Fiat Money vs. Cryptocurrency: What’s the Difference?

Money is the foundation of the modern economy. It has evolved from barter systems to digital assets. Today, the world primarily operates on two types of money: fiat and cryptocurrency. Both serve as a medium of exchange, store of value, and unit of account, but their differences are significant. Let’s dive into the key distinctions and what the future holds.

What Is Fiat Money?

Fiat money is government-issued currency that has no intrinsic value but is accepted as legal tender based on trust in the financial system. Examples include the US Dollar (USD), Euro (EUR), and Russian Ruble (RUB).

Key characteristics of fiat money:

✅ Government-controlled issuance. Central banks regulate the money supply.

✅ State-backed legitimacy. Governments enforce its use for taxes and payments.

✅ Not backed by assets. Unlike the gold standard, modern fiat money is not tied to physical commodities.

✅ Subject to inflation. Central banks can print more money, reducing its value over time.

Fiat money is convenient, widely accepted, and stable in the short term. However, it is vulnerable to inflation, economic crises, and government manipulation.

What Is Cryptocurrency?

Cryptocurrency is a digital asset that uses blockchain and cryptography to secure transactions. It is decentralized, free from government control, and offers financial freedom.

Popular cryptocurrencies:

🔹 Bitcoin (BTC) – the first and most famous cryptocurrency.

🔹 Ethereum (ETH) – a platform for smart contracts and decentralized apps.

🔹 Stablecoins (USDT, USDC) – pegged to fiat money to reduce volatility.

🔹 A DEXNET token is a digital asset that operates in the DexNet ecosystem.

Key features:

✅ Decentralization. No central authority controls crypto.

✅ Limited supply. Many cryptos (like Bitcoin) have fixed issuance, protecting against inflation.

✅ Transparency and anonymity. All transactions are recorded on a blockchain.

✅ Global access. No borders or intermediaries.

However, cryptocurrencies can be volatile and face regulatory uncertainty.

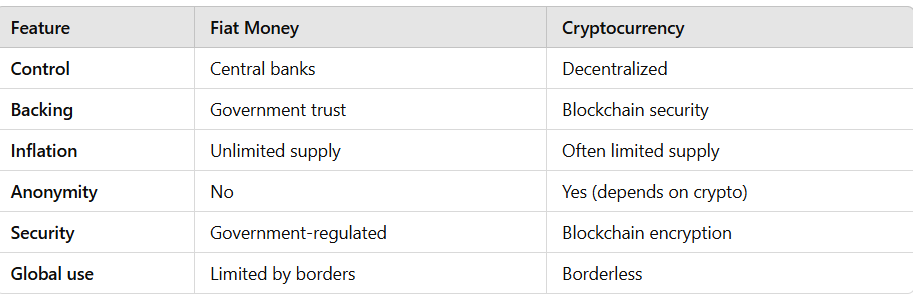

Fiat vs. Crypto: Key Differences

The Future of Money

Many governments are developing CBDCs (Central Bank Digital Currencies), combining fiat stability with blockchain efficiency. Meanwhile, cryptocurrencies continue to grow, becoming more mainstream as investment and payment tools.

Conclusion

Fiat and cryptocurrency represent two distinct financial models. Fiat is stable but inflationary and centralized, while crypto is independent but volatile. The future may blend both worlds, or one may dominate.