Discover The Vital Steps To Building A Long Lasting Connection With Your Riches Monitoring Expert

Short Article By-Hall McKinney

As you browse the complex landscape of wide range monitoring consultants, one important facet usually overlooked is the relevance of developing a solid connection with your picked advisor. Developing a strong relationship surpasses simple monetary transactions; it entails depend on, interaction, and alignment of values. The structure of this collaboration can substantially impact the success of your financial objectives and the overall monitoring of your wide range. So, how can you cultivate this essential bond with your consultant?

Comprehending Your Financial GoalsTo set a solid structure for your financial trip, plainly define your wide range goals. Begin by assessing what you desire accomplish monetarily. Do you aim to retire early, buy a 2nd home, or money your kid's education? Identifying your certain goals will certainly assist your riches management choices and assist you stay focused on what genuinely matters to you.

Take into consideration both short-term and long-lasting goals when describing your financial aspirations. Temporary goals might consist of constructing a reserve, repaying debt, or saving for a holiday. On the other hand, lasting objectives can entail spending for retirement, developing a tradition for your enjoyed ones, or accomplishing monetary self-reliance. By distinguishing between these 2 classifications, you can prioritize your purposes effectively.

Additionally, make sure your wealth objectives are sensible and quantifiable. Establish clear targets with timelines connected to check your development along the way. Keep in mind, your financial goals are personal to you, so ensure they align with your values and goals. By understanding your financial objectives, you're taking the critical very first step in the direction of safeguarding your economic future.

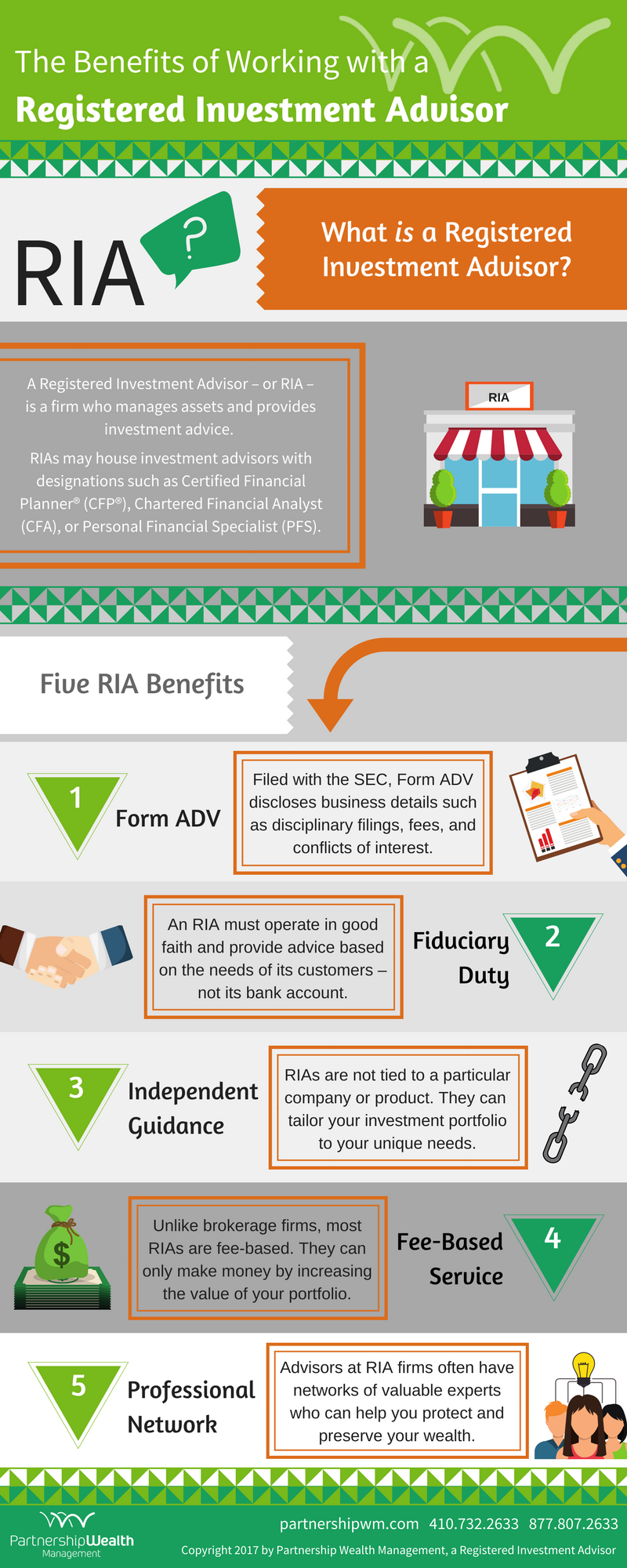

Reviewing Expert CertificationsWhen choosing a wide range administration expert, evaluate their qualifications to ensure they line up with your economic objectives and ambitions. Look for advisors with relevant certifications such as Qualified Economic Planner (CFP), Chartered Financial Expert (CFA), or Qualified Investment Monitoring Analyst (CIMA). These classifications suggest that the consultant has actually satisfied details education and experience requirements, showing a dedication to professional quality.

In addition, take into consideration the consultant's experience in the market and their track record of successfully managing clients' wealth. An experienced advisor who's navigated numerous market conditions can provide beneficial understandings and methods to aid you attain your monetary objectives.

It's also vital to examine the consultant's strategy to wide range management. Some advisors might focus on specific locations like retired life planning, estate planning, or financial investment management. Guarantee that their experience lines up with your needs. Furthermore, inquire about simply click the following internet site and just how they customize their strategies to meet clients' private situations.

Comparing Charge FrameworksWondering exactly how numerous wealth monitoring consultants structure their fees can aid you make a knowledgeable choice concerning that to pick for your monetary requirements.

When comparing fee structures, consider whether the consultant charges a percentage of assets under monitoring (AUM), a per hour rate, a flat fee, or a combination of these. read page charging a portion of AUM commonly take a percent of the overall possessions they manage for you, making their fees proportionate to your wealth.

Per hour prices are based on the moment the expert invests in your economic matters. Flat fees are fixed prices despite the assets managed. Some experts might use a tiered charge structure where the portion decreases as your assets enhance.

In addition, watch out for any type of surprise costs or payments that might affect your overall returns. By understanding and contrasting charge frameworks, you can pick a wealth monitoring advisor whose prices aligns with your financial objectives and choices.

Final thought

In conclusion, by plainly defining your financial objectives, assessing advisor qualifications, and contrasting cost structures, you can make an educated choice when choosing the right wide range administration consultant.

Remember to prioritize your ambitions, consider your objectives, and guarantee that the advisor's approach straightens with your demands.

With mindful consideration and study, you can find a consultant that'll aid you attain your financial objectives and safeguard your financial future.