Five Things You Need to Know to Start Your Day

Good morning. German elections, U.K. fuel shortage, China’s power crunch and new Bitcoin accounts halted. Here’s what’s moving markets.

German Elections

Olaf Scholz of the Social Democrats inched ahead of Chancellor Angela Merkel’s conservatives in an unprecedentedly tight German election which is still to decide who will lead Europe’s biggest economy. The SPD leader said it’s clear that voters want him as chancellor, but he still faces months of negotiation and uncertainty before he can make that a reality. The Christian Democrats’ Armin Laschet insisted that he too will try to form a coalition though his party has suffered its worst result ever, plunging below 30%.

Out of Fuel

Prime Minister Boris Johnson is under increasing pressure to do more to ease a supply chain crisis in Britain. BP said it ran out of the main grades at almost a third of its stations following intense demand and a shortage of truck drivers. The U.K. government said it will issue 5,000 short-term visas to lorry drivers and 5,500 to poultry workers in a significant U-turn on one of the key red lines of Brexit. The government will also temporarily drop competition rules and allow haulers, producers, suppliers and retailers to work together.

Power Crunch

China may be diving head first into a power supply shock that could hit Asia’s largest economy hard just as the Evergrande crisis sends shockwaves through its financial system. Economists are warning of lower economic growth in China as electricity shortages worsen, forcing businesses to cut back on production. The crisis is also beginning to hit people where they live, adding the risk of social instability on top of potential global supply chain disruptions.

Registration Halted

Two of the world’s largest Bitcoin exchanges have halted new registrations for Chinese users and one will retire current accounts, taking actions to comply with Beijing’s latest crypto ban. Exchange operators Huobi and Binance have stopped letting traders use mainland China mobile numbers to register new accounts, after the People’s Bank of China said Friday all crypto-related transactions will be considered illicit financial activity.

Coming Up…

European stocks are headed higher, though gains in Asia fizzled and Treasury yields stayed elevated. While the dust settles on the German election, European Central Bank President Christine Lagarde is set to speak at a European Parliament hearing. Italy’s Danieli is scheduled to report results, while United Utilities will give a sales update. In the U.S., traders will be making use of several chances to hear more thoughts from a raft of Federal Reserve officials, including Governor Lael Brainard, Chicago Fed President Charles Evans and New York Fed President John Williams.

And finally, here's what Cormac is interested in this morning

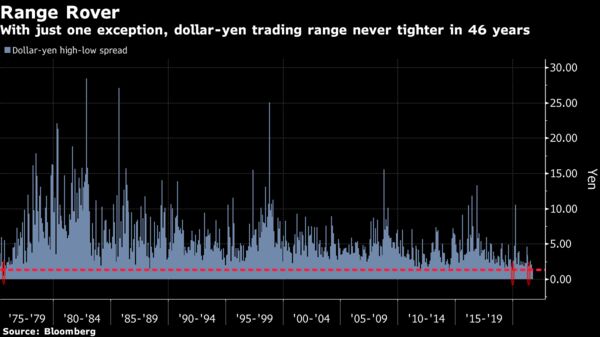

Spare a thought for Japan's bored yen traders, struggling to eke out a few pips of a move in a currency that is as quiet as the fanzone was in Tokyo's Olympic Stadium. With just one exception, the trading range this month in the dollar-yen has never been tighter in 46 years, according to data compiled by Bloomberg through lunchtime Wednesday. Even the prospect of a new administration, the threat of a China Evergrande Group restructuring and prospect of Federal Reserve tapering have done little to wake the currency out of its September slumber. Market activity has been falling. Japan’s foreign-exchange margin trading volumes fell to some $3.8 trillion in August, the lowest since before the pandemic, according to data from the Financial Futures Association of Japan. There seems to be little indication yen watchers expect the quiet to end. The average year-end forecast for the dollar-yen is 110, less than half a percent from where the currency traded Friday, according to analysts surveyed by Bloomberg.

Cormac Mullen is a cross-asset reporter and editor for Bloomberg News in Tokyo.