Facts About Unlocking the Secrets of Secure and Efficient Financial Transactions with ACH Payments Uncovered

Decoding ACH Payments: An In-Depth Look at its Meaning and Functionality

ACH remittances have ended up being an indispensable component of the modern financial system, allowing people and businesses to easily move funds electronically. Nonetheless, View Details are still unfamiliar of what ACH settlements are and how they work. In this article, we will definitely dig in to the meaning and performance of ACH settlements, dropping illumination on this largely utilized strategy of moving cash.

What is ACH?

ACH stand up for Automated Clearing House. It is a system that makes it possible for electronic funds transfers (EFTs) between financial institutions in the United States. The ACH network serves as a main clearinghouse for processing transactions such as direct deposits, costs payments, business-to-business payments, and various other types of digital moves.

How do ACH Remittances Work?

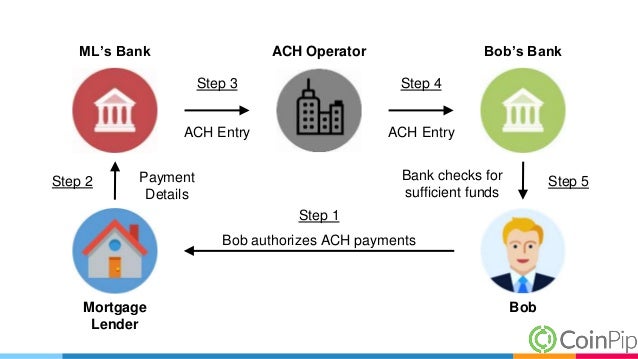

ACH settlements entail the activity of funds from one financial institution account to another via the ACH network. The process starts when a sender starts a deal by offering their financial institution with the required details, featuring the recipient's bank account particulars. This info is after that sent to the email sender's financial institution.

The email sender's banking company submits the deal to the ACH system during frequent processing windows throughout each company day. The system acts as an intermediary between banks and helps with safe and secure interaction and settlement deal procedures.

Once acquired by the receiver's banking company via the ACH network, funds are deposited in to the marked recipient's profile. This entire method commonly takes one to two company days for conclusion.

Benefits of Using ACH Repayments

1. Benefit: One considerable perk of making use of ACH settlements is comfort. People may send out or obtain money electronically without having to write checks or visit physical banking sites.

2. Cost-Effective: Contrasted to other repayment strategies like cable transactions or newspaper inspections, utilizing ACH can easily be much more cost-effective for both people and companies.

3. Safety: With security process in place throughout the whole entire process, sending out funds through ACH delivers a high degree of surveillance, lessening the threat of fraudulence or fraud.

4. Automation: ACH repayments can easily be established up for recurring deals, such as regular costs payments or payroll deposits. This computerization spares time and attempt for each events included.

ACH Payments in Different Situations

1. Direct Deposit: A lot of workers acquire their compensations through direct deposit, where employers utilize ACH to move funds straight right into their workers' financial institution accounts. This eliminates the necessity for newspaper inspections and simplifies pay-roll processes.

2. Online Bill Repayments: ACH payments are commonly made use of for online expense settlements. People can easily accredit recurring repayments to automatically clear up their bills each month without possessing to worry regarding overdue fees or overlooked as a result of dates.

3. Business-to-Business Settlements: ACH is commonly utilized by services for making vendor settlements, supplier invoices, and other business-to-business purchases effectively.

4. E-commerce Transactions: Internet merchants frequently offer the option to pay for through ACH in the course of take a look at methods, providing customers along with an different remittance approach various other than credit scores cards or electronic budgets.

Understanding ACH Payment Processing Times

While ACH settlements are commonly faster than typical paper-based procedures like inspections, it's essential to recognize the processing opportunities affiliated with such transfers.

Same-Day ACH: In 2016, same-day ACH was presented to expedite specific types of transactions. Same-day handling allows faster settlement deal of qualified debts and debits within the exact same organization time.

Next-Day ACH: For typical deals triggered just before details cut-off opportunities (generally very early afternoon), funds are commonly available in the receiver's account on the following business time.

Elements Impacting Processing Times: Numerous factors can easily have an effect on how long an ACH remittance takes to process:

- Weekends and holidays may postpone processing times as financial institutions do not run on these days.

- Cut-off opportunities vary from bank to banking company; launching a transfer after a particular time may lead in delayed processing till the upcoming organization day.

- Transaction quantity: Higher transaction amounts in the course of height times may slow down the handling of ACH payments.

Final thought

ACH payments are an effective and safe approach of transmitting funds electronically. Understanding the meaning and performance of ACH remittances is important for both individuals and organizations, as it allows them to leverage this modern technology for a variety of financial transactions. Whether it's obtaining incomes, paying bills, or helping make business-to-business payments, ACH offers a practical and cost-effective service in today's electronic world.