Current market situation

CcThe market has been in consolidation for a month already, and technically the picture does not change much. But nevertheless, there are some interesting moments, which we will consider below.

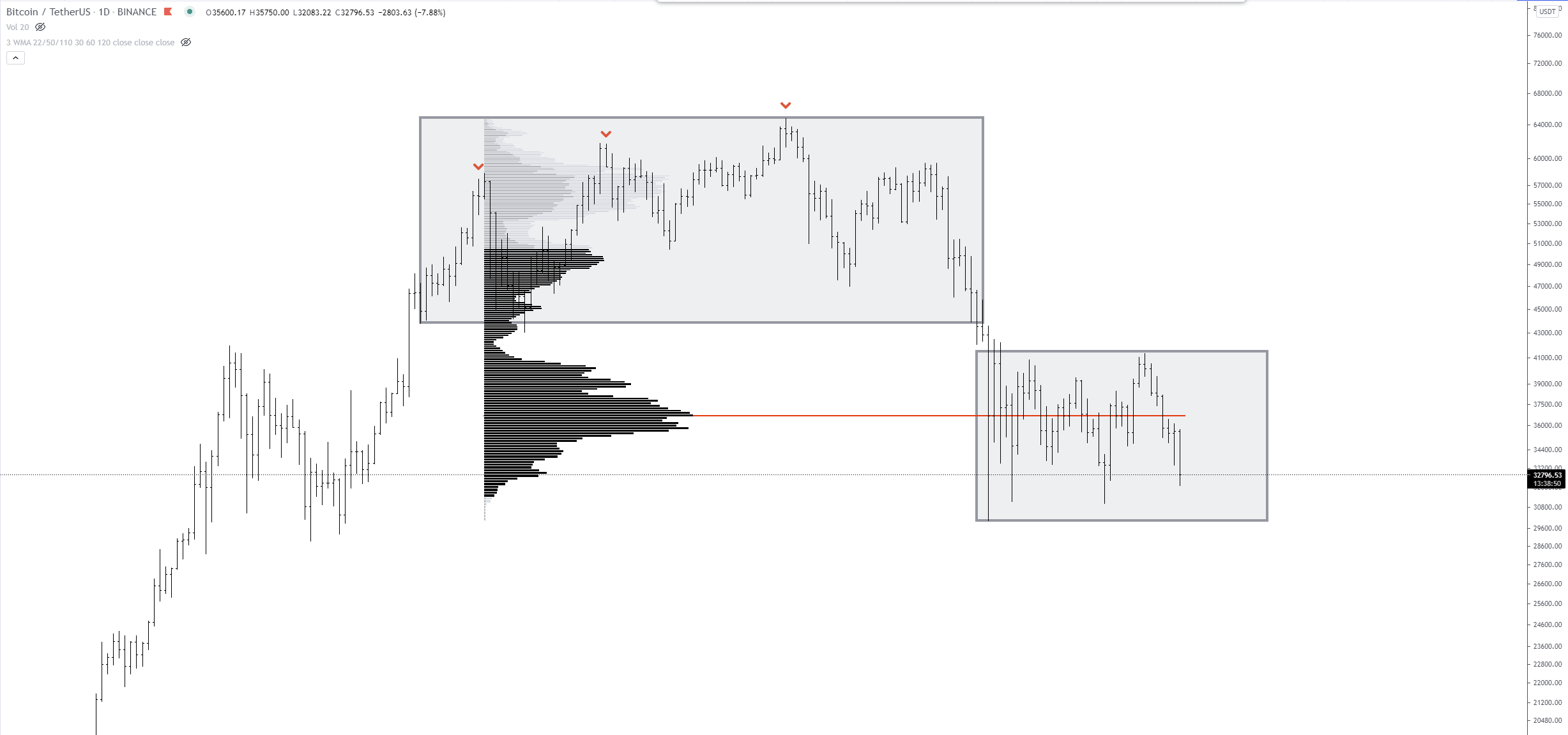

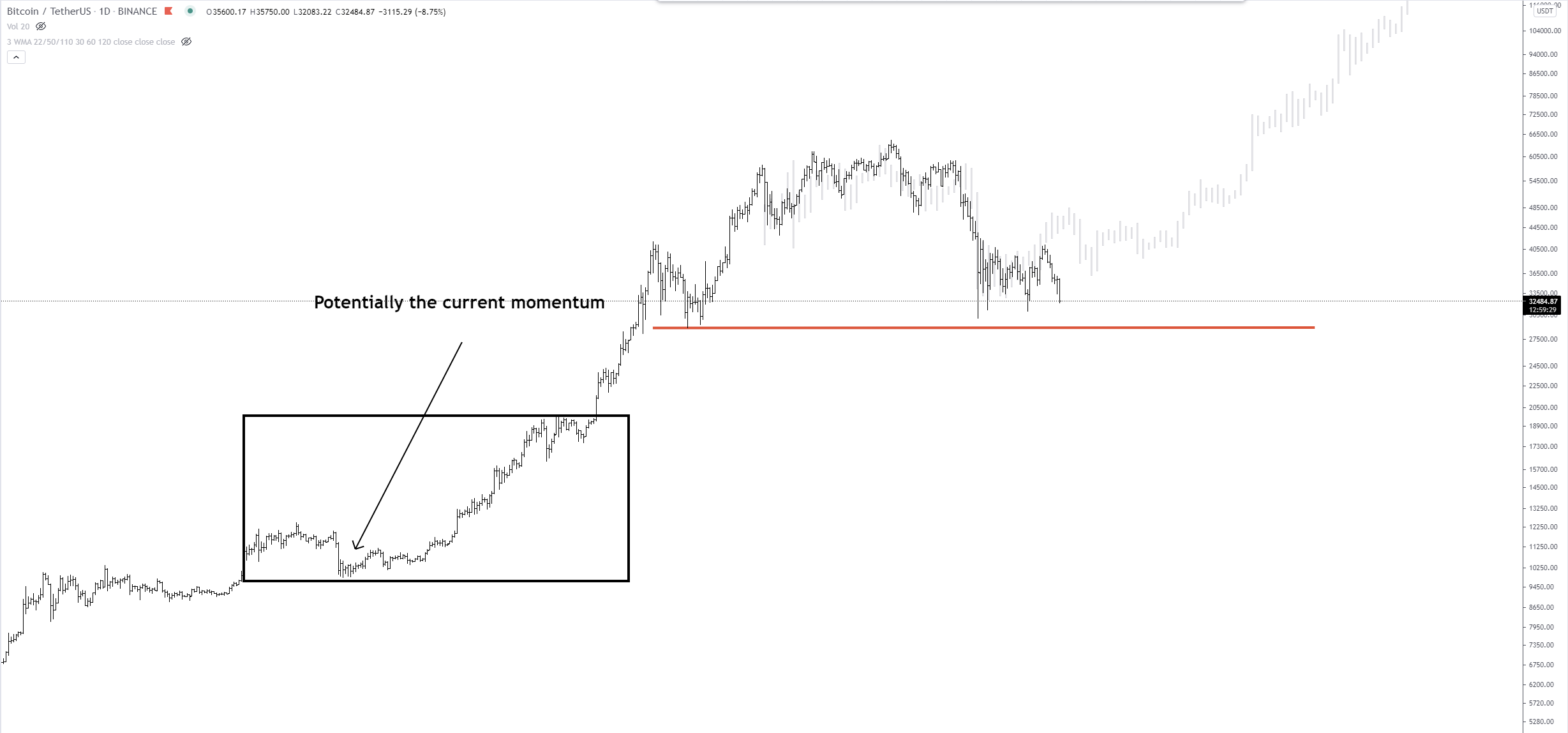

The first thing I would like to draw your attention to is that during the current consolidation there were more volumes than during the section from which we can trace the appearance of supply (separated by rectangles on the chart)

The moment where there were substantial sales is marked with red checkmarks. And the red line shows us where the largest amount of transactions took place.

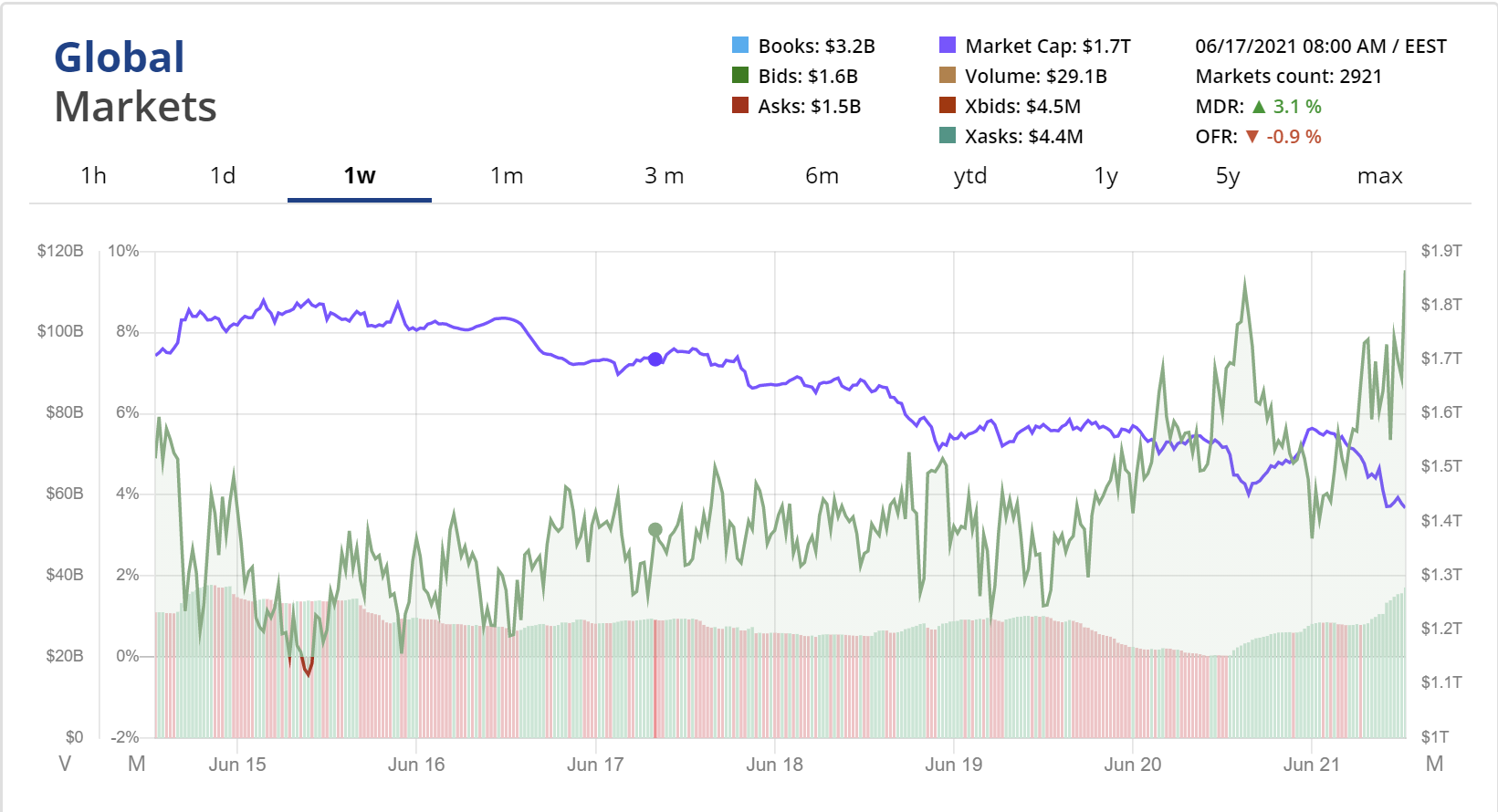

If we take the last week of aggressive decline, we can see that the decline was accompanied by an increase in buy orders.

The blue line on the chart above is the price. We can see that it is decreasing.

The green line/area is the buy orders. They do not simply prevail over sell orders, they have an ascending trend.

Obviously, the lower the price, the more willing to buy at that price, and we see that there are more and more of them.

Of course, these are all prerequisites for growth, but let's not forget the supply, and here is one inconvenient fact for that very growth to be realized.

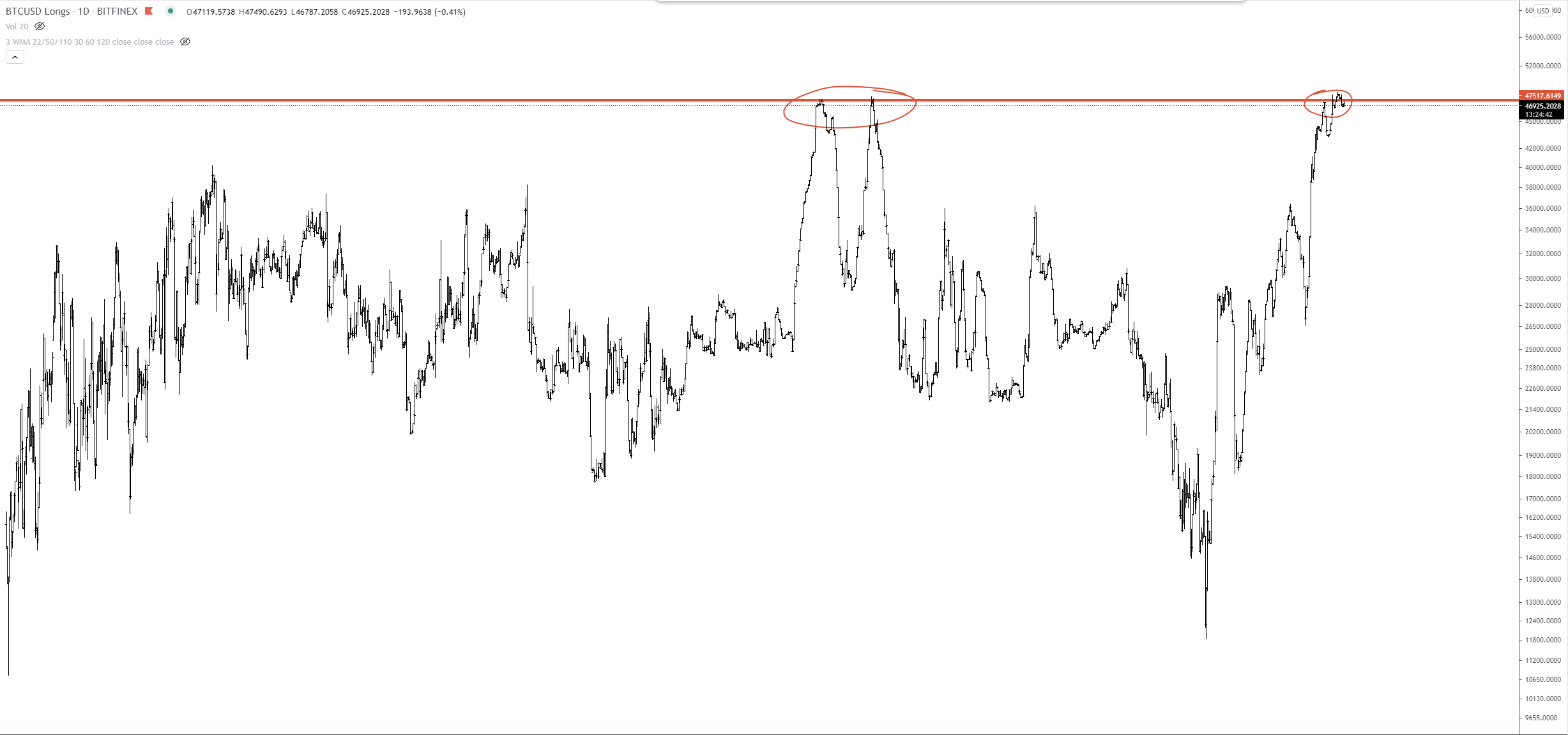

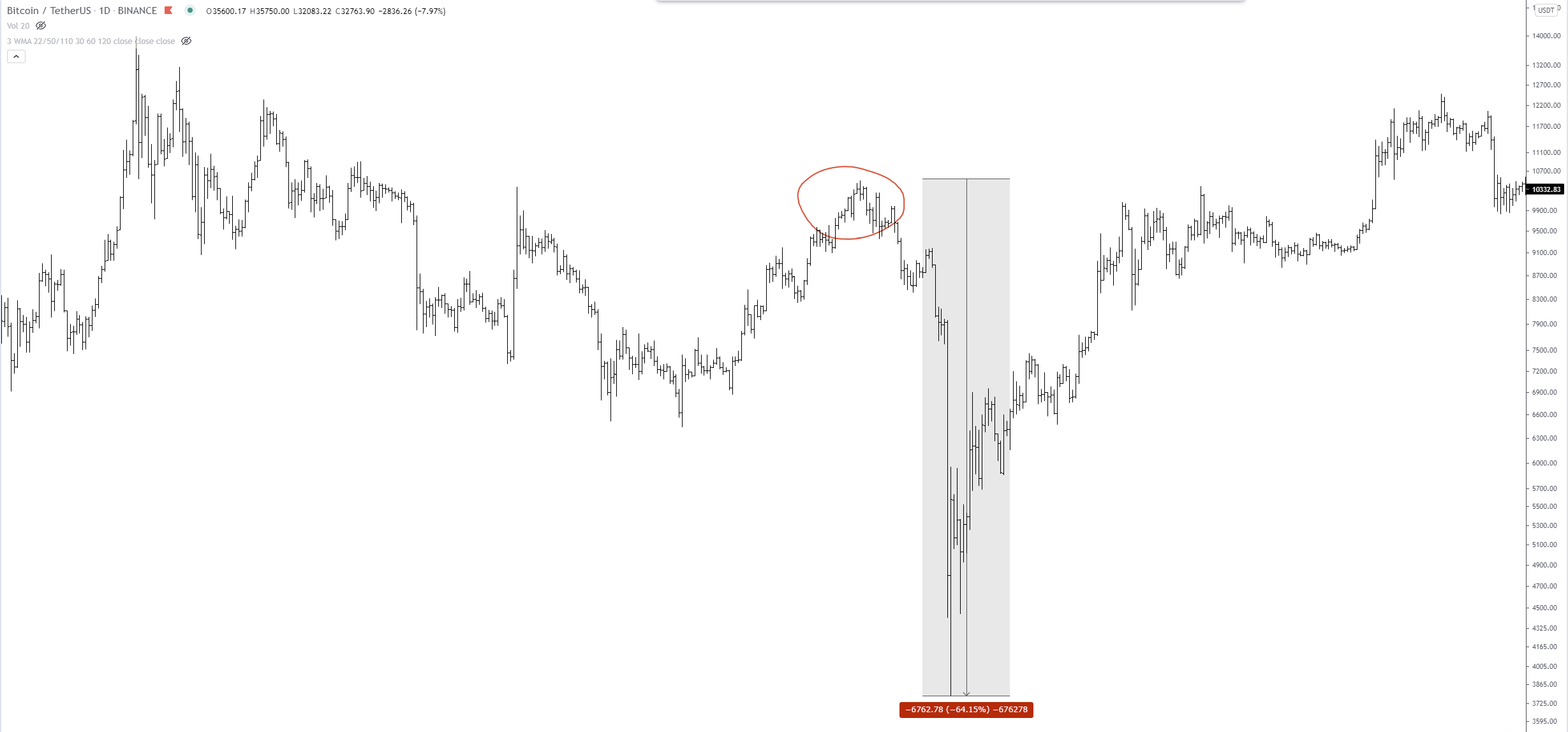

This is the number of long positions displayed by the curve. As you can see their number is at its historical highs and the previous time when the number of long positions reached such values was the area of February 20, 20. And then we had one of the most significant collapses in a short period of time.

Why is this so? It would seem that if there are a lot of purchases / long positions, then the price should rise ... The reality is unfortunately different and exchanges are making good money on the liquidation of long positions.

The situation is as follows:

We see that there is demand and it is growing. Therefore, we should get a certain growth. But on the other hand, a large number of purchases with leverage in practice leads to the opposite.

What can be done in this situation?

Exactly the recipe that we have written about so many times...

Let's run through it one more time.

All you need to do on the SPOT market is to make small incremental purchases of good projects. STOP-LOSS in this situation will be ineffective because the market is in uncertainty and is wobbling from side to side. Therefore, you reduce the size of the position to a minimum.

On the futures market, we open short positions at opportune moments so that if the market does collapse more we can make money. And on the futures market, STOP LOSSES are mandatory at all times without exception.

Thus, it is more likely that this difficult period of uncertainty will be passed with profits.

Now let's look at a few scenarios.

If the price comes out of the current consolidation down, we somehow get a pullback for the entire downward momentum to the conditional dynamic line of the downtrend (this is the area of 45k)

Thus, the very small purchases that we make now will be closed in the plus.

In case history repeats itself and we see a fractal, which we have already seen before - our purchases will be closed in the plus, but the short positions will reach stop-losses.

Be prepared for any situation, up to the fact that the market may go on "summer vacation"

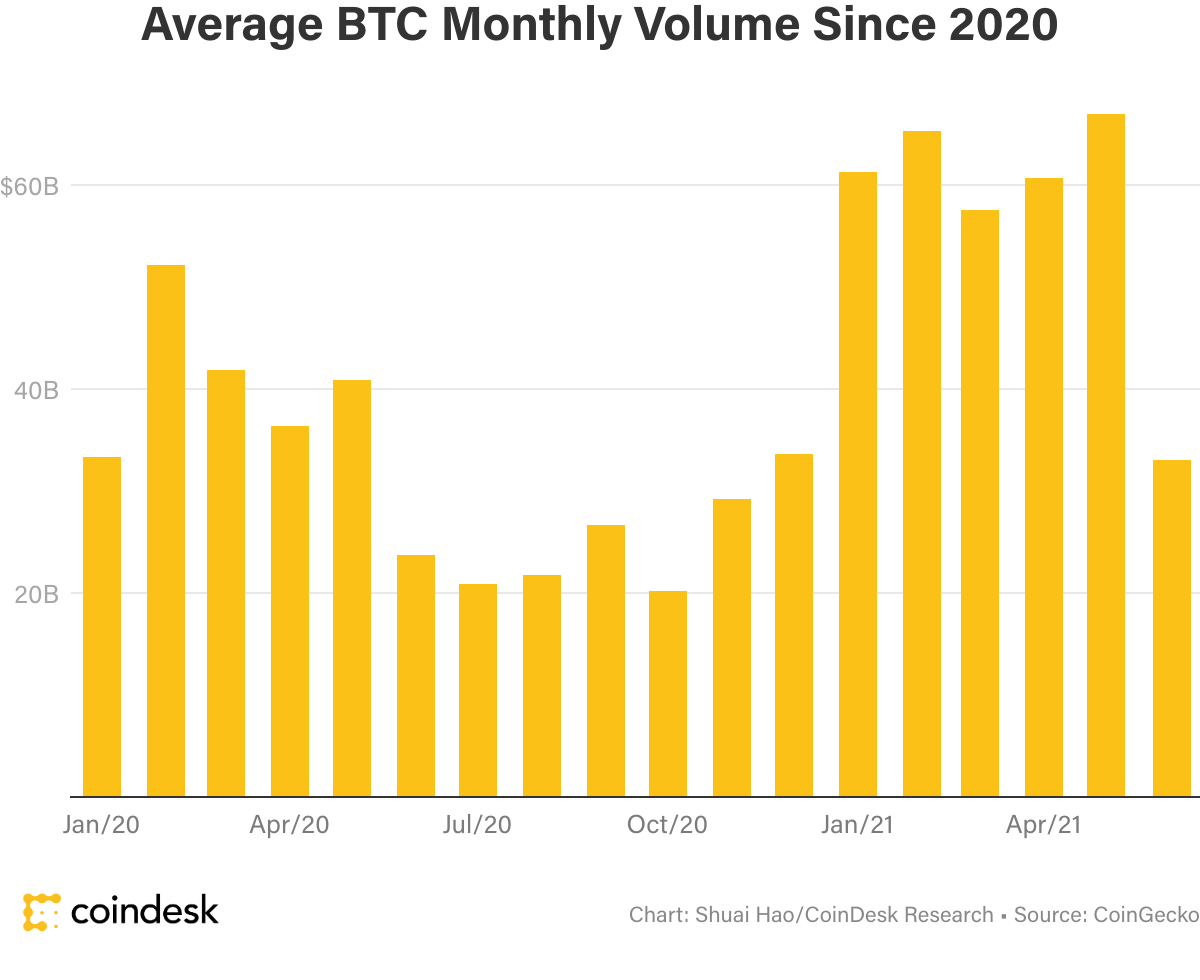

This month the volumes have halved (the last yellow column is the current month), if the interest and volume of deals will keep this trend, the flat could last for a long time.