EBAN Statistics Compendium

Ruben Osipyan, https://t.me/threenstartups

Investments Made

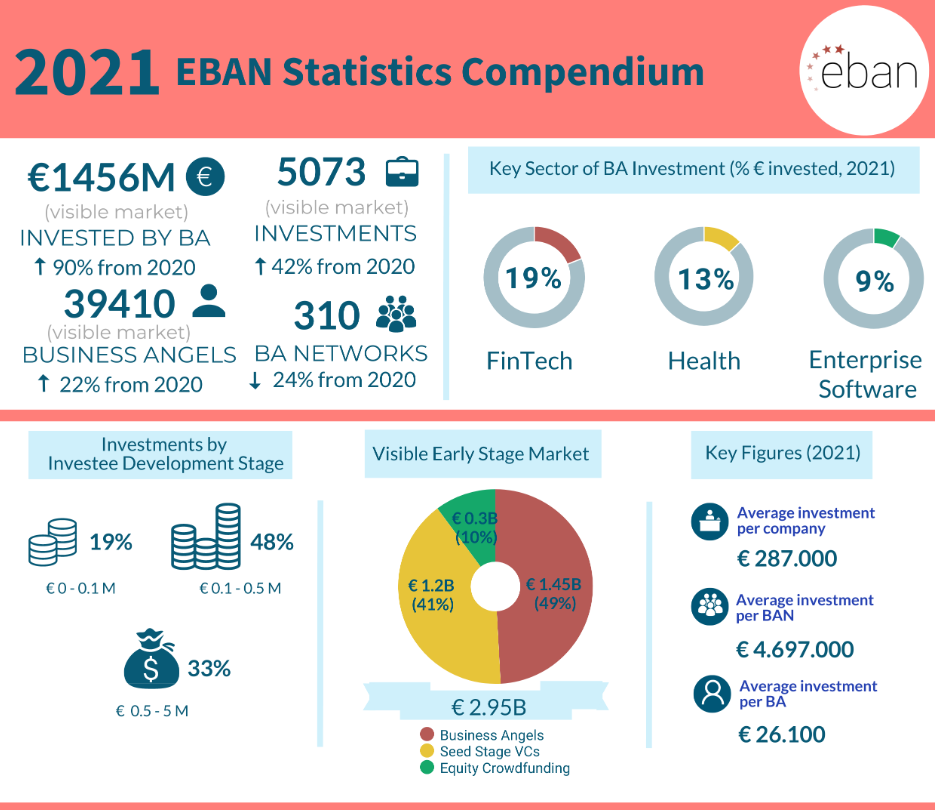

Angel investment market in the European continent grew to ~1.5 billion EUR in 2021 (from 767 million EUR in 2020, +90% increase).

Despite the strong development of the industry, for comparison, angel investment in the US has reached an estimated 29.1 Billion US dollars in 2021.

Average Investments

The average amount invested by angels (individually, as syndicates or as co-investments with other early-stage investors) per company, per round, increased substantially from the 214,150 Euros of 2020 to the 287,000 Euros of 2021. The median investment also increased, from the 196,500 Euros of 2020 to the 223,300 Euros of 2021.

There are three main explanations for this increase:

- firstly, the rise of startup company valuations in seed stages

- secondly, the effects of price inflation across Europe

- finally the increased investment activity by angels in follow-on rounds and later stages.

In average each Business Angel Network invested 4.697.000 EUR in 2021 (vs 1.880.000 in 2020). In average Business Angel invested 26.100 EUR in 2021 (vs 23.800 in 2020).

Stages of Investments

In terms of stages of investment, business angels predominantly invest in the early stages of the company’s development, typically before any revenues occur.

Across the 38 countries involved in this study, approximately 19% of the investments made by angels were in rounds equal to or lower than 100,000 Euros (in 2020 the number was 30%).

48% of all the visible investments made were in rounds between 0.1-0.5 Million Euros (compared to 45% in 2020). 18% of the rounds where business angels invested in were worth between 0.5-1 Million Euros (compared to 14% in 2020), and 15% of all deals done last year were in rounds above 1 Million Euros (compared to 11% in 2020).

Quantity of Investment Rounds

In 2021, angel investors were involved in over 5070 observed funding rounds, consisting in both initial investments and follow-on investments made in European based start-ups resulting in an increase of 41% vs 2020.

Demographics

There are approximately 39400 active business angel investors on the European continent who are part of a local investment network or association.

Sources of Capital

Angel investment remains the primary source of seed capital for startups across Europe, with seed VC investment accounting for 1.2B Euros and equity crowdfunding accounting for approximately 0.3B Euros last year.

Leaders of Angel Investment in Europe

United Kingdom continues to be the leading country with 388.5 Million Euros invested in 2021 (compared to 142.1 Million Euros invested in 2020). Germany comes in second with 159.7 Million Euros of angel investment in 2021, followed by France with 153.5 Million Euros of annual investment.

Despite the strong performance of large European countries, it is important to highlight the continuing success of “smaller” markets such as Sweden, Ireland, Estonia, Austria, Finland, Belgium, and the Netherlands, which count on vibrant start-up ecosystems and well-connected communities of investors at a national and regional level.

Sectors of Investment

For the second consecutive year, the main sector of investment in 2021 (in terms of total Euros invested) was Fintech. Fintech is also the leading sector in terms of total rounds of investments made. Important to note is the strong growth of the health sector during 2021 with respectively 13% share of the total amount of investments made (in Euros), and overtaking Enterprise Software in second place this year. Another notable growth happened in the food sector. Continuing its increasing trend from 3% (2019) to 4% (2020) and 7% (2021) taking 4th place overall in 2021. This is a sector EBAN is anticipating to grow over the coming years following the trends observed so far.

© This content is created by the European Business Angels Association - EBAN. More details can be found here: https://www.eban.org/eban-publications/