Economic Injury Disaster Loans - SBA for Dummies

SBA reopens EIDL loan, $10K Grant Program - IHCC Business - Questions

The procedure for the COVID-19 version of EIDLs has actually been streamlined and must take less than 130 minutes. The first thing you'll see is a disclosure, which describes the loan in information and states your information is just collected for eligibility functions. If you do not provide all the needed details, your application will not be processed and any false information submitted subjects you to a perjury penalty.

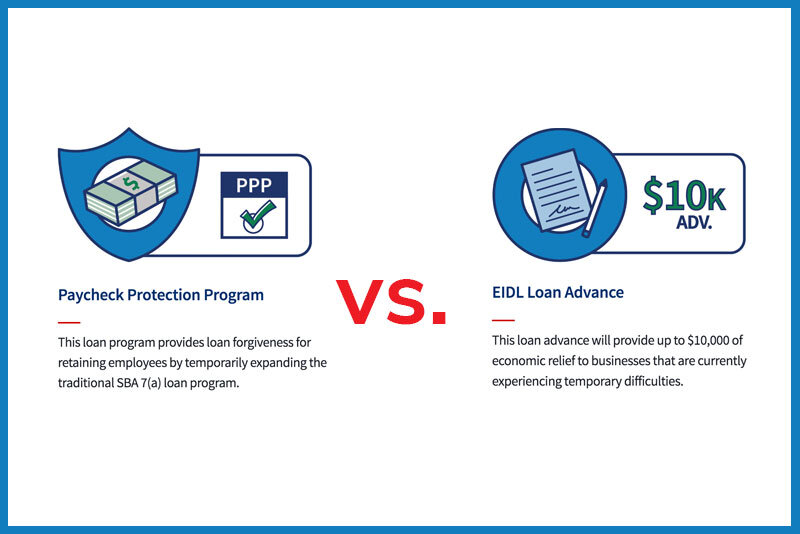

Be sure to check your information also so your loan can be authorized and funds can be directly transferred into your account. The advance will be forgiven if it is spent on paid leave, preserving payroll, home mortgage or lease payments. To keep your employees on payroll, think about using for the Income Security Program (PPP) too, as you can get financing from both.

Updated] The Economic Injury Disaster Loan (EIDL) Program vs The Paycheck Protection Program (PPP) - Comparison Chart - KROST

Updated] The Economic Injury Disaster Loan (EIDL) Program vs The Paycheck Protection Program (PPP) - Comparison Chart - KROSTEIDL Program Loans - Mid Penn Bank for Beginners

However, if you utilize a PPP loan for payroll purposes, you can not also use an EIDL for payroll if you desire the $10,000 advance to be forgiven. Payment Security Program Loans (PPP Loans)How PPP Loans Work, The SBA developed PPP loans to make it possible for little companies to keep workers on payroll.

How to Check Who's Received EIDL Grants or Loans or PPP Loans

How to Check Who's Received EIDL Grants or Loans or PPP Loans5 times your average regular monthly payroll for the year preceding your application. This Author will be forgiven if all workers stay utilized for 8 weeks and if the funds are used for payroll, rent, mortgage interest or energies. Any part of loans not forgiven will be dealt with as a two-year loan with a 1% fixed interest rate, and payments will be postponed for 10 months (however, interest will continue to accrue over this duration).

Indicators on Small Business Administration Offering COVID EIDL Loans for You Should Knowhas 500 staff members or less, despite revenue. is a sole proprietorship, does independent contracting or if you are a self-employed person that regularly carries on any trade or service (consisting of in the "gig economy"). is a non-profit entity under Area 501(c)( 3) so long as it has 500 employees or less.

The SBA also has complex association requirements, which means a business should aggregate all of its moms and dad business, affiliates and subsidiaries to determine if stated company meets the size requirements and obtaining eligibility. These still apply under the PPP but are waived for: hospitality or food service businesses categorized under an NAICS code beginning with 72.