

API Trading

Trading Station

Ways to Trade

CFD Trading

Spread Betting

Active Traders

Professional Clients

Copy-trading

Institutional

Platforms

Trading Station

MetaTrader 4

NinjaTrader

ZuluTrade

TradingView

Capitalise AI

Trading Details

Spread Costs

Leverage and Margin

Execution

CFD Expirations

Dividend Calendar

Algo Trading

API Trading

Forex Python

Compare API

Trading Apps

Market Data

Products

Forex

Shares

Indices

Commodities

Crypto

Trading Baskets

Forex Baskets

Stock Baskets

Popular

EUR/USD

Gold Trading

Trading Crude Oil

Bitcoin

Quotes

AAPL

AMZN

FB

TSLA

View All Quotes

Research

Economic Calendar

Market News

Live Forex Charts

Trade Volatility

Heat Map

Education

What is Forex?

Become a Better Trader

Free Online Live Classroom

Free SMS Trade Alerts

Trading Guides

Learn Forex Trading

Successful Traders

Trading Tools

FXCM PLUS

FXCM Apps

Market Scanner

Trading Signals

Global Economies

What Is The G20?

What Is OPEC?

Interest Rates

International Monetary Fund (IMF)

Trading Strategies

Position Trading

What Is Scalping?

Currency Carry Trades

Effective Leverage

Risk Management

Forex Indicators

Momentum Trading

Pivot Points

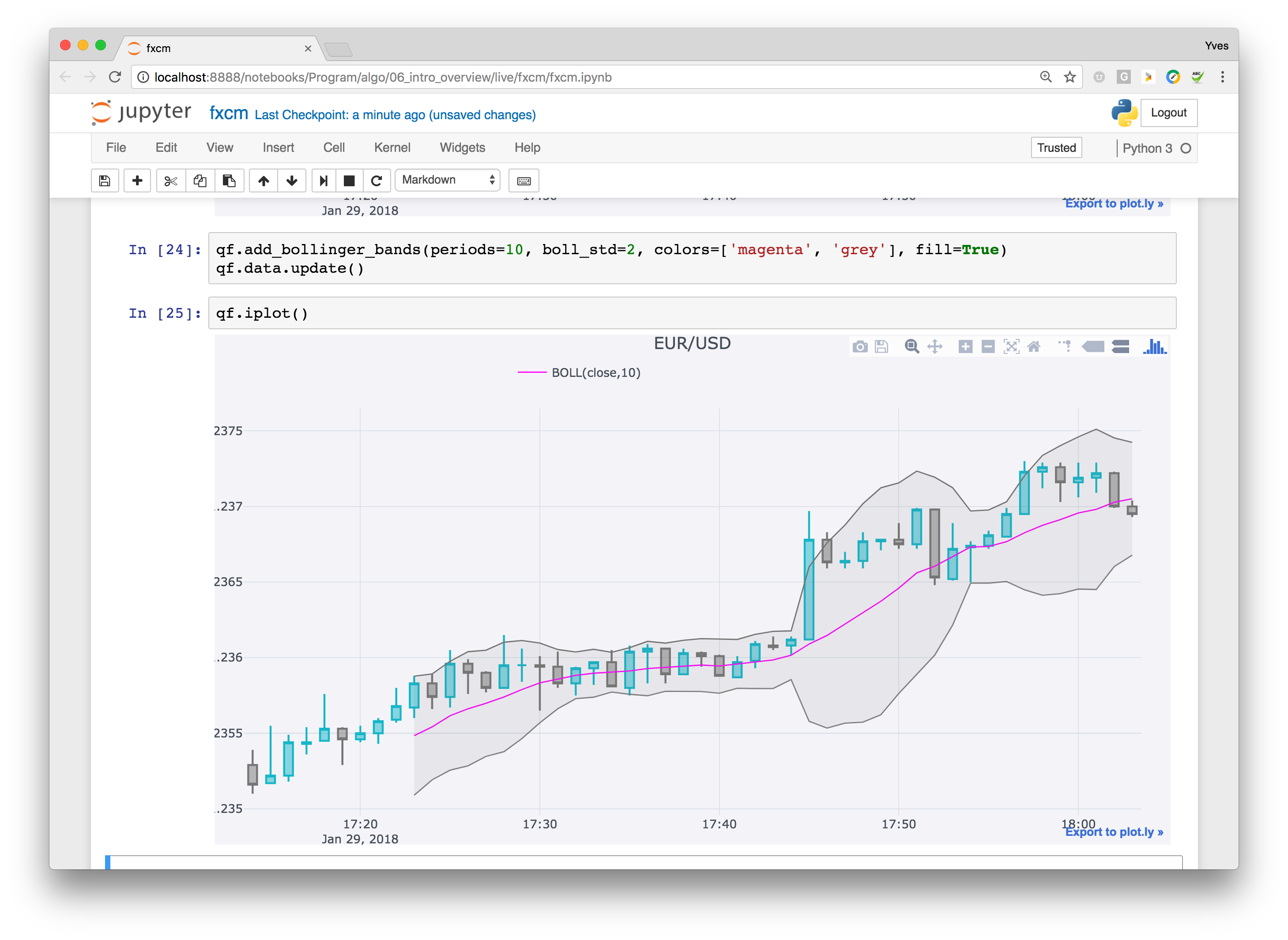

Bollinger Bands

Glossary

Monetary Policy

Money Supply

Currency Union

Liquidity

Manage Account

MYFXCM Login

Deposit Funds

Client Resources

FXCM PLUS

Become a Better Trader

Upgrade Your Account

Trading Platforms

Trading Station Web

Download Trading Station

Download MetaTrader 4

VPS Hosting

Trading With FXCM

Global Broker

Awards and Accolades

International Offices

Institutional

20 Years of Trading

Who We Are

Financial Oversight

Regulation

Client Funds

Execution

Execution Transparency

Slippage Statistics

Liquidity Providers

Insights

Forex

Advanced Forex Trading

Forex Chart Analysis

Forex Indicators

Forex Trading Tips

Trading For Beginners

Trading Strategies

Please Select British Virgin Islands Curaçao Isle of Man Monaco United Kingdom ---------- Afghanistan Albania Algeria American Samoa Andorra Angola Anguilla Antigua & Barbuda Argentina Armenia Aruba Australia Austria Azerbaijan Bahamas Bahrain Bangladesh Barbados Belarus Belgium Belize Benin Bermuda Bhutan Bolivia Bosnia & Herzegovina Botswana Brazil British Virgin Islands Brunei Bulgaria Burkina Faso Burundi Cambodia Cameroon Canada Cape Verde Caribbean Netherlands Cayman Islands Central African Republic Chad Chile China Colombia Comoros Congo - Brazzaville Costa Rica Côte d’Ivoire Croatia Cuba Curaçao Cyprus Czechia Denmark Djibouti Dominica Dominican Republic Ecuador Egypt El Salvador Equatorial Guinea Eritrea Estonia Eswatini Ethiopia Falkland Islands Faroe Islands Fiji Finland France Gabon Gambia Georgia Germany Ghana Gibraltar Greece Greenland Grenada Guam Guatemala Guernsey, Channel Islands Guinea Guinea-Bissau Guyana Haiti Honduras Hong Kong SAR China Hungary Iceland India Indonesia Iran Iraq Ireland Isle of Man Israel Italy Jamaica Japan Jersey, Channel Islands Jordan Kazakhstan Kenya Kiribati Kosovo Kuwait Kyrgyzstan Laos Latvia Lebanon Lesotho Liberia Libya Liechtenstein Lithuania Luxembourg Macao SAR China Madagascar Malawi Malaysia Maldives Mali Malta Marshall Islands Mauritania Mauritius Mexico Micronesia Moldova Monaco Mongolia Montenegro Montserrat Morocco Mozambique Myanmar (Burma) Namibia Nauru Nepal Netherlands New Zealand Nicaragua Niger Nigeria North Korea Norway Oman Pakistan Palau Palestinian Territories Panama Papua New Guinea Paraguay Peru Philippines Poland Portugal Puerto Rico Qatar Republic of North Macedonia Romania Russia Rwanda Samoa San Marino São Tomé & Príncipe Saudi Arabia Senegal Serbia Seychelles Sierra Leone Singapore Slovakia Slovenia Solomon Islands Somalia South Africa South Korea Spain Sri Lanka St Helena St Kitts & Nevis St Lucia St Martin St Vincent & Grenadines Sudan Suriname Sweden Switzerland Syria Taiwan Tajikistan Tanzania Thailand Timor-Leste Togo Tonga Trinidad & Tobago Tunisia Turkey Turkmenistan Turks & Caicos Islands Tuvalu Uganda Ukraine United Arab Emirates United Kingdom United States Uruguay US Virgin Islands Uzbekistan Vanuatu Venezuela Vietnam Yemen Zambia Zimbabwe Country *

About FXCM

Global Broker

International Offices/Sites

Regulation

Awards and Accolades

Press Releases

Career Center

Client Funds

Choose Country

International (English) UK (English) Australia (English) Canada (English) Português China (中文) Hong Kong, China (English/中文) Deutschland (Deutsch) France (Français) Italia (Italiano) Español Ελλάδα (Ελληνικά) Philippines (Tagalog) Indonesia (Bahasa) Malaysia (Malay) South Africa (English) Vietnam (Tiếng Việt) العربية Arabic (English) ישראל (עברית) International (English) UK (English) Australia (English) Canada (English) Português China (中文) Hong Kong, China (English/中文) Deutschland (Deutsch) France (Français) Italia (Italiano) Español Ελλάδα (Ελληνικά) Philippines (Tagalog) Indonesia (Bahasa) Malaysia (Malay) South Africa (English) Vietnam (Tiếng Việt) العربية Arabic (English) ישראל (עברית)

Popular Platforms

Trading Station

MetaTrader 4

NinjaTrader

Download

Download Trading Station

Download Mobile

Download MetaTrader 4

Launch Software

Trading Station Web

MetaTrader 4 Web

Accounts

Forex Trading Demo

Open an Account

Manage Account/Deposit

More Resources

Insights

FXCM App Store

Institutional Services

FXCM Policies

Cookie Policy & Settings

Privacy Policy

Treat Customers Fairly

We believe that an account with FXCM EU is the best way to reduce disruption to your trading in the months ahead.

FXCM now offers WhatsApp support to our clients! Simply add our WhatsApp number to your contacts (+44 7537 432259) or click here and reach out to us from Sunday at 5pm EST to Friday at 5pm EST.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76.31% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

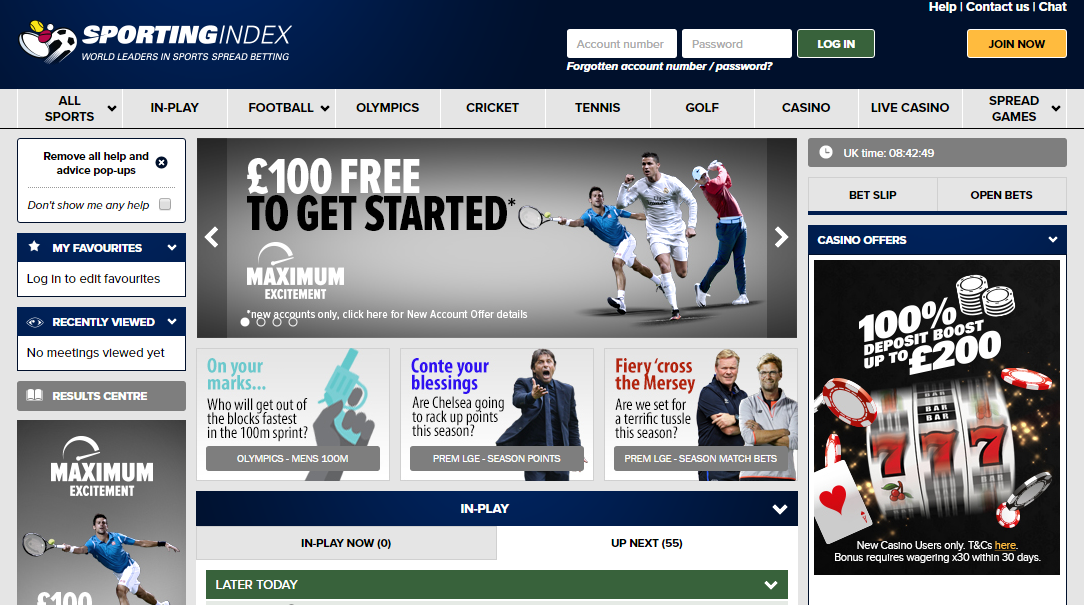

Spread betting is a speculative strategy in which participants make bets on the price movements of a security. At its most basic level, this kind of speculation involves placing wagers on the bid and ask prices provided by a spread-betting company. Because spread betting does not involve buying or selling the underlying asset, it is a type of financial derivatives trading.

The bid price is the highest amount a buyer is willing to pay to purchase a security. Alternatively, the ask is the lowest price a seller is willing to accept for the security being sold. The difference between the bid and the ask is the spread. Once the buyer and seller negotiate a price, the transaction takes place.

While a buyer and seller are looking to work out a price for the security so they can set up this transaction, the spread bettor is making a bet on whether the security's price will rise or fall after receiving the prices offered by a broker.

For example, an investor buys 500 shares of Apple Inc. common stock for £100 apiece. Apple Inc. releases some important news and its common stock surges £7 apiece. The investor then sell these shares for a gross profit of £3,500.

This example provides a gain, but it also comes at a cost. Buying and then selling the shares generate fees, and the gains produced could provide the investor with tax liability. Past that, an investor would need to have £50,000 to make the initial purchase.

Had the Apple stock sunk £7 a piece, the loss would be £3,500 in addition to the large capital investment and fees.

As an alternative example, investor spread bettor makes a spread bet on Apple Inc.'s common shares. He believes the company's stock will surpass £100, and a spread-betting company quotes a bid price of £100 and an offer price of £105. The investor wagers £10 for every 1 pence the price increases above £100. Should the stock reach £107, the bet captures 700 points, which would generate a profit of 700 x £5 or £3,500.

Had the market swung in the opposite direction, dropping 700 points at £5 a point, the spread bettor would see a £3,500 loss, equivalent to the stock trader's loss. In this case, however, the large capital investment is lessened because of the available leverage.

Trading on margin carries a high degree of risk and losses can exceed deposited funds.

If the investor decided upon the spread-betting approach, he would gain or lose the exact same amount as he would have made by buying the shares outright and then selling them. However, spread betting would not require the investor to have £50,000 in capital. In addition, using this approach would likely allow him to avoid paying capital gains tax or commissions.

While there are many speculative activities investors can harness, spread betting sets itself apart in certain ways. Those interested in spread betting can potentially enjoy tax benefits through such activity in some jurisdictions, primarily the United Kingdom or Ireland.

Spread bettors can initiate both long and short positions, while investors who purchase stock outright are relying on the shares rising in value to capture capital appreciation. By taking part in spread betting, investors can make use of leverage , which could amplify both gains and losses. Finally, spread bettors can make relevant wagers in a wide range of markets.

Investors should keep in mind that spread betting comes with risks of its own. If they participate in such activity, they will have to worry about the bid-offer spread, which could be greater than the spreads of other markets.

Additionally, spreads become increasingly narrow as the asset they involve becomes less thinly traded, and the bettor must overcome the spread to simply break even on a trade.

While leverage can potentially increase returns, it can also amplify losses. As a result, investors using this resource could lose substantial amounts in a short time frame.

There are some simple approaches investors can use to help manage the risk associated with spread betting.

Stop Loss Orders - Investors can help limit their risk by using a stop-loss order, which automatically closes out a trade once a market price rises or falls below a certain level. Spread bettors could potentially set up guaranteed stop-loss orders, which will close a position out at a specified amount; or a standard stop-loss order, which will close out a trade at the best available price once a stop value has been hit.

While a guaranteed stop loss provides greater certainty, the associated broker may levy an additional fee. Alternatively, a standard stop-loss order can cause a position to close out at a point that is even less advantageous than the stop point.

While some use spread betting as a means of generating a profit through placing wagers on a security's future price movements, spread betting on margin involves a high level of risk and losses can exceed deposited funds. Interested investors should conduct the needed due diligence and/or consult an independent investment adviser.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites are provided as general market commentary and do not constitute investment advice. FXCM will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information.

I consent to receive educational trading material and marketing communication from the FXCM Group of companies.

By providing your telephone number, you agree that FXCM may contact you regarding this product.

You can opt-out at any time. Network charges may apply. FXCM will use data collected for the purposes of providing service, contacting, and sending you important information. To find out more, please visit our Privacy Policy .

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interests arising out of the production and dissemination of this communication. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed here .

High Risk Investment Notice: Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. The products are intended for retail, professional, and eligible counterparty clients. Retail clients who maintain account(s) with Forex Capital Markets Limited ("FXCM LTD") could sustain a total loss of deposited funds but are not subject to subsequent payment obligations beyond the deposited funds but professional clients and eligible counterparty clients could sustain losses in excess of deposits. Prior to trading any products offered by FXCM LTD or other firms within the FXCM group of companies [collectively the "FXCM Group"], carefully consider your financial situation and experience level. The FXCM Group may provide general commentary, which is not intended as investment advice and must not be construed as such. Seek advice from a separate financial advisor. The FXCM Group assumes no liability for errors, inaccuracies or omissions; does not warrant the accuracy, completeness of information, text, graphics, links or other items contained within these materials. Read and understand the Terms and Conditions on the FXCM Group's websites prior to taking further action.

Forex Capital Markets Limited ("FXCM LTD") is an operating subsidiary within the FXCM group of companies (collectively, the "FXCM Group"). All references on this site to "FXCM" refer to the FXCM Group.

Forex Capital Markets Limited is authorised and regulated in the United Kingdom by the Financial Conduct Authority. Registration number 217689. Registered in England and Wales with Companies House company number 04072877.

Important Information: FXCM LTD offers spread betting exclusively to UK and Ireland Residents. Residents of other countries are NOT eligible. Spread betting is not intended for distribution to, or use by any person in any country and jurisdiction where such distribution or use would be contrary to local law or regulation.

Tax Treatment: The UK tax treatment of your financial betting activities depends on your individual circumstances and may be subject to change in the future, or may differ in other jurisdictions.

20 Gresham Street,

4th Floor,

London EC2V 7JE,

United Kingdom

Spread Betting - FXCM Markets

What Is Spread Betting ? - FXCM UK

FXCM Markets - Home | Facebook

What is Spread Betting | Spread Bet with FxPro | CFD Forex Trading...

FXCM spread on GBPUSD: Real time spread monitoring and statistics

Mature April

Pornstars Ass

Wife Masturbate And Pee

Yoga Nudist

Nasty Tube Porn