Fixed Spreads

🔞 ALL INFORMATION CLICK HERE 👈🏻👈🏻👈🏻

Fixed Spreads

Welcome to BrokerNotes. This site uses cookies - here's our cookie policy . Ok

Sort By

SORT

Our Pick

Most Popular

Lowest Spread

What can you trade?

Forex

Crypto currencies

Indices

Commodities

Stocks

ETFs

Regulated by: Central Bank of Ireland, ASIC, IIROC, FSA, FSB, UAE and BVI.

Platforms

MT4

MT5

Web Trader

Mobile App

Funding Methods

Credit cards

PayPal

Bank transfer

What can you trade?

Forex

Crypto currencies

Indices

Commodities

Stocks

ETFs

Regulated by: Financial Conduct Authority.

Platforms

MT4

MT5

Web Trader

Mobile App

Funding Methods

Credit cards

PayPal

Bank transfer

What can you trade?

Forex

Crypto currencies

Indices

Commodities

Stocks

ETFs

Regulated by: Financial Conduct Authority.

Established in 1999

HQ in United States.

Platforms

MT4

MT5

Web Trader

Mobile App

Funding Methods

Credit cards

PayPal

Bank transfer

What can you trade?

Forex

Crypto currencies

Indices

Commodities

Stocks

ETFs

Regulated by: Financial Conduct Authority and ASIC.

Established in 2007

HQ in Australia.

Platforms

MT4

MT5

Web Trader

Mobile App

Funding Methods

Credit cards

PayPal

Bank transfer

What can you trade?

Forex

Crypto currencies

Indices

Commodities

Stocks

ETFs

Regulated by: Financial Conduct Authority, ASIC and MAS.

Platforms

MT4

MT5

Web Trader

Mobile App

Funding Methods

Credit cards

PayPal

Bank transfer

It's fast, easy and 100% free!

Ready to find your broker?

Between 54-87% of retail CFD accounts lose money. Based on 69 brokers who display this data.

For our fixed spread comparison, we found 14 brokers that are suitable and accept traders from Russian Federation.

79% of retail investor accounts lose money when trading CFDs with this provider.

82% of retail investor accounts lose money when trading CFDs with this provider.

79% of retail investor accounts lose money when trading CFDs with this provider

68.5% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

73% of retail investor accounts lose money when trading CFDs with this provider

Read our in-depth

City Index review

Between 54-87% of retail CFD accounts lose money. Based on 69 brokers who display this data.

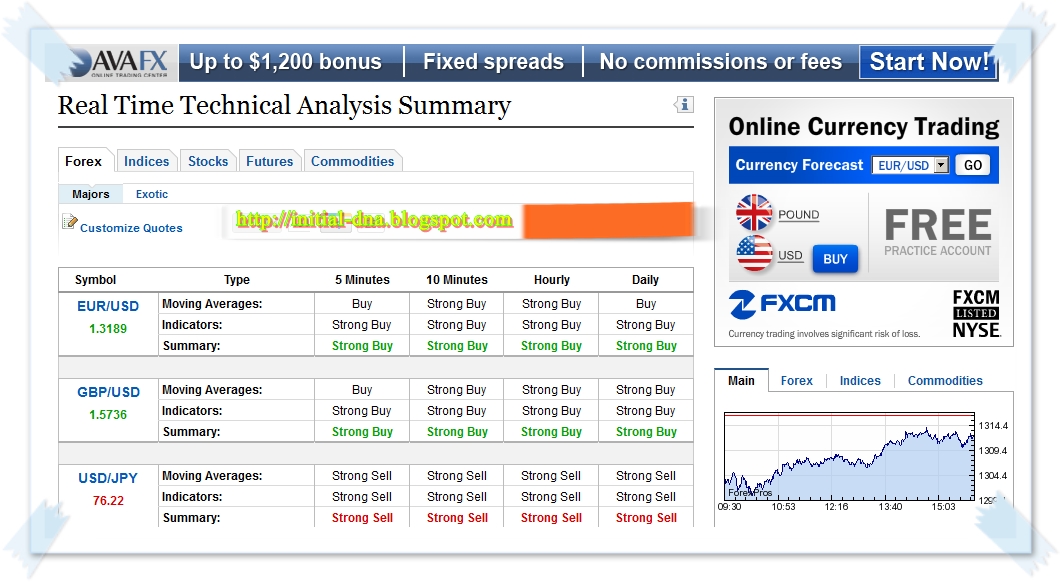

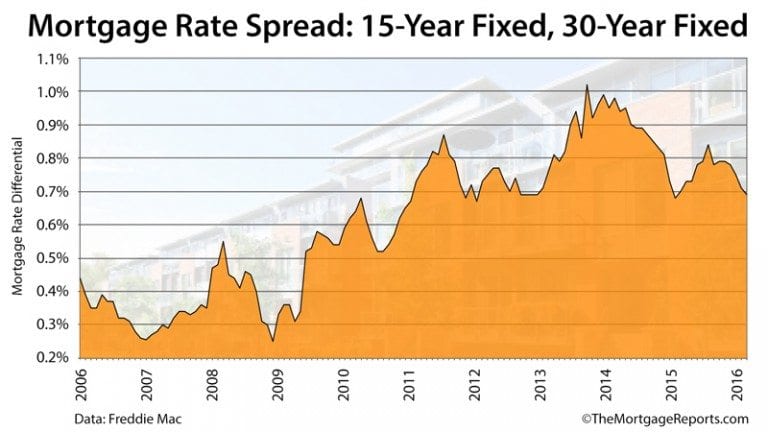

Forex brokers normally quote two different prices for currency pairs: the bid (buy) and ask (sell) price. The difference between these two prices is known as the spread. Generally speaking, the spread is how “no commission” brokers make their money. Instead of charging separate fees for making trades, the cost is built into the buy and sell price of the forex pair you want to trade.

The spread is usually measured in pips, which is the smallest unit of price movement of a traded asset. For most currency pairs, one pip is equal to 0.0001. An example of a 4 pip spread for EUR/GPB would be 1.2339/1.2335. However, currency pairs involving the Japanese yen are quoted to only 2 decimal places – an example of a USD/JPY quotes would be 109.53/109.45. The example quote indicates an 8 pip spread.

The type of spreads seen on a forex platform is determined by the structure of business offered by the forex broker. There are two types of spreads:

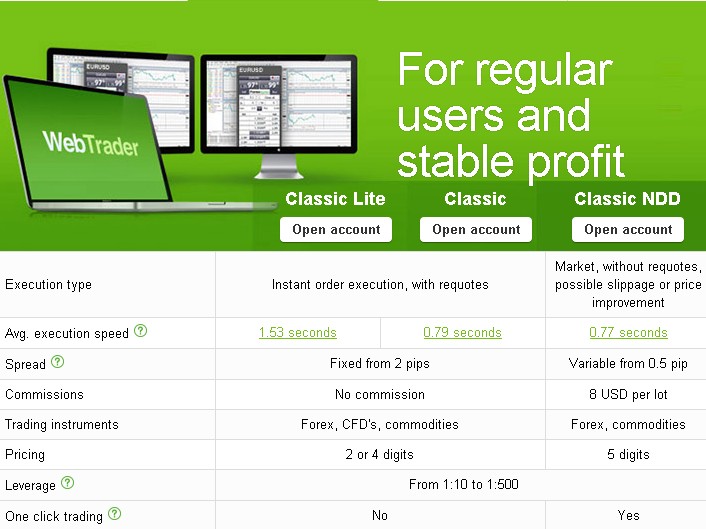

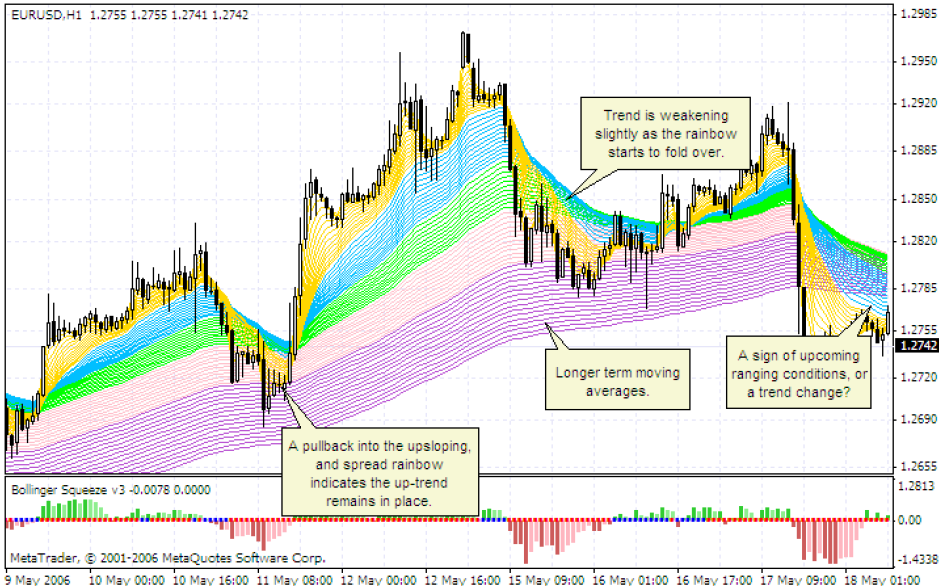

Fixed spreads are usually offered by brokers that operate a market maker model of business while variable spreads are offered by brokers operating a non-dealing desk model of brokerage business.

Fixed spreads stay the same irrespective of what market conditions are at play at any given time. In other words, conditions of slippage or intense volatility do not affect a fixed spread. Fixed spreads are seen with brokers that offer the market maker business model.

With this model, the broker buys off large positions from the liquidity providers and offers these positions in smaller chunks to traders using a dealing desk. Thus, the market maker acts as the counterparty to the trade. In this manner, the broker is able to offer fixed spreads to its clients because they are able to control what is offered to these traders using the dealing desk.

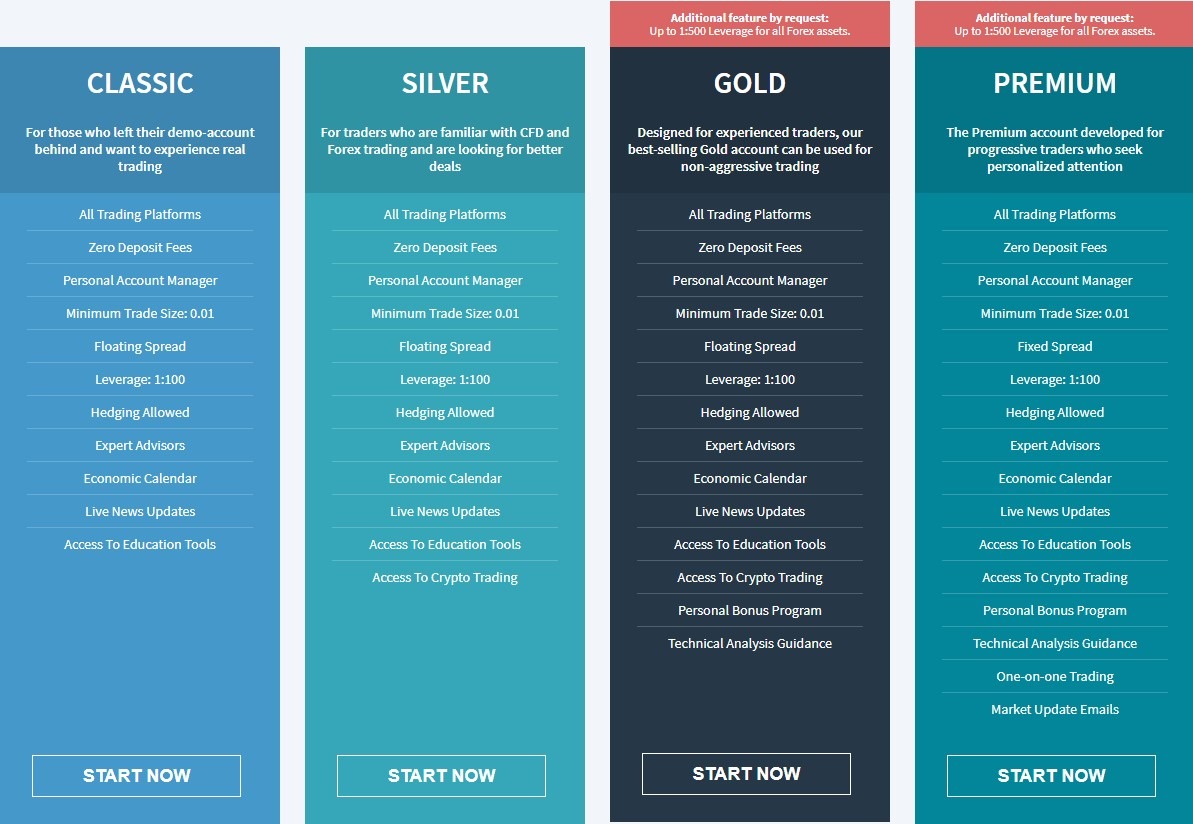

Fixed spreads have smaller capital requirements, so trading with variable spreads requires a lot of liquidity which many retail traders cannot afford. Therefore, fixed spreads offer a viable and cheaper alternative.

Trading with fixed spreads also enables better trade planning. This is because traders are always sure of what they can expect to pay when they execute a trade. If you are a scalper, then the fixed spread is for you. Scalping involves taking very small profits in many trades within a day. Obviously, the spread will impact on any profits made, so scalpers will be better served using fixed spreads.

Requotes are very common with fixed spread arrangements since pricing is coming from just one source. There will always be times when pricing moves very fast as a result of supply-demand dynamics. With no room for spread adjustment to accommodate these movements, the broker has no option but to ask the trader to accept a new entry price provided for the trade.

Slippage can be another huge problem. When prices are moving fast, the ability of the broker to offer a fixed spread is compromised and the price fill may end up being far worse than if a widened variable spread was use. Because fixed spreads are only possible because the broker’s dealing desk is controlling the order flows and execution prices, you may find the concept of trading with fixed spreads not very attractive.

The question of which is a better option between fixed and variable spreads depends on the situation of each individual trader. There are traders who will find the use of fixed spreads more advantageous than using variable spread brokers. However, the reverse can also be the true for other traders. Generally speaking, traders with smaller accounts and fewer monthly trades will benefit from fixed spread pricing.

Scalpers

Those who get in and out of the market very quickly, multiple times a day and just take a few pips at a time generally prefer trading with fixed spread brokers. However, there is a caveat that a broker offering wide fixed spreads may not be the best fit.

News traders

Traders who trade the news could benefit from using fixed spreads. Some traders have complained of spreads widening to as high as 50 pips during news trades with variable spread brokers, therefore choosing a broker with the fixed spreads brokers could prevent this.

Micro Accounts Traders

Low-frequency traders and those with smaller deposits using micro accounts could be better off with fixed spread brokers. You will not pay extra commissions (just the spread as discussed above) on trades, unlike with variable spread brokers who charge commissions on each side (buy and sell) of trades.

BrokerNotes Ltd is an Appointed Representative of Resolution Compliance Ltd, which is authorised and regulated by the Financial Conduct Authority (FRN: 574048). BrokerNotes Ltd is registered in England and Wales. Company No. 10464674. Registered office: Thames Wing, Howbery Park, Wallingford, OX10 8BA, UK.

Copyright © 2014-2021 BrokerNotes Ltd

Disclaimer: BrokerNotes.co is for informational purposes only. This website does not provide investment advice, nor is it an offer or solicitation of any kind to buy or sell any investment products. Rates and terms set on third-party websites are subject to change without notice. Please note that BrokerNotes.co has financial relationships with some of the merchants mentioned here and may be compensated if consumers choose to utilise some of the links located throughout the content on this site.

Fixed Spread Forex Trading Broker | What is a Spread ? | easyMarkets

10 Best Forex Brokers With Fixed Spreads of 2021

15 Best Fixed Spreads Accounts 2021 - Comparebrokers.co

Fixed Spread vs Floating Spread | What is Spread | IFCM

Fixed Spreads Vs Variable Spreads

Top Fixed Spreads Accounts for 2021 Review by Andrew Blumer

last updated on

January 31, 2021

Roboforex was established in 2009 and is used

by over 10000+ traders. Losses can exceed deposits Roboforex offers Forex, CFDs.

Funding methods

Bank transfer

Credit Card

Paypal

Platforms

MT4, MT5, Mac, Web Trader, cTrader, Tablet & Mobile apps

Customer support

Live chat Phone support Email support

Account Types

Micro account

Standard account

Islamic account

VIP account

Regulated by Cyprus Securities and Exchange Commission (CySEC)

Trading 212 was established in 2006 and is used

by over 14000000+ traders. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Trading 212 offers Stocks, Forex, Commodities, Indices.

Funding methods

Bank transfer

Credit Card

Paypal

Platforms

Web Trader, Tablet & Mobile apps

Customer support

Live chat Phone support Email support

Account Types

Micro account

Standard account

Islamic account

VIP account

Regulated by Financial Conduct Authority (FCA), Financial Supervision Commission (FSC)

Plus500 was established in 2008 and is used

by over 15500+ traders. 76.4% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Plus500 offers CFDs.

Funding methods

Bank transfer

Credit Card

Paypal

Platforms

Web Trader, Tablet & Mobile apps

Customer support

Live chat Phone support Email support

Account Types

Micro account

Standard account

Islamic account

VIP account

Regulated by Plus500UK Ltd authorized & regulated by the FCA (#509909), Plus500CY Ltd authorized & regulated by CySEC (#250/14), Plus500AU Pty Ltd (ACN 153301681), ASIC in Australia AFSL #417727, FMA in New Zealand, FSP #486026 and Authorised Financial Services Provider in South Africa FSP #47546

easyMarkets was established in 2001 and is used

by over 142500+ traders. Your capital is at risk easyMarkets offers CFD, Forex, Commodities, Indices, Shares, Crypto.

Cryptocurrency availability with easyMarkets is subject to regulation.

Funding methods

Bank transfer

Credit Card

Paypal

Platforms

MT4, Web Trader, Tablet & Mobile apps

Customer support

Live chat Phone support Email support

Account Types

Micro account

Standard account

Islamic account

VIP account

Regulated by Cyprus Securities and Exchange Commission (CySEC), Australian Securities and Investments Commission (ASIC)

SpreadEx was established in 1999 and is used

by over 10000+ traders. Losses can exceed deposits SpreadEx offers Forex, CFDs, and spread betting.

Funding methods

Bank transfer

Credit Card

Paypal

Platforms

Web Trader, Tablet & Mobile apps

Customer support

Live chat Phone support Email support

Account Types

Micro account

Standard account

Islamic account

VIP account

Regulated by Financial Conduct Authority (FCA)

City Index was established in 1983 and is used

by over 14000+ traders. 75% of retail investor accounts lose money when trading CFDs with this provider City Index offers Forex, CFDs, Spread Betting.

Funding methods

Bank transfer

Credit Card

Paypal

Platforms

MT4, Web Trader, Tablet & Mobile apps

Customer support

Live chat Phone support Email support

Account Types

Micro account

Standard account

Islamic account

VIP account

Regulated by Financial Conduct Authority (FCA), Australian Securities and Investments Commission (ASIC), Monetary Authority of Singapore (MAS)

NordFX was established in 2008 and is used

by over 10000+ traders. Losses can exceed deposits NordFX offers Forex.

Funding methods

Bank transfer

Credit Card

Paypal

Platforms

MT4, MT5, Tablet & Mobile apps

Customer support

Live chat Phone support Email support

Account Types

Micro account

Standard account

Islamic account

VIP account

Regulated by Cyprus Securities and Exchange Commission (CySEC), License No: 209/13

Markets.com was established in 2008 and is used

by over 10000+ traders. 84% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Markets.com offers Forex, CFDs and Spread Bets. Spread Bets are only available to UK customers.

Funding methods

Bank transfer

Credit Card

Paypal

Platforms

MT4, MT5, Web Trader, Tablet & Mobile apps

Customer support

Live chat Phone support Email support

Account Types

Micro account

Standard account

Islamic account

VIP account

Regulated by Cyprus Securities and Exchange Commission (CySEC), Financial Sector Conduct Authority (FSCA), Financial Conduct Authority (FCA), Australian Securities and Investments Commission (ASIC)

HYCM was established in 1977 and is used

by over 10000+ traders. Losses can exceed deposits HYCM offers Forex, CFDs.

Funding methods

Bank transfer

Credit Card

Paypal

Platforms

MT4, Tablet & Mobile apps

Customer support

Live chat Phone support Email support

Account Types

Micro account

Standard account

Islamic account

VIP account

Regulated by Financial Conduct Authority (FCA), FCA reference number 186171, Cyprus Securities and Exchange Commission (CySEC), CySEC license number 259/14, Cayman Islands Monetary Authority (CIMA), CIMA reference number 1442313, Dubai financial services authority (DFSA), DFSA license number 000048

Swissquote was established in 1999 and is used

by over 300000+ traders. Losses can exceed deposits Swissquote offers Forex, Social Trading.

Funding methods

Bank transfer

Credit Card

Paypal

Platforms

MT4, MT5, ZuluTrade, Web Trader, Tablet & Mobile apps

Customer support

Live chat Phone support Email support

Account Types

Micro account

Standard account

Islamic account

VIP account

Regulated by Financial Conduct Authority (FCA)

AvaTrade was established in 2006 and is used

by over 200000+ traders. 79% of retail investor accounts lose money when trading CFDs with this provider AvaTrade offers Forex, CFDs, Spread Betting, Social Trading.

Funding methods

Bank transfer

Credit Card

Paypal

Platforms

MT4, Mac, Mirror Trader, ZuluTrade, Web Trader, Tablet & Mobile apps

Customer support

Live chat Phone support Email support

Account Types

Micro account

Standard account

Islamic account

VIP account

Regulated by Central Bank of Ireland, Australian Securities and Investments Commission (ASIC), Financial Services Authority (FSA), Financial Stability Board (FSB), British Virgin Islands Financial Services Commission (BVI)

We found 11 online brokers that are appropriate for Trading Fixed Spreads Accounts.

A fixed spread is the difference between the ask and bid price stays the same even when the market

prices are changing.

Usually, brokers who operate as a market maker offer fixed spreads while those who operate as a non-

dealing desk offer variable spreads.

Lets explain fixed spreads. A trader buys a product at a wholesale price and sells it at a retail price to

earn profit with a slight increase in price. The seller adjusts the profit depending on the volatility of the market.

This means if the market is volatile; the retail price would be more compared to the usual market.

Similarly, the spreads between buy and sell of currencies in Forex trading change depending on the

volatility of the market. But if the buyer and seller fix up the price irrespective of market volatility, it is known

as fixed spreads.

So, in fixed spreads you know what would be the spread is in the future and develop your trading strategy

accordingly.

As mentioned above, spreads are of two types. One is fixed spreads and the other is variable spreads,

which is also called as floating spreads.

In variable or floating spreads the value differences between buy and sale price change constantly.

The fluctuation depends on factors like supply, demand and trading activities. Usually, the spreads are

very tight when the trading sessions are highly active and liquidity is at the optimal level.

In short, the variable or floating spreads are completely based on market phenomenon.

In fixed spreads, the differences between buy and sale are fixed and are not affected by a volatile

market.

There is a couple of fixed spreads advantages worth mentioning here and those are as below:

There are basically three types of fixed spreads and those are as below:

Investors who want to make lower deposit amounts with their broker or do not trade very often may prefer

using a fixed spread broker.

If you are a bit fickle-minded and usually take an entry and exit several times a day, scalpers are best for

you.

If you trade the news, you can understand the role of news traders. If the market is highly volatile, it is

suggested to opt for fixed spreads.

Fixed spreads are a useful trading strategy for some. Fixed spreads play an important role when the

market is highly volatile.

We've collected thousands of datapoints and written a guide to help you find the best Fixed Spreads Accounts for you. We hope this guide helps you find a reputable broker that matches what you need.

We list the what we think are the best fixed spreads accounts below. You can go straight to the broker list here .

There are a number of important factors to consider when picking an online Fixed Spreads Accounts trading brokerage.

Our team have listed brokers that match your criteria for you below. All brokerage data has been summarised into a comparison table. Scroll down .

We compare these features to make it easier for you to make a more informed choice.

Here are the top Fixed Spreads Accounts.

Compare Fixed Spreads Accounts min deposits, regulation, headquarters, benefits, funding methods and fees side by side.

All brokers below are fixed spreads accounts. Learn more about what they offer below.

You can scroll left and right on the comparison table below to see more fixed spreads accounts that accept fixed spreads accounts clients

You can compare Fixed Spreads Accounts ratings, min deposits what the the broker offers, funding methods, platforms, spread types, customer support options,

regulation and account types side by side.

We also have an indepth Top Fixed Spreads Accounts for 2021 article further below. You can see it now by clicking here

We have listed top Fixed spreads accounts below.

Fixed Spreads Accounts Table of Contents

Trading the financial markets with Fixed Spreads Accounts when conditions are volatile can be difficult, even for experienced traders.

Apart from the educational and other resources made available online, another important factor for traders to consider when looking for Fixed Spreads Accounts

is the platform that a Fixed Spreads Accounts offer.

Choose Fixed Spreads Accounts that's at the forefront of innovation and generally considered an industry-leader.

To gain access to the financial markets, you'll need Fixed Spreads Accounts that you can rely on.

Follow these five rules for selecting a broker that's right for you:

Look for a broker that has a good track record/longevity in the market so that your strategy is your primary concern for navigating the markets.

The top rated Fixed Spreads Accounts broker is

Roboforex .

Established in 2009, and in operation for 9 years

Roboforex

have a head office in Cyprus.

Roboforex

is regulated. This means Roboforex are supervised by and is checked for conduct by

Cyprus Securities and Exchange Commission (CySEC) regulatory bodies.

Another top rated broker is

Trading 212 .

Trading 212

was established 2006, and in operation for 14 years

Trading 212

have a head office in UK.

Trading 212

is regulated. This means Trading 212 are supervised by and is checked for conduct by

Cyprus Securities and Exchange Commission (CySEC) regulatory bodies.

Choose a broker that's at the forefront of innovation and generally considered an industry-leader.

Roboforex Segregates clients funds and offers over 100 instruments.

Roboforex offers both an online trading platform as well as a mobile platform giving clients easy access to markets.

In addition, Roboforex supports many popular third-party trading platforms enabling access to a

variety of markets worldwide that can be traded with the assistance of expert advisors or a customizable automatic trading strategy.

Roboforex is a world-leader when it comes to innovation and they are always looking at ways to improve

and to maintain their competitive advantage.

Another good choice when looking for Fixed Spreads Accounts is

Trading 212 .

Trading 212 Segregates clients funds and offers over 3000 instruments.

Ensure that your broker is transparent with fees and those dues are competitive.

The best rated Fixed Spreads Accounts broker Roboforex

offers competitive offers for Forex, CFDs. Roboforex minimum deposit is 1.

Another top rated Fixed Spreads Accounts broker Trading 212 offers

Stocks, Forex, Commodities, Indices. Trading 212 minimum deposit is 1.

Please note that any cryptocurrency availability with any broker is subject to regulation.

When dealing with Fixed Spreads Accounts having convenient funding and withdrawl facilities makes the trading process and your trading experience smoother.

Customer service is very important when dealing with Fixed Spreads Accounts.

When investing and dealing with brokers customer support can be a range of customer services to assist customers in making cost effective and correct use the brokers services.

It can include assistance in installation, training, troubleshooting, upgrading, and cancelation of a product or service.

Fixed Spreads Accounts customer support can include Phone answering services, Live chat support and Email customer service support.

Roboforex support a wide range of languages including English, Chinese Simplified, Chinese Traditional, Indonesian, Malaysian, Portuguese, Spanish, Italian, Polish, Arabic, Thai, Russian, and Ukrainian

Trading 212 support a wide range of languages including English, Deutsch, Nederlands, Espanol, Francais, Italiano, Polski, Srpski, Norsk, Svenska, Cesky, РУССКИЙ, Romana, Turkce, العربية, 中文

Roboforex and Trading 212 offer support where clients are able to call or contact the helpdesk via email or a chat service.

Make sure your broker offers free resources like analysis, education and risk-management tools.

With a wealth of knowledge from top analysts, Roboforex and

Trading 212 work together to bring the latest news and insights to traders.

For most traders, the first – and sometimes only – concern is pursuing their 'edge'. While that is surely important,

along with sound money management habits, to navigating the markets; that step alone does not represent the full preparation.

As each trader dives into this important venture, it is important not to forget the most rudimentary yet crucial steps such as

selecting the best broker to access the markets.

A regulated Fixed Spreads Accounts broker lowers your risk.

Broker regulation protects consumers. Too little broker regulation can lead to poor services and possibly financial harm.

Fixed Spreads Accounts brokers are regulated to stop fraud. The agent's working capital and clients funded account have to be separated.

This amounts to fraud if client money is used to conduct the business.

Regulation is required to make sure this does not happen.

The best Fixed spreads accounts brokers that are regulated are

The best Fixed spreads account broker is Roboforex. We consider

Roboforex one of the best Fixed spreads accounts brokers because Roboforex is actively

used by over 10000 active traders.

Roboforex ia regulated by tier 1 financial regulators including Cyprus Securities and Exchange Commission (CySEC). Roboforex were founded in 2009 and have a headquarters in Cyprus. You can open a live trading account with Roboforex with as little as a 1 min deposit.

Read our reviews on our Fixed Spreads Accounts listed above. You can read our indepth Fixed Spreads Accounts reviews below.

If you feel some of the above Fixed Spreads Accounts are not quiet what you are looking for or perhaps you would just like to see some alternatives.

See our highly rated list of Fixed Spreads Accounts alternatives below.

You can read some of our Fixed Spreads Accounts comparisons.

We compare side by side some of our top rated Fixed Spreads Accounts .

Read some Fixed Spreads Accounts VS pages below.

Please note that Comparebrokers.co may have financial relationships with some of the merchants mentioned here and may be compensated

if consumers choose to click the links located throughout the content on this site.

RISK WARNING: Your capital is at risk. Trade with caution,

these products might not be suitable for everyone so make sure you understand the risks involved.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 74-89% of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Some of the links on this websites articles and comparison tables are affiliate links, which means we receive a commission should open an active account.

This does not increase the cost to you for using a broker and is how the site is funded and covers the costs of running this website.

The information contained in this website is for informational purposes only and does not constitute financial advice.

The material does not contain (and should not be construed as containing) investment advice or an investment recommendation, or, an offer of or solicitation for, a transaction in any financial instrument.

Cyprus Securities and Exchange Commission (CySEC)

Financial Conduct Authority (FCA), Financial Supervision Commission (FSC)

Plus500UK Ltd authorized & regulated by the FCA (#509909), Plus500CY Ltd authorized & regulated by CySEC (#250/14), Plus500AU Pty Ltd (ACN 153301681), ASIC in Australia AFSL #417727, FMA in New Zealand, FSP #486026 and Authorised Financial Services Provider in South Africa FSP #47546

Cyprus Securities and Exchange Commission (CySEC), Australian Securities and Investments Commission (ASIC)

Financial Conduct Authority (FCA), Australian Securities and Investments Commission (ASIC), Monetary Authority of Singapore (MAS)

Cyprus Securities and Exchange Commission (CySEC), License No: 209/13

Cyprus Securities and Exchange Commission (CySEC), Financial Sector Conduct Authority (FSCA), Financial Conduct Authority (FCA), Australian Securities and Investments Commission (ASIC)

Financial Conduct Authority (FCA), FCA reference number 186171, Cyprus Securities and Exchange Commission (CySEC), CySEC license number 259/14, Cayman Islands Monetary Authority (CIMA), CIMA reference number 1442313, Dubai financial services authority (DFSA), DFSA license number 000048

Central Bank of Ireland, Australian Securities and Investments Commission (ASIC), Financial Services Authority (FSA), Financial Stability Board (FSB), British Virgin Islands Financial Services Commission (BVI)

Bank transfer

Credit Card

Paypal

Bank transfer

Credit Card

Paypal

Bank transfer

Credit Card

Paypal

Bank transfer

Credit Card

Paypal

Bank transfer

Credit Card

Paypal

Bank transfer

Credit Card

Paypal

Bank transfer

Credit Card

Paypal

Bank transfer

Credit Card

Paypal

Bank transfer

Credit Card

Paypal

Bank transfer

Credit Card

Paypal

Bank transfer

Credit Card

Paypal

Allows scalping Allows hedging Offers STP Low min deposit

Allows hedging Offers STP Low min deposit Guaranteed stop loss Offers Negative Balance Protection

Low min deposit Offers Negative Balance Protection

Allows scalping Allows hedging Low min deposit Guaranteed stop loss Offers Negative Balance Protection

Allows scalping Allows hedging Low min deposit Guaranteed stop loss

Allows hedging Offers STP Low min deposit Guaranteed stop loss Offers Negative Balance Protection

Allows scalping Allows hedging Offers STP Low min deposit

Allows scalping Allows hedging Low min deposit Guaranteed stop loss Offers Negative Balance Protection

Allows scalping Allows hedging Low min deposit

Allows scalping Allows hedging Low min deposit

Demo account Micro account Mini account Standard account Zero spread account ECN account Islamic account

Demo account Standard account Islamic account

Demo account Micro account Mini account Standard account Islamic account

Demo account Micro account Mini account Standard account Managed account

Demo account Micro account Mini account Standard account Zero spread account ECN account Islamic account

Demo account Mini account Standard account Islamic account

Demo account Micro account Mini account Standard account Islamic account

Demo account Mini account Standard account

Demo account Micro account Mini account Standard account Islamic account

MT4, MT5, Mac, Web Trader, cTrader, Tablet & Mobile apps

MT4, Web Trader, Tablet & Mobile apps

MT4, Web Trader, Tablet & Mobile apps

MT4, MT5, Web Trader, Tablet & Mobile apps

MT4, MT5, ZuluTrade, Web Trader, Tablet & Mobile apps

MT4, Mac, Mirror Trader, ZuluTrade, Web Trader, Tablet & Mobile apps

Live chat

Phone support

Email support

Live chat

Phone support

Email support

Live chat

Phone support

Email support

Live chat

Phone support

Email support

Live chat

Phone support

Email support

Live chat

Phone support

Email support

Live chat

Phone support

Email support

Live chat

Phone support

Email support

Live chat

Phone support

Email support

Live chat

Phone support

Email support

Live chat

Phone support

Email support

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

76.4% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

75% of retail investor accounts lose money when trading CFDs with this provider

84% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

79% of retail investor accounts lose money when trading CFDs with this provider

MY, BE, US, CA, CN, ID, PH, TG, NG, DO, MA, ZW, PR, TZ, TN, UG, BW, AO, AE

US, CF, TD, CG, CG, CI, CU, GN, ER, GN, FR, GW, HT, IR, IQ, KR, LB, LR, LY, MM, NZ, NG, SL, SO, SD, SY, TM, UZ, VE, EH, YE, ZW

RU, BR, CH, ZA, SG, JP, US, CA, BE, IL, TR, NZ, MY, SY, TH, ID, IR, IQ, HK, PH, PR

Cyprus Securities and Exchange Commission (CySEC)

Financial Conduct Authority (FCA), Financial Supervision Commission (FSC)

Plus500UK Ltd authorized & regulated by the FCA (#509909), Plus500CY Ltd authorized & regulated by CySEC (#250/14), Plus500AU Pty Ltd (ACN 153301681), ASIC in Australia AFSL #417727, FMA in New Zealand, FSP #486026 and Authorised Financial Services Provider in South Africa FSP #47546

Cyprus Securities and Exchange Commission (CySEC), Australian Securities and Investments Commission (ASIC)

Financial Conduct Authority (FCA), Australian Securities and Investments Commission (ASIC), Monetary Authority of Singapore (MAS)

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

76.4% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

75% of retail investor accounts lose money when trading CFDs with this provider

MT4, MT5, Mac, Web Trader, cTrader, Tablet & Mobile apps

MT4, Web Trader, Tablet & Mobile apps

MT4, Web Trader, Tablet & Mobile apps

MY, BE, US, CA, CN, ID, PH, TG, NG, DO, MA, ZW, PR, TZ, TN, UG, BW, AO, AE

US, CF, TD, CG, CG, CI, CU, GN, ER, GN, FR, GW, HT, IR, IQ, KR, LB, LR, LY, MM, NZ, NG, SL, SO, SD, SY, TM, UZ, VE, EH, YE, ZW

Cryptocurrencies (availability subject to regulation)

Live chat

Phone support

Email support

Live chat

Phone support

Email support

Live chat

Phone support

Email support

Live chat

Phone support

Email support

Live chat

Phone support

Email support

Live chat

Phone support

Email support

English, Chinese Simplified, Chinese Traditional, Indonesian, Malaysian, Portuguese, Spanish, Italian, Polish, Arabic, Thai, Russian, and Ukrainian

English, Deutsch, Nederlands, Espanol, Francais, Italiano, Polski, Srpski, Norsk, Svenska, Cesky, РУССКИЙ, Romana, Turkce, العربية, 中文

English, French, Italian, Spanish, Portuguese, German, Dutch, Polish, Arabic, Hebrew, Danish, Norwegian, Czech, Slovak, Bulgarian and Chinese

English, German, Arabic, Chinese, Spanish and Polish

English, Spanish, German, Arabic, Polish, and Chinese

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

76.4% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

75% of retail investor accounts lose money when trading CFDs with this provider

Private Exporting

Old Mature Xxx

Sex Teen Massage Porno

50 Old Milf Public Agent Sex

Pee Desperation Porn