FINWHALEX - Peer-to-Peer Lending on the New Level

JigaMola

FinWhaleX is a P2P lending platform that provides access to credit in any place and at any time on the basis of blockchain technologies, machine learning and Big Data.

The rise of the blockchain has caused a boom in financial service offerings. When identifying fintech and blockchain’s intersection, it’s tough to ignore how the technology is transforming lending. People who are otherwise shut out of the lending marketplace now have more opportunities to extend their credit. Platforms to help borrowers manage their past, present, and future credit are on the rise. Blockchain has inspired the creation of many new services that could significantly change the way everyone in the finance landscape thinks about lending.

FinTech's unprecedented boom has turned China into one of the world's largest online markets for alternative financing in terms of transaction volume, with P2P lending at the forefront of the growth sector.

The world's first P2P credit platform, Zopa, was launched in 2005 in the UK, and since then, P2P platforms have achieved extraordinary growth and have become a vast global industry. This is not surprising, since it is able to provide 2 billions access to credit throughout the world. However, no region in the world even came close to such an explosive and unprecedented growth in P2P lending, which was noted in the world's second largest economy: China.

In 2007, China first released the P2P platform, and by 2013, that number had soared to 800. By May 2018, 6,142 platforms were operating in China. In 2016, over 3.4 millions investors were registered on China's P2P platforms, while the increase in the amount of capital involved in P2P lending increased from 21 billions Yuan (3 billions US dollars) in 2012 to 1,411 billions Yuan (216 billions US dollars) in 2016.

Growth of P2P platforms in the West: in 2016 in the UK there were only 9 authorized companies offering crowdfunding platforms based on loans, in the European Union there were 24 platforms with a volume of 3.2 billions Euros, and in the USA - 25 with a volume of 29 billions dollars. According to Dr. Chuanman You, a FinTech expert based at Tel Aviv University, loans emerged in the Oxford Capital Markets Law Journal report on the recent development of FinTech regulation in China.

China’s phenomenal growth in the P2P lending industry is due to both insufficient financing of small and medium-sized enterprises (SMEs) and low-income households by traditional banking institutions, and, on the other hand, high return on P2P investments. According to Dr. You, the lending industry has attracted capital like private and institutional investors.

While financial constraints for SMEs and low-income households are a global problem, the problem is exacerbated by the dominant economic structure of China’s state-owned enterprises combined with repressive financial policies.

In 2016, almost 50% of Chinese P2P platforms were problematic, often fraud, flight of funds, and illegal fundraising were reported. By May 2018, about 2058 platforms encountered liquidity problems or other more serious problems.

China’s initial lack of a comprehensive regulatory regime has contributed to the phenomenal growth of P2P platforms, but it also generated huge market risks that could jeopardize the sustainable development of the industry.

FinWhaleX is a P2P credit lending platform that provides access to loans anywhere and anytime. Let’s take a look at how this works. In order to apply for a loan, the borrower must first set the parameters for the loan. These include the amount, interest rate, loan term, etc. Sometimes the company recommends evaluating the parameters of other applications in order to more easily navigate the process and select the most advantageous offers.

FinWhaleX brings together the private interests of the lender and the borrower. It organizes technical support of transactions on the basis of smart contracts in decentralized registries that securely carry out cash flows and digital assets. FinWhaleX also maintain a credit history of users, calculate their risk profiles, monitor the current status of loans issued, provide information support to the parties, notify users of insufficient collateral, and implement collateral to cover costs if necessary.

In addition, there are options for choosing an application for a loan on bail. Two ways can be offered for this. First, you can place an application for secured lending. This method is more attractive. Second, you can transfer the required amount of collateral after the lender accepts the application. The commission for filing a loan application is 0.5% of the amount depending on the loan term.

Features of the Platform

- User verification: You know who you are dealing with by talking to a real person.

- Crypto as Collateral: Advanced security and reliability of your collateral

- Legal support of transactions: The legal department of our company will help draw up an agreement on the legal norms of the countries in which the parties to the agreement live.

- 24/7 customer support: Specialists are always in touch and will help resolve any issues.

- Direct 1-by-1 arrangements: The parties to the agreement themselves negotiate the loan term, interest rate and payment schedule.

- Affiliate program: The presence on the wallet or issuance of a loan in the amount of 30,000 FWX is a reason for making profit in the form of platform tokens.

How FinWhaleX works

- You Place a Loan Application

When creating your loan application, the Borrower set the parameters at its choice (amount, interest rate, period, etc.). We recommend evaluating the parameters of other applications already placed on FinWhaleX - lenders choose the most profitable applications for themselves. You can choose when to secure a loan application with collateral. There are two available ways. On the one hand, you can place the collateralized loan application which is more attractive for creditors. On the other hand, you can transfer the necessary amount of the collateral after the lender accepts your application. When placing the loan application, you need to pay a transaction fee in amount of 0.5% of the loan amount depending on the loan period.

- Lender accepts your Loan Application

All creditors guarantee to fulfill their obligations for the accepted applications. After the lender accepts the application, FinWhaleX will generate a special multisig-address where your collateral (bitcoins) will be stored until the end of the loan period. Each party owns only one Private key for the multisig-address. Multisignature (multisig) refers to requiring more than one Private key to authorize a Bitcoin transaction. It guarantees that no one is able to access the collateral owning just one Private key.

- You Return the Money within the Term of the Loan

After repayment of the loan, you automatically return the deposit to yourself. No one can use your bitcoins until the loan is repaid - they are frozen in a special wallet. You can not return the loan, if it is not profitable for you. If the rate of bitcoin has not risen or fell, then you can refuse to repay the loan. In this case, the collateral simply goes to the lender, and your loan obligations are repaid.

Advantages of FinWhaleX

For Borrowers

A great option for those who do not want to get involved with banks and MFIs . Loan processing through our platform is:

- The ability to get money with a bad credit history.

- Interest rate is lower than in any financial institution.

- Prompt receipt of money without unnecessary bureaucratic procedures.

For Investors

Suitable for those who want to increase their income without spending a lot of time and effort on finding options. Providing a loan through our platform is:

- Higher interest rate than bank deposit.

- Less risk of losing money due to collateral.

- Opportunity to independently choose who to lend.

For Token Holders

The best option for those who are aware of the potential of the crypto market and lending. Acquiring our platform tokens is:

- Getting a stable profit, regardless of the economic and political situation.

- Possibility to resell tokens in the future at a higher price.

- Participation in market scaling with huge potential, promising high dividends.

FinWhaleX Token

FWX token is a utility token implemented according to the ERC-20 standard on the Ethereum blockchain. Holders of tokens have access to the platform, increased scoring score for the loan, the possibility of taking a loan and lending to other users.

All transactions within the platform will be conducted only through the FWX token. For example, the issuance of a loan secured token FWX. The FWX Token will allow its owner to use the FinWhaleX platform to take out a loan and lend to others.

After the IEO, the token will be available on the main crypto exchanges. The main functionality of the platform will be available only for the FWX token. All transactions of the loan process will be made through the user's wallet on the FWX platform in FWX, thereby ensuring the filling of the purchase glass on third-party exchanges. Further partnerships with exchanges / digital goods platforms will also be made via the FWX token.

Token Details

- Token name: FinWhaleX

- Symbol: FWX

- Type: ERC20

- Platform: Ethereum

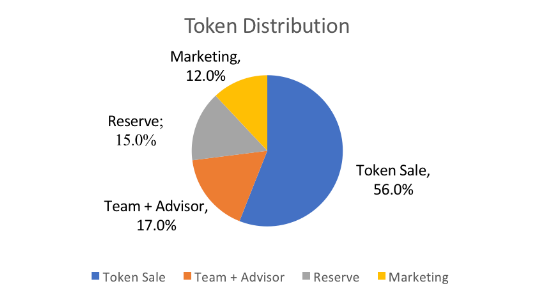

Token Distribution

Road Map

09.2018

- The emergence of an idea about p2p lending based on blockchain technology, smart contracts

11.2018

- Market and competitive environment analysis

01.2019

- Concept development, platform architecture FinWhaleX

03.2019

- Platform prototype implementation

04.2019

- Private round of financing, demonstration of the platform concept and prototype.

- Hiring a development team to implement the product.

05.2019

- Presentation of the platform at the conference Russian Tech Week-2019.

- Start of development of the platform:

- Smart contracts / crypto-wallets

- Web interface / backend.

- Mobile application

06.2019

- Launch of the beta version of the platform.

07.2019

- Launch of the platform with the functionality of issuing loans secured by BTC and ETH, verification of user documents, referral system.

08.2019

- Launch of Liquidity Provider functionality to provide liquidity for cryptocurrency exchange traders.

- IEO FinWhaleX.

09.2019

- The first release of the mobile application for the Android / iOS platform.

11.2019

- Obtaining financial licenses for working with fiat currencies.

- Launch FWX Scoring technology.

12.2019

- Adding to the platform of a new type of collateral - tokens Ethereum ERC-20

01.2020

- Adding a new type of collateral platform - tokens EOS

02.2020

- Adding a new type of collateral platform - tokens Tron TRC-20

03.2020

- Listing token FWX 5 kriptobirzhah

04.2020

- Adding to the platform A new type of collateral - digital assets Steam Market (TF2, Dota 2, CS: GO)

05.2020

- Getting the platform started to work with pawnshops.

- The release of a mobile application with the support of a new type of collateral.

06.2020

- Start of operation of the platform with fiat currency.

- The release of a mobile application with support for working with pawnshops.

08.2020

- Run the issuance of loans without collateral.

- Mobile application release with support for fiat currency.

10.2020

- Release of a mobile application with support for issuing loans without collateral.

12.2020

- Launch of products based on Big Data.

For more information, please visit:

Website: https://finwhalex.com/

WhitePaper: https://docs.google.com/document/d/1XhjDhhnjHJnTmgHlIzDlwECd4nV5zsPwJEmGZxdqjJ0/edit?usp=sharing

Twitter: https://twitter.com/FinWhaleX/

Facebook: https://www.facebook.com/FinWhaleX/

Instagram: https://www.instagram.com/finwhalex/

Telegram chat: https://t.me/finwhalex

Reddit: https://reddit.com/user/FinWhaleX/

Medium: https://medium.com/finwhalex-platform

Author: JigaMola

Bitcointalk profile: https://bitcointalk.org/index.php?action=profile;u=1847143