Dracula Protocol FAQ

Dracula.sucksV2 FAQ:

- https://hackernoon.com/defi-vampirism-draws-first-blood-as-dracula-protocol-upgrades-to-v2-gq7y339g

- https://davejones02.medium.com/dracula-protocol-v2-defis-ultimate-yield-aggregator-and-booster-94cedf75c865

- https://hackernoon.com/dracula-protocols-growth-hacking-tricks-a-crypto-marketing-story-303y335q

- https://draculaprotocol.medium.com

- https://www.notion.so/Dracula-Protocol-FAQ-7339eeefb07b4b6e9b796d2caf918ba2

V1 FAQ:

Dracula Victim Pools

SUSHI/ETH example

You make an LP token on sushi (for the case of this example let's say you make a SUSHI/ETH pair).

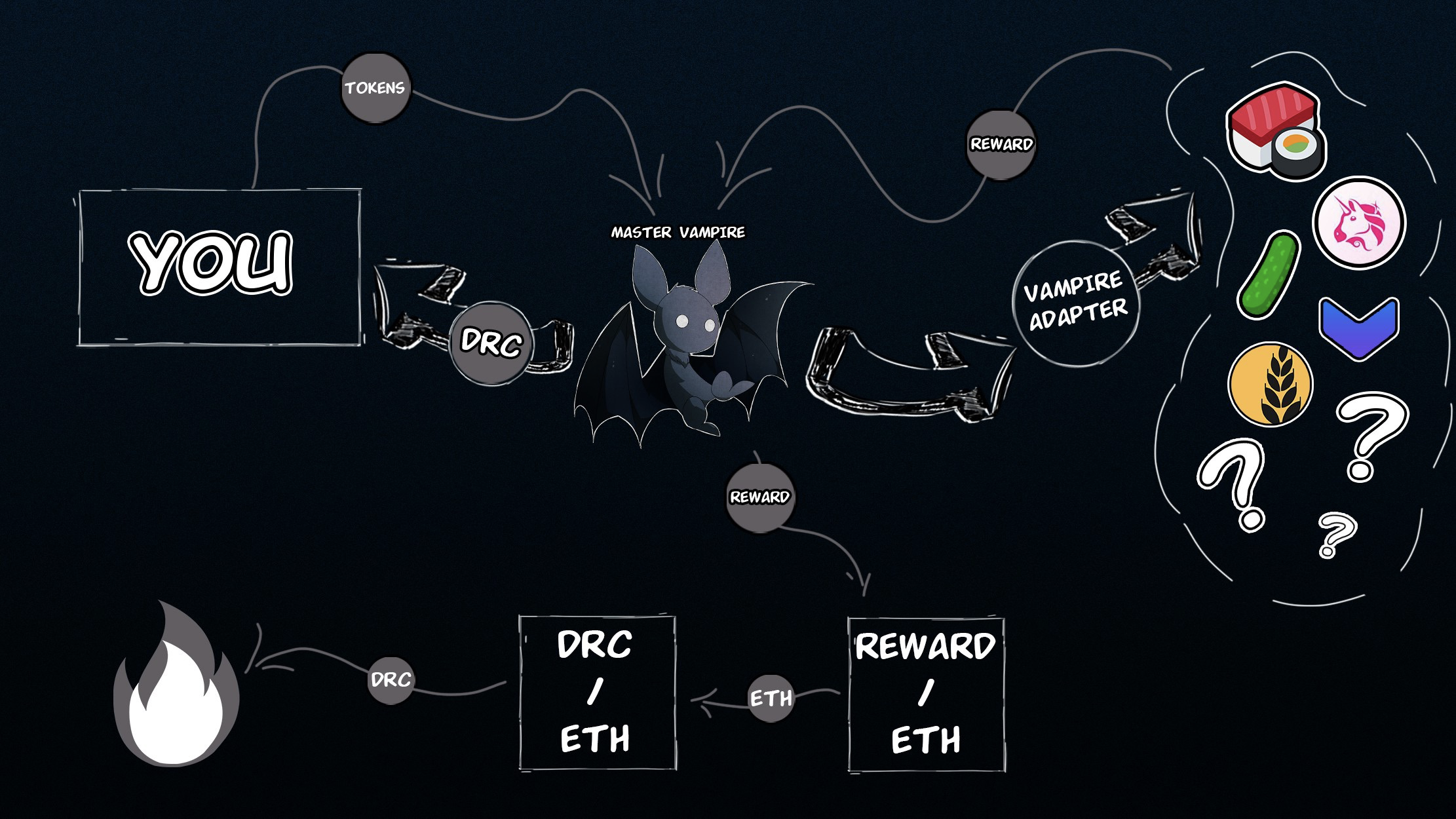

You would take that LP token and deposit it into Dracula. Instead of earning sushi you would earn Dracula tokens (DRC). The rewards earned, in this case sushi, are then pooled by the mastervampire contract. The APY provided by Dracula will always be higher than that of the underlying pool.

When someone hits drain the pool rewards are sold for ETH, the ETH is then used for: 50% buy back burn of the DRC token 45% used for liquidity 5% goes to stakers.

USDC/ETH example

If you don't want to lose the assets because of IL you provide LP for you need to stake something stable in price like USDC-ETH.

The higher DRC goes the less DRC u will have when you exit the LP pool.

The USDC-ETH pairing is relatively stable and offers insane APYs.

What you are doing when you provide LP to a pool is providing coins/ETH for the market so people have coins to buy. If you staked LP for the ETH-DRC pool, when someone wants to buy DRC they will take some of your coins and you get some of the ETH that they spent to swap on Uniswap. When people sell DRC they take some of your eth and you get the DRC.

However, when the price rises like DRC did, there are more people buying than there are people selling, so the DRC that is taken from your pool is higher than what it being put into your pool.

ETH-DRC Pool

That is a bit risky to start from buying DRC and provide liquidity in DRC-ETH instead of being a liquidity providers in the victim pools. If you do not understand impermanent loss (IL) you should not be providing liquidity in a LP. You are able to farm DRC with your holding assets like ETH, YFI, WBTC, LINK. So you get DRC for free.

If you a new to DeFi - better read the beginning of this article again and ask in chat how to operate with victims instead of facing risk of the IL.

Liquidity trading - to do this you have to understand the mechanism of

AMM (automated market maker):

https://www.gemini.com/cryptopedia/amm-what-are-automated-market-makers

You also have to understand an Impermanent Loss

https://julianhosp.com/impermanent-loss-other-liquidity-mining-risks-explained/

or

https://www.google.com/amp/s/academy.binance.com/en/articles/impermanent-loss-explained.amp

Once you have learned the basic concepts - you can start to make money.

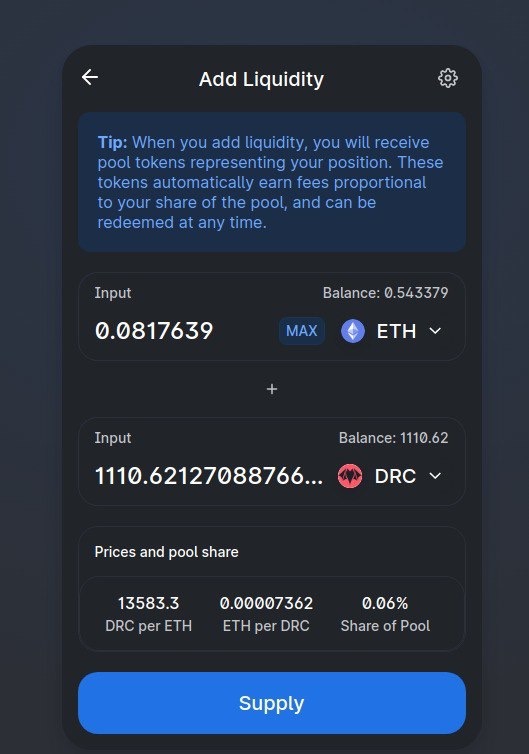

I hope you have already decided on which pair you want to deliver liquidity - I'll take DRC-ETH pair on Uniswap as an example. And so we need two currencies are DRC and Ethereum. We can either buy the currency from a centralized exchanger or on Dex.

I will tell you how to do it on Dex - for this you need to go to

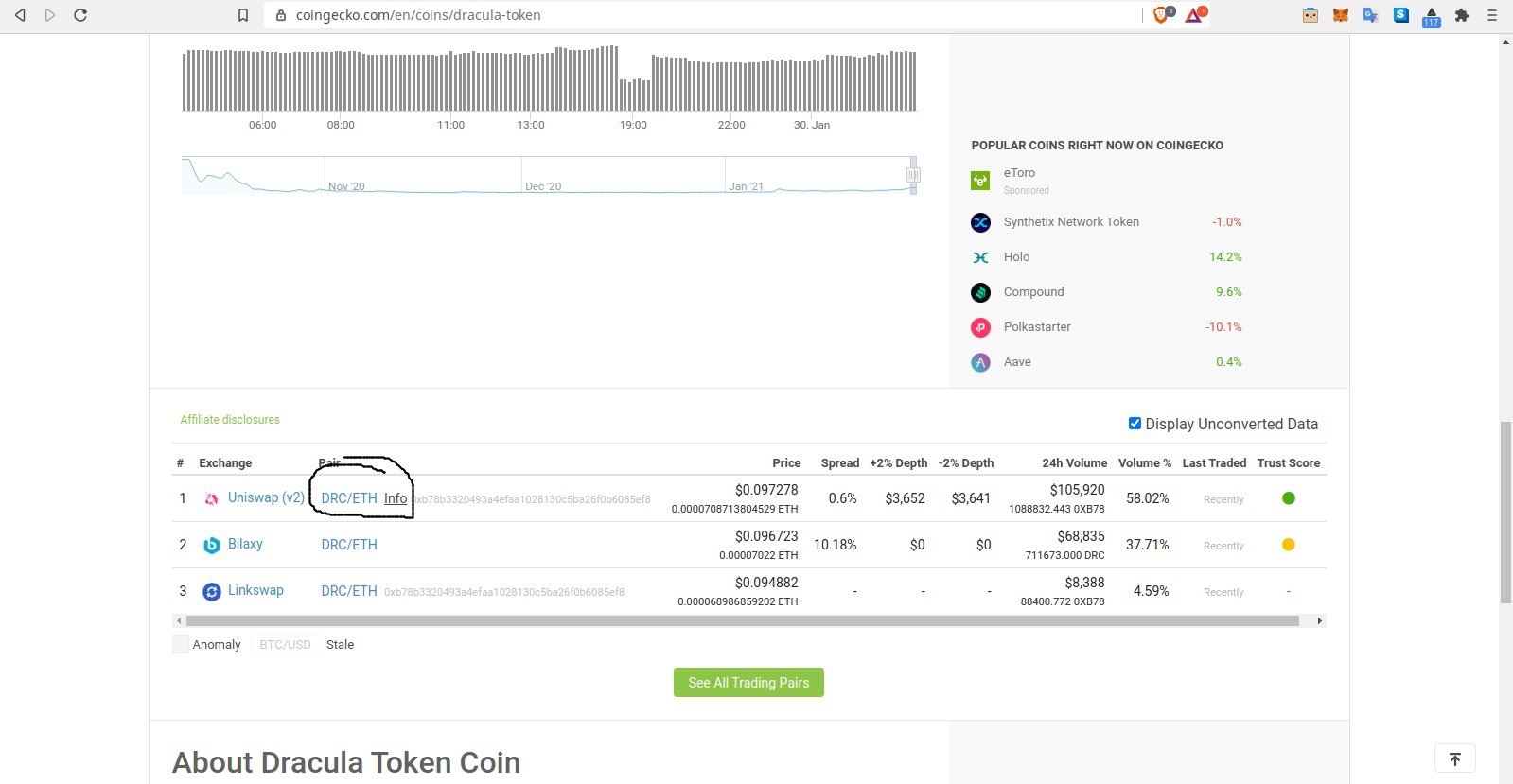

https://www.coingecko.com/ and search for the required currency.

Here I marked a decentralized exchanger where you can buy DRC. If you bought $1000 worth of DRC, you also need to buy $1000 worth of Ethereum. After then you need to go to https://app.uniswap.org/#/pool and click on "Add Liquidity". After that in place where it is written "Select a Token" we need to add the address of DRC - which we can find on Coingecko:

"0xb78b3320493a4efaa1028130c5ba26f0b6085ef8"

After that you will need to allow the Uniswap protocol to spend your tokens so press "approve" and confirm the transaction. When it is confirmed you will need to press "supply".

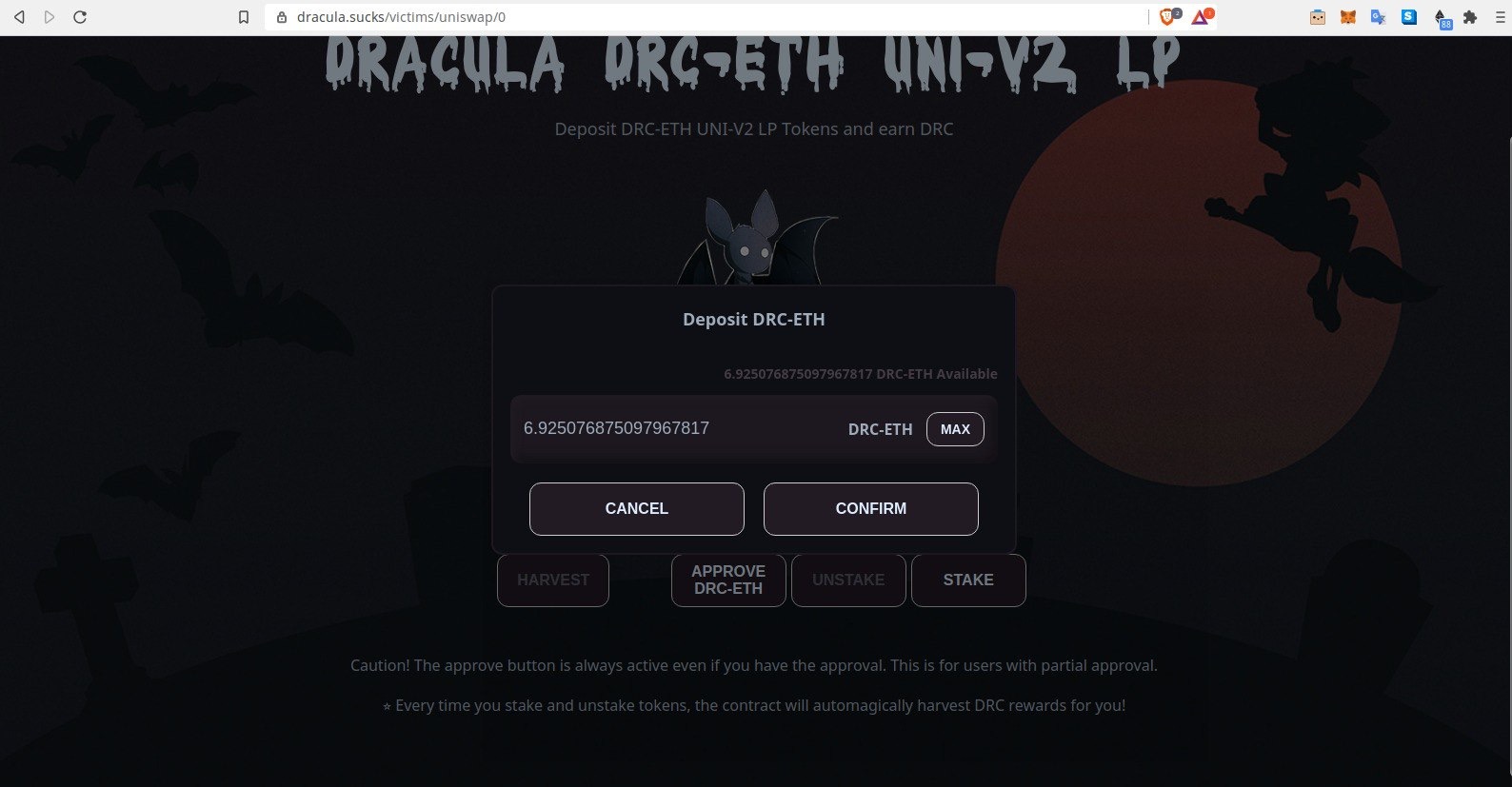

Once the transaction is confirmed you will receive UNI-V2 tokens (This Uniswap Liquidity Provider (LP) token represents the DRC and ETH pairing.)

Next go to https://dracula.sucks/ there select Victims and select the pairing DRC-ETH. Click on Approve DRC-ETH and confirm the transaction. Once the transaction is done you can press "Stake" -> "max" -> "confirm" and confirm the the transaction again.

Well, that's it my friend, you've started earning.Similarly you can deliver liquidity on all pairs - the only difference is sushi, lua, pickle, etc.

Apy.vision

liquidity.vision Are must-have services for you

defiyield.info

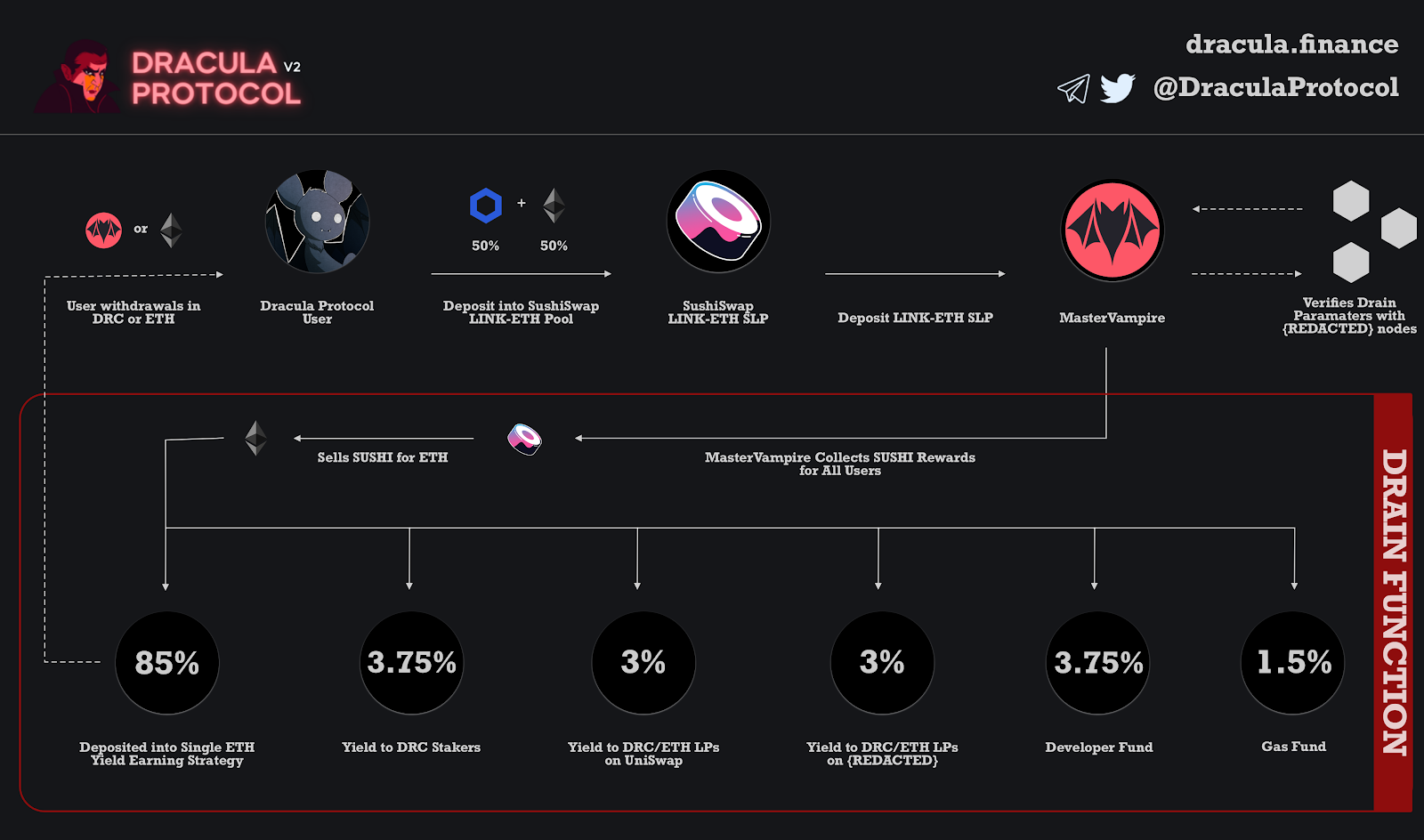

DRC -> ETH utilizes buyback mechanics. Our victim pools earn tokens from their underlying protocols, such as UniSwap, SushiSwap, and Pickle. These yields are gathered through our ‘Drain’ function, where the underlying tokens earned (UNI, SUSHI, PICKLE) are sold for WETH.

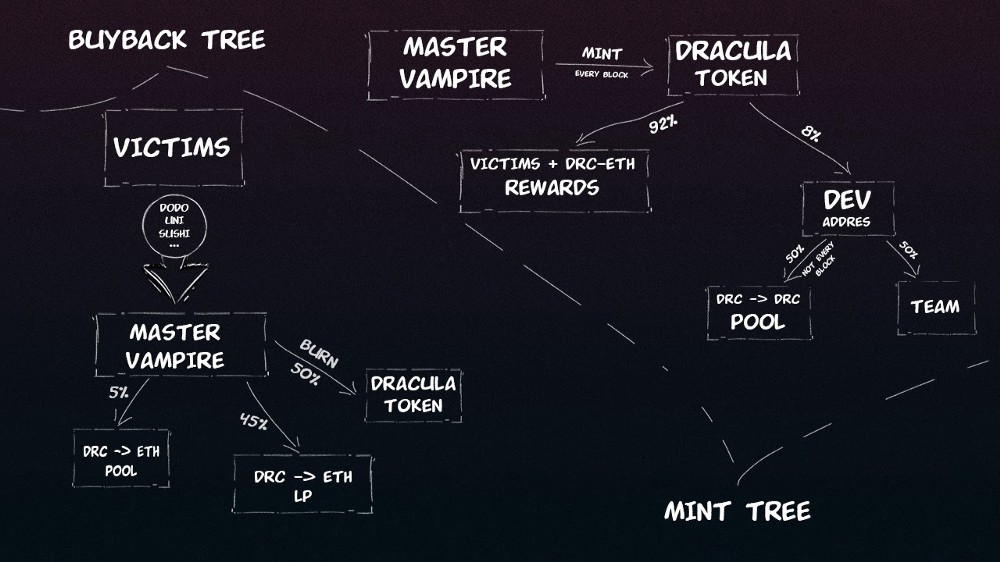

Under our new tokenomics, 50% of the WETH goes to buying and burning DRC. 45% of the WETH goes to provide liquidity for the DRC-ETH, which is locked permanently. The remaining 5% goes to fund the pool, which is how DRC stakers in this pool earn yields in ETH.

DRC-DRC Pool

DRC -> DRC utilizes mint and rewards distribution. Stakers of this pool earn 4% of the total DRC mint (50% from mint to dev address). The remaining 4% of minted DRC goes to our developer fund.

Keep in mind DRC is minted at an inflationary rate until the circulating supply reaches around 10M. Once that number is reached, the community will have to decide if the supply should be capped or increased.

Collecting Rewards

The Dracula Horde Pool (DRC -> ETH) is just a regular staking pool: When you stake there, you earn rewards in ETH over time. The pool is currently being funded in a non-linear manner due to the ‘Drain’ function, (approximately once every 12 hours), but the distribution is linear and constant due to the contract logic. Because of this, you may see some fluctuations in the amount of ETH earned.

DRC -> DRC pool is a bit different. You stake your DRC and receive a BLOOD — LP token. This pool is funded with DRC in a non-linear manner, and since you own a share of the pool (represented by the BLOOD token), your total amount of owned DRC will increase in non-linear manner as well. You also cannot ‘harvest’ — only stacking and unstaking. You ‘harvest’ your shares of DRC by unstaking from the pool. You also receive voting power with BLOOD, which will be implemented soon.

Keep in mind that 1% of your staked DRC is burned when you unstake. This mechanism is in place to prevent repetitive entry and exits to the pools and provides a layer of stability for the DRC token.

Knowledge Base

How to buy Dracula DRC:

https://telegra.ph/How-to-buy-Dracula-Protocol-DRC-from-mobile-phone-03-14

FAQ:

What is you project about?

https://telegra.ph/Dracula-Protocol-DRC-helpsheet-10-09

Why I do not see staked tokens on Uniswap?

https://telegra.ph/Why-I-do-not-see-staked-tokens-on-Uniswap-10-10

Why I cannot make a deposit?

https://telegra.ph/Why-I-cannot-stakedeposit-solved-10-10

Why price dropped from 300$ to less than 1$?

It was initial pre-launch stage with no minting and only 35 DRC in supply.

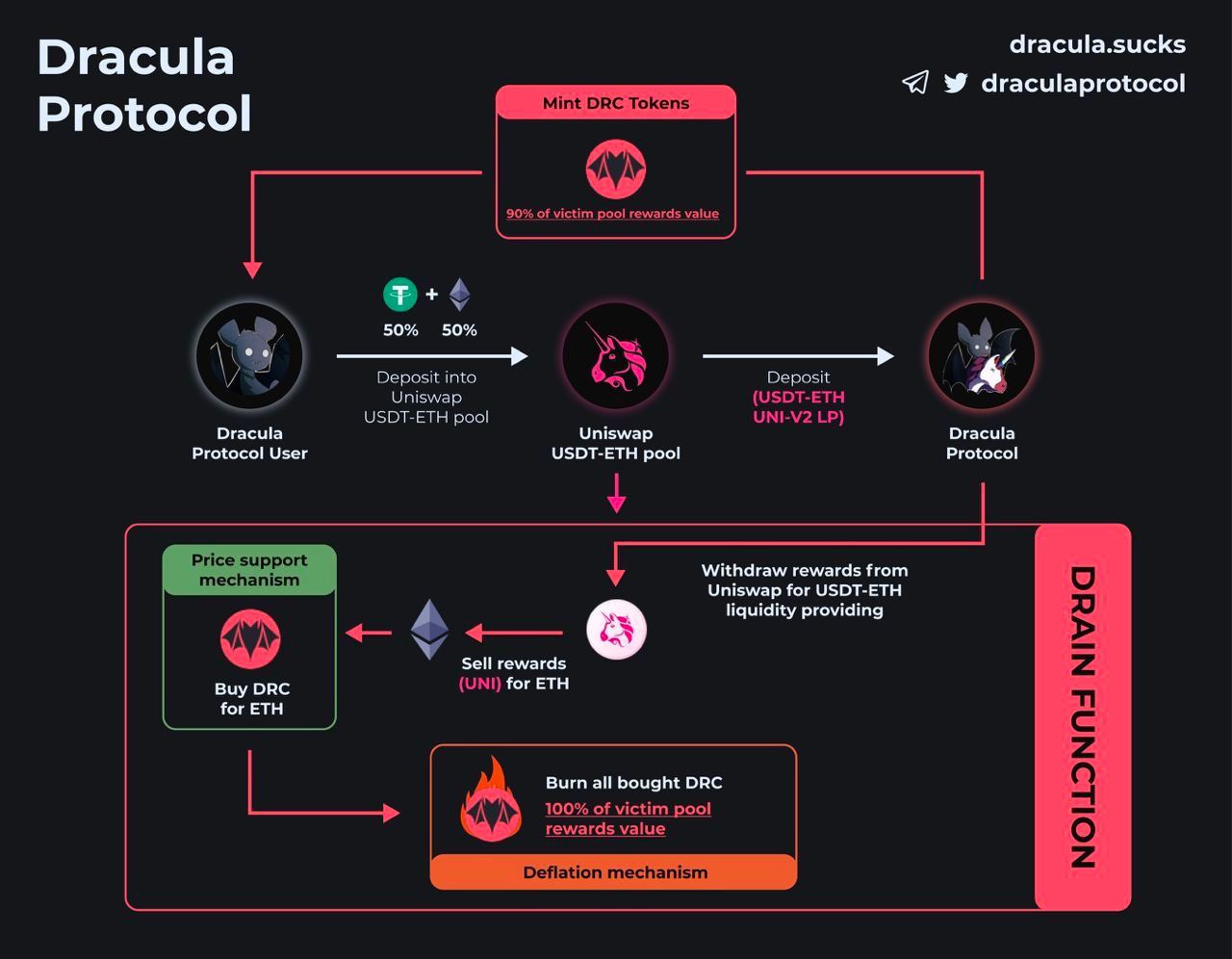

What is drain button for and how the drain works?

Here is a nice explanation with example of Sushi ETH-USDC LP token by @Summer1ce

How Drain works:

1. You stake ETH-USDC in SushiSwap TAB

2. Your tokens farm both rewards - in SushiSwap and in Dracula Protocol, but you only get rewards from Dracula Protocol when you press "Harvest"

3. When you press "Drain" - Dracula Protocol harvest your rewards in SushiSwap, than swap them for DRC (from market, on uniswap) and than burns those DRC tokens

4. From "Drain" you support DRC price and burn a little bit of supply and help ecosystem. But don't press Drain too often, because you pay gas fees.

More info regarding arbitrage/frontrun on drain function https://t.me/DraculaProtocol/6506

The value of the dracula token is like any other token, (i.e. you can buy or sell it on uniswap). The drain is a mechanism which boosts the price while curbing inflation. The drain sells all the other tokens harvested for eth, 50% of that eth is used to market buy and burn dracula tokens. 45% goes to liquidity. 5% goes to stakers.

It is a MULTI step process..

What are those 2 drain numbers for?

The first number is the amount of reward token in $ that is associated with a target pool that is ready to be drained, the second number - associated with the number of reward tokens on MasterVampire itself. And the second number is the same for every pool with the same reward token.

Rebalance weight for pools formulas used:

APY used - victim pool APY.

TVL_victim_pool * APY^0.5

TVL_victim_pool * APY^0.65

TVL_our_pool^0.3 * TVL_victim_pool^0.7 * APY^0.65

TVL_our_pool^0.6 * TVL_victim_pool^0.4 * APY^0.85

TVL_our_pool^0.65 * TVL_victim_pool^0.35 * APY^0.75

TVL_our_pool^0.65 * TVL_victim_pool^0.35 * APY^0.85

TVL_our_pool^0.65 * TVL_victim_pool^0.35 * APY^0.85

Timelock:

Contracts are protected with timelock with 24 hours delay on any action. We made some deviations from default timelock, to ensure that user funds are 100% safe and to be able to reach them even in case of emergency. Transfer ownership transaction.

https://etherscan.io/tx/0x3cfd71bb8790868af0a850f078dddf2ea5af977eea59e2099d394fc36ade9e96#eventlog

More info about Timelock https://t.me/DraculaProtocol/668

What earns more, staking DRC or staking an LP token?

Depends on what you're looking to do. If you'd like to hold another token (like sushi) but think drc will do better in the long run you could liquidity mine dracula tokens as opposed to sushi. If you're looking to just to get a large stack of dracula tokens it may make more sense just to purchase dracula tokens.

You could work out, roughly, how many tokens you could get with an APY calculator prior to liquidity mining.

https://www.coingecko.com/en/yield-farming

Or if sheckles are USD, stake them in the DRC-> DRC pool to compund. When your'e happy with your stack, move it to the DRC-> ETH pool. Earn passive ETH.

Deflation Explained

In pools like Uniswap or Sushi, the more money locked in the pools, the more your share is diluted and the less rewards you get.

Dracula, on the contrary, works in the exact opposite way; the more locked in its pools, the more rewards its receives, which translates to more $ETH being received which goes in to directly buy $DRC and reward its token holders. At the same time, a portion of these tokens are burned, reducing the total supply.

This is how Dracula creates deflation. It sounds a bit complicated, but main idea is that more TLV locked -> more rewards selling -> more DRC buybacks - more burning - WIN WIN situation. You don't have to sell rewards tokens yourself, you don't buy your main assets, you don't need to lock them in pools. You save a lot of gas by not having to claim or swap tokens, or adding liquidity to pools. Instead, you get an asset that should grow in value while the total supply of the asset is constantly decreasing. This all depends on Dracula Protocol being able to attract enough TLV in its victims pools.

Lifehack:

You can manually enter function below by connecting your wallet (need at least 1 DRC/ETH LP token), going to write contract, and selecting the "3. enter" function:

https://etherscan.io/address/0x9d722e929d96ffb318577dc37e5cd54b12ef5171#writeContract

Sushi/ETH:

Currently Dracula sells other tokens and 5% goes to stakers in the form of ETH, 45% goes to liquidity lock, and 50% goes to a burn of DRC tokens.

So if you're in Sushi / ETH and deposit tokens to Dracula your rewards, from sushi, are used to buy burn DRC, lock liquidity, and reward stakers with ETH.

It's made to attractive so you'll put your LP tokens in. You won't get sushi, and that gets sold to deflate DRC / lock liquidity/ give stakers ETH.

1 - Farm Them All

We started $DRC and Dracula Protocol as a reaction to the unfairness that occurred with Sushiswap. When Sushi entered the market, centralized exchanges and major corporations listed and supported the project, despite its lack of ingenuity or novel ideas. This support from big money resulted in vicious dumping on ordinary retail investors and eventually led to a massive price crash. Dracula Protocol was meant to combat this type of behavior; our idea was to exploit and punish whale-baked farms with a second-layer “vampire” concept.

That’s how the story has started.

I’m sure that you have heard about farming the $UNI token. By providing liquidity to one of the four pools (although you can also to all four), you receive $UNI tokens as a reward. Very simple idea.

Some people decide to keep these tokens, but many people immediately sell these tokens for a different asset. The goal is to increase the body of its main assets.

But there are several nuances: low rewards and high gas prices for transactions and swaps. These factors make it unprofitable if you do not have a large amount of capital in the pool.

Therefore, whales are the only people who are engaged in this, selling their tokens and thereby pushing the price of the reward ($UNI) down. Ordinary users watch how the price of their reward is constantly falling (take $SUSHI, for example).

That’s where Dracula comes in. Dracula Protocol aggregates on its smart contracts deposited by users LP tokens (tokens that you get for providing liquidity in @Uniswap, @SushiSwap, @Pickle, @LuaSwap, @BreederDodo) and starts to earn rewards of these victim pools. With the help of “Drain” function, activated by users, it collects these rewards and sells them on the market, than uses the received Ethereum to buy Dracula Protocol ($DRC) tokens (thus supporting DRC price), and then burns a portion of these tokens (deflation mechanism), while also distributing $DRC as reward to liquidity providers in his protocol.

Now let's talk about the advantages (without going into technical details) of Dracula over its victims. In pools like Uniswap or Sushi, the more money locked in the pools, the more your share is diluted and the less rewards you get.

Dracula, on the contrary, works in the exact opposite way; the more locked in its pools, the more rewards its receives, which translates to more $ETH being received which goes in to directly buy $DRC and reward its token holders. At the same time, a portion of these tokens are burned, reducing the total supply.

This is how @Draculaprotocol creates deflation. It sounds a bit complicated, but main idea is that more TLV locked -> more rewards selling -> more DRC buybacks - more burning - WIN WIN situation.

You don't have to sell rewards tokens yourself, you don't buy your main assets, you don't need to lock them in pools. You save a lot of gas by not having to claim or swap tokens, or adding liquidity to pools.

Instead, you get an asset that should grow in value while the total supply of the asset is constantly decreasing. This all depends on Dracula Protocol being able to attract enough TLV in its victims pools.

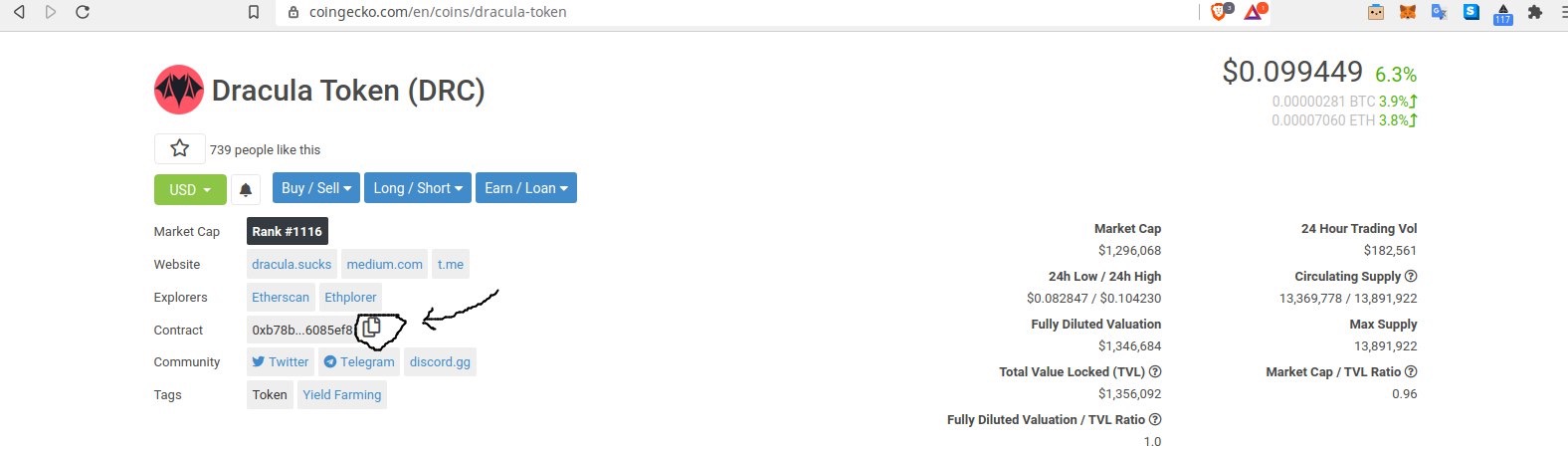

Major Info

Address contract: 0xb78b3320493a4efaa1028130c5ba26f0b6085ef8

Dracula Protocol official website: dracula.sucks dracula.finance

Github for contracts:

https://github.com/Dracula-Protocol/

Audits :

- https://github.com/valo/publications/blob/cdda80e28a9462dc1761c214f18ee247ee682a0e/Smart%20Contract%20Reviews/Dracula%20Protocol/Dracula%20Protocol%20Security%20Review.md

- https://twitter.com/valentinmihov/status/1317120493577768960

- https://t.co/iTVcCGkV88

Telegram:

Chinese Chat 中國:

https://t.me/draculaprotocolchina

Sticker-Set:

https://t.me/addstickers/draculasucks

Twitter:

https://twitter.com/DraculaProtocol

Victims: https://dracula.sucks/victims

DeFi Lama TVL

https://defillama.com/protocol/dracula

Uniswap DRC/ETH:

https://uniswap.info/pair/0x276E62C70e0B540262491199Bc1206087f523AF6

Charts: https://www.dextools.io/app/uniswap/pair-explorer/0x276E62C70e0B540262491199Bc1206087f523AF6

Livewatch:

https://www.livecoinwatch.com/price/DraculaProtocol-DRC

Coingecko:

https://www.coingecko.com/en/coins/dracula-token

Dapp Radar:

https://dappradar.com/ethereum/defi/dracula-protocol

BlockFolio:

https://blockfolio.com/coin/DRC_2

СoinMarketCap:

https://coinmarketcap.com/currencies/dracula-token/ratings/

Links:

https://telegra.ph/Dracula-Protocol-Links-03-22

How to buy Dracula Protocol $DRC from mobile phone:

Step 1. Download MetaMask Wallet on your smart phone and/on your desktop and follow instructions to either set up a new wallet or import an existing wallet using your 12 word recovery seed phrase.

(If you import an existing wallet that holds ETH or almost any ERC-20 token, skip to step 3)

Step 2. Once you’ve set up a new wallet in MetaMask, click on ETH and select Receive, copy your ETH wallet address (begins with 0x) and paste it when prompted by the wallet you are sending ETH or an ERC-20 token from.

After verifying the address you are sending to is your MetaMask wallet address, accept all fees necessary to send the transaction.

(If you have insufficient funds, that’s an Ethereum problem, you need more ETH in the wallet you are trying to send from)

Step 3. Go to https://app.uniswap.org/#/swap and click Connect Wallet, then click WalletConnect, then click MetaMask.

Accept all prompts/requests to move forward.

Step 4. Now that your MetaMask Wallet is connected to Uniswap, you want to swap from ETH or your ERC-20 to Dracula Token DRC.

(Best way to guarantee it’s the correct DRC is to go to CoinGecko and search for Dracula Protocol. Click on it. Copy the Contract Address (Token Address) and paste it in Uniswap where you would normally type in “DRC”)

Step 5. Make sure you save enough ETH for transaction fees if swapping from ETH. If swapping from a different token, you will need around $40-100 worth of ETH for the transaction fee. It’s a good idea to send a couple hundred dollars worth of ETH to your MetaMask in case you plan on doing multiple swaps. It always sucks when you go to make a swap but then you don’t have enough ETH in your wallet to cover transaction fees.

Approve token if asked or just go ahead and click Swap. Accept the following prompt asking to confirm transaction and any fees necessary.

Step 6. Once you confirm the swap, your DRC is on its way. Give it a couple minutes and you should see your Dracula Token appear in your MetaMask.

If it doesn’t show up after 5 minutes, you’ll need to Add a Custom Token to MetaMask. Paste the Dracula Protocol DRC Contract/Token Address (0xb78b3320493a4efaa1028130c5ba26f0b6085ef8) from CoinGecko, and it will automatically fill in the other 2 fields.