Comprehending LLCs: Trick Information for Business Owners and Company Owner

An LLC, or Minimal Liability Firm, is a preferred service structure chosen by many entrepreneurs as a result of its flexibility and security benefits. This entity integrates the pass-through tax of a partnership or single proprietorship with the minimal liability of a firm, making it an attractive choice for small to medium-sized services. LLCs are authorized by state statutes, and the requirements for developing an LLC differ from state to state. Typically, the procedure includes submitting a file, commonly called the Articles of Company, with a state's business enrollment entity and paying a declaring charge. While an LLC can shield personal properties from organization obligations under a lot of scenarios, it is very important to maintain the correct splitting up in between personal and organization finances to ensure this security works.

The management structure of an LLC is extremely versatile. Participants can select to take care of the firm themselves, known as member-managed, or they can designate supervisors to take care of the daily procedures, known as manager-managed. This versatility permits the participants to tailor the administration according to their skills, experience, and the service's demands. One more advantage of an LLC is the ability to select how it is exhausted. By default, LLCs are treated as pass-through entities for tax purposes, implying the company itself does not pay taxes on service earnings. Rather, the revenues and losses of the business "go through" to the members' individual tax returns. An LLC can additionally choose to be tired as a company if it would certainly be extra helpful. Understanding these options and talking to a tax expert can aid make the most of a company's tax obligation advantages.

Understanding the Framework and Purpose of Restricted Liability Companies (LLCs)

At its core, a Limited Responsibility Company (LLC) is a popular organization structure preferred by entrepreneurs across various industries as a result of its adaptability and protective attributes. This form of business entity integrates the pass-through tax of a partnership or sole proprietorship with the minimal responsibility of a corporation. This indicates that LLC proprietors, frequently described as participants, can gain from the earnings of business without being personally in charge of its liabilities and financial obligations. Each participant's personal properties, such as their home, car, and savings, are safeguarded from being confiscated to cover business financial obligations, which offers a substantial security net that is not offered in a few other business kinds, like sole proprietorships.

The functional adaptability of an LLC is an additional compelling reason for its widespread fostering. Unlike corporations, which are required to have a fixed administration framework and a board of supervisors, LLCs permit an extra customizable administration setup. Members can choose to handle business themselves, or they can appoint managers to deal with these duties. This makes it an ideal structure for various types of businesses, from single-owner operations to multi-partner endeavors with intricate administration requirements. In addition, LLCs are not bound by the stringent record-keeping and meeting demands that corporations need to adhere to, which simplifies administrative duties and enhances operational performance.

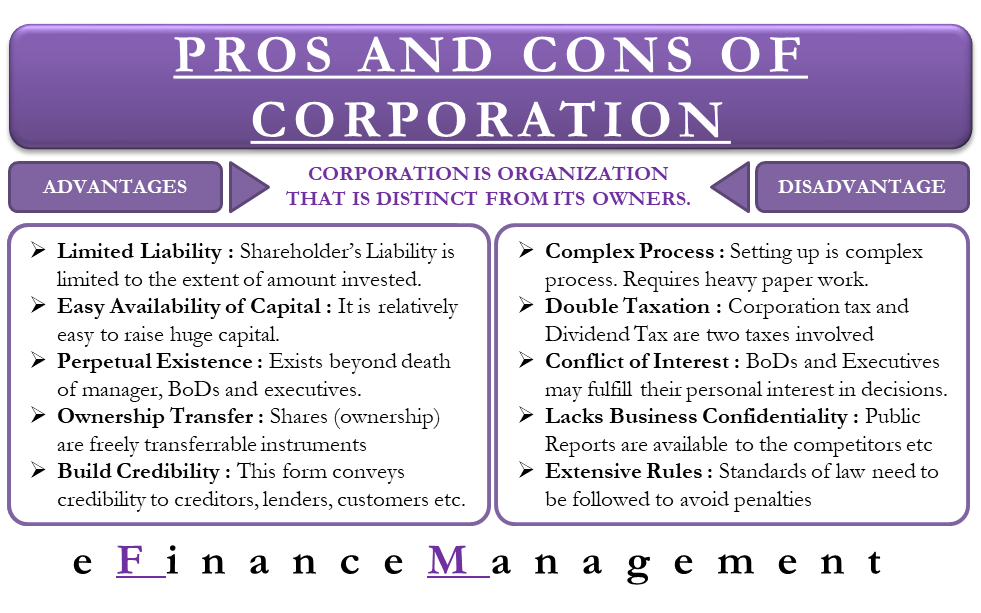

From a tax viewpoint, LLCs are inherently versatile. By default, LLCs are dealt with as pass-through entities for tax obligation objectives, suggesting that the business itself is not tired directly. Instead, the profits and losses are passed with to the members, that after that report them on their individual tax returns. This avoids the dual taxation generally linked with firms, where both the company revenues and the rewards paid to shareholders are strained. If it is helpful for tax obligation purposes or lines up better with service goals, an LLC can choose to be exhausted as a corporation, giving even higher flexibility and calculated tax obligation preparation chances.

The procedure of creating an LLC varies a little from one state to another, however it generally includes filing the needed documents, such as the Articles of Organization, with the proper state firm and paying a declaring charge. The requirement of composing an operating agreement, which lays out the monitoring structure and operational treatments of the LLC, is highly suggested though not required in all states. This record plays a vital role in stopping misunderstandings amongst members and ensuring smooth procedures.

As we check out the subtleties and benefits of LLCs, it becomes clear that this service framework uses a distinct blend of protection, performance, and versatility. It is tailored to meet the requirements of contemporary organizations, providing the necessary legal shields while suiting varied administration styles and tax obligation choices.

Recognizing the Structure and Benefits of an LLCWhen taking into consideration the formation of a Minimal Liability Firm (LLC), it is vital to understand both its architectural elements and the integral benefits it gives to its owners. An LLC is a popular service structure in the USA that integrates the pass-through taxation of a collaboration or sole proprietorship with the minimal liability of a firm. This means that the LLC itself is not tired directly. Rather, revenues and losses are travelled through to each member's personal earnings tax returns, hence preventing the double taxes often related to companies.

One of the key benefits of an LLC is the adaptability it provides in regards to monitoring and possession. Unlike corporations, which are needed to have a board of directors and business officers, an LLC does not have these inflexible frameworks and can be managed by its participants or a designated manager. This flexibility can be particularly helpful for small services or startups that need to adjust swiftly to transforming service problems without the difficult procedures of a company.

Moreover, the responsibility protection offered to LLC participants is a significant benefit. It shields individual properties from company debts and cases, an attribute that is exceptionally appealing to small company owners. stewart title stock symbol from the LLC being a separate lawful entity, suggesting that participants are usually not personally accountable for the firm's financial debts or lawful problems. It is important to keep correct company practices and conformity with the legislation to guarantee this separation is appreciated by the courts.

Another crucial benefit of an LLC is the ease of setup and upkeep. While needs vary by state, establishing up an LLC normally includes filing Articles of Organization with the state and paying a charge. Contrasted to please click the next web page and regulative demands of forming and preserving a corporation, an LLC is easier and frequently much less costly. Additionally, several states need fewer yearly filings and less formal functional procedures for LLCs, making them a less challenging option for local business proprietors.

An LLC offers considerable versatility in profit distribution amongst its members. Unlike a corporation, where profits should be distributed according to the portion of possession or variety of shares held, an LLC can disperse revenues in any kind of manner agreed upon by its members, despite their investment or possession level. This can permit more strategic economic planning and reinvestment in the organization, tailored to the distinct requirements and circumstances of its participants.

Finally, an LLC is an attractive alternative for several business owners because of its combination of limited obligation security, functional flexibility, simplicity of upkeep, and desirable tax obligation therapy. Recognizing these crucial facets can aid potential company owner make notified decisions regarding whether an LLC is the ideal framework for their business endeavors.

Comprehending the Framework and Advantages of an LLCThe Limited Liability Firm (LLC) has become a preferred choice for local business owner looking for flexibility and defense in their business structure. An LLC distinctively mixes the attributes of both partnership and company frameworks, providing a versatile administration configuration and liability security for its owners, that are usually described as members. The key allure of an LLC is its minimal obligation feature, which means that members are normally not directly in charge of business financial debts and liabilities. This protection resembles that enjoyed by shareholders of a firm but features less rules and even more flexible management choices. LLCs additionally use tax benefits. They are treated as pass-through entities by default, implying that business income is only tired as soon as at the participant degree, avoiding the dual tax faced by C firms. One of the noteworthy versatilities of an LLC is that it can be managed either by its members (member-managed) or by appointed managers (manager-managed), which can be useful relying on the members' expertise and the degree of participation they desire to have in daily procedures. An additional considerable advantage is the simplicity of establishing and maintaining an LLC contrasted to a company. The demands for developing an LLC usually include filing a file, commonly called the Articles of Company, with the particular state's Secretary of State office, along with a moderate filing fee. The recurring needs, such as yearly reports and fees, vary by state but are normally less difficult than those related to companies. This simplicity makes the LLC an attractive alternative for small to medium-sized services and for individuals looking for a much more simple method to company possession and procedure.

Understanding the Financial and Tax Effects of an LLCThey profit from a versatile organization entity that blends the attributes of both partnerships and firms when business owners pick to structure their service as a Restricted Responsibility Company (LLC). One of the most substantial advantages of an LLC is the adaptability in tax treatment it supplies. Unlike firms, an LLC is not tired as a separate organization entity. Instead, all losses and profits are "gone through" per participant of the LLC. Participants report earnings and losses on their personal federal tax returns, just as the owners of a collaboration would certainly, which indicates the LLC itself does not pay tax obligations straight. This stays clear of the double tax typically come across in corporations, where both the company's revenues and the returns paid to investors are exhausted.

Nevertheless, while pass-through taxes is advantageous, it calls for LLC proprietors to pay self-employment taxes, which cover Social Security and Medicare payments. This aspect is frequently overlooked by brand-new LLC proprietors and can result in unexpected economic problems if not effectively prepared for. Furthermore, LLCs offer the choice to be taxed as a firm if it ends up being useful. At greater degrees of income, the corporate tax rate may be reduced than the private tax obligation rates of the participants. Making register a business in canada as a non-resident can be strategically valuable, though it requires cautious monetary analysis and potentially the assistance of a monetary expert or accountant.

An additional financial effects of operating an LLC entails the management of financial obligations. While the structure provides minimal obligation defense, meaning participants are commonly not personally in charge of organization debts and liabilities, this protection is not outright. Incorrect upkeep of the LLC, such as combining individual and service funds, can cause a court "puncturing the company veil," which might reveal participants to individual responsibility. It's vital for LLC proprietors to stick purely to lawful rules, preserving clear separation of personal and company funds, and making certain all service tasks are conducted under the LLC's name.

Finally, LLCs likewise have much less inflexible requirements for record-keeping and conferences compared to firms, but maintaining arranged and extensive documents is still necessary for both legal securities and economic transparency. Regular economic reviews can assist in identifying inadequacies and recognizing chances for development and improvement. The capacity of an LLC to adjust to the transforming requirements of its business and its participants is one of its most useful attributes, cultivating growth and helping with less complicated administration.