Comprehending LLCs: Secret Features and Advantages

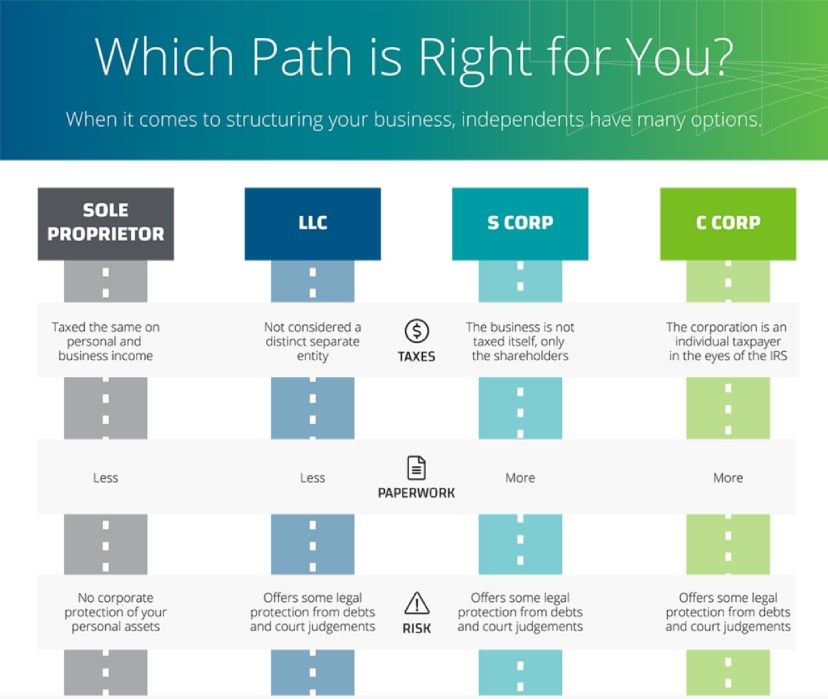

An LLC, or Limited Obligation Business, is a prominent company framework in the USA because of its flexibility and safety attributes. It integrates the minimal obligation of a company with the operational versatility and tax obligation performances of a partnership. Developing an LLC is favored by lots of entrepreneurs and entrepreneur since it provides individual asset protection, which shields individual assets from company financial debts and cases. This means that when it comes to lawsuit against the service, the personal effects of the owners-- such as homes, autos, and personal savings-- continue to be safeguarded. Additionally, an LLC is identified by its pass-through taxes system, where the revenues of business are strained just once, at the individual income level of the owners, avoiding the double taxation generally related to corporations.

Past the basic benefits, LLCs provide considerable flexibility in management and organization. Unlike companies, which are needed to have a board of directors and carry out annual meetings, LLCs do not call for these formalities, making them less complicated and less pricey to run. Owners of an LLC, that are described as participants, can handle business themselves, or they can pick to appoint managers who might or might not be participants. This makes LLCs particularly appealing for small companies and startups that might not have the sources to abide by the strict laws that govern corporations. Additionally, what is an annual return companies office can have an unrestricted variety of participants, and there are no limitations on the sorts of entities that can be members, consisting of individuals, companies, and even other LLCs. This adaptability makes LLCs a suitable option for a variety of company activities, from single-person enterprises to larger, multi-national companies.

Recognizing the Framework and Advantages of Limited Liability Companies (LLC)For entrepreneurs venturing right into new organization territories, recognizing the structure and benefits of a Limited Liability Business (LLC) is crucial for critical preparation and legal compliance. An LLC is a versatile organization entity integrating the pass-through taxation of a partnership or single proprietorship with the restricted responsibility of a company. This double nature not just streamlines tax prep work but likewise shields personal assets from organization financial debts and obligations. In an LLC, proprietors, referred to as participants, can be individuals, companies, various other LLCs, or perhaps foreign entities, without optimum limit on the variety of members. This inclusivity makes LLCs an attractive choice for a variety of service tasks.

The operational flexibility of an LLC is an additional considerable advantage. Unlike companies, LLCs are not called for to have a board of directors or hold normal board conferences, hence enabling and decreasing administrative burdens for easier decision-making processes. Participants can handle the LLC directly, or they can choose managers to manage the business's day-to-day operations. This can be specifically helpful in scenarios where owners want to be easy investors rather than active managers. In addition, the capability to customize the earnings circulation amongst members-- which need not align with the portion of possession-- provides more versatility and can be customized to fulfill the one-of-a-kind needs of the service and its proprietors.

From a lawful standpoint, forming an LLC generally entails declaring posts of company with the state and paying a declaring charge, which differs by state. As soon as established, it is very important for the LLC to follow continuous state demands such as restoring and filing annual reports company permits. Compliance makes sure that the LLC maintains its great standing and remains to supply liability protection to its participants. In addition, having an LLC can boost a business's integrity with customers, providers, and possible financiers, thereby supporting business's development and security. An LLC serves not just as a kind of business entity but as a calculated device for attaining organization goals effectively and sensibly.

Minimal Liability Companies (LLCs) supply a versatile and beneficial structure for organization owners, combining attributes of both firm and collaboration organizational structures. This crossbreed setup enables LLC proprietors, commonly referred to as participants, to delight in the obligation defense normally afforded to companies, without the strict operational and tax obligation needs linked with them. Essentially, any kind of debts or lawful issues encountered by the organization are usually not passed on to the participants, thus securing their individual possessions. One more considerable advantage of an LLC is the versatility in taxation. Unlike conventional corporations that deal with double taxes-- first on corporate incomes and again on rewards-- LLCs take pleasure in pass-through taxes. This means revenues and losses can be reported on the participants' individual tax obligation returns, therefore preventing double taxes and streamlining the procedure.

The operational flexibility of an LLC is also a notable benefit. Unlike what should i name my jewelry business , which are required to have a board of directors, hold normal meetings, and preserve comprehensive minutes of those conferences, LLCs do not have these rigid needs. Participants can handle business directly, or they can select to appoint managers that might or may not be members themselves. This makes LLCs especially attractive to tiny company proprietors who look for to decrease management burdens while preserving control over service procedures. Furthermore, LLCs are not limited to a details variety of members, giving scalability and simplicity of adding or releasing participants without substantial legal hassles or restructuring.

An additional element where LLCs reveal adaptability is in earnings distribution. Unlike in collaborations where earnings are distributed according to the proportion of ownership or financial investment, LLCs can customize revenue distribution in manner ins which do not necessarily line up with the percentage of possession. This can be specifically valuable in circumstances where participants add in a different way in terms of time, expertise, or sources. Establishing an LLC is usually simple with less documentation and reduced initial prices contrasted to establishing up a corporation, making it an easily accessible alternative for lots of budding entrepreneurs and existing organizations looking to restructure. The formation of an LLC includes filing the Articles of Company with the appropriate state authority, a process that can typically be finished on-line with family member ease.

Comprehending the Framework and Benefits of an LLCWhen considering the structure and benefits of a Minimal Liability Company (LLC), it appears that this organization form is tailored to supply versatility and security for its owners. An LLC distinctively combines the pass-through tax of a partnership or single proprietorship with the limited responsibility of a firm, making it an enticing option for several business owners. Among the key advantages of an LLC is the defense it offers to its participants against personal obligation for service debts and claims. This indicates that in the event of lawsuits or organization failure, the individual properties of the proprietors, such as homes, automobiles, and personal savings, are typically safeguarded. This is not the case with sole proprietorships and collaborations where proprietors can be held directly liable for organization responsibilities. In addition, LLCs are recognized for their operational flexibility. Unlike corporations, which are needed to have formal officers, a board of directors, and normal director and investor meetings, LLCs can be managed by their members or assigned supervisors without these formalities. This makes the LLC specifically useful for small companies that seek simpleness in their functional structure. One more significant benefit of an LLC includes taxation. LLCs take pleasure in a pass-through tax obligation condition, indicating that business's losses and revenues are travelled through to the specific participants' income tax return, consequently avoiding the dual taxation that companies undergo. This can result in considerable tax savings for LLC participants, especially in circumstances where the business tax obligation rates are more than private tax prices. Moreover, the regulatory needs for LLCs are normally less difficult than those for corporations, which might include considerable record-keeping, reporting, and compliance commitments. The loved one ease of establishing and maintaining an LLC, combined with its adaptable administration structure, makes it an ideal lorry for business owners that wish to reduce administrative expenses while still taking advantage of considerable legal protections.

Strategic Benefits and Considerations for Creating an LLCWhen contemplating the development of a Restricted Liability Firm (LLC), it's important to analyze both the strategic advantages and considerations entailed. An LLC, preferred amongst business owners and local business owner, provides an adaptable framework and special benefits that can be critical for company growth and protection. Among the most significant advantages is obligation security. Owners of an LLC, called members, are commonly not directly liable for the company's financial obligations or lawful concerns, meaning individual assets are frequently shielded in the occasion business deals with lawsuits or insolvency. This function is specifically appealing for small to medium-sized ventures that face significant sector threats.

From a tax point of view, LLCs display considerable versatility. Unlike corporations, which undergo dual taxes-- as soon as at the corporate degree and again on returns-- LLCs enjoy pass-through taxes. This implies that organization earnings is just strained once, on the participants' personal income tax return, possibly resulting in reduced total tax liability depending upon the specific tax situations of the participants. Additionally, LLCs permit for the allotment of profits and losses amongst members in manner ins which do not necessarily associate with ownership portions; this can be exceptionally helpful in circumstances where participants add in a different way in terms of capital, experience, or time.

Operationally, LLCs offer a much less inflexible structure compared to firms. They do not need a board of supervisors, investor conferences, or various other formalities typically related to companies. This can result in reduced management overhead and higher simplicity in handling daily procedures, making them optimal for start-ups and smaller sized companies that desire to remain nimble. The capability to establish credibility with possible capitalists, financial institutions, and partners by operating as an LLC should not be underestimated. The official organization framework can make an organization show up even more structured and dependable, which can be vital for drawing in funding and service opportunities.

Forming an LLC is not without its considerations. The procedure entails paperwork and charges that differ by state. click over here has its own regulations and guidelines concerning LLCs, which can affect everything from the configuration fees to the complexity of conformity. It's crucial for possible LLC participants to understand these demands and perhaps look for legal suggestions to browse them efficiently. Additionally, while the pass-through nature of taxation can be beneficial, it can also complicate individual income tax return, requiring more in-depth accountancy and possibly greater accountancy prices.

To conclude, while the choice to develop an LLC includes a number of layers of factor to consider, the advantages usually exceed the disadvantages for lots of business owners. The secret is to meticulously consider just how the unique features of an LLC line up with the certain requirements and objectives of the organization. By leveraging the safety framework, tax benefits, and operational adaptability of an LLC, local business owner can place themselves for lasting growth and success in their respective markets.