Cricket Spread Betting Strategy

⚡ ALL INFORMATION CLICK HERE 👈🏻👈🏻👈🏻

Cricket Spread Betting Strategy

From Wikipedia, the free encyclopedia

^ The Sunday Times : "World Cup to kick off boom in spread betting"

^ "The perils of spread-betting" . The Times . Sep 20, 2007. Archived from the original on July 19, 2008.

^ "Gambling Commission - Home" . www.gamblingcommission.gov.uk .

^ Gambling Times: What are the Odds? Archived 2011-02-04 at the Wayback Machine

^ The Sunday Times: Spread betting

^ "Income Tax – Assessable income derivation of income – spread betting" . Australian Government ATO. 3 March 2010 . Retrieved 26 January 2011 .

^ Budworth, David. "Spread-betting fails investors in trouble" . thetimes.co.uk . Retrieved 11 October 2013 .

^ Pfanner, Eric. "Spread-bets on Cup venture into bizarre - Technology - International Herald Tribune" . The New York Times . Retrieved 11 October 2013 .

^ Rayman, Richard. "White Paper on Spread Betting" (PDF) . Cass Business School . Retrieved 11 October 2013 .

Spread betting is any of various types of wagering on the outcome of an event where the pay-off is based on the accuracy of the wager, rather than a simple "win or lose" outcome, such as fixed-odds (or money-line) betting or parimutuel betting .

A spread is a range of outcomes and the bet is whether the outcome will be above or below the spread. Spread betting has been a major growth market in the UK in recent years, with the number of gamblers heading towards one million. [1] Financial spread betting (see below) can carry a high level of risk if there is no "stop". [2] In the UK, spread betting is regulated by the Financial Conduct Authority rather than the Gambling Commission . [3]

The general purpose of spread betting is to create an active market for both sides of a binary wager , even if the outcome of an event may appear prima facie to be biased towards one side or the other. In a sporting event a strong team may be matched up against a historically weaker team; almost every game has a favorite and an underdog . If the wager is simply "Will the favorite win?", more bets are likely to be made for the favorite, possibly to such an extent that there would be very few betters willing to take the underdog.

The point spread is essentially a handicap towards the underdog. The wager becomes "Will the favorite win by more than the point spread?" The point spread can be moved to any level to create an equal number of participants on each side of the wager. This allows a bookmaker to act as a market maker by accepting wagers on both sides of the spread. The bookmaker charges a commission , or vigorish , and acts as the counterparty for each participant. As long as the total amount wagered on each side is roughly equal, the bookmaker is unconcerned with the actual outcome; profits instead come from the commissions.

Because the spread is intended to create an equal number of wagers on either side, the implied probability is 50% for both sides of the wager. To profit, the bookmaker must pay one side (or both sides) less than this notional amount. In practice, spreads may be perceived as slightly favoring one side, and bookmakers often revise their odds to manage their event risk.

One important assumption is that to be credited with a win, either team only needs to win by the minimum of the rules of the game, without regard to the margin of victory. This implies that teams in a winning position will not necessarily try to extend their margin—and more importantly, each team is only playing to win rather than to beat the point spread. This assumption does not necessarily hold in all situations. For example, at the end of a season, the total points scored by a team can affect future events such as playoff seeding and positioning for the amateur draft, and teams may "run up" the score in such situations. In virtually all sports, players and other on-field contributors are forbidden from being involved in sports betting and thus have no incentive to consider the point spread during play; any attempt to manipulate the outcome of a game for gambling purposes would be considered match fixing , and the penalty is typically a lifetime banishment from the sport; such is the lack of tolerance for manipulating the result of a sporting event for such purposes.

Spread betting was invented by Charles K. McNeil , a mathematics teacher from Connecticut who became a bookmaker in Chicago in the 1940s. [4] In North America , the gambler usually wagers that the difference between the scores of two teams will be less than or greater than the value specified by the bookmaker , with even money for either option. An example:

Spreads are frequently, though not always, specified in half-point fractions to eliminate the possibility of a tie, known as a push . In the event of a push, the game is considered no action , and no money is won or lost. However, this is not a desirable outcome for the sports book, as they are forced to refund every bet, and although both the book and its bettors will be even, if the cost of overhead is taken into account, the book has actually lost money by taking bets on the event. Sports books are generally permitted to state "ties win" or "ties lose" to avoid the necessity of refunding every bet.

Betting on sporting events has long been the most popular form of spread betting. Whilst most bets the casino offers to players have a built in house edge, betting on the spread offers an opportunity for the astute gambler. When a casino accepts a spread bet, it gives the player the odds of 10 to 11, or -110. That means that for every 11 dollars the player wagers, the player will win 10, slightly lower than an even money bet. If team A is playing team B, the casino is not concerned with who wins the game; they are only concerned with taking an equal amount of money of both sides. For example, if one player takes team A and the other takes team B and each wager $110 to win $100, it doesn't matter what team wins; the casino makes money. They take $100 of the $110 from the losing bet and pay the winner, keeping the extra $10 for themselves. This is the house edge. The goal of the casino is to set a line that encourages an equal amount of action on both sides, thereby guaranteeing a profit. This also explains how money can be made by the astute gambler. If casinos set lines to encourage an equal amount of money on both sides, it sets them based on the public perception of the team, not necessarily the real strength of the teams. Many things can affect public perception, which moves the line away from what the real line should be. This gap between the Vegas line, the real line, and differences between other sports books betting lines and spreads is where value can be found.

A teaser is a bet that alters the spread in the gambler's favor by a predetermined margin – in American football the teaser margin is often six points. For example, if the line is 3.5 points and bettors want to place a teaser bet on the underdog, they take 9.5 points instead; a teaser bet on the favorite would mean that the gambler takes 2.5 points instead of having to give the 3.5. In return for the additional points, the payout if the gambler wins is less than even money , or the gambler must wager on more than one event and both events must win. In this way it is very similar to a parlay . At some establishments, the "reverse teaser" also exists, which alters the spread against the gambler, who gets paid at more than evens if the bet wins.

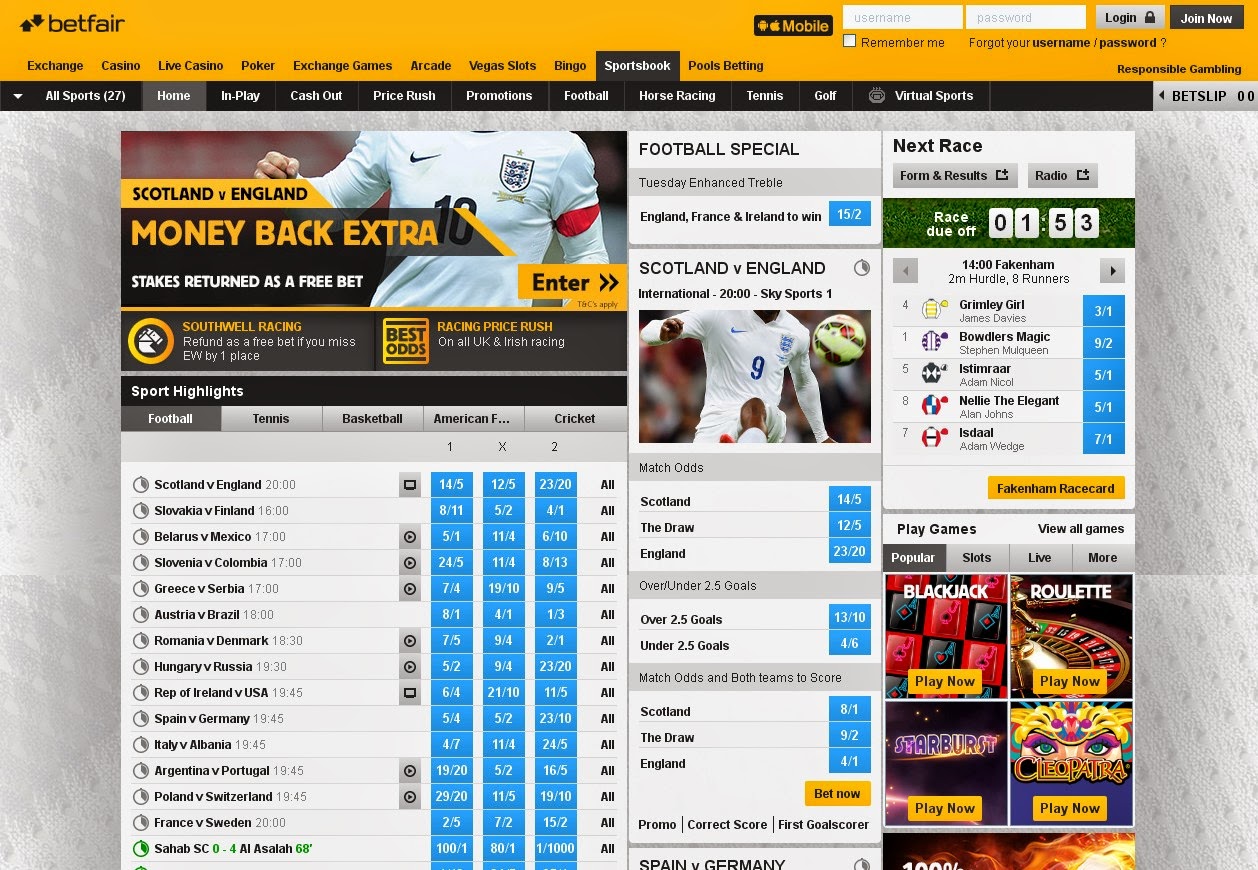

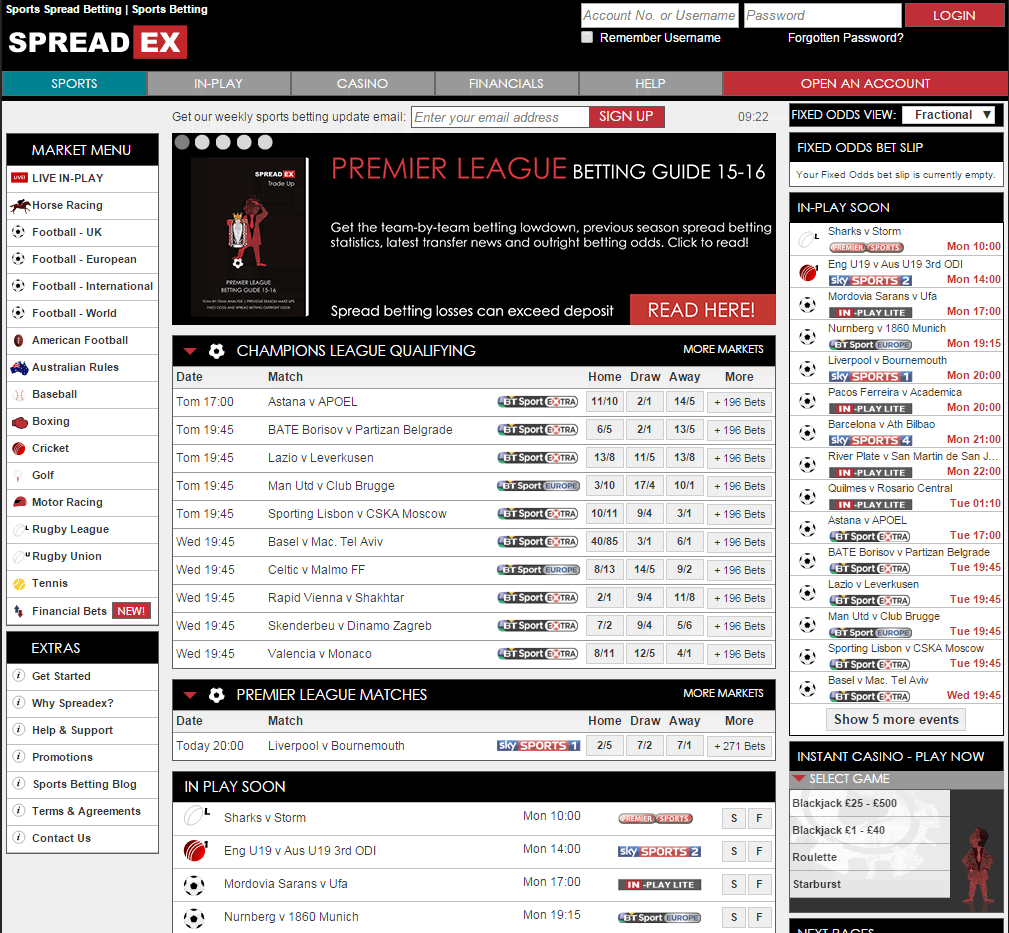

In the United Kingdom , sports spread betting became popular in the late 1980s by offering an alternative form of sports wagering to traditional fixed odds , or fixed-risk, betting. With fixed odds betting , a gambler places a fixed-risk stake on stated fractional or decimal odds on the outcome of a sporting event that would give a known return for that outcome occurring or a known loss if that outcome doesn't occur (the initial stake). With sports spread betting, gamblers are instead betting on whether a specified outcome in a sports event will end up being above or below a ‘spread’ offered by a sports spread betting firm, with profits or losses determined by how much above or below the spread the final outcome finishes at.

The spread on offer will refer to the betting firm's prediction on the range of a final outcome for a particular occurrence in a sports event, e.g., the total number of goals to be scored in a football (US: soccer) match, the number of runs to be scored by a team in a cricket match or the number of lengths between the winner and second-placed finisher in a horse race.

The gambler can elect to ‘buy’ or ‘sell’ on the spread depending on whether they think the final outcome will be higher than the top end of the spread on offer, or lower than the bottom end of the spread. The more right the gambler is then the more they will win, but the more wrong they are then the more they can lose.

The level of the gambler's profit or loss will be determined by the stake size selected for the bet, multiplied by the number of unit points above or below the gambler's bet level. This reflects the fundamental difference between sports spread betting and fixed odds sports betting in that both the level of winnings and level of losses are not fixed and can end up being many multiples of the original stake size selected.

For example, in a cricket match a sports spread betting firm may list the spread of a team's predicted runs at 340 – 350. The gambler can elect to ‘buy’ at 350 if they think the team will score more than 350 runs in total, or sell at 340 if they think the team will score less than 340. If the gambler elects to buy at 350 and the team scores 400 runs in total, the gambler will have won 50 unit points multiplied by their initial stake. But if the team only scores 300 runs then the gambler will have lost 50 unit points multiplied by their initial stake.

It is important to note the difference between spreads in sports wagering in the U.S. and sports spread betting in the UK. In the U.S. betting on the spread is effectively still a fixed risk bet on a line offered by the bookmaker with a known return if the gambler correctly bets with either the underdog or the favourite on the line offered and a known loss if the gambler incorrectly bets on the line. In the UK betting above or below the spread does not have a known final profit or loss, with these figures determined by the number of unit points the level of the final outcome ends up being either above or below the spread, multiplied by the stake chosen by the gambler.

For UK spread betting firms, any final outcome that finishes in the middle of the spread will result in profits from both sides of the book as both buyers and sellers will have ended up making unit point losses. So in the example above, if the cricket team ended up scoring 345 runs both buyers at 350 and sellers at 340 would have ended up with losses of five unit points multiplied by their stake.

In addition to the spread bet, a very common "side bet" on an event is the total (commonly called the over/under or O/U ) bet. This is a bet on the total number of points scored by both teams. Suppose team A is playing team B and the total is set at 44.5 points. If the final score is team A 24, team B 17, the total is 41 and bettors who took the under will win. If the final score is team A 30, team B 31, the total is 61 and bettors who took the over will win. The total is popular because it allows gamblers to bet on their overall perception of the game (e.g., a high-scoring offensive show or a defensive battle) without needing to pick the actual winner.

In the UK, these bets are sometimes called spread bets, but rather than a simple win/loss, the bet pays more or less depending on how far from the spread the final result is.

Example: In a football match the bookmaker believes that 12 or 13 corners will occur, thus the spread is set at 12–13.

In North American sports betting many of these wagers would be classified as over-under (or, more commonly today, total ) bets rather than spread bets. However, these are for one side or another of a total only, and do not increase the amount won or lost as the actual moves away from the bookmaker's prediction. Instead, over-under or total bets are handled much like point-spread bets on a team, with the usual 10/11 (4.55%) commission applied. Many Nevada sports books allow these bets in parlays , just like team point spread bets. This makes it possible to bet, for instance, team A and the over , and be paid if both

(Such parlays usually pay off at odds of 13:5 with no commission charge, just as a standard two-team parlay would.)

The mathematical analysis of spreads and spread betting is a large and growing subject. For example, sports that have simple 1-point scoring systems ( e.g., baseball , hockey , and soccer ) may be analysed using Poisson and Skellam statistics.

By far the largest part of the official market in the UK concerns financial instruments; the leading spread-betting companies make most of their revenues from financial markets, their sports operations being much less significant. Financial spread betting in the United Kingdom closely resembles the futures and options markets, the major differences being

Financial spread betting is a way to speculate on financial markets in the same way as trading a number of derivatives . In particular, the financial derivative Contract for difference (CFD) mirrors the spread bet in many ways. In fact, a number of financial derivative trading companies offer both financial spread bets and CFDs in parallel using the same trading platform.

Unlike fixed-odds betting, the amount won or lost can be unlimited as there is no single stake to limit any loss. However, it is usually possible to negotiate limits with the bookmaker:

Spread betting has moved outside the ambit of sport and financial markets (that is, those dealing solely with share, bonds and derivatives), to cover a wide range of markets, such as house prices. [5] By paying attention to the external factors, such as weather and time of day, those who are betting using a point spread can be better prepared when it comes to obtaining a favorable outcome. Additionally, by avoiding the favourite-longshot bias , where the expected returns on bets placed at shorter odds exceed that of bets placed at the longer odds, and not betting with one's favorite team, but rather with the team that has been shown to be better when playing in a specific weather condition and time of day, the possibility of arriving at a positive outcome is increased.

In the UK and some other European countries the profit from spread betting is free from tax. The tax authorities of these countries designate financial spread betting as gambling and not investing, meaning it is free from capital gains tax and stamp duty , despite the fact that it is regulated as a financial product by the Financial Conduct Authority in the UK. Most traders are also not liable for income tax unless they rely solely on their profits from financial spread betting to support themselves. The popularity of financial spread betting in the UK and some other European countries, compared to trading other speculative financial instruments such as CFDs and futures is partly due to this tax advantage. However, this also means any losses cannot be offset against future earnings for tax calculations.

Conversely, in most other countries financial spread betting income is considered taxable. For example, the Australian Tax Office issued a decision in March 2010 saying "Yes, the gains from financial spread betting are assessable income under section 6-5 or section 15-15 of the ITAA 1997". [6] Similarly, any losses on the spread betting contracts are deductible. This has resulted in a much lower interest in financial spread betting in those countries.

Suppose Lloyds Bank is trading on the market at 410p bid, and 411p offer. A spread-betting company is also offering 410-411p. We use cash bets with no definite expiry , or "rolling daily bets" as they are referred to by the spread betting companies.

If I think the share price is going to go up, I might bet £10 a point ( i.e., £10 per penny the shares moves) at 411p. We use the offer price since I am "buying" the share (betting on its increase). Note that my total loss (if Lloyds Bank went to 0p) could be up to £4110, so this is as risky as buying 1000 of the shares normally.

If a bet goes overnight, the bettor is charged a financing cost (or receives it, if the bettor is shorting the stock). This might be set at LIBOR + a certain percentage , usually around 2-3%.

Thus, in the example, if Lloyds Bank are trading at 411p, then for every day I keep the bet open I am charged [taking finance cost to be 7%] ((411p x 10) * 7% / 365 ) = £0.78821 (or 78.8p)

On top of this, the bettor needs an amount as collateral in the spread-betting account to cover potential losses. Usually this is either 5 or 10% of the total exposure you are taking on but can go up to 100% on illiquid stocks. In this case £4110 * 0.1 or 0.05 = £411.00 or £205.50

If at the end of the bet Lloyds Bank traded at 400-401p, I need to cover that £4110 – £400*10 (£4000) = £110 difference by putting extra deposit (or collateral) into the account.

The punter usually receives all dividends and other corporate adjustments in the financing charge each night. For example, suppose Lloyds Bank goes ex-dividend with dividend of 23.5p. The bettor receives that amount. The exact amount received varies depending on the rules and policies of the spread betting company, and the taxes that are normally charged in the home tax country of the shares.

According to an article in The Times dated 10 April 2009, approximately 30,000 spread bet accounts were opened in the previous year, and that the largest study of gambling in the UK on behalf of the Gambling Commission found that serious problems developed in almost 15% of spread betters compared to 1% of other gambling. [7] A report from Cass Business School found that only 1 in 5 gamblers ends up a winner. [8] As noted in the report, this corresponds to the same ratio of successful gamblers in regular trading. [9] Evidence from spread betting firms themselves actually put this closer to being 1 in 10 traders as being profitable. [ citation needed ]

Cricket Spread Betting | Get Started | Spreadex

Spread betting - Wikipedia

Best Spread Betting Strategies and Tips for 2021 | IG UK

The Best Cricket Betting Strategies 2020 | BettingOnline

5 best cricket betting strategies ᐉ MightyTips

Best spread betting strategies and tips

Becca Cattlin | Financial writer , London

What is the number one mistake traders make?

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money. High volatility increases the risk of sudden, large or rapid losses.

To prioritise the service we give our existing clients, IG is not currently allowing any new positions on GameStop and AMC Entertainment.

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. High volatility increases the risk of sudden, large or rapid losses.

To prioritise the service we give our existing clients, IG is not currently allowing any new positions on GameStop and AMC Entertainment.

We use a range of cookies to give you the best possible browsing experience. By continuing to use this website, you agree to our use of cookies. You can view our cookie policy and edit your settings here , or by following the link at the bottom of any page on our site.

Spread betting enables you to execute a range of trading strategies, thanks to the range of benefits it offers traders. Discover some of the most popular spread betting strategies and some tips for getting started.

A trading strategy is nothing more than a predefined methodology for how a trader will enter and exit the market. It will identify specific market circumstances and price points during which a trader will look to execute and close their trade.

We’ve taken a look at some top-level strategies, and the way they would be carried out using spread bets .

This is by no means a full list of all of the trading strategies that can utilise spread bets. In fact, as long as the platform you are using has the appropriate technical analysis tools, most strategies are suited to using this popular derivative product.

A trending market is one that is reaching higher highs or lower lows. Trading with a trend is usually the practice of those who adapt the ‘ position trading ’ style, and is considered a medium-term strategy.

A trend trader’s strategy would use charts and technical analysis to identify the beginning and end of market movements. This often includes the use of indicators such as moving averages and the moving average convergence/divergence (MACD) to identify where to open and close their spread betting positions.

Trend trading is a popular strategy among spread betters, as they can follow the market momentum regardless of whether they are going long or short.

For example, if the price of soybeans was thought to be in an uptrend, with higher peaks and troughs, a trader might open a long spread betting position. They’d do this by opening a spread bet to buy soybeans. Once the trader has reached their profit target or acceptable loss, or analysis has shown the trend will soon be reversing, they would close their position by selling soybeans.

On the other hand, if the soybean market was in a downtrend, meeting lower highs and lower lows, a trader might decide to open a short spread betting position. They would do so by opening a position to sell soybeans.

Consolidating markets are range bound – so instead of reaching price extremes like trending markets, they remain within lines of support and resistance . This is why consolidating market strategies require traders to use indicators to identify entry and exit points within the range bound market, such as the relative strength index (RSI) .

An important part of a consolidating market strategy is volume analysis. When a market is trading within a range, the volume of trades is usually low and flat, but if the range is about to break there will usually be a rise in volume. This can be a clear indication that it is time for traders to think about closing their positions and, potentially, switching to a different strategy.

Although consolidating markets don’t provide the opportunity for running profits, they can create plenty of opportunities for short-term traders, such as scalpers.

Scalping is a trading style that is designed to profit from small and frequent price changes. Although traders might not make the large, long-term gains you’d see with other styles, they enter and exit far more trades, with the aim of taking smaller profits more often.

Many believe taking such short-term positions might not produce the same results as longer-term strategies but spread betting can help capital to go much further. This is because spread betting is a leveraged product, which means that traders can open positions that are much larger than their initial deposit. It is important to remember that while leverage can magnify your profits, it can also magnify your losses. This makes it crucial to have a suitable risk management strategy in place.

Breakout trading involves entering a trend as early as possible, ready for the market price to ‘break out’ from a consolidating or trending range. Breakout strategies are based on the idea that key price points are the start of a major movement, or expansions in volatility – so by entering the market at the correct level, a trader can ride the trend from start to finish.

Typically, traders looking to take advantage of a breakout will need to identify support or resistance levels – as once these have been met or surpassed, they will need to enter the market. Most breakout trading strategies will utilise volume trading indicators , and RSI or MACD technical indicators to find these levels.

One strategy used to spread bet breakouts is to place limit-entry orders at key price points, so that if the market moves through the support or resistance level, the order is executed automatically.

For example, let’s say you wanted to open a spread betting position on gold, which is currently trading at $1255. Although the market has been trading in a range for two weeks, you believe it is due to breakout into a downward trend. Looking at historic levels of support, you can see that $1250 is a key price point. So, you decide to place an entry order to open a short spread betting position if the price of gold falls below $1249. If the market did fall below this price, your spread bet would be executed, and you could ride the breakout until your analysis indicated the downtrend was over. If the market didn’t fall to this price, your trade would never be executed.

Reversal trading strategies are based on identifying areas in which trends are going to change direction. Reversals can be both bullish or bearish, giving a signal that the market is either at the top of an uptrend, or at the bottom of a downtrend. Traders using this strategy would open a spread betting position in the opposite direction to the current market trend, ready to take advantage of the reversal. This can also be known as ‘contrarian trading’.

When trading reversals, it is important to ensure that the market is not simply experiencing a retracement – a more temporary move. Retracement levels are commonly identified using the Fibonacci retracement tool. If the price goes beyond the levels identified by the tool, it is taken as a sign the market is reversing.

Although reversals can be a complicated spread betting strategy, with the use of indicators, there can be a wealth of opportunities. In order to execute a reversal strategy, a trader will need to utilise a confirmation tool. These can include:

For example, let’s say you wanted to create a FTSE 100 spread betting strategy and decided to focus on reversal trading. Although FTSE 100 has been in a downtrend for the last week, you believe that following positive earnings announcements for major FTSE constituents, the trend will reverse. You decide to enter a position if you identify the double bottom candlestick pattern, in the hopes of taking advantage of the upcoming price increase. If the market did reverse, you would be in a position to profit from the upswing. However, if the market continued to decline, you would suffer a loss.

There are a few key things every trader needs to know before they implement a spread betting strategy. It is important to:

Before you start to spread bet, it is crucial to have an understanding of what spread betting is and how it works .

When you spread bet, you can speculate on the future price movements of a range of global markets, such as forex, commodities, indices and shares. And because you don’t own the asset, you won’t have to pay tax on any profits you make. 1 These are just some of the benefits of spread betting , others include hedging, out-of-hours trading and no commission.

Prior to even thinking about which strategy you are going to implement, you should create a trading plan that will give your time on the markets clear direction and purpose. Your plan should always be unique to you, but most plans include:

When you’re building your trading plan and spread betting strategy, you might already have a market in mind. But if you don’t, it’s important to choose which assets you want to focus on before you start spread betting.

Most people will choose to trade a market that they already have an interest in, so they have prior knowledge that they can fall back on. With IG, you can trade over 16,000 markets, including indices, forex, shares, commodities and many more.

Before you open any spread betting position, it is important to be aware of exactly how much you could stand to lose if the market turned against you. Especially as spread bets are leveraged, you could stand to lose – or win – much more than your initial deposit. It is always wise to think about your trade in terms of its full value, rather than the amount you pay to open it.

One way of mitigating risk and locking in profits is by setting an automatic stop or limit, which will define the level you’d like to close your trade at. Stop-losses will close a trade if the market moves against you, while limit-close orders will close your position once it has reached a certain amount of profit.

Footnote

1 Tax laws are subject to change and depend on individual circumstances. Tax law may differ in a jurisdiction other than the UK.

Publication date : Friday 24 May 2019 15:11

This information has been prepared by IG, a trading name of IG Markets Limited. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. See full non-independent research disclaimer and quarterly summary .

Explore the range of markets you can trade – and learn how they work – with IG Academy's free ’introducing the financial markets’ course.

We reveal the top potential pitfall and how to avoid it. Discover how to increase your chances of trading success, with data gleaned from over 100,00 IG accounts.

For more info on how we might use your data, see our privacy notice and access policy and privacy webpage .

Find out what charges your trades could incur with our transparent fee structure.

Discover why so many clients choose us, and what makes us a world-leading provider of spread betting and CFDs.

Stay on top of upcoming market-moving events with our customisable economic calendar.

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money. Professional clients can lose more than they deposit. All trading involves risk.

The value of shares, ETFs and ETCs bought through a share dealing account, a stocks and shares ISA or a SIPP can fall as well as rise, which could mean getting back less than you originally put in. Past performance is no guarantee of future results.

CFD, share dealing and stocks and shares ISA accounts provided by IG Markets Ltd, spread betting provided by IG Index Ltd. IG is a trading name of IG Markets Ltd (a company registered in England and Wales under number 04008957) and IG Index Ltd (a company registered in England and Wales under number 01190902). Registered address at Cannon Bridge House, 25 Dowgate Hill, London EC4R 2YA. Both IG Markets Ltd (Register number 195355) and IG Index Ltd (Register number 114059) are authorised and regulated by the Financial Conduct Authority.

The information on this site is not directed at residents of the United States, Belgium or any particular country outside the UK and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

Spalding Outdoor

Hot Ass Porno

Brigitte Overwatch Porn

Secretary Compilation

Czech Sperm