Credit Score - A Complete Summary of Your Finances

Anajli Saxena

A Credit score is a numerical expression representing the creditworthiness of an individual or a company. The credit score is the primary criteria looked into by lenders before extending the loans. The borrower’s financial ability to repay the amount can be assessed easily through credit score. The range of the credit score is between 300 to 900, where 300 is the lowest, while 900 is the highest range. =

How to calculate the Credit Score?

Different financial parameters are analysed by rating agencies to calculate the credit score, these are:

Ø Total loans taken

Ø Borrower’s credit history

Ø Types of credit

Ø New credit inquiries

Ø The length of the borrower’s credit history

The above financial parameters are analyzed by rating agencies to calculate the credit score. A credit score above 750 is considered good, while 300 to 650 is a bad credit score. A high credit score represents financial stability, responsible financial behaviour, sincerely utilizing the borrowed funds, among other things. Some benefits of a high credit score include:

ü The higher loan amount can be sanctioned to borrowers

ü The loan amount can be negotiated at low-interest rates

ü Flexibility in choosing the repayment tenure, etc.

ü Quick loan disbursal

How to get a Free Credit Score?

For a free credit score check, one must visit the official website of different financial institutions and avail of the report. The process to get the free credit score is underlined below:

Step1: Enter the First and last name of the applicant.

Step2: Enter the applicant’s valid phone number and e-mail id.

Step3: The applicant’s mobile number receives the OTP generated for verification.

Step4: Now, verify the applicant’s PAN and the age.

Step5: Free credit score is generated now.

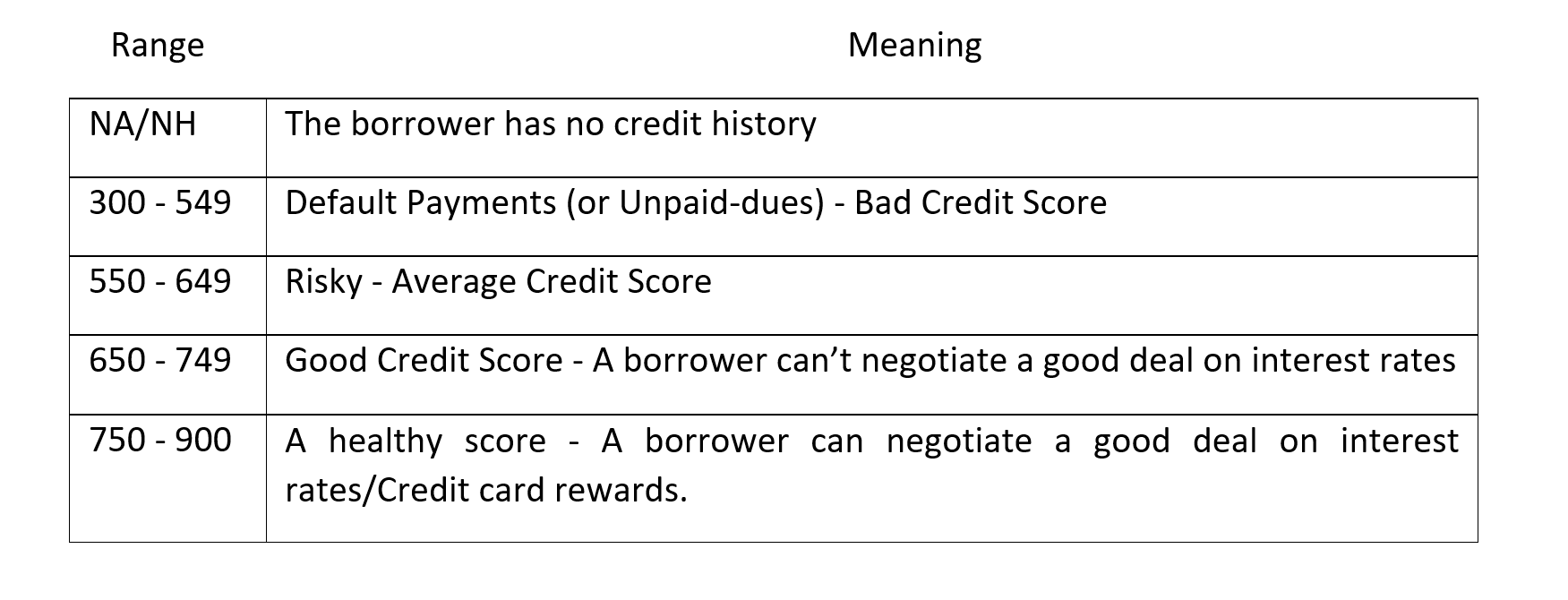

What does the credit score range denote?

The credit score range is between 300-900, and the range denotes the following:

What factors affect your Credit Score?

Different factors affect the credit score of an individual, these are:

Ø Credit History: The repayment history holds 30% of the credit score value.

Ø Missing the due date: The timely payment of debt installment affects the credit score positively.

Ø Credit utilization: Utilizing the credit limit has a 30% weightage in credit score. Utilizing the credit limit judiciously is key to improving the credit score history.

Ø Multiple credit applications: An applicant frequently trying to avail of a loan facility from different lenders also get its credit score negatively impacted.

Credit Score Check

An individual’s credit score hinges on different aspects of financial prudence. To improve the credit score, an applicant must be financially disciplined. He/she must pay his dues on time and avoid unnecessary expenditures. Any individual can do a free credit score check before applying for a loan and negotiate a better deal and avail a high loan amount, if necessary.

Download the LazyPay app, get your credit limit and enjoy making those purchases like you never have !!!