Common Misconceptions about ACH Payment Systems Debunked Things To Know Before You Buy

Exploring the Security Features of ACH Payment Systems

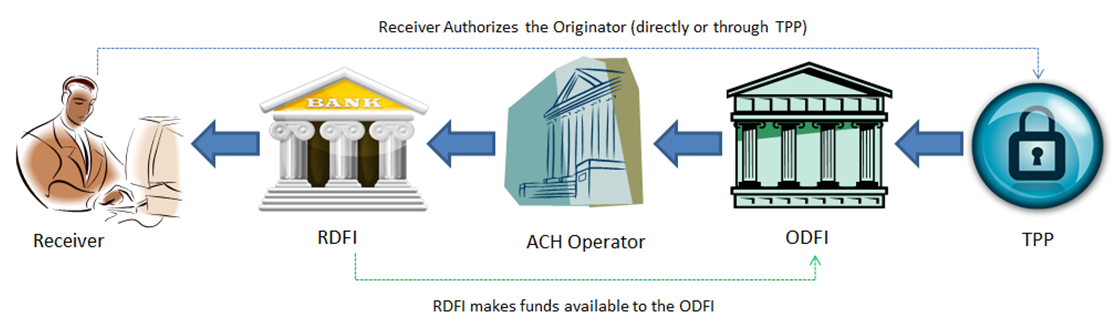

ACH, or Automated Clearing House, is a payment system that allows the digital transactions of funds between monetary organizations. With the rise of internet banking and digital transactions, ACH has become a well-known technique for services and individuals to send out and receive settlements securely. In order to make certain the safety and security and integrity of these transactions, ACH payment bodies integrate numerous surveillance attribute. Permit's look into some of these function in detail.

Shield of encryption:

One of the basic security features in ACH remittance systems is security. Shield of encryption involves rushing record so that it can easily just be reviewed by authorized parties who have the decryption trick. In an ACH transaction, vulnerable information such as bank profile information, path amounts, and purchase volumes are encrypted just before being transmitted over systems or held in data banks. This aids defend against unauthorized gain access to or interception through malicious actors.

Authorization:

Authentication is an additional important protection procedure worked with through ACH settlement bodies. It confirms the identification of individuals prior to making it possible for them accessibility to their accounts or starting a transaction. Popular authentication methods include codes, PINs (Personal Identification Numbers), biometrics (fingerprint or face recognition), and two-factor authentication (demanding both a security password and a verification code sent out to a registered mobile unit). By executing This Piece Covers It Well , ACH remittance units reduce the danger of unwarranted gain access to and identification burglary.

Fraud Monitoring:

To sense deceitful activities in real-time, ACH payment bodies use stylish scams screen devices. These units use innovative formulas to analyze transaction patterns and recognize questionable actions a measure of fraudulent activity. For instance, if an account instantly starts making sizable transactions to strange receivers or if multiple deals occur within a brief duration of time, it may cause an warning for further investigation.

Digital Certificates:

Digital certifications play a critical job in making sure safe interaction between different companies involved in an ACH deal. These certifications are given out through relied on Certificate Authorities (CAs) and serve as digital accreditations that validate the legitimacy and honesty of the parties included. By utilizing digital certificates, ACH remittance devices set up a secure connection between financial organizations, encrypt information in the course of gear box, and protect against unwarranted tampering or interception.

Firewalls and Intrusion Detection Systems:

To defend against outside threats, ACH repayment bodies utilize firewalls and intrusion detection devices (IDS). Firewalls function as a obstacle between inner systems and external systems (such as the world wide web), monitoring incoming and outgoing visitor traffic to shut out unwarranted gain access to or suspicious activities. IDS, on the various other palm, sense possible protection breaches by evaluating system web traffic for known strike designs or unusual actions. Through carrying out these surveillance action, ACH repayment systems fortify their defenses against cyberattacks.

Data Storage Security:

The protection of held data is similarly crucial in ACH settlement bodies. Economic companies that take care of ACH deals need to attach to meticulous record storage requirements to safeguard sensitive details. This includes implementing robust gain access to managements, encrypting held information, regularly backing up information to prevent loss in scenario of device breakdown or information violations, and conducting routine weakness assessments to identify prospective weaknesses.

Regulatory Compliance:

In addition to combining technological protection features, ACH repayment units additionally comply along with several regulative requirements developed by authorities authorizations. These requirements guarantee that financial companies follow market absolute best practices in terms of safety and security protocols and threat administration. Conformity with guidelines such as the Payment Card Industry Data Security Standard (PCI DSS) helps keep a secure setting for processing ACH transactions.

Verdict:

As electronic remittances carry on to grow in popularity, guaranteeing the protection of ACH repayment units comes to be very important. Encryption, verification approaches like codes and biometrics, fraudulence monitoring formulas, electronic certifications for secure interaction, firewalls and intrusion discovery bodies for network defense, strong record storage strategies along with security and data backups are some of the key component that add to helping make ACH remittances risk-free from cyber risks. Through combining these surveillance measures and adhering to regulatory standards, ACH payment bodies deliver a dependable and safe and secure system for administering digital deals.