"Depth of Market" trading (Ricochet algo)

ApitradeThe "Ricochet" algorithm in the "Hurricane" futures grid-bot automatically opens a long or short trade when the current price approaches large walls (accumulation of limit orders at a certain price) in the Binance BTCUSDT spot trading pair (due to the fact that this is the most liquid market that also affects futures) with a short stop loss and closes them on a rebound.

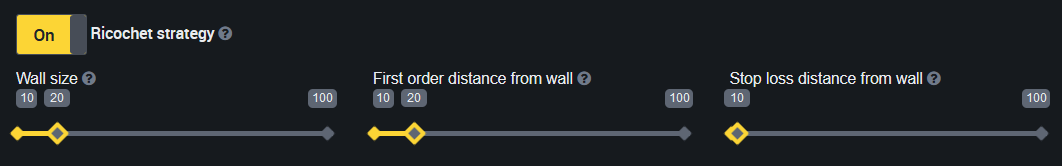

You can choose:

Wall size (from 10 to 100 BTC). The walls can be seen at the link https://www.binance.com/en/trade/BTC_USDT?layout=pro (the most convenient view is for 10 BTC). Walls are monitored only for BTCUSDT, regardless of which coin you run the bot on. It is recommended to run Ricochet in BTCUSD, BTCUSDT, BTCBUSD futures pairs.

Distance from the wall to place a limit opening order (from $10 to $100). Once this opening order is filled, the order grid is placed and trading begins.

Stop loss distance from the wall (from $10 to $100). Stop loss is placed behind the wall.

You can choose the direction of the bot: long, short, no strategy. If "no strategy" is selected, a limit order will be placed either at the upper wall (short) or at the lower wall (long), depending on which wall is closer.

After filling the first take profit, the system should automatically place a stop loss at breakeven near the opening price.

The size of your first order specified by you and the standard size of orders and the distance between them are very important. The user's task is to select such settings at which the profit from successful transactions (when the rate bounces off the wall) is much higher than the loss from stop loss triggering.

If there is a clearly defined trend in the market, then you should not launch Ricochet in the opposite direction, it is better to launch it only along the trend or in a calm market without a strategy.