Employee Retention Tax Credit - Justworks Help Center - Questions

941 - Worksheet 1 Credit for Qualified Sick and Family Leave Wages and the Employee Retention Credit (DAS)

941 - Worksheet 1 Credit for Qualified Sick and Family Leave Wages and the Employee Retention Credit (DAS)Our What Wages Qualify Calculating Employee Retention Credit? PDFs

With the finalizing of the Facilities Financial Investment and Jobs Act on Nov. 15, 2021, the Employee Retention Tax Credit program end date retroactively altered to Sept. 30, 2021, for many businesses. Recovery Start-up Service stay qualified to pay certified wages through Dec. 31, 2021 to declare the credit. On Dec.

This guidance was required after the signing of the law made some companies ineligible for ERTC in the 4th quarter since of the retroactive termination of the program. This law is the third considering that ERTC was produced under the Coronavirus Help, Relief and Economic Security (CARES) Act was enacted in April 2020.

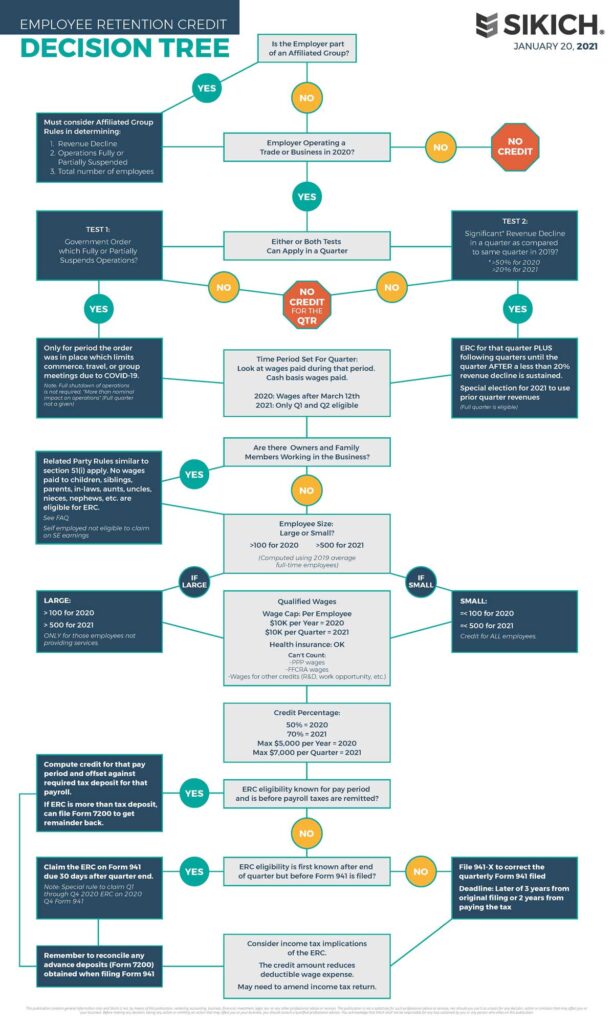

This article highlights eligibility, qualified incomes, how the credits work and more. It likewise marks by law and date because, depending on whether you took a Paycheck Defense Program (PPP) loan and when you claim the credit, there are various requirements. What is the Staff Member Retention Credit? The ERTC is a refundable credit that services can claim on qualified earnings, consisting of particular health insurance costs, paid to workers.

IRS Issues Guidance for Employers Claiming 2020 Employee Retention Credit - Gould & Ratner LLP - JDSupra

IRS Issues Guidance for Employers Claiming 2020 Employee Retention Credit - Gould & Ratner LLP - JDSupraUnknown Facts About Does Your Business Qualify for the ERTC Now? - Frost Brown

31, 2020. Consolidated Appropriations Act 2021 Employers who qualify, including PPP receivers, can declare a credit against 70% of certified salaries paid. Furthermore, Read More Here of wages that certifies for the credit is now $10,000 per employee per quarter for the first 2 quarters of 2021. American Rescue Plan Act 2021 The credit remains at 70% of qualified incomes as much as a $10,000 limit per quarter so a maximum of $7,000 per employee per quarter.

30, 2021. However, Recovery Startup Businesses are still eligible for ERTC through completion of the year. A Recovery Start-up Company is one that began after Feb. 15, 2020 and, in basic, had approximately $1 million or less in gross receipts. They might be qualified to take a credit of up to $50,000 for the 3rd and fourth quarters of 2021.