Excitement About Debt Review Upliftment

App to remove “Debt Review” banner on credit scores report (likewise understood as Debt Review Upliftment): Upon app for debt evaluation through a customer, and once the financial debt consultant has produced the resolve that a consumer is over-indebted in phrases of Segment 86(6)(a) of the National Credit Act, the debt counsellor will keep in mind a “flag” or report of the personal debt assessment on the credit scores bureaus.

The individual’s credit score bureau file will certainly thereby show that the consumer had administered for financial obligation testimonial. The volume of the review determines the quantity of credit score that is required or achievable. The buyer's credit score file relevant information should be gotten continually for at least 90 days. The economic file agency will make use of this details to mention credit score rankings based on rating agencies and the Consumer Financial Protection Bureau (CFPB) and to stop, identify and answer to modifications in credit history ratings.

Must the customer make a decision to call off the financial obligation customer review, the debt counsellor maynot merely clear away the mentioned banner if all personal debts are not spent, but the consumer can move toward the Magistrate’s Court for such extraction. The Magistrate can easily also provide a summons as every the policies of the magisterial court of the State, if the aggrieved individual maynot pay back the personal debt.

Such function to the Magistrate’s Court can easily be performed only prior to the financial obligation rebuilding plan being helped make an order of Court in phrases of Section 86(7)(c) of the National Credit Act. The validity of the order of Court might not be influenced through the payment of the financing from the lender to any sort of gathering. In such scenario, the order of Court will be topic to the stipulations of the National Credit Act pertaining to discharging of financial debt responsibilities.

Our workplaces will certainly happily help you in recommending an app in terms of Area 87(1)(a) of the National Credit Act to the Magistrate’s Court. Such apps are regarded as for point to consider of the stipulations of this Subdivision. Please take note that this Neighborhood does not use to all forms of function. If you file an application along with us at any sort of opportunity prior to your due settlement date, you do thus at no other cost than the amount of any type of charge assessed by the Government.

The function need to confirm to Court that the customer is not over-indebted and that the banner ought to, therefore, be gotten rid of. Source would at that point have the energy to customize the Banner banner or its layout (as long as the adjustment connects to an "under the sunshine") to show the flag's market value. The app would likewise be open to the general people if it would demand the authorities to take measures to take out flag flags from social residential or commercial property.

The Court purchases that the financial debt counsellor’s result of over-indebtedness shall be denied, in impact thereby proclaiming that the financial debt review is uplifted. The volume of the judgment is not to surpass 2.5 times or 1.4 opportunities the quantity of the judgment for any kind of infraction. The court of law after that orders that the personal debt consultant should be notified of the debt and the volume of all the lawful price coming from each sentence got into.

This application is merely necessary when the managerial procedure and Court proceedings were not completed along with the debt counsellor. Such handling is viewed as for more proceedings with regard to this personal debt by regulation. Note: Find also section 31 para 26 above. 6. If in addition to the function for bail, in purchase for the payment of the bond notice and sentence to take place, the Court get a new financial obligation advisor that has been issued along with the same authority as another financial obligation consultant.

This application is just proper when the managerial process and Court procedures were not accomplished with the debt consultant. Such processing is considered for additional procedures along with regard to this financial debt by legislation. Take note: View additionally segment 31 para 26 above. 6. If in enhancement to the function for bail, in order for the settlement of the bond notice and paragraph to take location, the Court buy a brand new debt consultant that has been released along with the exact same authority as one more personal debt counsellor.

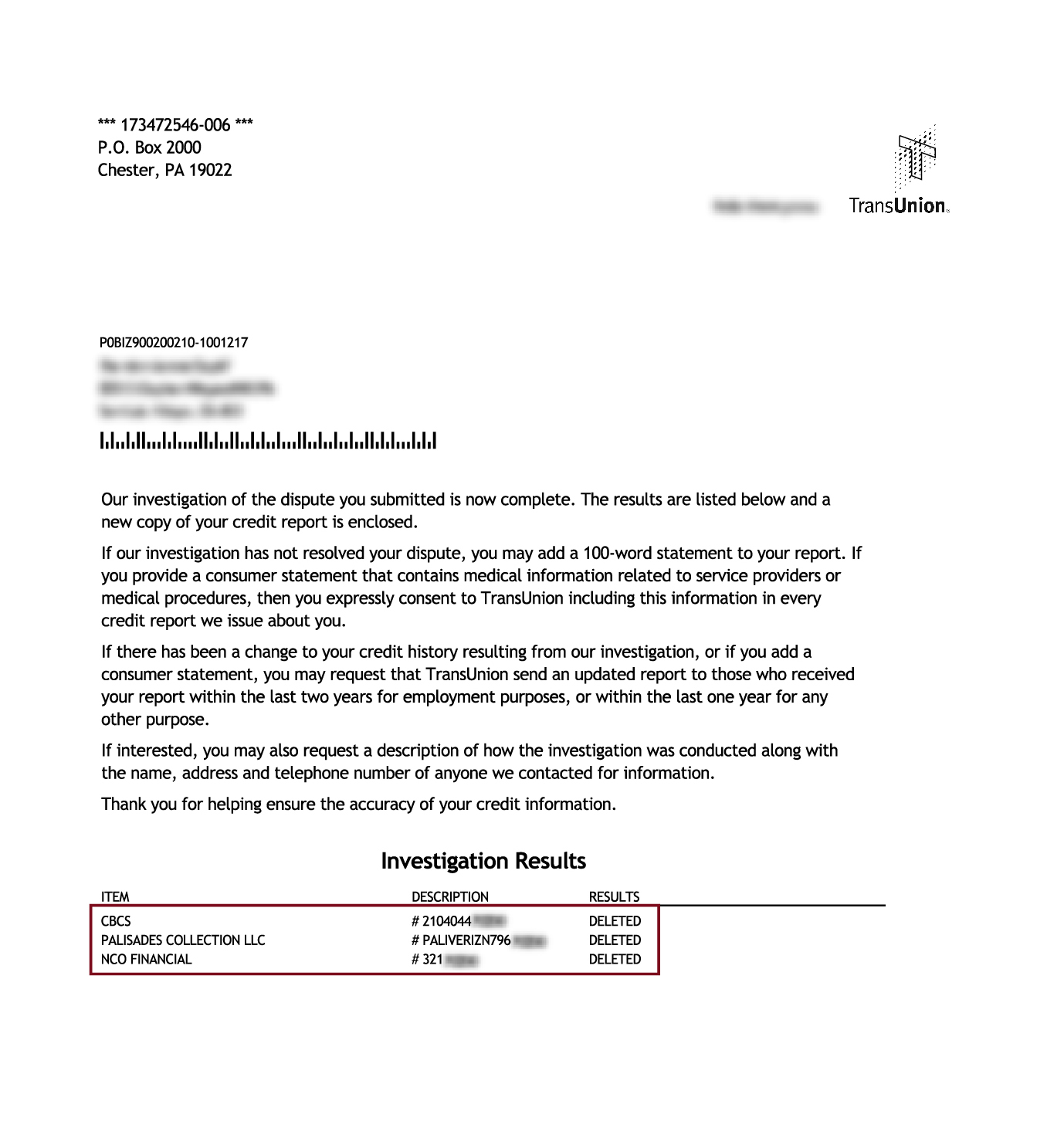

Once the above order has been obtained coming from Court, it will be offered to the financial obligation advisor in order for them to get rid of the report of “personal debt customer review” from the credit score agencies. It is encouraged to submit an function for a reconsideration of the debt opinion upon delivery of the documents of passion in this court through the participant at the earliest achievable time. Additionally, the financial institution has been encouraged of the expense of prepping the purchase.