Funding For Mature Students

🛑 👉🏻👉🏻👉🏻 INFORMATION AVAILABLE CLICK HERE👈🏻👈🏻👈🏻

We use cookies to personalise content and ads, to provide social media features and to analyse our website traffic. We also share information about your use of our site with our social media, advertising and analytics partners who may combine it with other information that you’ve provided to them or that they’ve collected from your use of their services to provide personalised advertising to you.

Find out your options and start planning your next steps

All the information you need to take your education to the next level

Not sure if uni or college is for you? Find out what else you can do

All you need to know about student finance for mature applicants

Funding your studies – what’s available?

Higher education is a major investment in your future. Once you’ve decided what and where to study, you’ll need to consider how to fund your studies. Be aware that there are different options depending on where you live, where you plan to study, and at which level, so check the details carefully before you make your application.

Applications for student finance open at different times depending on the organisation you need to apply to (Student Finance England (SFE), Student Awards Agency For Scotland (SAAS), etc). It’s best to apply as early as possible to ensure that your finances are in order for the start of term.

Undergraduate finance and funding

Maintenance loans and grants

Maintenance loans and grants help with living costs, such as food, accommodation, and travel. The amount you can receive is dependent on factors such as where and what you'll study, whether you are planning to study full-time or part-time, and your household income.

Tuition fee loans cover the cost of your undergraduate course fees, and are paid directly to the university or college.

There is no age limit on eligibility for tuition fee loans, so anyone can apply, providing that they’re going to be studying for their first undergraduate degree.

Universities and colleges can charge up to £9,250 a year for undergraduate tuition fees to full-time UK and EU students. This amount is set by the governments in each country, and can vary depending on whether you study in or outside your home country.

Check the tuition fee costs for your course and university on the UCAS search tool.

Depending on where you live, there are different options available, and you will need to apply to different organisations. Each will have different deadlines, so read the following information carefully:

Students from England can apply for a tuition fee loan wherever they choose to study in the UK.

A means-tested maintenance loan is available to all students who are eligible for student finace.

For students who live in Northern Ireland and choose to study at a Nortern Irish course provider, the maximum tuition fee is capped. If you choose to study elsewhere in the UK, the costs will be higher. You can apply for a tuition fee loan to cover the yearly course costs wherever in the UK you choose to study.

Students can apply for a maintenance grant, and eligible students can also receive a maintenance grant or Special Support Grant.

Students from Scotland and the EU (excluding England, Wales, or Northern Ireland) can study for free in Scotland – the Scottish government pays the yearly course fee on behalf of the student.

Scottish students who wish to study elsewhere in the UK will be charged the standard tuition fees for their chosen course provider, but may apply for a tuition fee loan.

Students may apply for a means-tested maintenance loan wherever in the UK they choose to study.

Be aware that most Scottish undergraduate degrees take four years to complete, as opposed to three years in the rest of the UK, so this can impact the size of your student loan. For more information, refer to the SAAS guidelines.

Students from Wales can apply for a tuition fee loan to cover the cost of an undergraduate degree anywhere in the UK.

Eligible students can receive money towards the cost of accomodation and living costs, and some may also be able to apply for an additional means-tested maintenance grant. Maintenance loans are available to all students.

Your eligibility for student finance will depend on where you plan to study, and whether you are from the EU or outside of the EU.

You may still be eligible for a student loan if you’re studying part-time. Student Finance England offers loans to students on courses with a ‘course intensity’ of 25% or higher – this is measured by how much of your course you’ll complete each year compared to a full-time student.

For more information and guidance, refer to the Student Finance England website.

It is means-tested, and based on your household income. As a mature student, there a number of factors that could affect this, such as dependents, employment, and a partner's earnings. SFE have set up a calculator to help clarify what you could be entitled to.

Many universities and colleges offer scholarships or bursaries. Check out their individual websites or speak to student services directly (either call or during an open day/visit) for more information, or use the Scholarship Hub.

Extra support for applicants with invididual needs, and for those with children and dependants may also be available, such as the Parents’ Learning Allowance, Childcare Grant, Adult Dependants’ Grant, Disabled Students Allowances (DSAs), and others.

There is also help available to fund an Access to Higher Education course, called an Advanced Learning Loan. If you take out an Advanced Learning Loan to study an Access to Higher Education Diploma course, it will be written off once you complete a subsequent higher education course.

Please note that different funding is available if you want to study in Northern Ireland, Scotland, or Wales.

Where you need to apply for student finance is dependent on where your chosen course is situated.

Getting funding for postgraduate study isn't always as straightforward as the process for undergraduate study, but there's still a range of options you can look into.

The finance and funding available for postgraduate teacher training courses varies depending on where in the UK you plan to study.

Find out more about the different forms of support and help available on the student finance or additional funding sections of our website.

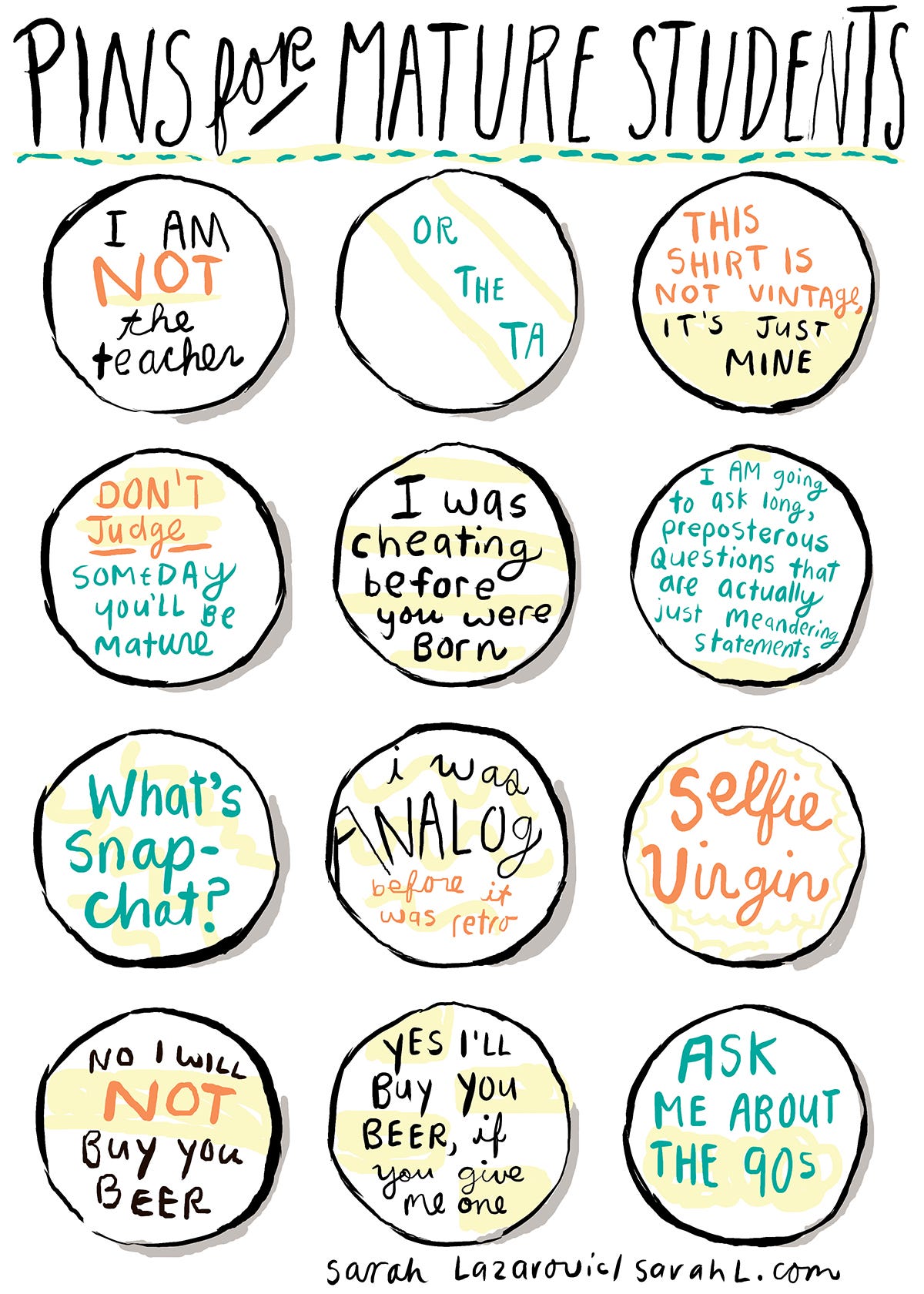

Every year, thousands of mature students go to university or college. It's a great chance to develop new skills and career options – at any age.

Make sure you're best prepared to start your studies by making the most of the support available to you.

If you are responsible for the care and wellbeing of a child aged 17 or under, you may be able to access additional support while studying.

find your perfect postgrad program

Search our Database of 30,000 Courses

Funding for mature students can often be more complicated than for younger students, and this is partly the case because many more mature students study part time.

Both full- and part-time postgraduate students qualify for some sort of Government funding in the UK, but please note that or full-time and part-time students a masters course must be worth 180 credits to qualify for funding. Part-time students must complete the course in either two or four years (depending on the length of the full-time course) or three years if no other part-time option is available. Part-time students are not eligible for Government loans for living expenses, but they are for those loans covering tuition fees. The other major thing that affects Government funding in the UK is whereabouts you live.

For students living in England they can claim up to £10,906 over the duration of their course.

If you are a resident of Wales, the Government offers a combination of loans and grants up to a total of £17,000, depending on your household income and this is for full- and part-time students.

In Scotland, both full and part-time students can claim a loan of up to £5,500 for their tuition fees and full-time students under 60 years old can claim a loan of up to £4,500 for living costs.

Northern Irish students can claim a loan of up to £5,500 to help towards the cost of tuition fees.

Another option that many mature students choose is self-funding. This usually is either through savings or by working as well as studying their postgraduate program. Most students who work and study are part-time students, but with online or distance learning courses you may find that you are able to work and study full time.

If a colleague with a specific skill set is due to retire or leave, then you might find that your boss will agree to fund a postgraduate course that qualifies you do fill that position when it becomes free. It is fairly standard practice in the UK for employers to insist that employees who are having their studies funded by the business or organisation sign a contract agreeing to work for at least two years, otherwise the student will be liable to repay the costs of the course.

Spend some time searching through scholarships and bursaries especially those available directly from your university as they are usually open to a wide range of students. Applying to scholarships often requires writing a personal statement and providing grade transcripts throughout your studies. And don’t forget if you get offered a place on a postgraduate program you will be eligible to apply for a Postgrad Solutions Study Bursary worth £500.

There are a few financial institutions that offer career development loans and postgraduate study loans. Be sure before you borrow the money, but since you are a mature student, this is probably not the first time you've borrowed money.

Both the Government and universities themselves offer additional funding to students with disabilities. Mature students are more likely to have a disability, so make sure you find out what additional help you could get with the Disabled Student Allowance.

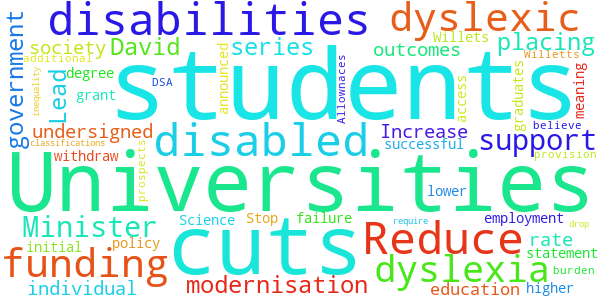

Here is a table showing the numbers of full- and part-time mature postgraduate students by age group and study mode in 2018-19

Exclusive bursaries Open day alerts Funding advice Application tips Latest PG news

© Postgrad Solutions Ltd 2006-2021. All rights reserved.

Sign up now!

Take 2 minutes to sign up to PGS student services and reap the benefits…

The chance to apply for one of our 20 exclusive PGS Bursaries

Fantastic scholarship updates

Latest Postgrad news sent directly to you

No, thanks Yes, I'd like to sign up

Sissy Dreams Game

Rock Shox Silver Tk Solo Air

Xnxx Retro Nudistki

Naked Women Ass Video

Www Xnxx Com Shemale

Mature students: university and funding - GOV.UK

Funding, Loans & Grants For Mature Students | Student Finance

Funding for mature students | Postgrad.com

Scholarships and grant funding for mature students - The ...

Mature Students - funding a second degree - The ...

Grants and funds available for mature students

Can you afford to go to university as a mature student? - Saga

Grants and bursaries for adult learners - GOV.UK

Mature students scholarships |2021-2022 Scholarship Listing

Funding For Mature Students