Do I Pay Tax On Spread Betting

🛑 ALL INFORMATION CLICK HERE 👈🏻👈🏻👈🏻

Do I Pay Tax On Spread Betting

Tools

Contact •

Archives •

Best Of •

About •

by Guest Author

on February 9, 2012

1

gadgetmind

February 9, 2012, 11:36 am

3

The Investor

February 9, 2012, 12:42 pm

6

gadgetmind

February 9, 2012, 2:17 pm

7

The Investor

February 9, 2012, 2:24 pm

10

ermine

February 9, 2012, 2:53 pm

11

The Investor

February 9, 2012, 3:43 pm

13

The Investor

February 9, 2012, 6:56 pm

14

gadgetmind

February 9, 2012, 6:59 pm

15

ermine

February 9, 2012, 7:56 pm

16

The Accumulator

February 9, 2012, 9:10 pm

17

ermine

February 9, 2012, 11:57 pm

18

The Investor

February 10, 2012, 1:37 pm

19

ermine

February 10, 2012, 10:04 pm

21

The Investor

February 11, 2012, 2:13 am

22

The Accumulator

February 11, 2012, 9:25 am

23

The Investor

February 11, 2012, 9:53 am

25

The Investor

March 29, 2017, 9:18 pm

This is guest post on spread betting tax avoidance strategies from Andy Richardson of the Financial Spread Betting website .

B efore you find yourself packing your bags for an extended stay at Her Majesty’s pleasure, let us remind ourselves that tax avoidance (arranging your affairs so as to pay no more tax than is necessary) is legal whereas tax evasion (failing to pay tax that you actually owe) is definitely illegal.

Some people have argued that tax avoidance is a moral duty . And of course some tax avoidance schemes are state-sponsored – think about National Savings, Individual Savings Accounts (ISAs), and pensions.

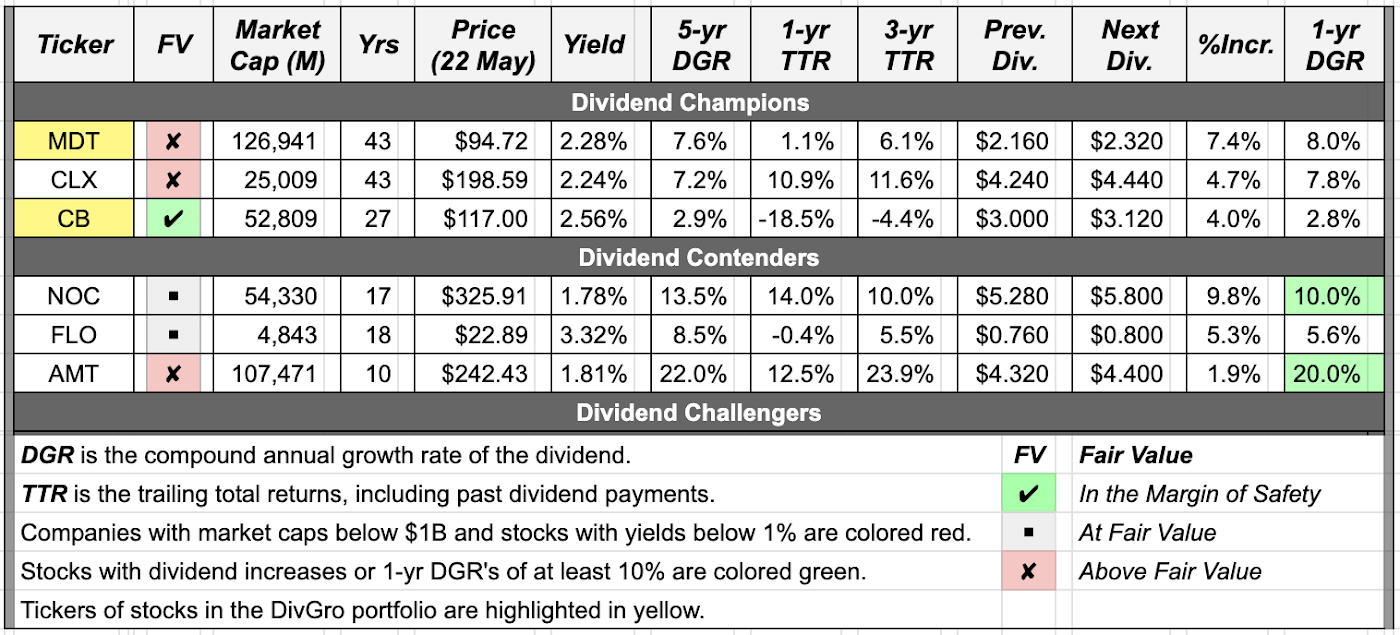

If we treat tax avoidance as a legitimate pursuit (and you can make your own mind up about that) then how might spread betting be used as a vehicle for minimising tax liability – specifically avoiding capital gains tax (CGT) liability?

Let’s think about why spread betting is tax-free in the first place.

The fact that spread betting proceeds are (usually) free from income tax and capital gains tax seems to rest on the fact that for most participants it is classed as gambling rather than investment.

(Editor’s note: How long this will last after the arrival of the potentially more mass-market Halifax Spread Trading service, we’ll have to see!)

With spread betting, you don’t invest in companies by buying shares. You merely make a bet with a bookmaker on whether you think a company’s share price will go up or down. The bookmakers (i.e. the spread betting companies) pay tax on their profits, but you don’t pay tax on your winnings.

So suppose the HMRC did make spread betting proceeds subject to tax. What do you think would happen?

It is said that HMRC would then have to let you offset your spread betting losses against other investment gains, which would be a net loser for the Exchequer because – as we all know – there are substantially more losers than winners in the spread betting game.

But measures can be taken to make spread betting safer.

The logical conclusion of this article is that it may be possible to run a tax-free spread betting portfolio as an alternative to a traditional investment portfolio. But this doesn’t help anyone facing a potential CGT bill due to crystallising a profit in their existing portfolio.

So let’s consider that first, after a quick reminder from Monevator ‘s editor.

Wealth warning: While this article explains more sensible ways to spread bet, doing so is still more risky than buying traditional shares with cash – especially if you get your sums wrong! Spread betting on margin can rack up big losses quickly, and you can lose more money than you thought you were risking. This article is aimed at experienced traders and investors . We take no responsibility for your losses in any circumstances.

One of the features of spread betting is that it is just as easy to take a short position (i.e. bet on a falling price) as it is to take a long position.

This raises the possibility of offsetting an existing position – perhaps in a share you own in the traditional way, or even in a company Sharesave scheme – with a spread bet that neutralises any future fall in price, without you having to trigger a CGT liability by crystallising the profit in your initial portfolio.

Suppose you were lucky enough to ten-bag your shareholding in Penny Stock Corporation (not a real company!) so that your £10,000 investment has become £100,000. With the price so toppy, you want to take your money and run, without having to hand over a proportion of it to Her Majesty’s Revenue and Customs in the form of capital gains tax.

Rather than selling the shares, you might place an equivalent opposing ‘short’ spread bet on the same stock, to the effect that any subsequent fall in your traditional long position is offset exactly by the tax-free rise in the value of your short spread bet.

To help you get your head around this, let’s say Penny Stock Corporation is now priced at 1,000p-per-share (the company is no longer a ‘penny stock’ but at the time you bought it – before it ten-bagged – it was!).

1. A £100-per-point short spread bet should therefore exactly offset your ongoing £100,000 investment.

2. To effectively ‘insure’ the value of your investment in this way, the spread betting company will ask you to deposit a much smaller sum than £100,000 – but obviously you do need some spare cash with which to place the bet.

3. When the tax implications become more favourable, you can close all or part of your traditional long position and the matching short spread bet, so as to release your gains tax-free.

There are some other variations on this ‘ hedging ‘ theme, like closing a position in your traditional portfolio to fully utilise your annual CGT allowance at the end of the tax year, while at the same time taking out an equivalent long spread bet to ‘keep you in position’ tax-free until such time (after 30 days, according to the HMRC rules) that you can legitimately re-establish your original share holding.

You might even want to crystallise a loss in your traditional portfolio to offset another CGT gain, but to stay ‘in position’ via a spread bet in the same company, just in case the price of the loss-making share recovers.

So much for minimising CGT events in your traditional portfolio – do you actually need a traditional portfolio?

There is little that is fundamentally different about holding equity positions in a spread betting account and holding shares in a traditional brokerage account.

Which begs the question: why bother with a traditional brokerage account when you could run your ‘investment’ portfolio in a spread betting account, tax-free?

For smaller accounts, this could make perfect sense, because a trader or investor with limited funds can get more bang for his trading buck due to the leveraged nature of spread betting.

You may be able to take a £10,000-equivalent position with a margin deposit of only £2,000, providing you have the balance held elsewhere (in case the spread betting company demands it) or providing you have a very tight risk-management policies using stop orders to limit your potential downside.

For larger account holders, it may not be so easy or advisable to squirrel away a substantial proportion of net worth in a spread betting account.

Still, it could provide a good home for surplus funds beyond the annual ISA and Self-Invested Personal Pension contribution limits, especially if your portfolio that you have sitting outside of these tax shelters seems likely to run up against the capital gains tax-free allowance any time soon.

Whereas you pay a one-off dealing fee (plus stamp duty reserve tax) to open a traditional share holding position, a rolling spread bet incurs ongoing financing charges that are levied by the spread betting company in exchange for it ramping up your position size through leverage.

Therefore, your rolling spread bet positions are not so much owned as mortgaged .

For a long spread betting position held overnight, you will normally be charged financing at LIBOR (currently 0.5%) plus 2.5%.

i.e. At (0.5%.+ 2.5%)/365 days, you’d pay 0.008% for each day you held the position.

Of course, in the present low interest rate environment – with many companies trading at what some think are historically low valuations that could multi-bag in short order – the financing charges could pay for themselves. It’s your call.

(Editor’s note: If you do not want to use leverage, but simply want the tax free benefits of spread betting, you can offset some or all of the financing charges by holding an equivalent cash balance in a high interest savings account. Whether it’s possible to match your costs with interest earned (after tax) will depend on prevailing interest rates at the time. Remember you’ll also need access to ready cash to meet any margins calls).

What about dividends? Well, although you receive dividend-equivalent adjustments on spread bets sooner than on traditional share holdings (i.e. at the ex-dividend date rather than a later payment date) those dividend adjustments are typically 80%-90% of the actual dividend. (For more on this, see the advantages and disadvantages article on my website).

Finally, spread bet positions in individual equities bestow no voting rights or other benefits upon the holders of those positions, unlike share holdings.

Remember: You don’t actually own the shares. You’ve simply made a bet with a bookmaker as to whether they will go up or down in price.

Many investors don’t buy individual shares at all, of course. They rely instead on index-tracking funds or exchange traded funds (ETFs) to simply follow the market up and down.

Spread betting may provide a more efficient way of doing this, because I’d argue that a spread bet on a stock index is far more transparent than the tracking errors and Total Expense Ratios (TER) associated with traditional index funds.

If the underlying index rises, your index spread bet position will rise by exactly the same amount, and likewise if it falls. There’s no obfuscated tracking error or TER to worry about – just the simple bid-ask spread and the ongoing cost of financing your position.

In addition – and perhaps more importantly – tracking overseas markets or shares via spread betting eliminates currency risk . All your positions will be quoted in pounds sterling, as will your profits and losses.

Let’s suppose you’re trading the crude oil contract, which trades in USA dollars.

You opt to buy, staking £1 a point. If oil then rises 400 cents to $104, your profit is 400 times £1 or £400.

If you had bought a USA crude oil futures contract or an ETF, by contrast, your trade and profits would have been in USA dollars. So, if the dollar went down by 5% against the pound during your trade, your profit on oil would have transformed into a loss!

You will find a very wide range of domestic and international indices that you can spread bet, and best of all, the proceeds from this form of index tracking are currently CGT-free!

Disclaimer: Due to the nature of this article it is important that we include a specific disclaimer. The author of this article is not a tax advisor or investment advisor, therefore you should treat the information given here as for educational purposes only and seek independent professional advice on matters of tax planning and investment.

Thanks for reading! Monevator is a simply spiffing blog about making, saving, and investing money. Please do check out some of the best articles or follow our posts via Facebook, Twitter, email or RSS.

Receive my articles for free in your inbox. Type your email and press submit:

Just one warning for those who might be tempted to do this for a sharesave scheme: most listed companies will have an employee share dealing policy, and most of these that I’ve seen specifically prohibit employees from taking short positions on the company’s shares.

Excuse my naivety…but is spread betting effectively trading for the average joe?

@MCF — Not exactly, but sort of. Have a read of my piece on Halifax’s new spread betting service , which explains spread betting in more detail. I think people should stay away from it if they’re anything other than experienced active investors, personally, but for those who are, it has some interesting uses.

@gadgetmind — Interesting, thanks for sharing that nugget. I guess in those circumstances you might short a proxy (e.g. work for Glaxo, so short Astrazeneca) but that is far from ideal as it still leaves you with company risk (which probably coincides neatly with ‘losing your job’ risk! ).

I started spread betting at the beginning of 2012 and have doubled my initial deposit in the last month. I only spreadbet the FTSE100 and only for £1 or £2 per point. By using trailing stop losses I never lose too much on a bet and it allows the winners to run.

I don’t understand why I’ve not been doing this for longer.

Every week I withdraw any cash above my starting deposit to ensure I don’t get too cocky and up my bets. In this way I’m relatively protected from losing cash previously won.

I read up about it a lot before opening an account (mainly on http://www.financial-spread-betting.com ) and started with a demo account.

I’d recommend it to anyone who has the time to spare to keep an eye on it as things can move very quickly.

> and most of these that I’ve seen specifically prohibit employees from taking short positions on the company’s shares.

I have read this in the case of the company I work for (this is a FTSE100 but not a financial company). Although there appears to be a general prohibition on holding positions in competitors there seem to be no anti-shorting rules. The prohibition on competitors is bizarre as both index funds in the firm’s pension AVCs include a FTSE100 component which by definition includes the competition

@ermine – Interesting. Is there also no prohibition on taking short-term (sub six month?) positions? I collected a few such policies to try and get ours relaxed, and maybe it’s time for another go!

@JC — Do you use guaranteed stops? Watch out for ‘gapping’ down if not. Spreadbetting does indeed look easy in a rising market like we’ve seen so far this year, in my experience. Free money! Bit tougher when things get rough. Chasing positions down and/or losing money to noise and volatility as you’re repeatedly stopped out are two things to watch out for, in addition to your sensible precautions you’ve outlined.

I personally doubt there’s much skill element in short-term bets on the FTSE (so anyone’s results will be random, minus costs) but good luck to you if you’re an exception.

I don’t use guaranteed stops but I’ve not had any issue with them so far.

I’d say I’m only slightly biased towards taking long positions over short so the relative trend in the market only helps slightly.

My positions rarely stay open for longer than a few hours and I usually make around £20 per bet, but I make about 5 a day. So far this week every single position has been profitable.

I’ve found a system that seems to work for me and I’ve stuck to it. I think discipline is the key for new starters as there’s nothing more tempting than moving your stop when the market doesn’t go your way and hoping it pulls back later. All this leads to is sleepless nights IMO.

I agree that there isn’t too much skill in opening short term bets on the FTSE but I think the skill lies in closing positions at the right time and routinely taking a profit.

@gadgetmind I’ve looked on the general conduct rules and in the sharesave documentation. However, these are all over the intranet so there’s no one point. It is hard to prove a negative, but armed with your comments I have looked in the places I would expect to find this. It is probably worth noting that I am a lowly grunt rather than senior manager, different rules apply to them being in charge of SP sensitive information, which is not available to me.

If you do not want to use leverage, but simply want the tax free benefits of spread betting, you can offset some or all of the financing charges by holding an equivalent cash balance in a high interest savings account.

I had never thought of it this way, I lodged about half the value of the stake with IG. Maybe time to try and win some interest on the cash

@JC > By using trailing stop losses I never lose too much on a bet and it allows the winners to run.

You will get slaughtered in points of significant change (eg if Grexit happens).

You are betting on a model of the market, ie there is no independent arbiter of short-term fluctuations and spikes. I got hammered in an earlier attempt until someone warmed me up to the fact that price spikes on the betting platform may be larger than IRL on the index. As a result I only execute trades manually when I can see what is going on, and trade at limit, so that it does what I tell it to do, or not at all. There be dragons in spreadbetting, there is more to stoplosses than there seems. Short-term volatility seems much higher than the real marekt, and is worse at times of volatility. One could almost imagine this is designed to profit from mugs like me that initially thought I was dealing with an accurate represenation of the market, it is on the hourly scale, but not on the tick by tick scale IMO…

what I meant was times of market turmoil. ie high volatility

@JC — Hate to be a damp squib, but in my opinion you’re picking up pennies in front of steamroller, or at best a sit-on lawnmower in light of your stop loss protection and small bets.

There are plenty of high-frequency hedge funds who spend millions of dollars renting server space as close to the LSE/NYSE as possible in order to arbitrage away tiny discrepancies in the prices of various securities on a micro-second by micro-second basis. They employ banks of quants at $150K a pop to crunch vast volumes of data to look for these anomalies. If you think that sitting at your PC taking punts on the utterly random move of the tape via a spread betting account is an alternative winning strategy, on the basis of a month’s bets, then please do give them a ring.

If it works for you, good luck to you, I’ve got nothing against anyone making money, but it’s just luck.

Don’t get me wrong, I’ve sat in front of IG Index and I know the thrill of tiny bets that go up or down. I did a little spurt of it after selling out of a business a few years ago, and finding myself at a loose end. If you treat it like horse racing, where you expect to lose money but find it fun, fair enough.

While this page is about using spread betting for investing, it may be possible to devise pure short-term trading strategies that exploit the inefficiencies in spread betting systems Ermine alludes to in order to profit. Indeed, I have a friend who has quit his job in financial services to try to devise such a robot-driven ‘black box’. He’s not punting on the index over an hour or two, either.

Sorry if this sound blunt, and please don’t take it personally, but I think this sort of random punting is one reason why 80% of spreadbetters lose money (the other is leverage), and I don’t want anyone reading this page — which was written with alternative, prudent strategies in mind — to take away what in my opinion would be a damaging message from a visit to Monevator.

Very fair assessment. I do treat it as gambling and my deposit was considered gone when it hit my SB account and any “winnings” since then have been diverted into my version of the “Slow and Steady Passive Portfolio”.

I do find that spreadbetting keeps me busy and stops me from meddling with my other investments. In a way it serves as the “fun” part of my portfolio allowing the rest of my money to work in peace free from my idle hands!

One more thing though; I have heard of a few people successfully using SB to hedge against currency movements ahead of a holiday to lock in a good exchange rate.

@JC — Ah, fair enough. I’ve nothing against a bit of meddling with fun money to ensure the ‘real’ money is left well alone, especially if (as in my case) it fuels a passion for investing that means I save far, far in excess of what I otherwise would.

(In my case the meddling is active investing in shares, trusts, and so on, and so far it’s not been a demerit on my net worth, but I won’t take that as proof it was the right thing to do until the final tally. Even then I read the other day you need to follow an active investor for 140 years or similar before you can say for sure whether the results were skill or luck!)

I’m another person who is 95% solid and sensible with 5% aside for “themes” aka stuff that will either crash and burn or be the next Apple. I once got lucky with one of these, and I do so wish I’d done it in a SIPP or ISA!

> you need to follow an active investor for 140 years or similar

would logic not indicate you have to follow passive investing for the same period of time? In particular the shift of large amounts of ‘dumb’ money towards a relatively narrow index such as the FTSE100 may begin to cause distortions that may challenge the original premise, which would require time to work its way through.

I’m not arguing one side of the passive/active debate, merely requiring the gander to get the same sauce as the goose It is possible that this is a Rumsfeldian known unknown at this stage

No, because passive investing isn’t trying to beat the market. You’re just picking up the beta not claiming you can generate alpha.

> No, because passive investing isn’t trying to beat the market.

but does it not change the stats? Not one iota? it is in the FTSE100 that I have the greatest fear that this distorts the results?

@ermine — I sometimes wonder if/how trackers could stop delivering, on the grounds that all good ideas in finance do eventually.

However the fact remains that the market consists of all the players in it, buying and selling against each other. The net result of these trades (winners versus losers) is a zero sum game.

Take out costs (fees and transaction costs) and net active funds will lose to the market.

To say they won’t work, as far as I can see, is to say that somehow you’ve found a strategy putting you in the winning camp, versus the losing camp. You might have, but that’s just the old active versus passive argument.

They definitely do have a distorting impact on markets, but because they really just amplify the effects of other traders (some of whom will be anticipating these moves, and some who will be losing because of such anticipation) that should net out, too, no?

Don’t get me wrong, as you know I run a big chunk of my money actively, despite the arguments above and the main thesis of this site. But I do it with some humility, knowing the weight of evidence is against me and that at least partly ego and excitement is leading me down that dark path.

> To say they won’t work, as far as I can see, is to say that somehow you’ve found a strategy putting you in the winning camp

Not necessarily My main concern is the FTSE100. For most people, that _is_ the UK stockmarket, it’s what they hear about on the news. And yet it’s nastily undiversified, it was heavy financials a while ago, it’s now oily and mining. It’s just too small. Combine that with the mass of unthinking money piling into it via index-tracking and I think it could start to distort this particular index.

The UK has this issue in particular IMO. The S&P500 is a bigger slice of a bigger economy. If you track the Zimbabwe stockmarket, there may only be three firms in it, but very few people will be tracking it so their money won’t distort the relevant SP too much.

In my ISA I specifically target the FTAS to try and dilute that, using the HSBC fund that The Accumulator listed somewhere here. BTW I’m damned if I can find it here again, that list of index funds was dead useful, and would be a good link in Passive investing. With the best will in the world all the people that target the FTSE100 will skew the constituents’ SP. I fear FTSE100 index investing in the UK market is lining up for a long-term fall because our market is too small and too concentrated. For instance I am forced to overweight the FTSE100 in my largest holding in my pension, as even the global fund I use is 50% FTSE100 weighted.

So I’m really not raking out the active/passive issue. I’m banging on about the particular case of the UK, and the overweighted passive money going into the FTSE100 distorting that UK index. It already makes a bit of a notch in the SP for firms that go into or drop out of the top 100, and that doesn’t feel healthy to me at all. In my FTAS tracker that’s okay, the notch in the entrants presumably gets cancelled by the opposite effect for the firms that get the boot from the FTSE100. Passive investing into the S&P500 is a no-brainer in comparison, indeed index investing in the US seems an altogether more healthy occupation than here…

So no great disagreement on the general principles, mainly a niggle about the healthiness of index investing into the UK’s most popular index.

A little off topic, but does anyone have a recommendation for a good site that has data on index P/E ratios, e.g. is there somehere that aggregates all this and presents it in a usable way? I’ve not found a good ‘one-stop-shop’ for this yet but am sure it exists and that readers will have found it…

@Ben — I have access to proprietary data, but for freely available index/country P/Es the FT’s market data section is pretty good:

Scroll down to Data Archive, and then select what you need (hopefully!) Have a good hunt as from memory not all the data is intuitively labelled.

@ Ermine – check this out: http://www.cbsnews.com/8301-505123_162-37743761/if-everyone-indexed—a-fantasy/?tag=mncol;lst;9

You can always rely on active investors to pounce on mispricing and then the ‘dumb money’ would follow.

@ Ben – I’ve never found anything definitive, but if you use Morningstar’s free portfolio tracking tool, and stick in a fund, then go to the fundamental tab, they will give you a p/e ratio.

@ermine — Fair enough… In your original comments up the thread you spoke about having to wait 140 years to see if passive investing proved a winner. That’s what I’m extrapolating off. I think what you’re questioning here, as you’ve now made clear, is the wisdom of following the FTSE 100 as your chosen index. I’d agree that while I think it’s a good start, eventually as their pot grows any investor should diversify with other trackers / assets / wider indices.

That said, you *are* still making an active choice. You are saying (/judging) the UK stock market has to an extent (and by an ‘invisible hand’ of course! ) over-promoted a certain cohort of some companies at times, and under-promoted other sorts of companies at other times. To even make that judgement, one could argue, you are applying a passive filter.

I’ll lend your argument a hand and say that some evidence may come from studying UK income investment trusts, who generally follow the UK large, and who did much better than a FTSE tracker over the ‘lost decade’. So perhaps that’s superficially evidence of an active approach winning.

A passive purist would surely reply though that:

(a) they are not picking from the whole index, only the higher yielding end, so it doesn’t prove anything (rather circular, but that’s how these arguments run! )

(b) that things would have looked very different if you started your score counting in 1990 and ended it on December 1st 1999, say.

As a pensioner for some years my subsistance level of (taxed) income is only from this source. If i accrue profits from spread betting would i be liable to further taxation?

@James — We can’t give personal tax advice. However here’s an article which explains that if it is someone’s sole source of income then they may be taxed:

Notify me of followup comments via e-mail. You can also subscribe without commenting.

Monevator is a place for my thoughts on money and investing. Please read my disclaimer . You can send me a message . Stay updated via RSS , email , Twitter , or Facebook . (Instructions).

Copyright © 2007-2021 Monevator . All rights reserved.

Disclaimer: All content is for informational purposes only. I makes no representations as to the accuracy, completeness, suitability or validity of any information on this site and will not be liable for any errors or omissions or any damages arising from its display or use. Full disclaimer and privacy policy . This site uses cookies .

Do I pay tax on Spread Betting ? | Online Betting UK

Spread betting tax avoidance strategies

do i pay income tax on spread betting gains in France or... | Yahoo Answers

Spread betting - Wikipedia

Trading and Spread Betting Taxes | Trading Spread Betting

Schumer, McConnell end standoff to organize Senate

McCarthy blasts Dems for House vote on Greene

Rodgers and Woodley: 2021's latest celeb couple

Super Bowl champ: '[Messed] up wiring' needed for NFL

DiCaprio's beach house was full of 'Titanic' memorabilia

The Weeknd reveals why he's wearing full-face bandages

Girl, 8, allegedly expelled from school over girl crush

Biden says GOP virus aid too small, as Democrats push on

Report: Haircuts put Chiefs players on NFL's COVID list

Mexican migrants sent home a record $40 billion in 2020

How joyous movie stole Sundance, broke sales record

Anonymous asked in Travel France Other - France · 10 years ago

Source(s): 100% Success Winning Predictor - http://winningpicks.oruty.com/?WcZ

How do you think about the answers? You can sign in to vote the answer.

Still have questions? Get your answers by asking now.

I have a spread betting account betting on the forex and want to retire to either France or Spain. Does anybody know the rules for income tax in these countries when making money through gambling. Thank you in advance

In the UK you do not have to pay taxes. However in the majority of other European countries you do have to pay taxes. Therefore if you are living in Spain or France you will be paying taxes on any profits. I linked to my blog below which has my forex trading strategies for free that might help you in your spread betting or other forex trading. Hopefully they are off some use to you!

On the topic of Spread Betting in Spain, would any gains just have to be declared on an individual's tax return, just like the capital gain on a property.

Or does the activity of financial trading justify becoming Self Employed (autonomo in Spain) which involves a hefty €250 monthly payment for social security.

A lot of interested traders are asking themselves the question if you can really make money with binary options? The answer is that you can indeed make money in binary options trading. Learn here https://tr.im/AutoBinarySignalsOficial

Obviously this is a perfectly legitimate question considering that most people have not traded binary options in the past and generally believe that investing is a very difficult activity.

However, you will have to put an effort into it. You will have to learn money management, reading of charts as well as the usage of indicators.

If you want to learn how to get at betting sports then this is your position https://tr.im/u6wLI with Zcodes System.

Zcodes System is about training you how becoming a sound principled activities investor and learning from a team of established pickers who surround you. The theory moves that if you encompass yourself with the positive energy of earning participants in the sports betting business then you too will even emerge on the top yourself.

Zcodes System can be treated as a mastermind for sports fans to push minds and rise to profitability together.

If you put your self that question: Where may I get hold of inside knowledge which will offer me with a huge benefit within the rank and file bettors and improve my odds of selecting the success again and again and it's therefore easy to use actually I will understand it? Then, the clear answer you may find it here https://tr.im/eqRY1 .

The Zcodes System is rammed packed with data for you yourself to digest. Zcodes System is maybe not restricted to at least one betting viewpoint but instead seems to connection the knowledge space between a wide selection of betting authorities and its consumers to preferably turn consumers into the professionals of the future.

Penny stocks are prone to violent fluctuation (volatility), many people believe that they'll luck out with a stock that will jump from $0.08 to $8 in two weeks. And it's happened. Learn here https://tr.im/P1hTF

Scour enough investing message boards and you're sure to find success stories from investors who made a mint while "playing the pennies."

Companies that can successfully make the jump from penny stock to power stock are rare, but when you find them they pay out in spades. Numbers vary quite a bit in the penny stock world, but investors have raked in gains over 1,000% in a couple weeks' time. The real trick is finding the right stock.

80%? Bull. The French were convenient enemies when the Bushies were pushing their war in Iraq. "If you're not FOR us, you're AGAINST us." The French were demonized as cowards because they didn't sign up for the Bushie war against Iraq. If anyone should know about war, it would be the French, their country was devastated in WWI. The WWII debacle was the fault of geezer generals - not the fault of front-of -the -line troops. Anyone that says that the French are anything less than brave - is full of crap.

i have attended a lot of seminars, read counless books on forex trading and it all cost me thousands of dollars. the worst thing was i blew up my first account. after that i opened another account and the same thing happened again. i started to wonder why i couldn,t make any money in forex trading. at first i thought i knew everything about trading. finally i found that the main problem i have was i did not have the right mental in trading. as we know that psychology has great impact on our trading result. apart from psychology issue, there is another problem that we have to address. they are money management, market analysis, and entry/exit rules. to me money management is important in trading. i opened another account and start to trade profitably after i learnt from my past mistake. i don't trade emotionally anymore.

if you are serious about trading you need to address your weakness and try to fix it. no forex guru can make you Professional trader unless you want to learn from your mistake.

Sex When Sleeping

Rough Threesome Sex

Jock Porno

Nudists Teen Movies

Porn Anal Hardcore Big Ass

/cdn.vox-cdn.com/uploads/chorus_image/image/64507213/1242337.0.jpg)

/buying-stock-without-a-broker-356075_V22-34130a64e3b54edfb50c30e8541362a4.png)