Fintech: freshest payment trends

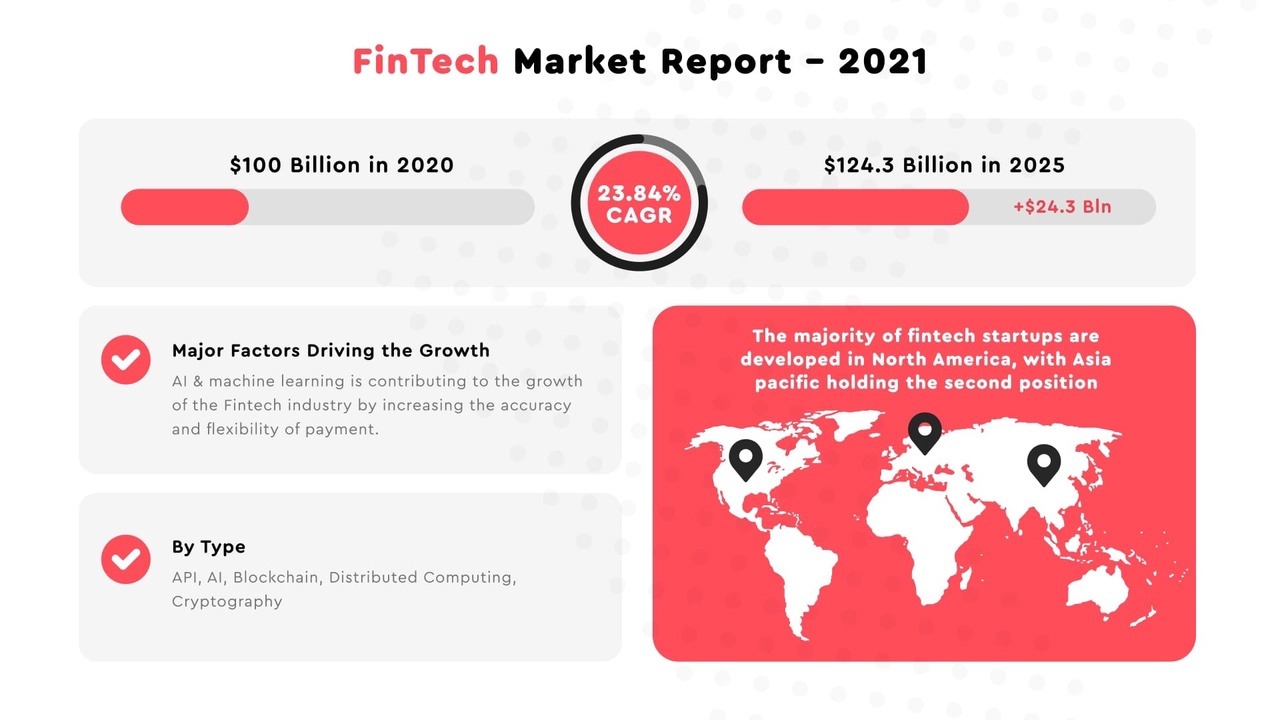

Vlada SparkThe Fintech industry makes us radically rethink the way we send and receive payments. The financial systems are getting more complex and powerful in order to provide better security and perform more complicated tasks. The term Fintech encompasses a rapidly growing industry bringing many benefits to both consumers and companies. From Big Data and open banking to insurance and cryptocurrency apps, fintech enables us to make payments more convenient than ever.

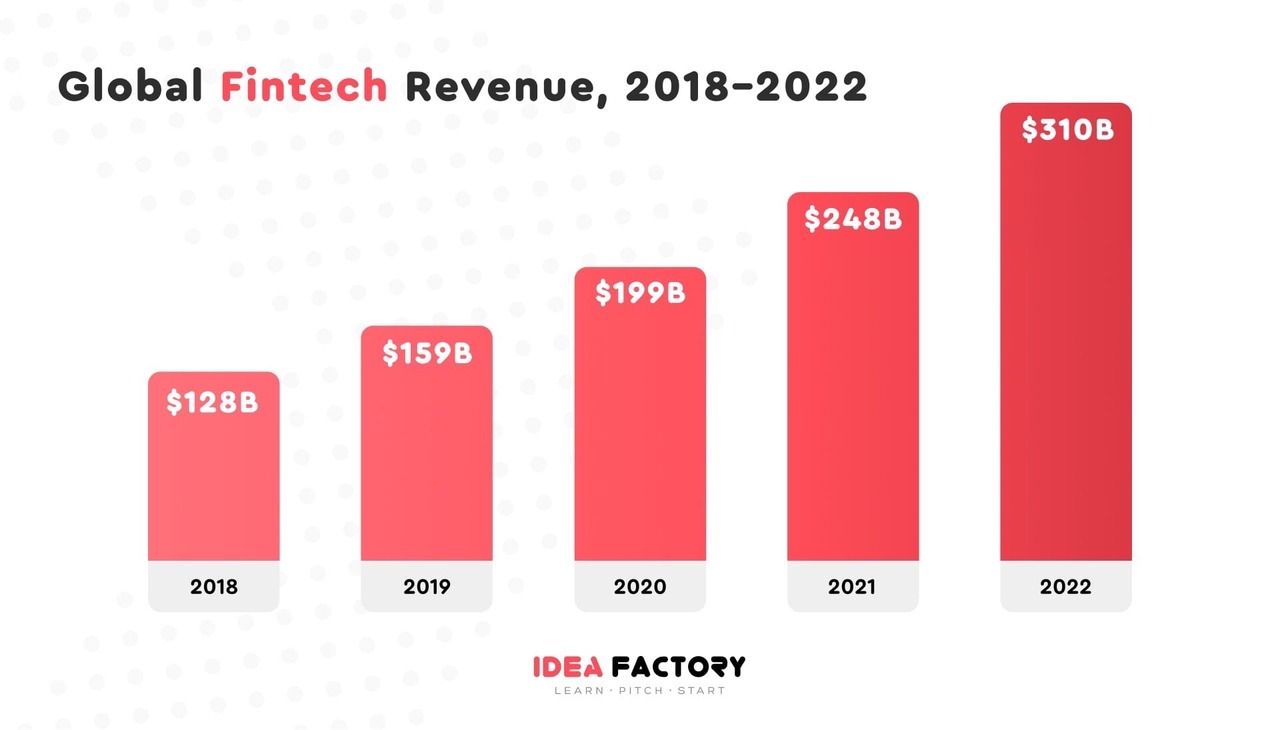

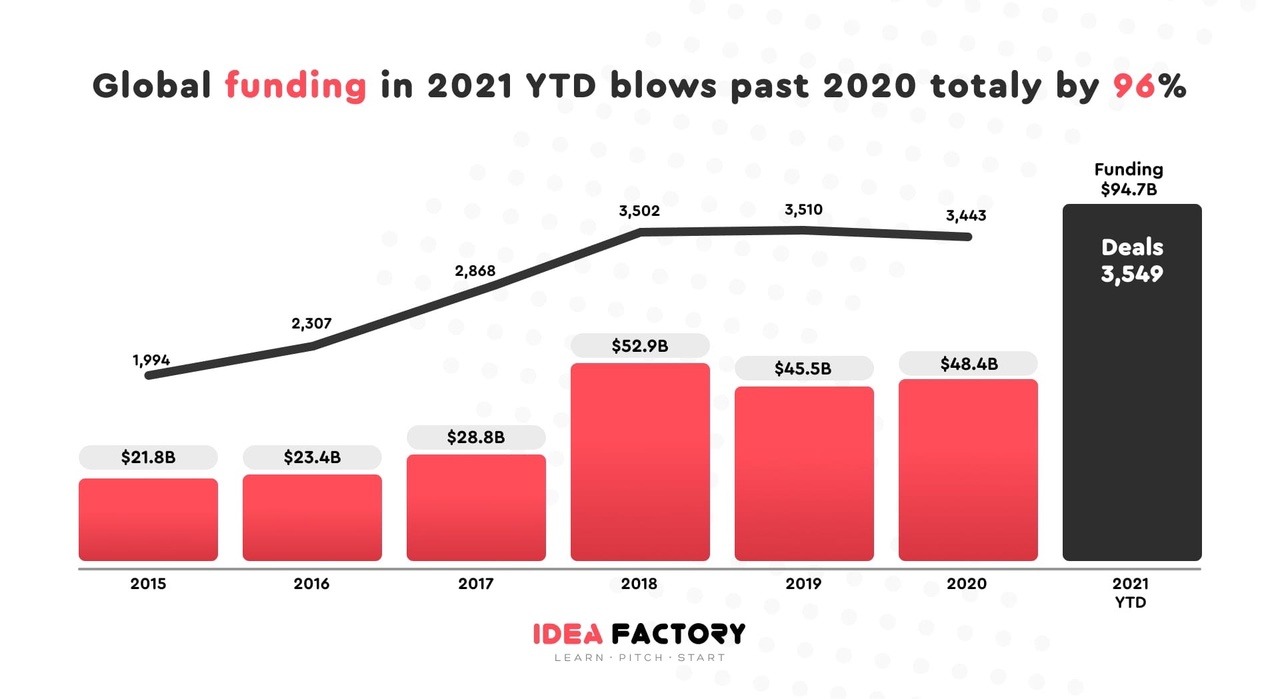

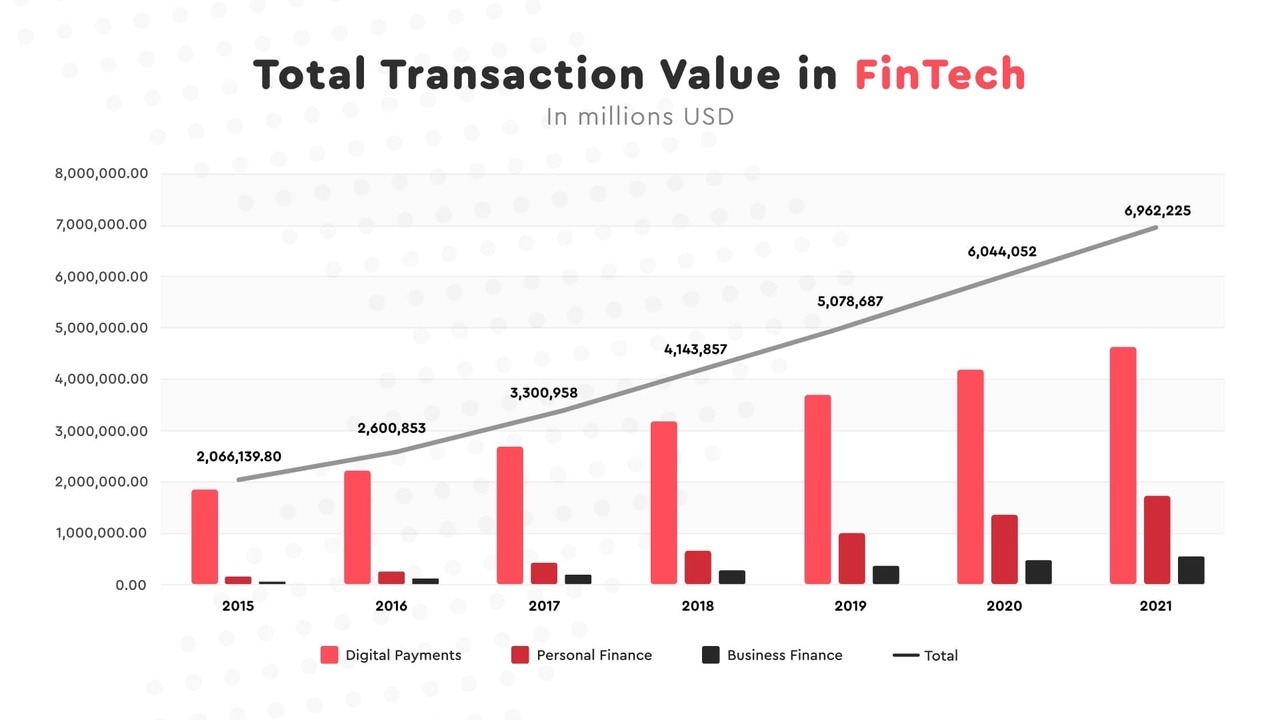

According to the Ernst&Young statistics, in 2020 around 65% of respondents had used fintech services at least once. The research of KPMG reveals that global investments in the Fintech industry reached nearly $1 trillion in the first half of 2021, which is 8 times more than a year ago. Those involve M&A, direct, and venture investments. The number of deals and their average budget tend to grow accordingly.

Particularly, there was an evident surge of interest of venture investors in the market — $52 billion investments in the span of 6 months. Whereas, in 2020, the fintech industry received $22 billion in total. Undoubtedly, such favorable conditions contributed to the emergence of new unicorns. Only in the first half of the year, 163 companies became billionaires.

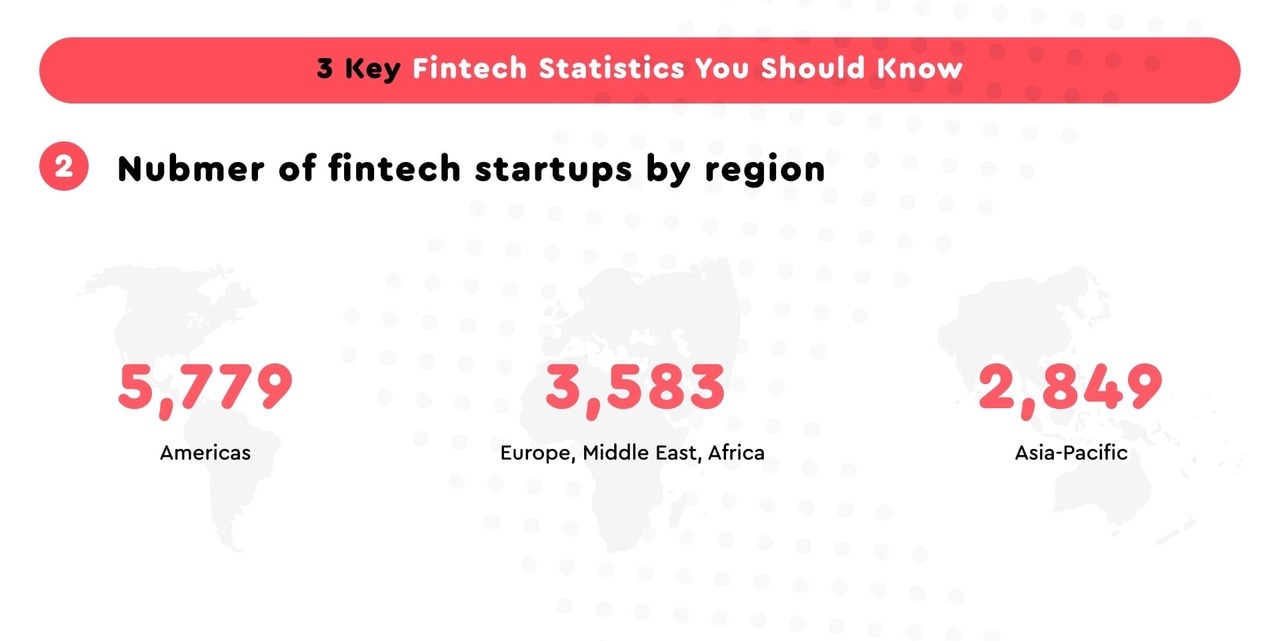

The U.S remains the leader of the market. $42 billion was invested in the American market, $25 billion of which refer to venture capital.

Europe, Asia, and Africa have been actively investing in fintech as well. In 2020, they invested $26 billion, whereas, in the first half of 2021, the sum reached $40 billion. The European leader is the UK.

In the Asia-Pacific region, the investment leaders are India ($2 billion), China ($1,3 billion), and Australia ($1 billion). Reportedly, the main focus has been on online payments, banking models, income-based solutions for funding.

Trends & companies

In the nearest future, the fintech industry is expected to penetrate the global economy — from retail to banking services. The experts of Digital Horizon highlight the following tendencies:

Embedded Finance

In 2018, Oracle research showed that 70% of users preferred to receive financial services without leaving home. There was no need any longer to visit a bank or set up additional apps from a marketplace.

The tools fintech companies integrate payment, credit, insurance to investment services into the merchant’s website right away. It doesn’t require the fulfillment of boring forms or endless interviews with bank employees.

Bsurance

Country: Austria

Total of investments: €4,5 million

The company digitalizes, individualizes, and creates innovative insurance products. They are simply embedded into existing sales processes, products, or services like apps, webshops, or cashier systems. This way, end customers are easily provided with access to fair and relevant insurance products. By means of REST APIs, B2C partners are connected to a cloud-based insurance management platform issuing policies in real-time.

Stripe

Country: the US

Total of investments: $2,2 billion

This is a global technology company developing economic infrastructure online. Stripe’s software enables businesses to accept online payments and run complex global operations. Besides an economic infrastructure, the company offers a set of applications for new business models like crowdfunding and marketplaces, fraud prevention, analytics, and more. Some of Stripe’s collaborators are such virtual giants as Apple, Google, Alipay, Tencent, Facebook, and Twitter.

Big Data & Open Banking

Of course, consumers expect financial service suppliers to detect and block suspicious transactions on their accounts. However, what is even more important is to assess financial flows of a customer and automatically offer them a reliable credit product. In order to perform this, you need to master and develop new AI and Big Data algorithms.

Referring to McKinsey, in 2017, 80% of the largest American banks used Big Data elements for searching and attracting new customers, providing proper communication, and raising their loyalty. The Gartner research reveals that a third of world banks are investing in this fintech segment.

Open Banking mechanisms are also a crucial part of Big Data. They allow startups to seamlessly receive different information from state registers and databases of major market players. Such an approach enables small businesses to implement their ideas more easily and swiftly. Thus, they are given a competitive advantage that allows them to rival traditional financial institutions.

One of the ways of implementing Big Data or Open Banking is a software tracking customer’s income and expenses and providing recommendations on how to optimize them. As a result, the customer will receive their salary in one bank and store in another. Wherein, they can pay by a card of a third bank offering the highest cash-back.

The banks using such technologies will be able to develop unique services for each client in accordance with their needs and financial capabilities.

Brainergy.Ai

Country: Canada

Total of investments: undisclosed

The company creates turnkey big data solutions for retail banking. In order to generate and process financial metadata, the startup integrates artificial intelligence and machine learning algorithms. This helps Brainergy.Ai provide respective recommendations according to the data. Such an approach allows improving numerous sectors like risk, fraud, audit, marketing, sales, service, finance, and operations.

FinAi

Country: Poland

Total of investments: $3,4 million

The company offers an eponymous big data FinTech space for improving client and user experience. The startup gives great solutions in order to facilitate the selling of high-margin loans for banks. In order to achieve this, FinAi implements a secure, cost-efficient, and digital channel. The technology considers a number of factors like behavioral economics aiming to make rational financial choices faster than ever.

Payment systems

This means creating and mastering clear, fast, and safe digital services that work within an effective infrastructure.

The growth of online payment numbers is making virtual businesses reduce the cost of transactions. Therefore, the alternatives to traditional payment systems are bound to actively develop in the nearest future. They include QR-codes, cryptocurrencies, e-wallets, and mobile payments.

These are the key issues the fintech market is going to tackle:

- margin decrease of the payment business;

- reduction in cost of payment services due to lower commissions and other expenses;

- providing simplicity, a good quality, transparency, and manufacturability of services;

- easy switching from one service supplier to another;

- creating principally new payment services.

Primer

Country: the UK

Total of investments: $73 million

This is a startup offering an automatic platform for payments and enabling companies to build payment flows through a unified checkout and workflows. With the help of Primer’s technology merchants can easily get access to PSPs, fraud providers, BI tools, account software, and other platforms. Its payments infrastructure helps companies to consolidate their ecosystems of partners across the entire payments services stack and enhance their payments strategy.

M10

Country: the USA

Total of investments: undisclosed

The company develops a modernized payment system for banks. It is working on crucial things like real-time and cross-border payments, liquidity management, connecting Real-Time Payment (RTP) systems, serves as a Central Bank Digital Currency (CBDC), etc. At the same time, M10 allows banks to regulatory and monetary policy risks. The system is capable of processing over $1 million payments per second and is immune to both hardware and software failures and cyberattacks.