Dominant Strategy

🛑 👉🏻👉🏻👉🏻 INFORMATION AVAILABLE CLICK HERE👈🏻👈🏻👈🏻

An outcome where one player has superior tactics regardless of the other players

The dominant strategy in game theory refers to a situation where one player has superior tactics regardless of how their opponent may play. Holding all factors constant, that player enjoys an upper hand in the game over the opposition. It means, regardless of the strategies employed by the opponent, the dominant player will always dictate the outcome.

In game theory, players employ different independent strategies to optimize their decision-making with the goal of beating the opponent. Players in an oligopolistic marketOligopolistic MarketThe primary idea behind an oligopolistic market (an oligopoly) is that a few companies rule over many in a particular market or industry,, military, managers, consumers, or games like the chase, often use game theory as a strategic tool.

In game theory, the outcomes of the actors are different depending on their actions. Some players enjoy an upper hand, while others are less fortunate. The dominant strategy describes a state where one of the players has a superior tactic that always leads to a winning outcome, despite the opponent’s employed choice of strategy.

In game theoryGame TheoryGame theory is a mathematical framework developed to address problems with conflicting or cooperating parties who are able to make rational decisions.The, the following are the outcomes players can expect:

In some situations, one player enjoys a strict advantage over their opponent. It means that, no matter how good the losing party’s tactic is, the dominant strategy will always prevail. Here, there is no other possible strategy the opponent can use to alter their odds.

In a weakly dominant outcome, the dominant player dominates the game but against some strategies, only weakly dominates.

In an equivalent outcome, none of the actors benefit or lose against each other. They each choose the one optimal result that is fair for both players. In case one of the players selects the alternative, it would mean an outlandish gain or loss.

In an intransitive outcome, none of the above three outcomes are experienced – no equivalent, strictly, or weak dominant outcome results. The available outcome happens by chance. Either player can win, while the other loses depending on the strategy employed. Therefore, in this outcome, there is no well-defined approach to point to the dominance strategy.

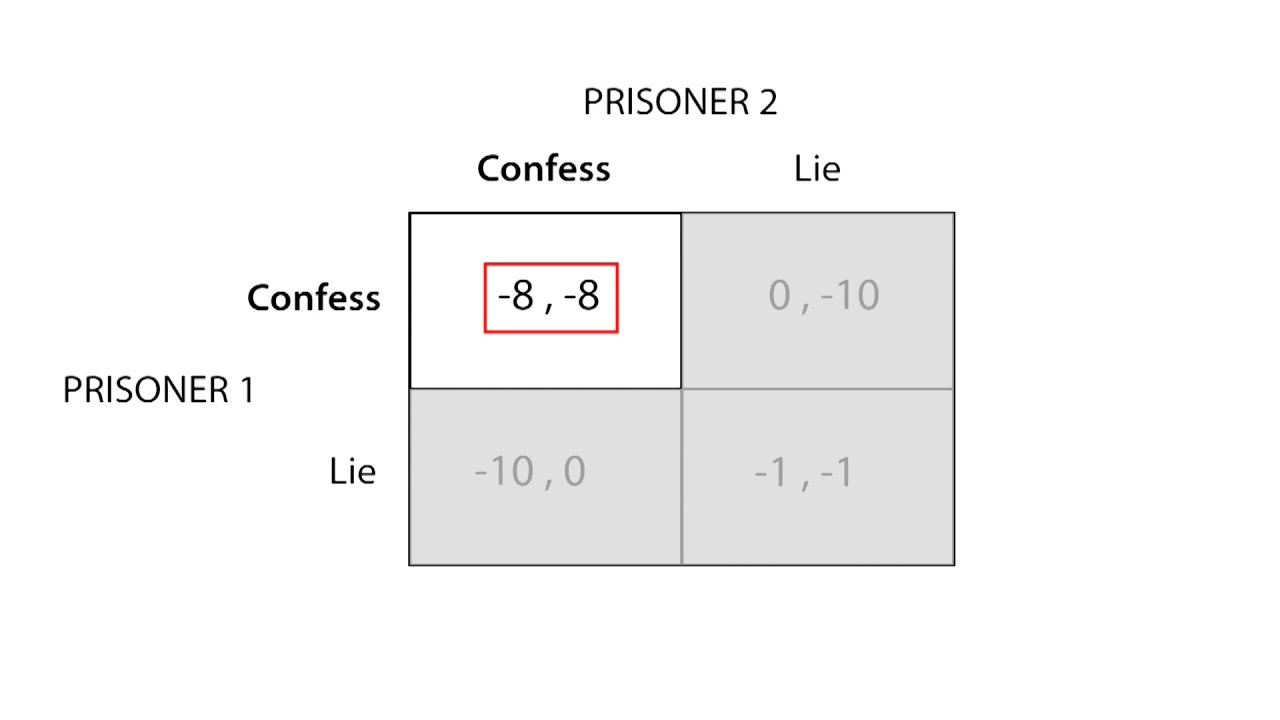

The prisoner’s dilemmaPrisoner's DilemmaA prisoner’s dilemma is a decision-making and game theory paradox developed by mathematicians M. Flood and M. Dresher in 1950. is a well-known example used to depict the predicament of two criminals, A and B, when facing persecution – i.e., car theft. During the trials, the prosecutor believes the two suspects might have committed an earlier crime but were not convicted – i.e., burglary. Since there is no hard evidence, the DA employs game theory to force a confession out of the two. They are offered a deal to rat each other out. The following are the terms:

The above information can be plotted in a payoff matrix as below:

The above example represents an equivalent outcome. This is because the dominant strategy for Suspect A and Suspect B will be to confess. Either suspect will always have a dilemma to choose between three years versus seven years and one year versus two years.

In case they committed the burglary, the only rational option available would be to choose the confession strategy. Neither will want to gamble with the loyalty of the other. This is because the alternative is worse – seven years versus a one-year jail term. They will both likely opt for a confession, and this stalemate situation is referred to as the Nash EquilibriumNash EquilibriumNash Equilibrium is a game theory concept that determines the optimal solution in a non-cooperative game in which each player lacks any.

The Nash Equilibrium was introduced by American mathematician John Forbes Nash, Jr. in 1950 and was republished in 1952. It refers to an optimal state where the game is considered stable, and no actor has an incentive to change from their chosen strategy, taking all factors constant.

Players in this outcome must consider the affairs of the other. The alternative leaves either of the players in a lesser preferred state. In the prisoner’s dilemma example above, it is the first quadrant where both suspects get an optimal offer of a three-year jail term.

CFI is the official provider of the Commercial Banking & Credit Analyst (CBCA)®CBCA® CertificationThe Commercial Banking & Credit Analyst (CBCA)™ accreditation is a global standard for credit analysts that covers finance, accounting, credit analysis, cash flow analysis, covenant modeling, loan repayments, and more. certification program, designed to transform anyone into a world-class financial analyst.

To keep learning and developing your knowledge of financial analysis, we highly recommend the additional resources below:

Become a certified Financial Modeling and Valuation Analyst (FMVA)®FMVA® CertificationJoin 850,000+ students who work for companies like Amazon, J.P. Morgan, and Ferrari by completing CFI’s online financial modeling classes and training program!

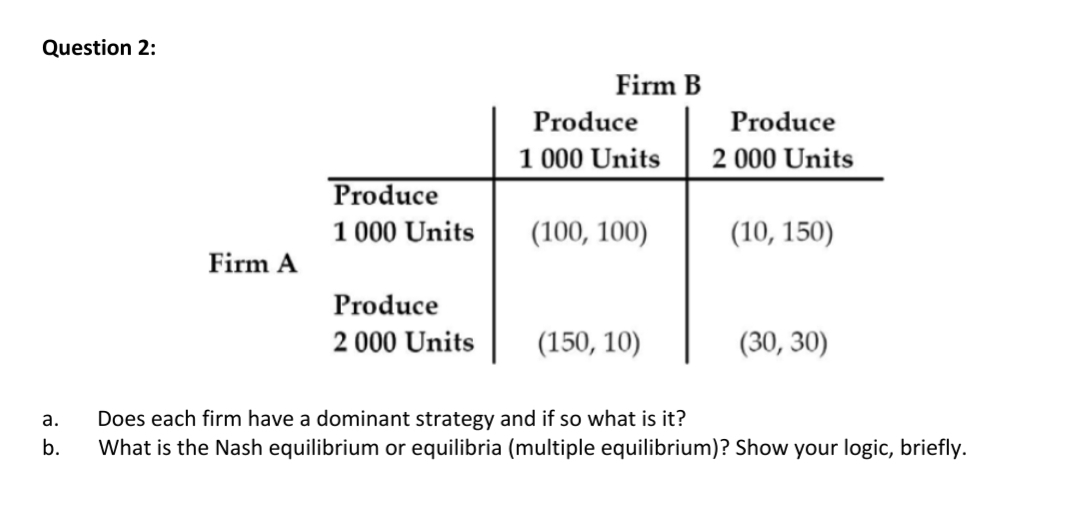

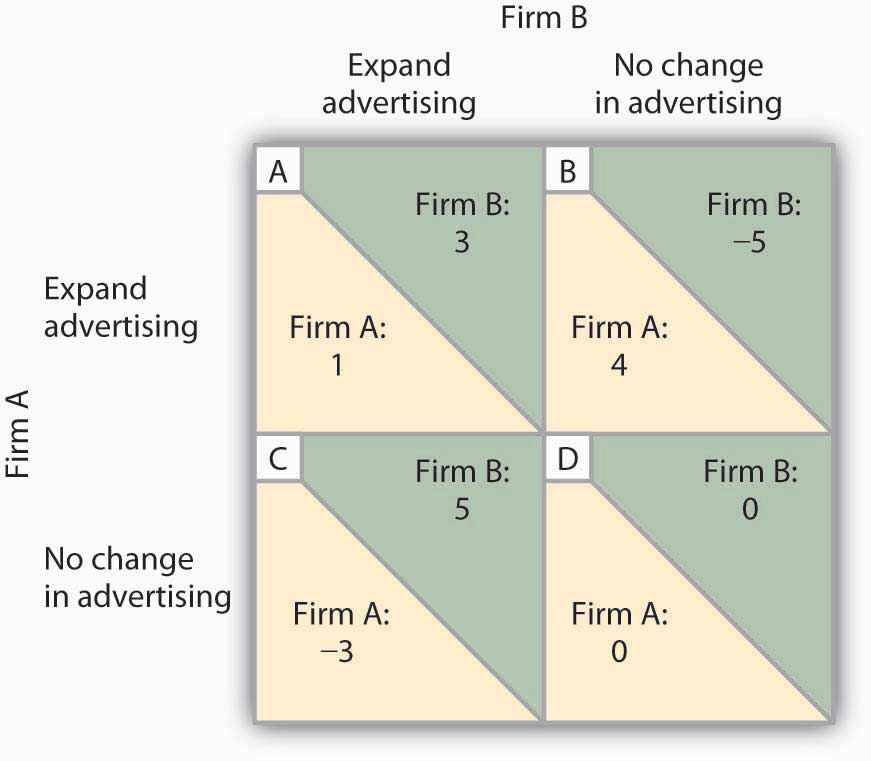

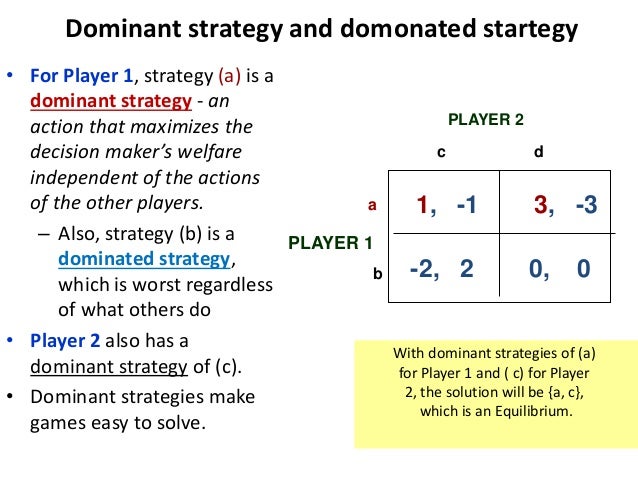

In game theory, a dominant strategy is the course of action that results in the highest payoff for a player regardless of what the other player does.

Not all players in all games have dominant strategies; but when they do, they can blindly follow them. It is because a dominant strategy is the optimal strategy unconditionally i.e. there is no dependence on the strategy the other player choses.

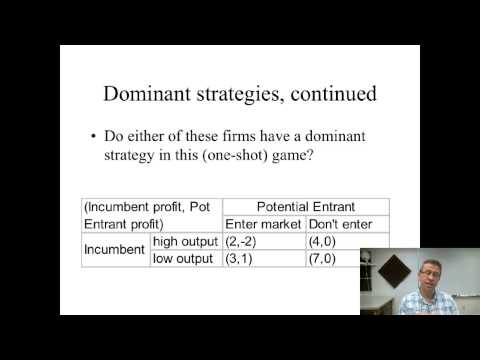

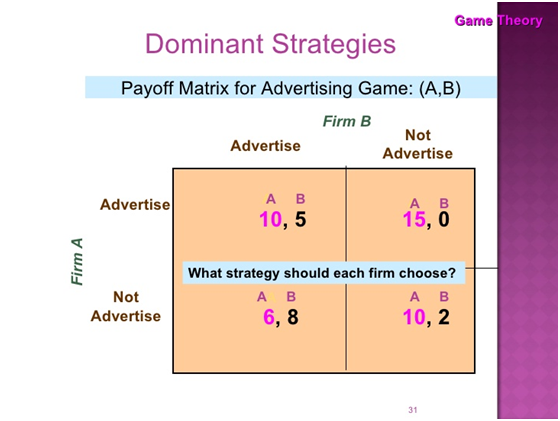

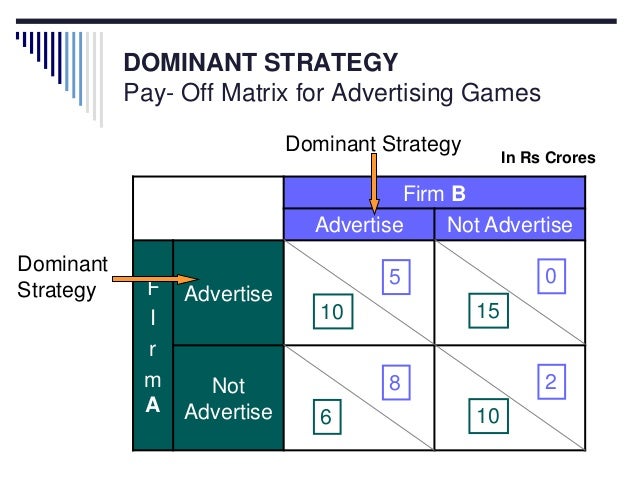

The following payoff matrix lays out the game:

The strategies of Firm A are listed in rows and those of Firm B are listed in columns. The payoffs to the left of the comma (in red color) belong to Firm A and those in blue to the right accrue to Firm B.

Hiring a lawyer is a dominant strategy for Firm A because if Firm B hires a lawyer, it is better to hire a lawyer and get $45 million instead of not hiring and getting only $25 million. If Firm B doesn’t hire a lawyer, it is better for Firm A to hire a lawyer and get $70 million instead of only $25 million.

Using the steps above, we can find out that hiring a lawyer is also a dominant strategy for Firm B.

by Obaidullah Jan, ACA, CFA and last modified on Mar 11, 2019

Studying for CFA® Program? Access notes and question bank for CFA® Level 1 authored by me at AlphaBetaPrep.com

XPLAIND.com is a free educational website; of students, by students, and for students. You are welcome to learn a range of topics from accounting, economics, finance and more. We hope you like the work that has been done, and if you have any suggestions, your feedback is highly valuable. Let's connect!

Cfnm Handjob

Casting Doggystyle

Milf Sex Pic

Dee Bukkake

Black Dick Com

Dominant Strategy - Overview, Outcomes, Examples

Dominant Strategy | Definition | Example

Dominant strategy - Dominant Investment home

Dominant Strategy in Game Theory: Definition & Examples ...

Strategic Dominance: A Guide to Dominant and Dominated ...

Dominant Strategy - Game Theory .net

Strategic dominance - Wikipedia

Dominant Strategy