Enhance One's Investment: Adopting Software for Achievement

In the rapid world of trading, staying ahead of the game requires more than just gut feelings and experience. As markets evolve, so too must the strategies that traders employ to navigate them successfully. Adopting technological solutions is now integral to modern trading systems, providing insights and streamlined processes that can considerably enhance decision-making and performance. Through the use of technology, traders can access real-time data, examine trends, and streamline processes, transforming the way they interact with financial markets.

Benefits of using software for trading are numerous and compelling. Automated trading systems can execute strategies with precision, freeing traders from the emotional biases that often cloud judgment. Moreover, sophisticated analytical tools can assist spot profitable opportunities more swiftly than manual approaches allow. In exploring the various benefits of these software solutions, it's clear that incorporating technology into your trading arsenal is a crucial step towards securing your trading efforts.

Comprehending Exchange Frameworks

A trading framework is a organized approach to trading that combines particular regulations and guidelines for making decisions. It includes different components such as entry and exit markers, risk management strategies, and market evaluation techniques. By establishing these criteria, dealers can create a rigorous method to their exchanging activities, reducing emotional decision-making and enhancing consistency in their tactics.

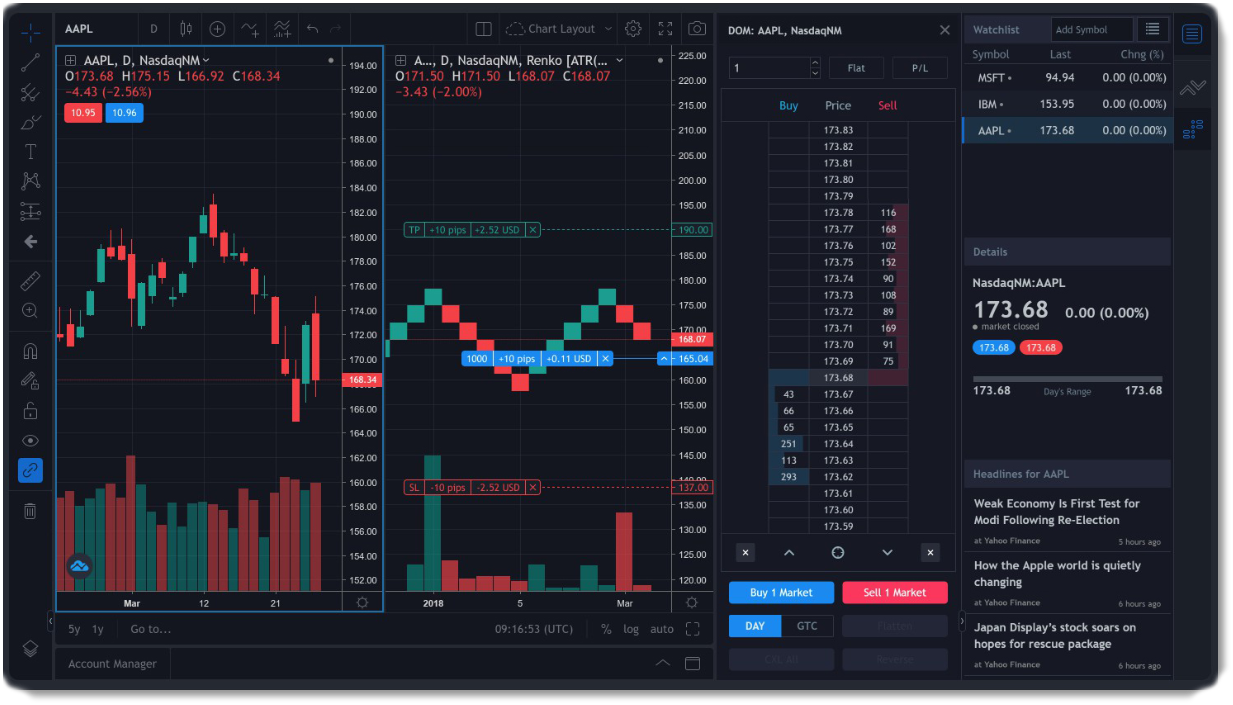

Software applications play a vital role in the development and execution of trading systems. They enable backtesting, which permits dealers to evaluate their strategies using historical data before deploying them in real-time markets. This process is essential as it assists identify the effectiveness of the system and modify parameters accordingly. Moreover, applications can mechanize transactions based on set rules, guaranteeing that opportunities aren't missed due to personal error or indecision.

Additionally, modern exchange frameworks often integrate sophisticated analytics and information visualization capabilities, allowing traders to gain deeper insights into market patterns. These tools can collect data from multiple sources, offering a holistic perspective of trading conditions. By utilizing applications, traders can enhance their choices process, tailoring their strategies to present trading dynamics and finally boosting their trading performance.

Benefits of Software Integration

Integrating software tools into your trading system can considerably enhance your overall trading strategy. One of the primary benefits is the ability to execute real-time analysis, permitting traders to arrive at informed decisions based on the latest market trends and data. By accessing the ability to cutting-edge analytical tools, traders can promptly identify patterns and signals that may not be readily visible through manual analysis. This quick decision-making process can lead to better trade execution and higher profitability.

Another positive aspect of software integration is automation. Trading software can perform trades automatically based on predefined parameters, lessening the emotional stress often associated with trading. Automated systems can help traders stick to their strategies without second-guessing their choices in the heat of the moment. This not only increases trading efficiency but also allows for a scalable method, enabling traders to manage various assets at once without being overwhelmed.

Additionally, software tools can strengthen risk management within the trading system. With features such as stop-loss orders, position sizing calculators, and immediate alerts, traders can effectively control their exposure and protect their capital. These tools enable a anticipatory approach to risk, ensuring that traders can adapt quickly to market movements and adjust their strategies accordingly. Embracing software technology thus not only enhances the trading process but also fosters a more disciplined trading environment.

Strategies for Ensuring Longevity

To keep pace in the constantly changing trading landscape, it's crucial to adopt a robust trading system that utilizes the newest software tools. Tradesoft is to integrate algorithmic trading into your operations. By utilizing algorithms, traders can exploit market inefficiencies in the moment, executing trades with accuracy and speed that human traders cannot match alone. These programs process vast amounts of data and detect trends, allowing for more informed decision-making and improved trading performance.

Another approach is to regularly educate yourself and your team on new technologies. Keeping abreast of advancements in artificial intelligence and machine learning can greatly enhance your trading strategies. Software tools that use these technologies can respond to market changes, providing traders with information based on previous data and predictive analytics. This not only enhances your trading accuracy but also creates confidence in your system's robustness against market volatility.

Finally, it's vital to confirm that your trading software has a user-friendly interface and coordinates seamlessly with additional systems. This accessibility allows traders to concentrate on strategy development rather than getting bogged down by technical issues. Investing in software that facilitates collaboration among team members can foster a culture of collective understanding and assist you to respond quickly to market dynamics. By emphasizing these strategies, you can develop a robust, long-lasting trading system that flourishes in both current and future markets.