"Exploring Different Types of Forex Charts and Their Uses" Fundamentals Explained

The Importance of Risk Management in Forex Trading

Currency exchanging, additionally understood as overseas substitution exchanging, involves the purchase and selling of unit of currencies. It is a highly liquefied market that runs 24 hrs a day, making it possible for investors to make money coming from fluctuations in unit of currency values. However, like any form of investment, forex investing carries its fair reveal of risks. This is where risk administration comes into play.

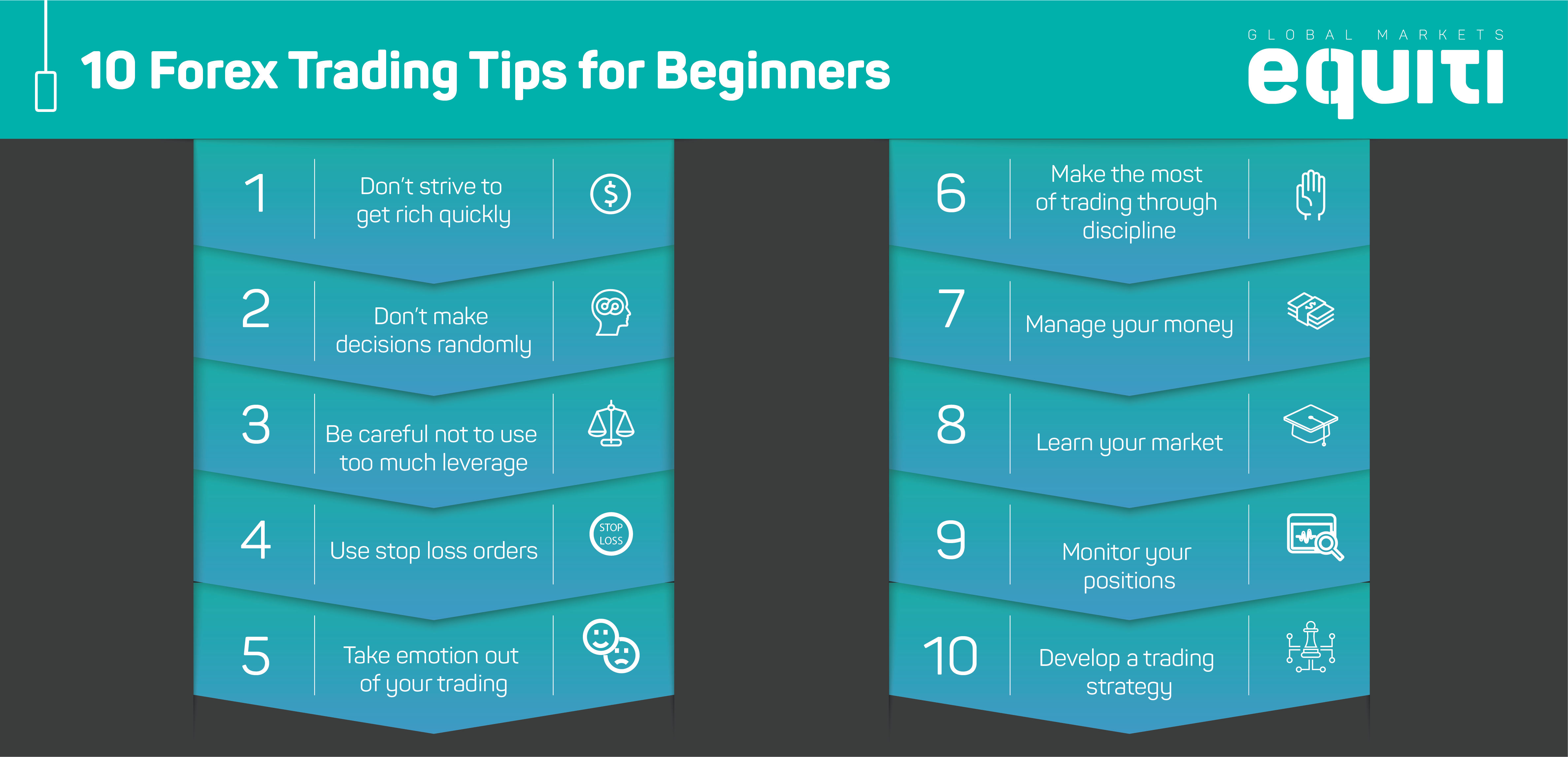

Threat control is the method of determining, evaluating, and taking actions to alleviate prospective risks. In the context of forex investing, it includes applying strategies to protect your capital and reduce losses. Listed here are some reasons why risk monitoring is crucial in forex exchanging:

1. Shielding หุ้นForex of the major objectives in currency trading is to protect your funds. By implementing threat administration strategies, you can guarantee that you don't shed even more than you may pay for to. This involves specifying stop-loss orders, which immediately close your trade when a particular level of loss is got to. By using stop-loss orders effectively, you can limit your downside threat and shield your funding.

2. Taking care of Utilize

Make use of enables traders to handle huge postures along with a relatively small volume of funding. While leverage can magnify incomes, it also enhances the danger of reductions. Without correct threat monitoring approaches in place, excessive take advantage of may rapidly wipe out your account.

By determining an suitable degree of leverage based on your threat tolerance and preparing strict restrictions on how a lot leverage you use per field or general profile visibility, you can successfully manage the fundamental threats linked with make use of.

3. Emotion Control

Currency investing may be mentally daunting due to the swift price activities and possibility for considerable gains or reductions within short time frames. Emotions such as fear and piggishness commonly shadow opinion and lead to spontaneous decision-making.

A solid risk management planning helps traders keep disciplined by supplying crystal clear rules on when to get into or leave business based on objective standards somewhat than emotional states alone.

4. Diversification

Variation is a threat administration approach that includes spreading out your expenditures all over different unit of currency sets and property training class. By branching out your portfolio, you lessen the influence of unpleasant events on any single field or setting.

For instance, if you possess a varied collection of various money pairs, a reduction in one profession may be balanced out by gains in various other profession. Diversity makes it possible for investors to minimize the risk of considerable losses and boost the possibility of consistent incomes over time.

5. Consistency and Long-Term Success

Prosperous foreign exchange trading demands congruity in both technique and risk administration. Through executing a audio danger monitoring strategy, traders can reduce reductions in the course of negative market conditions while optimizing increases during advantageous ones.

Regular danger management methods aid traders to stay in the game for the lengthy phrase by protecting their resources and stopping tragic losses that might likely lead to profile deficiency.

In final thought, danger management participates in a important function in forex trading. It helps safeguard your capital, take care of leverage properly, management emotions, expand your collection, and attain consistency for long-term excellence. Without correct risk control strategies in area, currency exchanging can be akin to wagering with higher concerns. Through understanding and implementing audio risk management guidelines, you may enhance your chances of earnings while lessening prospective reductions.