DYOR: The First Step Towards Financial Literacy on TON (Part I)

Tonstakers x TON Radar

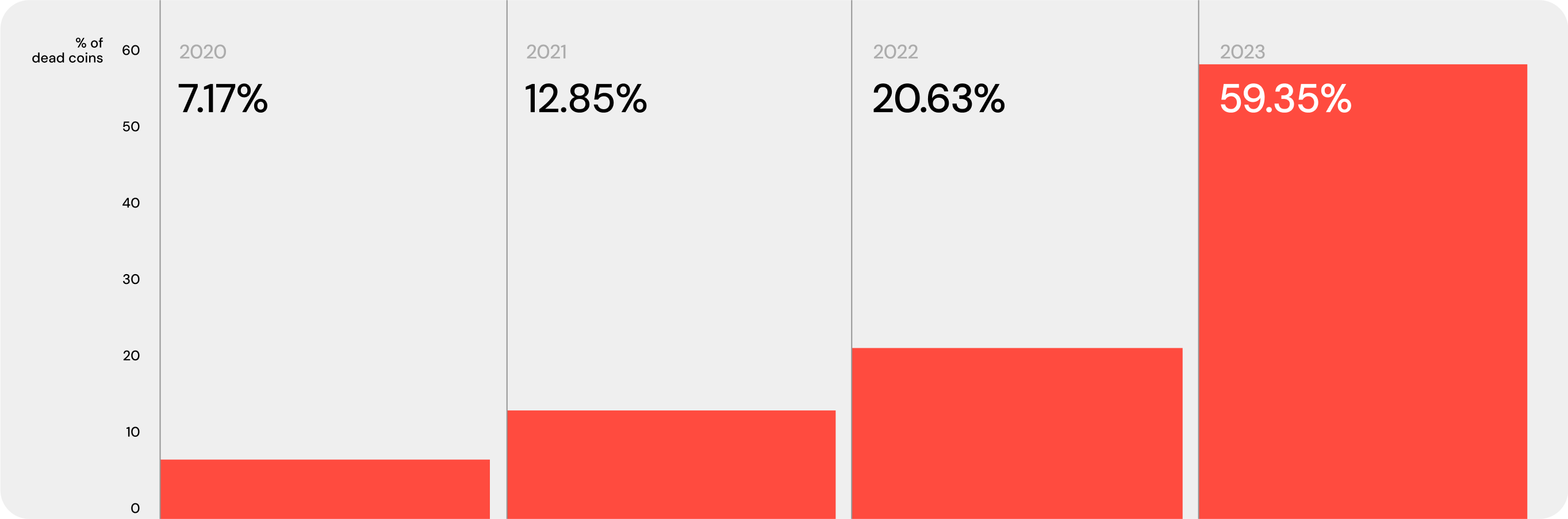

Recently, we published an introductory post that highlighted the connection between the rise of meme coins and fraud in the network (if you haven't read it yet, now is the time). Shortly after the publication, a study emerged, stating that 2023 set a record for the highest number of closed crypto projects.

Research has shown that each year sees an increasing number of crypto projects being created, yet a significant portion of them quickly shut down (for various reasons, including fraud). Users should understand that in 2024, they need to exercise even more caution when choosing a project to invest in, as the number of projects closing down is expected to rise. There are several reasons for this:

- Firstly, since the beginning of 2024, there has been a significant influx of new users on the TON blockchain (thanks to the release of Notcoin, the announcement of advertising payments in Telegram Ads via TON, the listing of TON on Binance, the rise in TON's price, etc.).

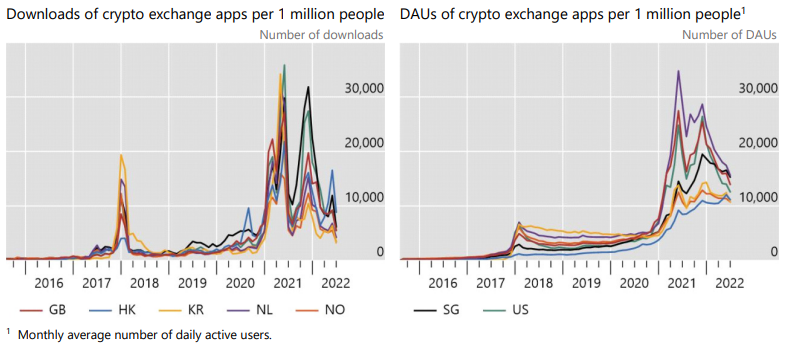

- Secondly, the overall growth of the crypto market, known as the "bull run," contributes to the increase in the number of users. For example, the BIS study provides the following example:

We find that 73% of users downloaded their app when the price of Bitcoin was above $20,000 – above the price of Bitcoin in October 2022).

- Thirdly, according to experts' estimates, the crypto market is projected to grow to almost 900 billion users in 2024.

For the crypto market, these are excellent news indicating economic growth for the entire market and, consequently, its participants. However, at the same time, ordinary users need to be more careful than ever. This can be compared to the economic growth of a city to the level of a metropolis: its residents have gained numerous new economic and financial opportunities, the standard of living has increased, but new risks emerge. Due to the growth of vehicles and roadways, there is an increase in accidents; and with the growth of small and medium-sized businesses, the number of violations in the field of competition and entrepreneurship has increased. Therefore, in such moments, the role and importance of behavioral rules increase. The crypto market also has its own protocol, called DYOR (do-your-own-research). In simple terms, DYOR involves thoroughly researching information about a project before investing in it (even in the case of hyped and popular projects).

DYOR in Practice

For you, we have prepared a list of recommendations and tools to help you conduct a comprehensive DYOR.

Less talk, more numbers!

Assets, market capitalization, transactions, transaction volume, and other crucial data are always stored on the blockchain and since all info on any blockchain is immutable and unchangable you can use tonviewer or tonscan to check the mentioned information. In the latter, simply input the project's name, and you'll obtain all the necessary details: dapp, category, website and blockchain address.

Additionally, you can gather essential information by learning about the number of active users and trade volume. Services like dyor.io and redoubt.online (DeFi Llama for other projects) are helpful for checking TON projects. For projects on other blockchains, Glassnode.com is an excellent resource.

Market Cap and Volume

Analyze the market capitalization and trading volume of the cryptocurrency. Higher market capitalization and trading volume can indicate greater liquidity and investor interest. The most important, if the project like NFT, having several owners and not be centralized.

Who's behind the project?

There's a common misconception that a project's quality is determined solely by its community and so-called project ambassadors.

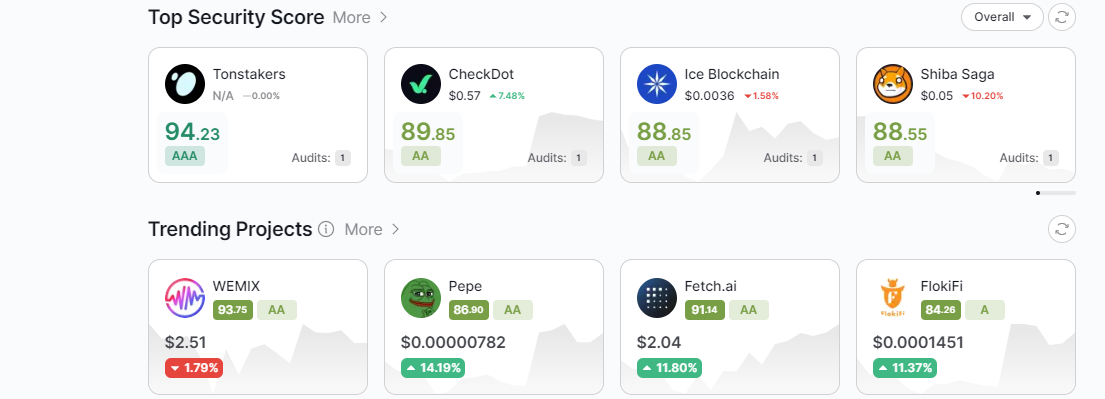

However, factors like Sybil attacks and shilling artificially generate audience and hype around a project. To avoid falling for such tactics, you can use services like tonradar.app (DappRadar is suitable for projects in other blockchains) or telemetr.me to obtain data on a project's unique users. For example, on tonradar.app*, the list of TON community channels looks like this:

When it comes to project ambassadors or influencers, it's crucial to remember that if these individuals aren't well-known developers or founders of such projects and are merely media figures, such behavior may be viewed as a commercial move and marketing rather than a guarantee of project safety and reliability. In most cases, significant projects share information about their team, which you can find in open sources or on CoinMarketCap.

Also, on CoinMarketCap, for many major projects, you can find information about project investors. This saves you from conducting a deep fundamental analysis, studying the project's tokenomics, roadmap, business model, and other essential documents, as these have likely been reviewed by the corresponding fund before investing in the project.

Look for partnerships and collaborations with established companies or institutions. These can provide credibility and indicate the project's potential for mainstream acceptance.

Technical documents and audits

For a more in-depth understanding, we also recommend familiarizing yourself with the project's whitepaper and technical documentation. Read the project's whitepaper thoroughly. This document outlines the technology, goals, and mechanisms of the cryptocurrency or blockchain project. Plus where they can read them or where to ask and who to ask to find them.

You can find this documents either on GitHub or on platforms like tonviewer, where this information is stored in the Code section. In the same place (or on the TON Society forum), you can discuss technical features with developers or even participate in Bug Bounty.

If the project is large and takes its security seriously, it usually undergoes an audit to confirm its safety. For example, one of the popular auditors is skynet.certik, which includes information about all crypto projects that have undergone an audit.

Technology and Development Team

Understand the underlying technology of the project, what are the exactly doing, cuz u know many projects hide behind fancy words but in real practicality they are not clear, Evaluate the credentials and experience of the development team behind the project.

Use Case and Adoption

Evaluate the practical applications and real-world use cases of the project, . Consider whether the project addresses a genuine problem and has the potential for widespread adoption.

Roadmap and Development Progress

Review the project's roadmap to understand its future plans and milestones. Monitor the progress of development updates, protocol upgrades, and new features.

Fundamental Analysis

It is worth mentioning separately the tools for fundamental analysis, which focus not so much on checking the project as on the value of the asset in the market. This process requires much more time and resources for examination since it involves studying the business model, tokenomics, marketing strategy, and other details.

In essence, fundamental analysis encompasses all previously mentioned criteria but is considered holistically, taking into account market analysis and the valuation of projects from a similar sector (DeFi, NFT, Exchange, Pool, etc.).

Additional Tools

A particularly vigilant user will also check the project's website, obtaining data such as the number of unique users over a specific period, the geolocation of these users, average time on the site, user sources, etc. You can obtain this data using the similarweb tool.

Furthermore, you can verify the website's domain, its creation date, and the entity it is registered to. Special services, such as this, can not only provide this information but also check SSL certification and the presence of dubious links on the site.

Conclusion

DYOR is the key to successful investments. Although it is time consuming to study the above list of data, it is necessary for everyone who decided to invest in this or that asset: NFT, token - it does not matter. Economists emphasize:

It's important not only to increase profits but also to preserve your deposit from losses.

Stay sharp, invest wisely!