Facebook Roe

🛑 👉🏻👉🏻👉🏻 INFORMATION AVAILABLE CLICK HERE👈🏻👈🏻👈🏻

High Quality Low Capex w ROE ROC min

This feature is only available for Premium Members, please sign up for GuruFocus Premium Membership

7-Day Free Trial Now

FB has been successfully added to your Stock Email Alerts list.

You can manage your stock email alerts here.

FB has been removed from your Stock Email Alerts list.

Please enter Portfolio Name for new portfolio.

View and export this data going back to 2012. Start your Free Trial

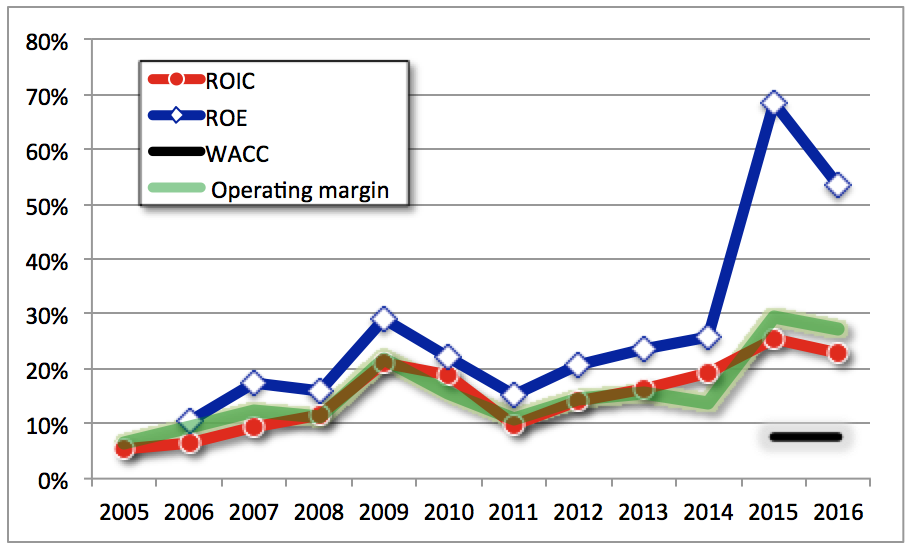

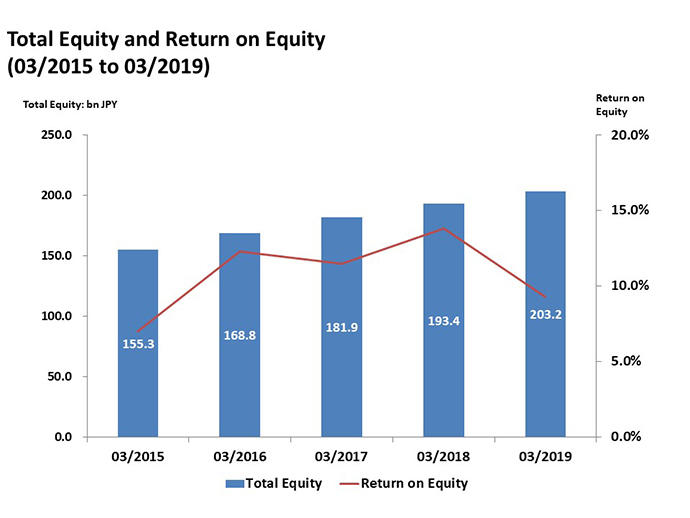

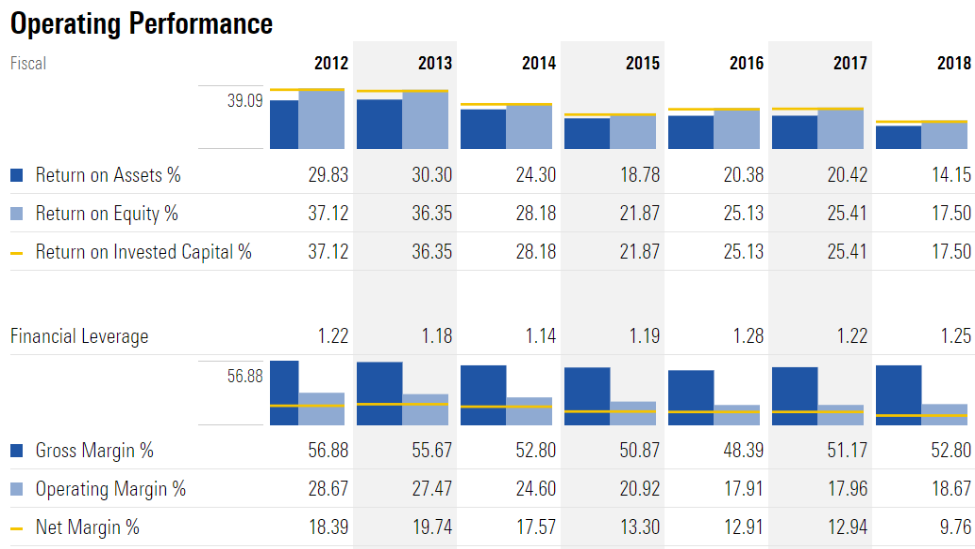

ROE % is calculated as Net Income attributable to Common Stockholders (Net Income minus dividends to participating security holders) divided by its average Total Stockholders Equity over a certain period of time. Facebook's annualized net income attributable to common stockholders for the quarter that ended in Dec. 2020 was $44,876 Mil. Facebook's average Total Stockholders Equity over the quarter that ended in Dec. 2020 was $123,011 Mil. Therefore, Facebook's annualized ROE % for the quarter that ended in Dec. 2020 was 36.48%.

During the past 11 years, Facebook's highest ROE % was 27.90%. The lowest was 0.38%. And the median was 19.31%.

* All numbers are in millions except for per share data and ratio. All numbers are in their local exchange's currency.

* The bar in red indicates where Facebook's ROE % falls into.

ROE %

Company Count

ROE % Industry Distribution

-2954.66

-40.2

-36.4

-32.6

-28.8

-25

-21.2

-17.4

-13.6

-9.8

-6

-2.2

1.6

5.4

9.2

13

16.8

20.6

24.4

28.2

32

35.8

243.85

0

10

20

30

40

GuruFocus.com

ROE %

Company Count

ROE % Sector Distribution

-4376.67

-26.3

-23.6

-20.9

-18.2

-15.5

-12.8

-10.1

-7.4

-4.7

-2

0.7

3.4

6.1

8.8

11.5

14.2

16.9

19.6

22.3

25

27.7

380.64

0

50

100

150

GuruFocus.com

Facebook's annualized ROE % for the fiscal year that ended in Dec. 2020 is calculated as

Net Income attributable to Common Stockholders (A: Dec. 2020 )

Facebook's annualized ROE % for the quarter that ended in Dec. 2020 is calculated as

Net Income attributable to Common Stockholders (Q: Dec. 2020 )

* All numbers are in millions except for per share data and ratio. All numbers are in their local exchange's currency.

In the calculation of annual ROE %, the net income attributable to common stockholders of the last fiscal year and the average total shareholder equity over the fiscal year are used. In calculating the quarterly data, the net income attributable to common stockholders data used here is four times the quarterly (Dec. 2020) net income attributable to common stockholders data. ROE % is displayed in the 30-year financial page.

Facebook (NAS:FB) ROE % Explanation

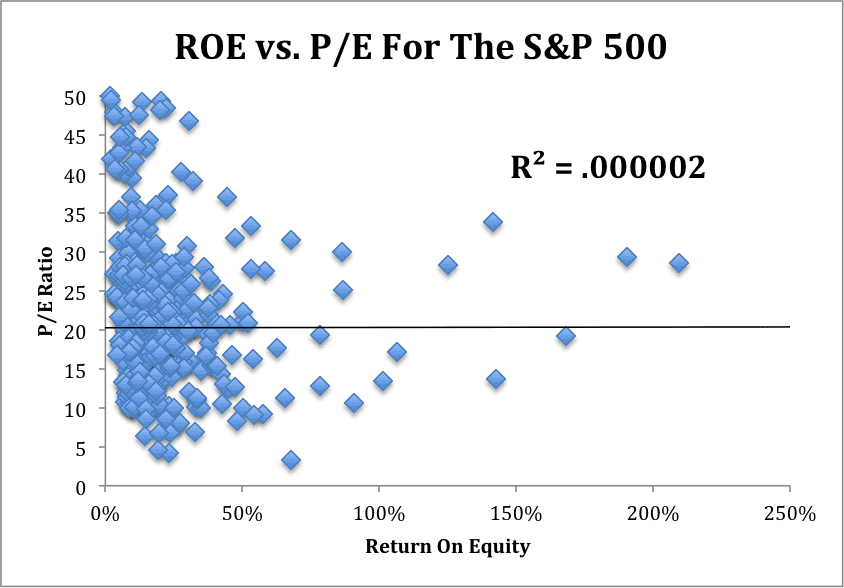

ROE % measures the rate of return on the ownership interest (shareholder's equity) of the common stock owners. It measures a firm's efficiency at generating profits from every unit of shareholders' equity (also known as net assets or assets minus liabilities). ROE % shows how well a company uses investment funds to generate earnings growth. ROE %s between 15% and 20% are considered desirable.

The factors that affect a company's ROE % can be illustrated with the three-step DuPont Analysis:

With this breakdown, it is clear that if a company grows its Net Profit Margin, its Asset Turnover, or its Leverage, it can grow its ROE %.

The factors that affect a company's ROE % can also be illustrated with the five-step DuPont Analysis:

Note: The net income attributable to common stockholders data used here is four times the quarterly (Dec. 2020) net income attributable to common stockholders data. The Revenue data used here is four times the quarterly (Dec. 2020) revenue data. The same rule applies to Pre-Tax Income and Operating Income.

* All numbers are in millions except for per share data and ratio. All numbers are in their local exchange's currency.

** The ROE % used above is for Du Pont Analysis only. It is different from the defined ROE % page on our website, as here it uses Net Income instead of Net Income attributable to Common Stockholders in the calculation.

Net income attributable to common stockholders is used.

Because a company can increase its ROE % by having more financial leverage, it is important to watch the equity multiplier when investing in high ROE % companies. Like ROA %, ROE % is calculated with only 12 months data. Fluctuations in company's earnings or business cycles can affect the ratio drastically. It is important to look at the ratio from a long term perspective.

Asset light businesses require very few assets to generate very high earnings. Their ROE %s can be extremely high.

Get WordPress Plugins for easy affiliate links on Stock Tickers and Guru Names | Earn affiliate commissions by embedding GuruFocus Charts

GuruFocus Affiliate Program: Earn up to $400 per referral. ( Learn More)

Disclaimers: GuruFocus.com is not operated by a broker, a dealer, or a registered investment adviser. Under no circumstances does any information posted on GuruFocus.com represent a recommendation to buy or sell a security. The information on this site, and in its related newsletters, is not intended to be, nor does it constitute, investment advice or recommendations. The gurus may buy and sell securities before and after any particular article and report and information herein is published, with respect to the securities discussed in any article and report posted herein. In no event shall GuruFocus.com be liable to any member, guest or third party for any damages of any kind arising out of the use of any content or other material published or available on GuruFocus.com, or relating to the use of, or inability to use, GuruFocus.com or any content, including, without limitation, any investment losses, lost profits, lost opportunity, special, incidental, indirect, consequential or punitive damages. Past performance is a poor indicator of future performance. The information on this site, and in its related newsletters, is not intended to be, nor does it constitute, investment advice or recommendations. The information on this site is in no way guaranteed for completeness, accuracy or in any other way. The gurus listed in this website are not affiliated with GuruFocus.com, LLC. Stock quotes provided by InterActive Data. Fundamental company data provided by Morningstar, updated daily.

Ошибка воспроизведения видео. Пожалуйста, обновите ваш браузер.

Facebook Facebook — одна из крупнейших социальных сетей в мире. Основана в 2004 году, штаб-квартира расположена в Калифорнии. Входит в пятерку наиболее посещаемых сайтов в мире. Ведущему акционеру, компании Facebook, также принадлежит сервис Instagram и мессенджер Whatsаpp

2010

2011

2012

2013

2014

2015

2016

2017

2018

2019

2020

2021

100 млрд

EBITDA за 2020 год по итогам за 4 квартала

Выручка за 2020 год по итогам за 4 квартала

Капитализация за 2020 год по итогам за 4 квартала

Чистая прибыль за 2020 год по итогам за 4 квартала

18 ноя 2020, 16:15 Инвестидея: +20% на акциях Facebook благодаря росту рекламных доходов Facebook FB Купить $330 (+21,32%) Прогноз 29 окт 2021 К дате JP Morgan Аналитик 57% Надежность прогнозов Восстановление рынка онлайн-рекламы повысит выручку Facebook. Увеличить рекламные доходы компании также поможет платформа онлайн-продаж Facebook Shops. Акции могут прибавить более 20% за год, считают в JPMorgan

Если вы впервые открываете брокерский счет в ВТБ

© АО «РОСБИЗНЕСКОНСАЛТИНГ», 1995–2021. Сообщения и материалы информационного агентства «РБК» (зарегистрировано Федеральной службой по надзору в сфере связи, информационных технологий и массовых коммуникаций (Роскомнадзор) 09.12.2015 за номером ИА №ФС77-63848) сопровождаются пометкой «РБК». Отдельные публикации могут содержать информацию, не предназначенную для пользователей до 18 лет. quote@rbc.ru

Котировки мировых финансовых инструментов предоставлены Reuters

Чтобы отправить редакции сообщение, выделите часть текста в статье и нажмите Ctrl+Enter

ROE - Home | Facebook

FB ROE % | Facebook - GuruFocus.com

Facebook - стоимость акций, дивиденды, новости компании, официальный...

Акции Facebook — График и котировки Фейсбук (FB) — TradingView

Акции Facebook - Цена сейчас (+пример покупки), Дивиденды | Equity

Asian Bondage Deepthroat

Fat Asian Fuck

Stream Sex Tubes

Facebook Roe

-Step-10.jpg)