Exempt Private Company

👉🏻👉🏻👉🏻 ALL INFORMATION CLICK HERE 👈🏻👈🏻👈🏻

What is an Exempt Private Company (EPC)?

Guides

Business Incorporation

What is an Exempt Private Company (EPC)?

There are a lot of technical jargons when it comes to types of Company entities. In this guide, learn the definition and features of an Exempt Private Company (EPC), one of the most common and simplest type of Private Limited Company.

What is an Exempt Private Company (EPC)?

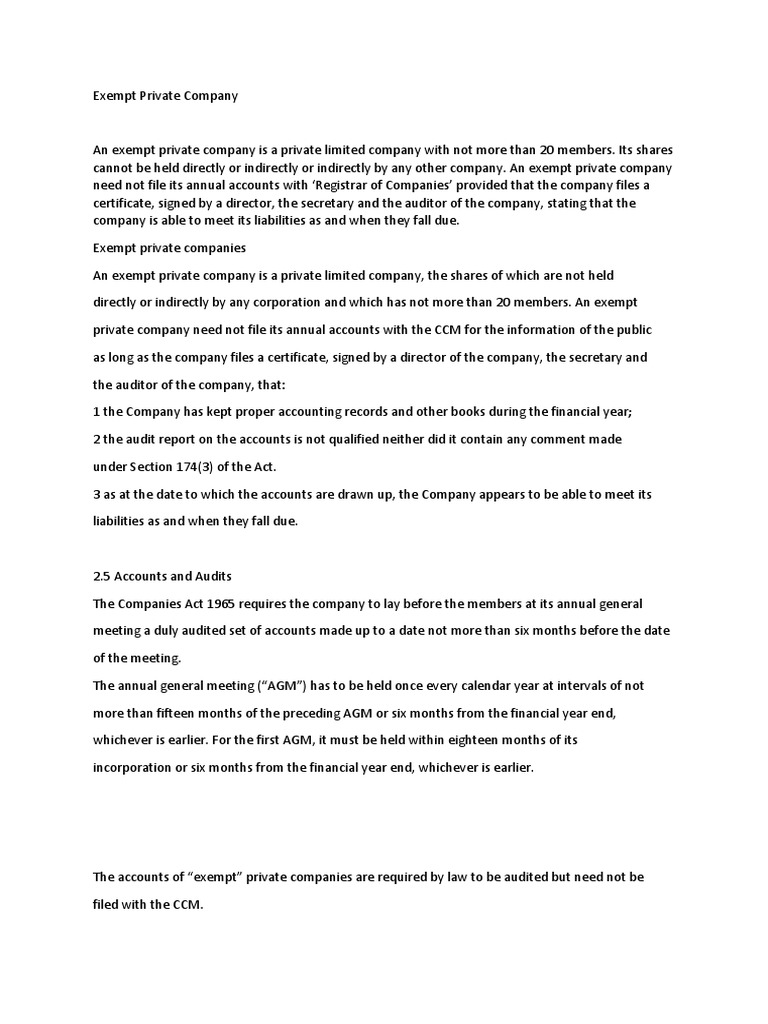

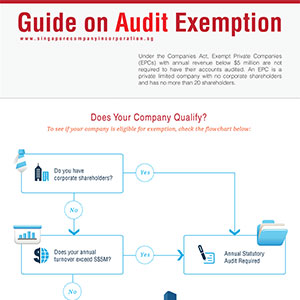

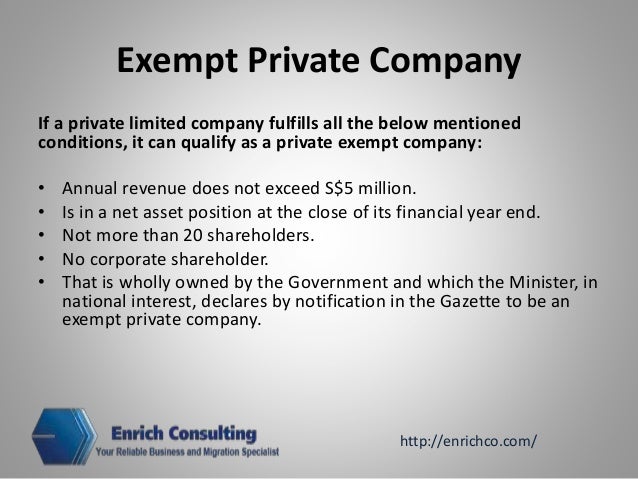

ACRA defines an Exempt Private Company (EPC) as a Singapore Company that meets the following 3 main characteristics:

For most small business owners, their newly incorporated private limited companies would be considered as an Exempt Private Company (EPC). Since the criteria of not having more than 20 shareholders, and of which all are individuals are easy to be met.

Features of an Exempt Private Company

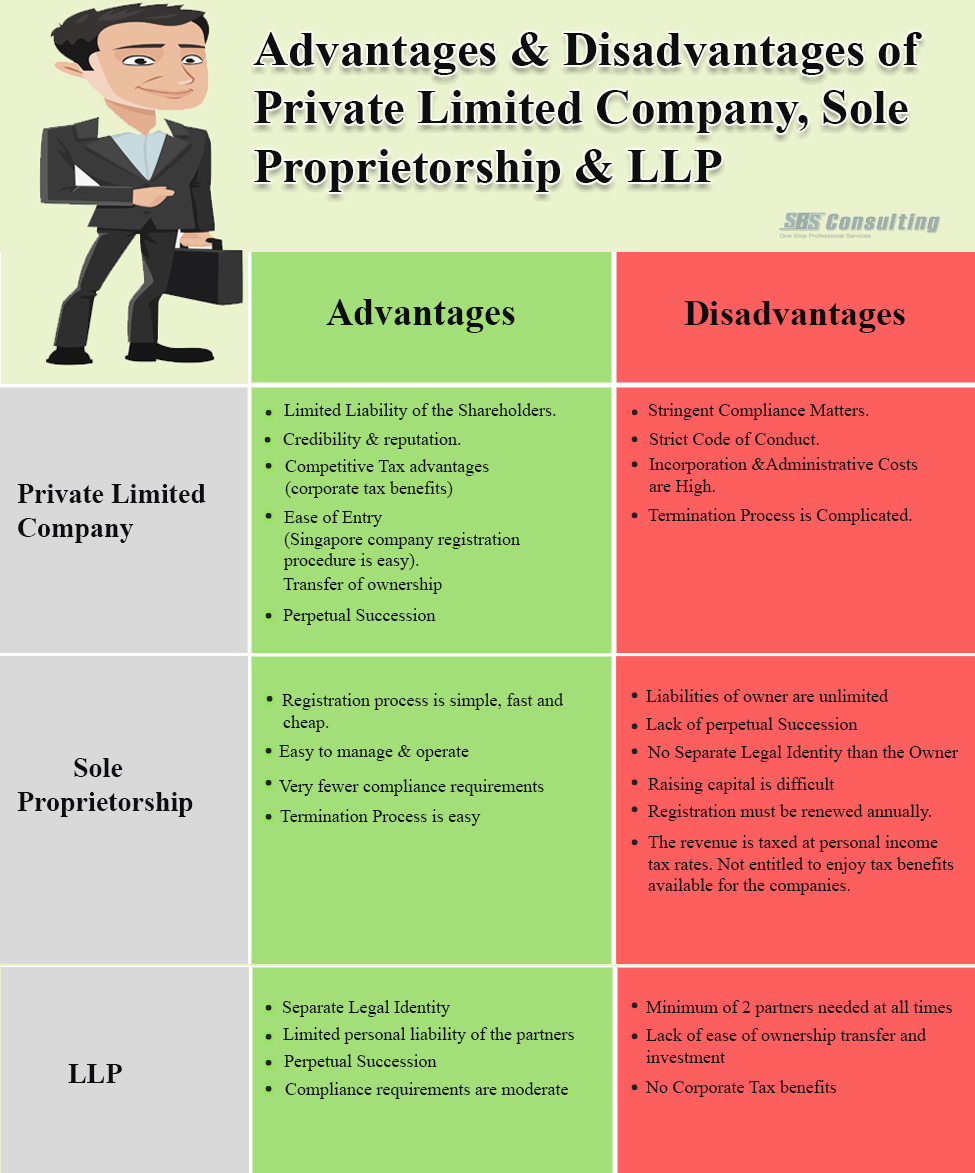

An EPC is the simplest and most common entity type in Singapore. The features and benefits of an EPC includes:

Exemption from audit: So long as the company’s annual turnover is less than S$10 million , and is able to meet all its liabilities, it is exempted from the requirement of an audit, as well as submission of financial statements to the registrar.

A solvency declaration that is acknowledged and signed by the company’s director(s) is sufficient.

Longer Annual Return Filing deadline: Being a non-listed private company with financial year ending after 31st August 2018, the deadline for annual return filing is 7 months after its financial year end.

As for the EPC’s AGM, it must be held within 6 months from the end of its financial year end. You may read more about the timeline for Annual Return & AGM.

There is only a requirement to be a minimum of 1 shareholder. Where the shareholder can either be a foreigner, or a Singapore Citizen. EPCs can also be setup with a low initial paid up capital of $1.

However, as the entity structure is still a Company, it is mandatory to appoint a company secretary within 6 months from incorporation.

Tax Exemption for new start-up Companies

As of the time of this writing and last updated date above, IRAS grants new start-up companies the following tax exemption schedule; where the first 3 tax assessment YAs fall on or after YA2020.

Registering your business doesn't need to be complicated.

Starting a business doesn't need to be complicated.

ACRA Registered Filing Agent: FA20200114

190 Clemenceau Avenue

Singapore Shopping Centre

#06-06 Singapore 239924

Privacy Policy Terms of Service

© 2021 Leftright Corporate Pte. Ltd.

What is an Exempt Private Company (EPC)?

Guides

Business Incorporation

What is an Exempt Private Company (EPC)?

There are a lot of technical jargons when it comes to types of Company entities. In this guide, learn the definition and features of an Exempt Private Company (EPC), one of the most common and simplest type of Private Limited Company.

What is an Exempt Private Company (EPC)?

ACRA defines an Exempt Private Company (EPC) as a Singapore Company that meets the following 3 main characteristics:

For most small business owners, their newly incorporated private limited companies would be considered as an Exempt Private Company (EPC). Since the criteria of not having more than 20 shareholders, and of which all are individuals are easy to be met.

Features of an Exempt Private Company

An EPC is the simplest and most common entity type in Singapore. The features and benefits of an EPC includes:

Exemption from audit: So long as the company’s annual turnover is less than S$10 million , and is able to meet all its liabilities, it is exempted from the requirement of an audit, as well as submission of financial statements to the registrar.

A solvency declaration that is acknowledged and signed by the company’s director(s) is sufficient.

Longer Annual Return Filing deadline: Being a non-listed private company with financial year ending after 31st August 2018, the deadline for annual return filing is 7 months after its financial year end.

As for the EPC’s AGM, it must be held within 6 months from the end of its financial year end. You may read more about the timeline for Annual Return & AGM.

There is only a requirement to be a minimum of 1 shareholder. Where the shareholder can either be a foreigner, or a Singapore Citizen. EPCs can also be setup with a low initial paid up capital of $1.

However, as the entity structure is still a Company, it is mandatory to appoint a company secretary within 6 months from incorporation.

Tax Exemption for new start-up Companies

As of the time of this writing and last updated date above, IRAS grants new start-up companies the following tax exemption schedule; where the first 3 tax assessment YAs fall on or after YA2020.

Registering your business doesn't need to be complicated.

Starting a business doesn't need to be complicated.

ACRA Registered Filing Agent: FA20200114

190 Clemenceau Avenue

Singapore Shopping Centre

#06-06 Singapore 239924

Privacy Policy Terms of Service

© 2021 Leftright Corporate Pte. Ltd.

Overwatch D Va Art 18

Alice 85 Jj Erotic Pictures

Www Xnxx Com Tr Porno

Seks Xxx Maloletka

Russian Mom Nude

Exempt Private Company | Limited Company | Privately Held ...

Guide on Singapore Exempt Private Company | Registration Guide

exempt private company - это... Что такое exempt private ...

What is an Exempt Private Company in Singapore?

Determining the Company Type

Companies (Exempt Private Companies) (Consolidation ...

Exempt Private Company