Final Margin Same As Spread Sports Betting

🔞 ALL INFORMATION CLICK HERE 👈🏻👈🏻👈🏻

Final Margin Same As Spread Sports Betting

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Start Spread Betting and pay no UK stamp duty or UK Capital Gains Tax*

Create Account

About Us

StoneX

Partnerships

Affiliates

Press Releases

Careers

Sitemap

Terms and policies

Incisive market analysis into the year ahead - Your Outlook 2021 is now online. Get started by reading: End of the Brexit transition period and Market implications of C19 vaccines .

Learn more about how trading on margin and leverage impacts your trading.

Spread Betting is a leveraged product which means that you can start trading using a relatively small initial deposit.

When you trade using a Spread Betting account, you trade on leverage, which allows you to gain a larger market exposure than may otherwise be possible with more traditional forms of investing. Trading on leverage can enhance your profits, but equally can increase your risk so make sure you understand how much you are risking with each position and use a risk management strategy that protects you against rapid market movement.

Margin is the amount of money or deposit you are required to have in your account in order to open a position. Because you are trading on leverage and your positions are magnified, you will need to have sufficient funds in your account in order to protect you against market movements. The amount you will be required to deposit is expressed as a percentage of your total position size. For more volatile markets, the margin level will almost always be higher.

Spread betting is a leveraged product. This means that you only need to deposit a small fraction of the overall value of any trade, known as margin.

For example, if the margin requirement for a trade is 20% then you would need 20% of the full value of the trade in your account to open the position.

If you buy 1,000 shares in ABC plc and its share price is 500p, your total investment is £5,000. The equivalent spread bet would be £10 per point on the same company.

In this example you are required to deposit £1,000 to open the equivalent of a £5,000 investment. This is how trading on margin leverages your position, freeing up additional funds to use on other products.

Trading on leverage means that you benefit from much larger market exposure from your initial capital outlay, increasing your potential profits. But, this also means that you are exposed to more risk if the trade goes against you and your losses will also be magnified.

In the example below you can see how trading on leverage has helped magnify profits compared to a similar investment using more traditional forms on share trading. Your Spread Bet in ABC plc is successful and you decide to close out your trade with a £100 profit. The return on your spread bet deposit is 10%, whereas the return on your share trade is 2%.

Remember, trading on leverages magnifies your losses as well as your profits and it is important that you understand the downsides of greater market exposure. The example below is based on the same trade as the profit example above, though in this example the market has moved against you and your losses are magnified.Your trade in ABC plc is unsuccessful and you decide to close out your trade with a £100 loss. The return on your spread bet deposit is -10%, whereas the return on your share trade is -2%.

Margin requirements refer to the amount of capital you will need in your account to cover your position. Margin requirements are expressed as a percentage of the total value of your position. Please note margin requirements vary across markets. Generally speaking, the higher the margin factor the riskier the market. Please see the relevant Market Information sheet on the trading platform for full details.

A margin call is a warning that the capital in your account has dropped below the required minimum amount needed to keep your position open. You should always ensure you have sufficient funds in your account to cover any losses for the period that you decide to maintain your trade.

If you don't, you could quickly find yourself on a margin call which puts you at risk of having your position automatically closed out.

The Margin Level Indicator on the City Index platform represents the level of cover you have associated with your open positions. It is located in the upper left corner of the trading platform. It displays one of the three scenarios listed below:

View spreads, margins and commissions for City Index products

Take control of your trading with powerful platforms and tools

View upcoming trading opportunities for the weeks ahead

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

We use cookies, and by continuing to use this site or clicking "Agree" you agree to their use. Full details are in our Cookie Policy .

Spread Betting Margin Explained | CMC Markets

Spread Betting Margin & Leverage Explained | City Index UK

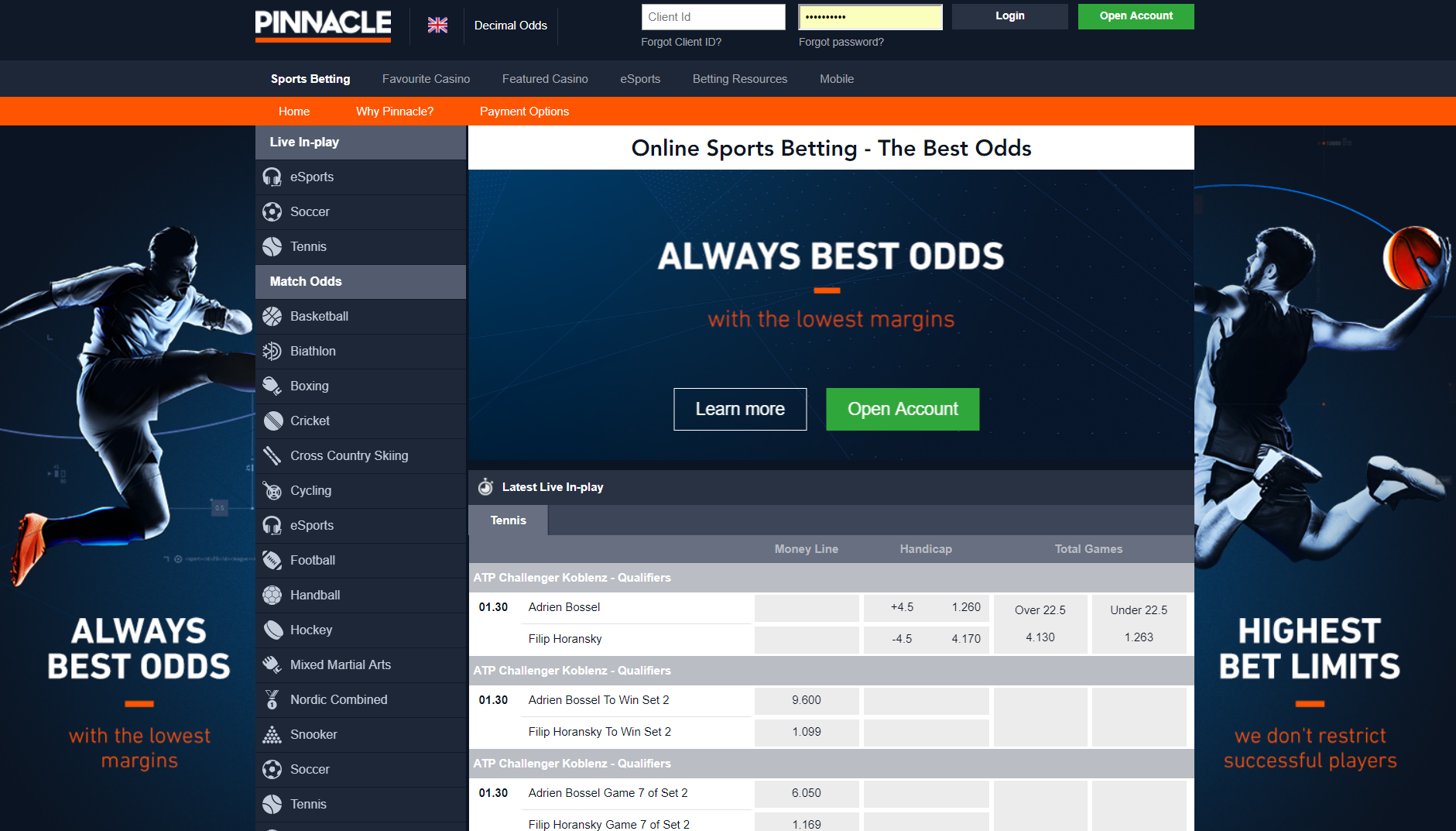

Pinnacle's margins | Betting strategy article

Spread Betting - Australia Sports Betting

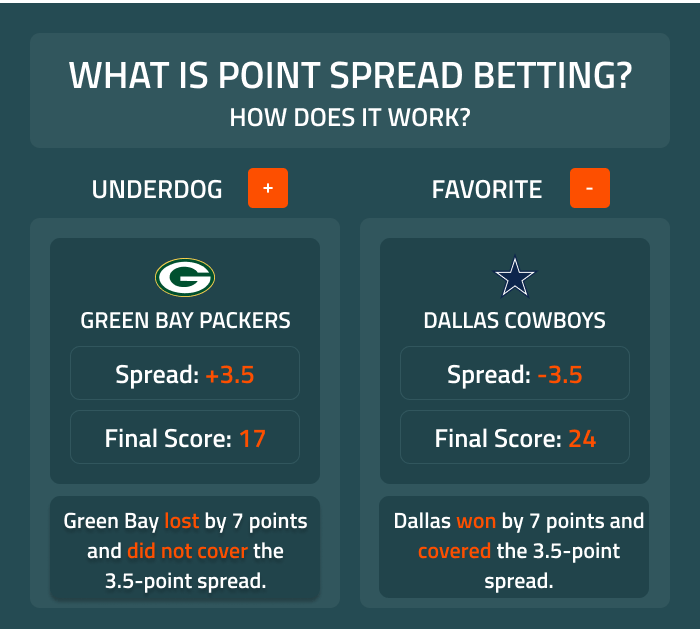

What Is Point Spread Betting ? | How To Bet The Super Bowl Spread

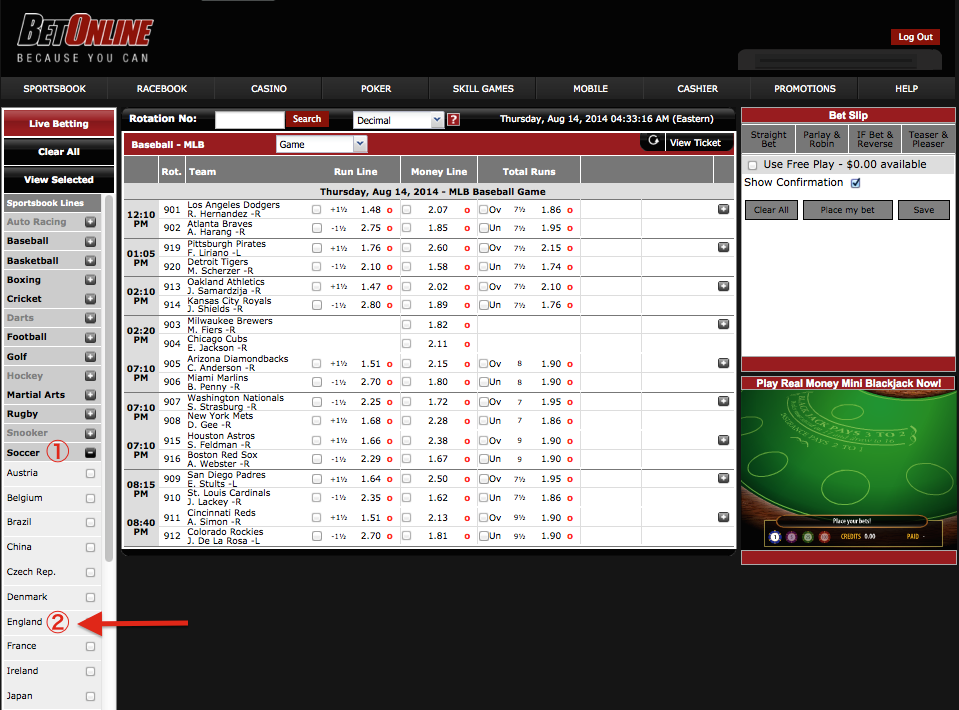

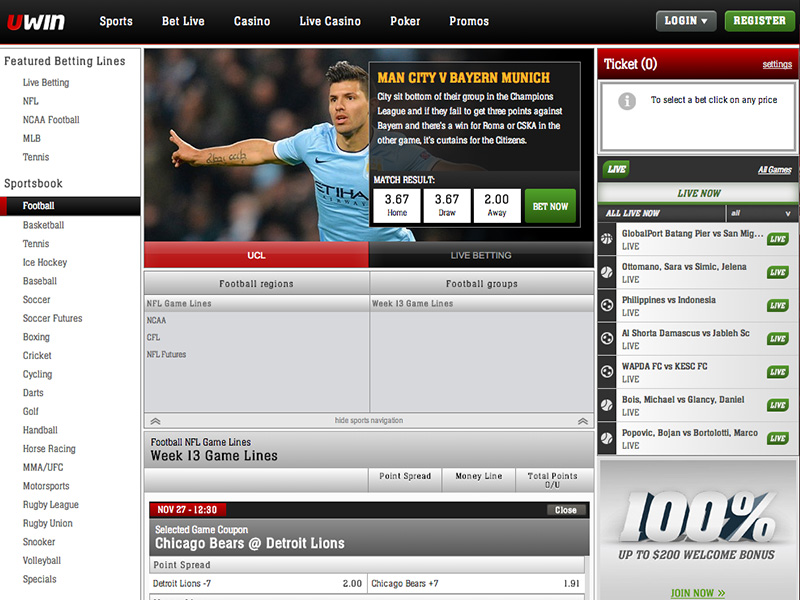

Sports Betting

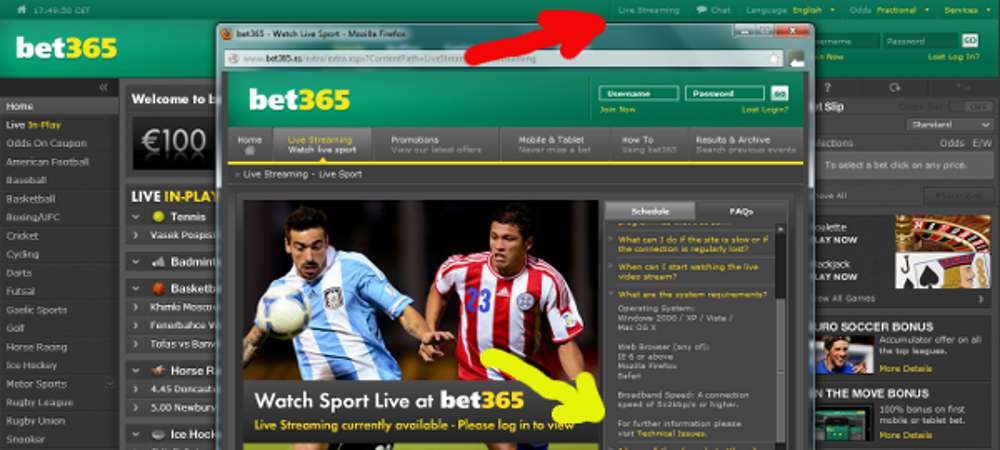

Live Centre

Casino

Live Casino

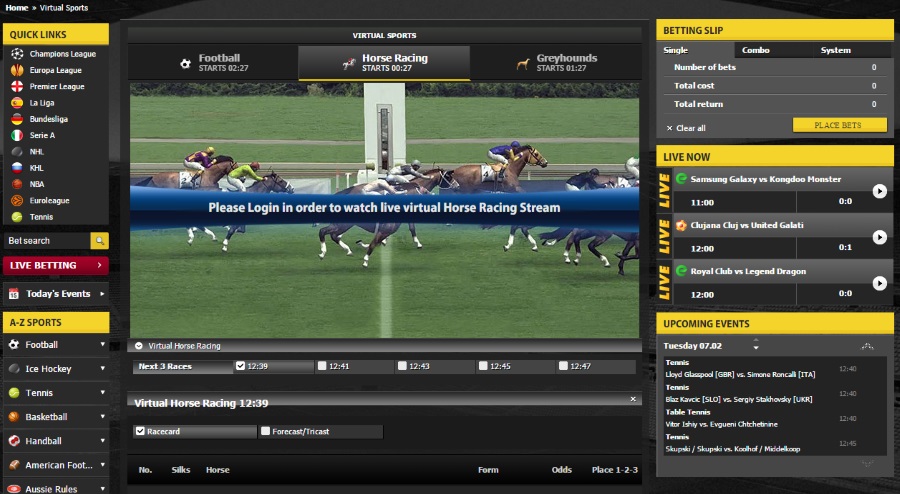

Virtual Sports

Esports

Betting Resources

Pinnacle

Betting Strategy

Learn how to calculate betting margins

Why do Pinnacle offer the best value?

The coin toss example

The market percentage

sign up here

We offer you the best odds, highest limits and a unique winners welcome policy.

Sign up here

Read more Betting Strategy articles here

We have a team of editors and writers at Pinnacle, as well as a collection of external contributors, ranging from university lecturers and renowned authors, to ex-traders and esteemed sports experts. Collectively, the Pinnacle team and external contributors produce the educational content within Betting Resources.

Sports Betting

Soccer Betting

Basketball Betting

Baseball betting

Football Betting

Tennis Betting

Hockey Betting

ESports Betting

About Pinnacle

Corporate

Press

Affiliates

B2B

About

Why Pinnacle?

Policies

Responsible Gaming

Terms & Conditions

Privacy Policy

Cookie Policy

Help & Support

Contact Us

Betting Rules

Help

System Status

Sitemap

Payment Options

If you're new to betting, you should learn how to calculate betting margins. This article explains what betting margins are, highlights why Pinnacle offer the best value and teaches you how to calculate betting margins.

In simple terms, bookmakers make a profit by accepting bets on a given market, and adjusting odds to attract bets in the right proportion to secure a profit regardless of the outcome. This is achieved by offering odds that do not fairly represent the actual statistical probability of the event concerned – true odds. The deviation of the odds offered from the ‘true odds’ is the bookmaker’s Margin.

The simplest analogy for explaining margins is betting on a coin toss. When betting with a friend, you might for example bet $10 to win $10, on Heads or Tails. Under these terms, neither of you hold any advantage, as the odds given ( 2.0 in Decimals odds/+100 in American odds ) reflect the actual probability (0.5) of the event occurring. In betting terms this is called a 100% Market or Book, which gives no advantage, or Margin to either the person placing, or accepting, the bet. Therefore, a 100% Market = zero Margin!

If, however, you were placing a bet on a coin toss with someone seeking to make a profit – i.e a bookmaker - that Market Percentage would be greater than 100%, and the amount by which the Market Percentage rises above 100% is the size of the Margin the bookmaker holds over the bettor (this is also known as edge, commission, juice or vigorish). This essentially is how all bookmakers work, but the important difference for bettors to understand is the variation in Margins that bookmakers hold, as this is what determines the value of their odds, and ultimately, the potential profit for a bettor.

Novice bettors might reasonably ask “Why should I care about the odds of all outcomes, as I am only betting on one?” The concept of betting value relates to the market as a whole, i.e. considering the odds for all outcomes. The higher the Margin, the poorer the value for a bettor , which is why Margins are the best way to truly compare odds.

You may be surprised by the huge difference in Margins across the spectrum of bookmakers within the industry. Using Premier League soccer 1X2’s as an example, you’ll find some bookies pricing their markets up to 110% i.e. a 10% Margin, compared to Pinnacle who at 2%, are the market leader, with the Industry Average at 6%. This represents a huge difference in potential value that any bettor seeking to get the best deal should be aware of.

Importantly, Pinnacle don’t selectively apply a low Margin policy to certain markets as loss leaders, we apply it to every market we post, and unlike Betting Exchanges who advertise similar Margins, don’t charge commission on winning bets, which negates the value of their odds.

The table below shows Pinnacle's Margins for our most popular sports betting markets, compared to the industry average*. This clearly demonstrates why it pays to bet at Pinnacle, giving you the best odds and the best chance to win more.

Compare Pinnacle's Margins

You can calculate margins using the following equation:

(1/Decimal Odds Option A)*100 + (1/Decimal Odds Option B)*100

For example, imagine a hyperthetical match between Roger Federer and Rafael Nadal. You could calculate the margin on the odds as follows:

Rafael Nadal 1.926 Roger Federer 2.020

(1/1.926)*100 + (1/2.02*100) = 51.92 + 49.51 = 101.43% = 1.43% margin

For anything greater than a two-way market simply sum the additional options in the same way.

Pinnacle’s Betting Resources is one of the most comprehensive collections of expert betting advice anywhere online. Catering to all experience levels our aim is simply to empower bettors to become more knowledgeable.

Gambling can be addictive. Please know your limits and gamble responsibly.

Impyrial Holdings Ltd, 8A Pitmans Alley Main Street, Gibraltar GX11 1AA, acting for processing purposes on behalf of Ragnarok Corporation N.V.

Pinnacle.com operates with the licence of Ragnarok Corporation N.V., Pletterijweg 43, Willemstad, Curaçao, which is licensed by the government of Curacao under the Licence 8048/JAZ2013-013 issued for the provision of sports betting and casino.

Pinnacle is a registered trade mark.

Online sports betting from Pinnacle bookmakers – your premier international sportsbook © 2004–2021 Pinnacle

Nasty Furry Porn

Outdoor Heater

Nudist Pageant Torrent

Girls Lickes Male Feet Xhamster Favourite List

Overwatch Out