Define Bet Spread

🔞 ALL INFORMATION CLICK HERE 👈🏻👈🏻👈🏻

Define Bet Spread

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider . You should consider whether you understand how spread bets and CFDs work and whether you can afford to take the high risk of losing your money.

Home

Insights

Learn to trade

Learn spread betting

What is spread betting?

You can sell (go short or short sell) if you think the price of an instrument is going to fall

You can trade on margin, so you only need to deposit a small percentage of the overall value of the trade to open your position. Remember, this means that your potential return on investment is magnified, as are your potential losses

Spread betting profits are tax-free*

You can trade on indices, forex, cryptocurrencies, commodities, global shares and treasuries

There is no separate commission charge to pay on spread bets

You get access to 24-hour markets

There is no stamp duty* to pay

Join a trading community committed to your success

Create a relevant trading plan and stick to it

Keep emotions aside from your trading

Evaluate market analysts’ news and write-ups as part of your analysis

Be aware of the macro environment through news outlets

Avoid recommendations and tips from unreliable sources, such as internet forums

Cut your losses short and let your profits run

Test new strategies on your spread betting demo account

Open a spread betting

demo account or

live account .

Accounts can be opened via our website or mobile app. Deposit funds if you have chosen to open a live account.

Research financial instruments to trade. Browse our news and analysis section, and check the insights, market calendar and chart forum platform modules. Live account holders can also access Reuters news and Morningstar fundamental analysis for inspiration.

Go long and 'buy' or go short and 'sell'. Go ahead and ’buy’ the asset if you think the price will rise, or ’sell’ the asset if you think the price will fall.

Follow your spread betting market entry and exit strategy. Based on your trading plan, enter the market at a defined time, and use your risk mitigation strategies like stop-loss orders.

Enter your position size and place your trade. When placing a spread bet, be aware of the full trade value, and don’t forget to add stop-loss and take-profit orders.

Monitor your trade. Keep track of the open trade on your mobile or PC, and close the position as defined in your trading plan.

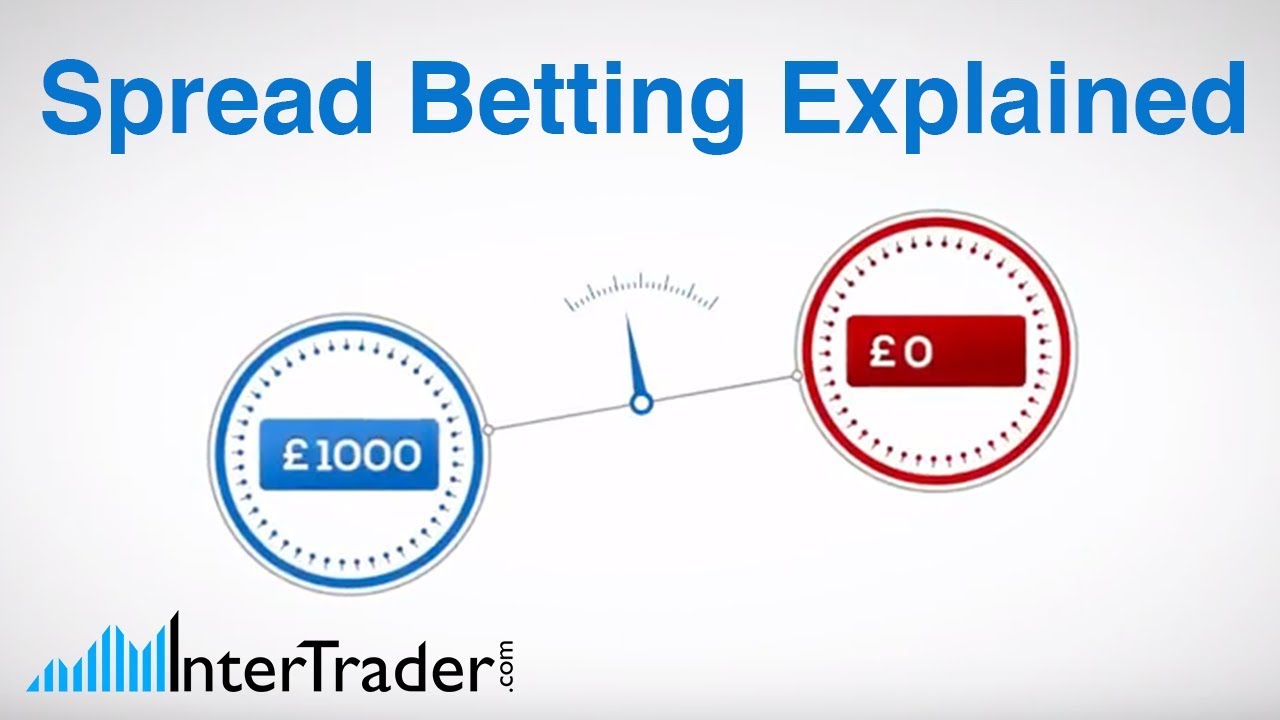

In this article, we’ll cover the essentials of spread betting , including strategies, tips and examples of a spread bet. This article should guide you towards understanding if spread betting is a suitable trading method for you. Watch the video below to get started.

Spread betting is a tax-efficient* way of speculating on the price movement of thousands of global financial instruments , including spread betting forex , indices, cryptocurrencies, commodities, shares and treasuries. Spread betting is one of the most common ways to trade on price action over several asset classes in the UK and Ireland. Spread betters can trade in both directions (‘buy’ or ‘sell’), and can make use of financial leverage to increase their trade exposure. With a spread betting account, you can choose between trading from home and on-the-go, as our platform is very flexible for traders of all experience levels.

With spread betting trading in the UK, you don't buy or sell the underlying instrument (for example a physical share or commodity). Instead, you place a spread bet based on whether you expect the price of an instrument to go up or down. If you expect the value of a share or commodity to rise, you would open a long position (buy). Conversely, if you expect the share or commodity to fall in value, you would take a short position (sell). You will make a profit or loss based on whether or not the market moves in your chosen direction.

With spread betting, you buy or sell a pre-determined amount per point of movement for the instrument you are trading, such as £5 per point. This is known as your spread bet 'stake' size. This means that for every point that the price of the instrument moves in your favour, you will gain multiples of your stake times the number of points by which the instrument price has moved in your favour. On the other hand, you will lose multiples of your stake for every point the price moves against you. Please note that with spread betting, losses are based on the full value of the position. See our spread betting examples for more information on how to spread bet.

The difference between the buy price and sell price is referred to as the spread. As one of the leading providers of spread betting in the UK, we offer consistently competitive spreads. See our range of markets for more information about our spreads.

Spread betting is a leveraged product, which means you only need to deposit a small percentage of the full value of the spread bet in order to open a position (also called trading on margin ). While margined (or leveraged) trading allows you to magnify your returns, losses will also be magnified as they are based on the full value of the position.

Many investors choose to spread bet on the financial markets as there are advantages of spreading betting over buying physical assets:

Before placing your trade, remember to make sure that you have followed risk-management guidelines as part of your strategy.

A spread-betting strategy is a pre-determined plan that helps you to define your market entry and exit points, and accompanying risk-management conditions such as stop-losses. When utilising a trading plan as part of your wider trading strategy, you aim to create a process in which you can monitor and forecast trade outcomes.

When trading with a spread betting account, it’s best practice to outline and follow your own trading strategy template relative to your needs. Strategy templates define a set of rules you should follow for every trade, helping you to remove emotions and irrational responses from your trading strategy. This helps to keep consistency within your trades, and can help improve your trading mindset. Visit our article on creating a trading strategy template , where you can follow an example to help define your strategy.

Every trader utilises different methods and strategies to suit their trading style. There are, however, some common spread betting tips a trader can utilise in order to maximise their trading potential:

See our article on spread betting tips and strategies , where we cover the topic in more depth.

It's a good idea to keep up to date with current affairs and news because real-world events often influence market prices. As an example, let's look at the UK government’s help to buy housing scheme.

Many believed that this scheme would boost UK home builders' profitability. Let's say you agreed and decided to place a buy spread bet on Barratt Developments at £10 per point just before the market closed.

Let's say that Barratt Developments was trading at 255 / 256 (where 255 is the sell price and 256 is the buy price). In this example, the spread is 1.

Let's assume that you opened a long position at £10 per point because you thought the price of Barratt Developments would go up. For every point that Barratts' share price moved up or down, you would have netted a profit or loss multiplied by your stake amount.

Let's say your spread betting prediction was correct and Barratt Developments' shares then rose to 306 / 307. You decide to close your buy bet by selling at 306 (the current sell price).

The price has moved 50 points (306 sell price – 256 initial buy price) in your favour. Multiply this by your stake of £10 to calculate your profit, which is £500.

Unfortunately, your spread betting prediction was wrong and the price of Barratt Developments' shares dropped over the next month to 206 / 207. You feel that the price is likely to continue dropping, so to limit your losses you decide to sell at 206 (the current sell price) to close the bet.

The price has moved 50 points (256 – 206) against you. Multiply this by your stake of £10 to calculate your loss, which is £500.

Learn more about spread betting for beginners and how to get started, and see our detailed spread betting examples. If you're ready to trade, open an account now.

Seamlessly open and close trades, track your progress and set up alerts

Spread betting works by traders speculating on whether a financial instrument’s price will rise or fall. Spread betters can go long (buy) if they believe the price of an asset will go up, or go short (sell) if they believe the market will start a downtrend. Learn more about spread betting .

Spread betting can be profitable, depending on multiple factors, but it’s also possible to make a loss. Most successful traders manage to make profitable trades by following a systematic trading plan, including in-depth fundamental and technical analysis, risk-management systems and several years of applicable knowledge. Try out a spread betting demo account to practise your trading plan.

Is spread betting taxable in the UK?

If you’re a resident in the UK or Ireland, profits from spread betting are free from capital gains tax (CGT). Additionally, spread betting transactions are exempt from stamp duty. Learn more about the risks of spread betting and the advantages of spread betting here. Please note tax treatment depends on your circumstances and tax laws are subject to change.

Spread betting providers are regulated by the Financial Conduct Authority (FCA) in the UK. It’s compulsory for all UK spread betting providers to be FCA regulated. Find out more about regulations at CMC Markets .

Losses above are based on the full value of the position. Past performance is not indicative of future performance.

^Prices are taken from our platform. Our prices may not be identical to prices for similar financial instruments in the underlying market.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

Join over 90,000 other committed traders

Complete our straightforward application form and verify your account

Deposit easily via debit card, bank transfer or PayPal

One touch, instant trading available on 9,300+ instruments

Get greater control and flexibility for peak performance trading when you're on the go.

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider. You should consider whether you understand how spread bets and CFDs work and whether you can afford to take the high risk of losing your money.

CMC Markets UK plc (173730) and CMC Spreadbet plc (170627) are authorised and regulated by the Financial Conduct Authority in the United Kingdom.

Telephone calls and online chat conversations may be recorded and monitored. Apple, iPad, and iPhone are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc. Android is a trademark of Google Inc. This website uses cookies to obtain information about your general internet usage. Removal of cookies may affect the operation of certain parts of this website. Learn about cookies and how to remove them. Portions of this page are reproduced from work created and shared by Google and used according to terms described in the Creative Commons 3.0 Attribution License.

This website uses cookies to optimise user experience. You can amend your cookie preferences by accessing our cookie policy .

Spread betting - Wikipedia

What is Spread Betting and How Does it Work? | CMC Markets

Spread betting in sport | What is spread betting ? | OddsMonkey

Spread Betting vs CFD Trading: Key Differences | IG UK

How to spread bet | Capital.com

Spread betting in sports: what is spread betting?

Wondering how to make money from matched betting once you run out of ‘welcome’ offers? Ian’s here to document his journey on life after sign ups.

Matched betting is one of the best ways to make money online , and at OddsMonkey we have all the tools and resources you need to get started. Find out how you can easily turn bookmaker offers into tax free profits today.

Address: 15 Parsons Court, Aycliffe Business Park, County Durham, DL5 6ZE

Email : support@oddsmonkey.com

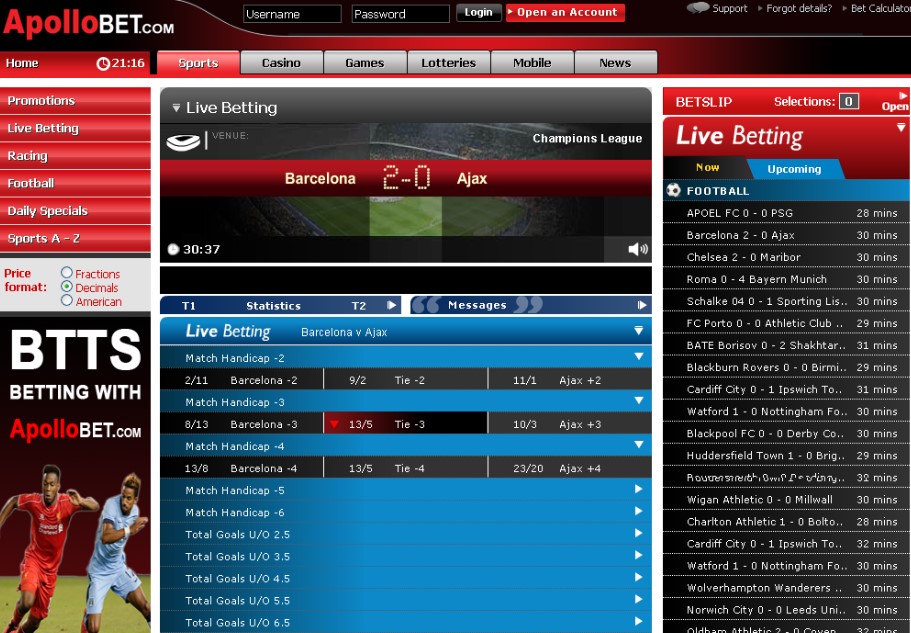

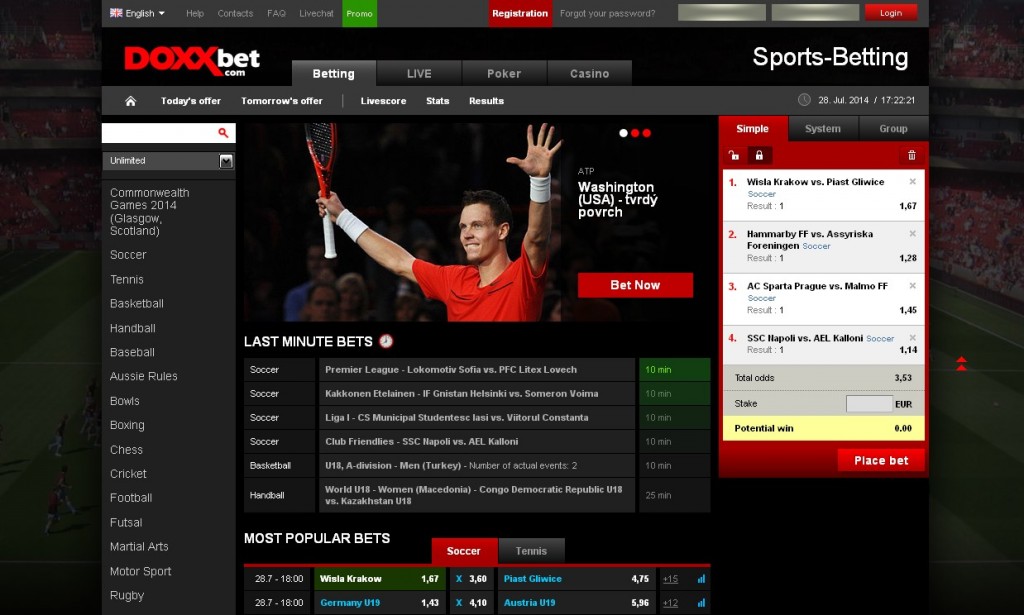

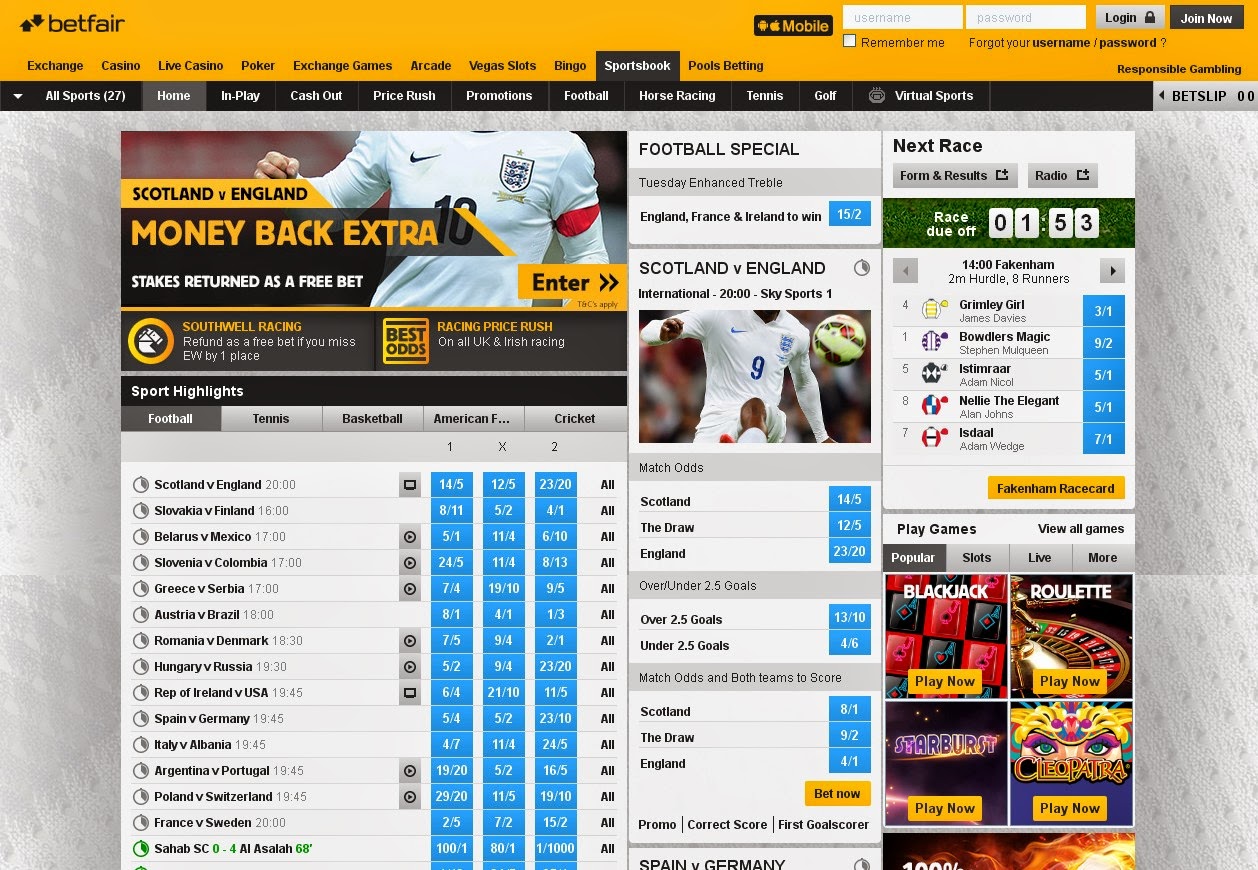

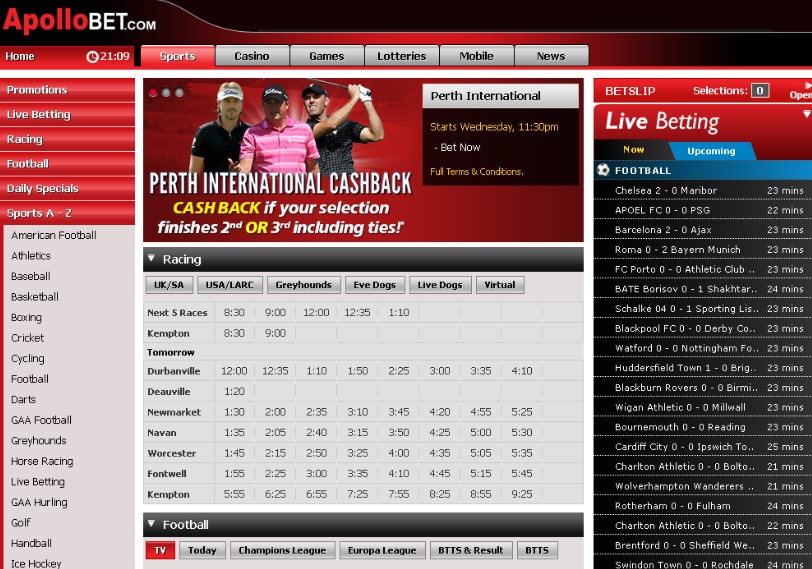

Spread betting is one of the most complex forms of betting. At least it seems that way until you start.

The thing that puts off your average punter is that it is extremely volatile and the potential for loss is greater than normal betting. It is for this reason that you need to understand spread betting and how it works before you get too heavily involved.

We suggest that if you start spread betting, then you are a little more knowledgeable about betting than average.

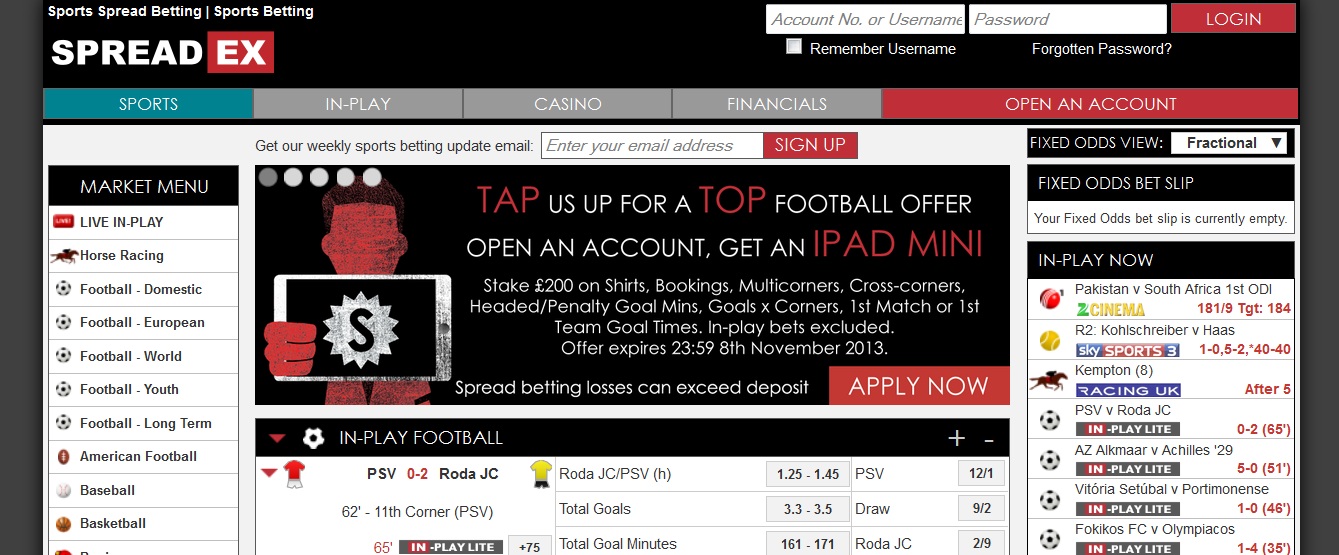

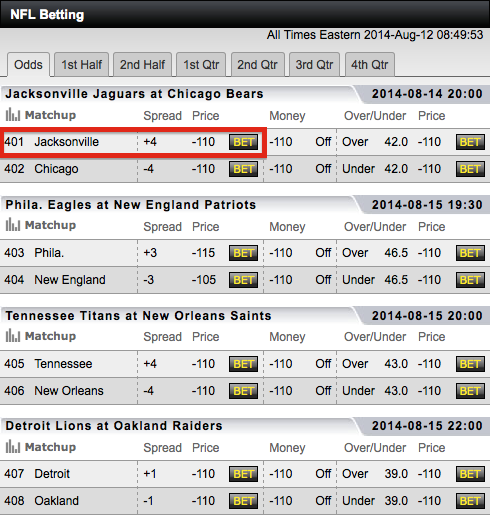

We’ll touch on financial spread betting in this post as it’s the most popular form, but we’ll focus on how spread betting works in sports.

Spread betting is hugely popular, especially among people who work in or have an interest in finance. This is because it allows easy access to speculate on the movement of financial markets. This simplified form of betting on financial markets has meant an increase in popularity for spread betting.

The variables are quite high when spread betting on financial markets. The volatility of these markets means that, without paying due care, you can lose thousands in the blink of an eye. Your investment capital can go further, but you can also lose more than you initially deposited.

It’s important to understand the risks involved and have suitable strategies in place to manage this.

Whilst financial spread betting is the most popular form of this kind of betting, it can also be done in the sports world.

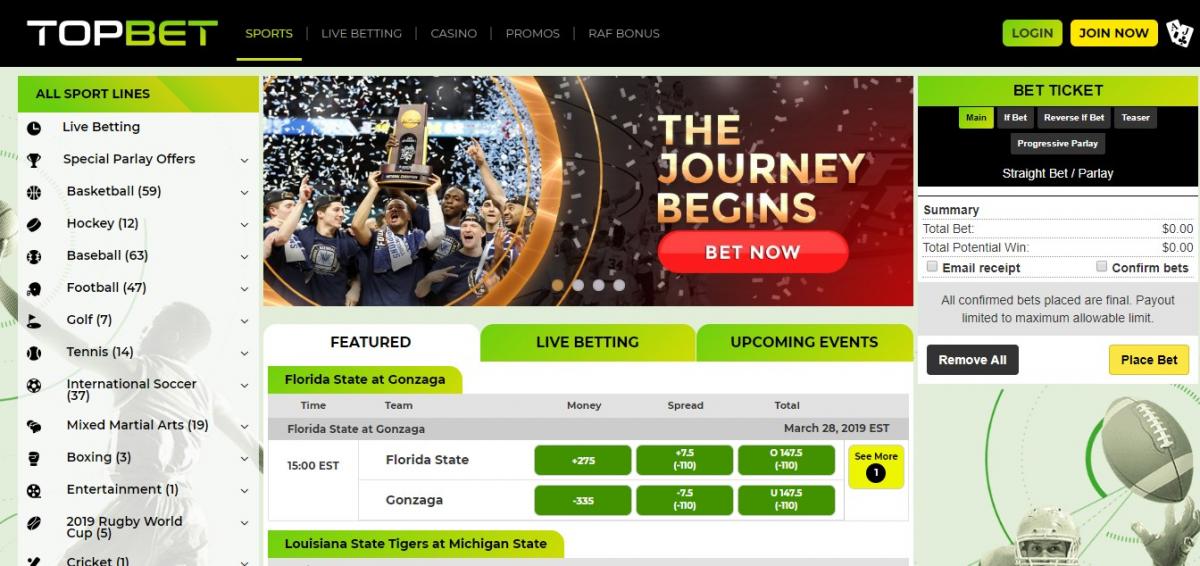

The way spread betting differs from traditional betting is that you’re betting on the movement of the market rather than an event. With traditional betting, you’re betting a set amount on the market to have a defined result at a set price. For example: you’re betting on a spread for a Premier League team’s total points and the spread is set at 70. You’ll bet a set amount per point that you think their final tally will be above or below the spread.

So, if you stake £5 per point that they will achieve a higher points tally than the spread, you’ll win £5 for every point over. However, should they get a lower points tally than 70, you’ll lose £5 for every point they miss that target by.

This means that there’s the potential for high wins. However, it also means that your potential for loss can be quite high should the team fail to hit this target.

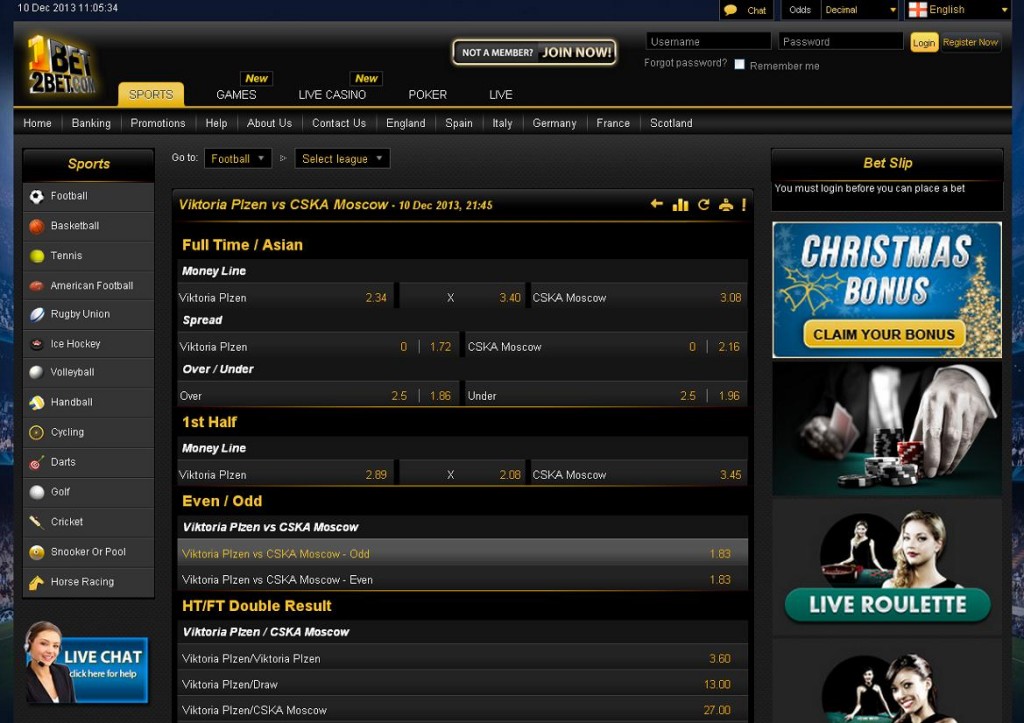

There is a mechanism that you can build into your bet to minimise losses. It’s called a stop loss. This is the point that you define in your bet that you want to cancel and take a loss.

Let’s look at how that works: you buy on a spread but the share price of the company you bought dramatically takes a hit. Your bet will be closed out at your defined price meaning you can’t lose any more than you’ve set.

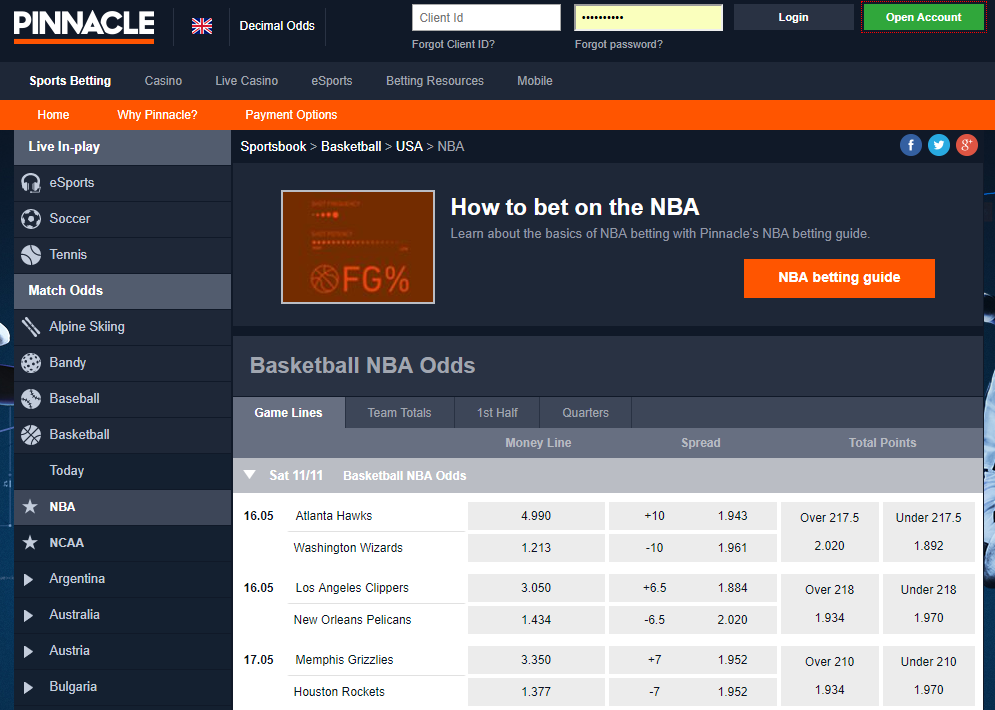

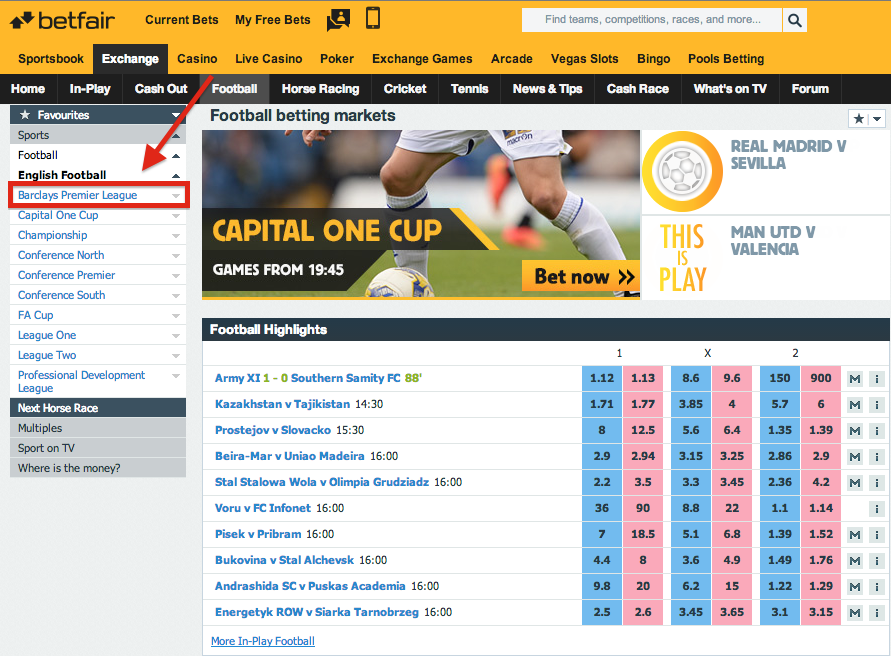

The best way to answer the question ‘how does spread betting work?’ is to look at football spread betting. It’s a sport that everyone understands, and therefore it makes it easy to compare spread betting to normal betting in football.

Let’s take a more detailed look at the example we touched on earlier.

Points betting over a season is one of the most popular spread bets. The prediction from the spread betting company may look something like this:

Manchester United points: 76 – 77.5

This means they are predicting Manchester United may finish on either 76 or 77 points. The lower one is the selling price. The higher one is the price you buy at.

If you buy the spread at £10 per point, and Manchester United finish on 84 points, you will win £65. That is £10 per point and £5 for the half a point.

However if Manchester United finished on 75 points, then you would have lost a total of £25.

Should you sell Manchester United points, you’re betting that they will finish with lower than 76.

If you bet at £10 per point, and they finish on 70, then you will win £60. However, should they finish on 80 points then you lose £40.

But perhaps the long term markets take a little bit too long for you, and you’d prefer to bet per match. You can do that with spread betting too.

One of the most popular match markets to bet on is player goal minutes. The spread for a star striker will be set at something like 37 – 40.

At the end of the match, the times they scored the goals are added up. If you buy the spread, it means you’re hoping the total points are more than 40. For example, in the following situation:

Harry Kane Player Goal Minutes: Sell 37 – Buy 40

Then he scores a goal on the 15th minute and the 45th minute. These obviously add up to 60 minutes. If you bought for £10 per point at 40, then you would win £200. However, if he only scored in the 5th minute then unfortunately, your luck is out. You would lose £350. Which shows perfectly the amount of risk involved with spread betting.

There aren’t as many spread betting strategies as there are in other types of betting. At least not in the same way. But there are a few handy hints you can follow to make the process a little bit easier for yourself.

Firstly, did you know that you can close out your bets in-play for many spread betting markets?

This is because the spread moves in-play, based on what is happening during the game.

Let’s say you bet on a Total Goal Minutes market and the spread was 167 SELL – 177 BUY . You bought the Total Goal Minutes thinking there would be a lot of goals in the match. But there were a few goals in the 20th minute of the game, to give you 50 points. The line would move to reflect this.

Say it moves to 200. This gives you an opportunity to get out of your bet and make a profit. By selling at this price, you’ll make an automatic profit.

To give you an idea of what types of markets you can bet on when you’re spread betting, here’s a list of the most common football markets, along with a brief explanation of how they work.

A supremacy bet is where the spread betting firm predict how dominant one team will be over another. This is where they set a spread based on how many goals a team will beat another by.

If you feel that Tottenham will win, you can buy them at 0.4 goals for a stake of £10.

When Tottenham win with a 5-1 scoreline, their supremacy is 4 goals. This means the actual result was +3.6 and you won £36.

This is where the spread predicts the time of the first goal in the match. They may set a spread of 19-22, and favour the first goal being scored in the first half.

However, expecting a quiet first half, you buy this for £10 per point. Eventually, during the match, the first goal is scored in the 32nd minute.

Given the 10 minute discrepancy, you win 10x your £10 stake giving you a profit of £100.

Total corners is an interesting spread betting market and gives you another angle to consider. The spread states how many corners they think will be taken by both teams during the match.

If a lot of corners are expected, the line might be set at 14.5 – 15 corners. You may feel that this is too high so decide to sell at 14.5 for a stake of £10.

But bad news: during the game, records were broken and there were 35 corners during the match. This would give you a whopping loss of £205. Ouch!

This is one of the more fun spread betting markets. It takes a lot of research and a big sprinkling of luck to have success with this market.

At the end of the game, the shirt numbers of all the goalscorers in the market are added together.

For argument’s sake, the spread betting firm may set the spread at 52-56.

Noticing the star striker likes to stand out and has the number 88 on his shirt, you buy at £10 per point.

However, disaster strikes, and after many missed chances, the game finishes 0-0. You run up a loss of £560.

Spread betting can be exciting because the ceiling for profit is quite high. However, this is why some people can also get carried away.

So during your spread betting journey, make sure you follow these rules to keep your losses to a minimum.

While spread betting can be fun, unfortunately, it can also be quite costly. It’s hard to get serious with spread betting and follow any real strategy. Unless you’re well into the financial markets and really know your stuff. And that can take A LOT of time and effort…

Something which doesn’t require as much time and effort, though, is matched betting. Now, it’s nowhere near as on-the-edge-of-your-seat as spread betting, but it’s sure as hell a lot more profitable. And the profits you do make from matched betting are completely tax-free.

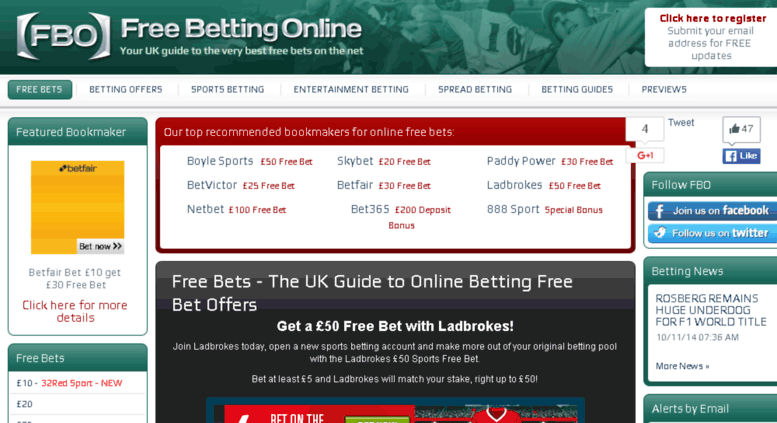

Bookmakers are in a constant fight to try and win customers due to the never ending growth of the industry. They offer free bets and other promotions to attract sign ups. Matched betting is a process where you can turn these free bet offers into real money. Money that goes from the bookmakers’ pockets, straight into your account.

The great thing is that anyone can do it, from university students to stay at home parents. You don’t have to be a sports fan. Hoards of people are profiting from this and earning anywhere from a few hundred to a few thousand pounds within the first few months.

Why waste money betting when you can win it? To find out more about matched betting, download our free introductory guide.

Looking for ways to make money online?

There are only 46 days until the biggest festival of the year is here for matched bettors – Cheltenham Festival. It is the time of

Serena Williams has won everything the game of tennis has to offer but victory at this year’s Australian Open will hand her two new records.

Does any other TV event signify Winter more than the annual return of Dancing on Ice? We think not and it is nearly upon us

Can you guess these 18 Christmas songs from just emojis? 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. 15.

We are a crack team of software developers and experienced Matched Bettors, dedicated to helping you earn a sustainable, tax free income every month.

Matched Betting isn’t Gambling, but it is only for over 18’s. If you do have any concerns about gambling please contact

Huge Ass Fucking

Madison Ivy Naughty America

Outdoor Tech Chips

Babes Lingerie Video

Rebecca Volpetti Pee Piss Porno

f_auto/p/86b91e40-a4e8-11e6-89db-00163ed833e7/4383828/sports-betting-platform-screenshot.png" width="550" alt="Define Bet Spread" title="Define Bet Spread">

f_auto/p/86b91e40-a4e8-11e6-89db-00163ed833e7/4383828/sports-betting-platform-screenshot.png" width="550" alt="Define Bet Spread" title="Define Bet Spread">