Cmc Spread Betting Review

🛑 ALL INFORMATION CLICK HERE 👈🏻👈🏻👈🏻

Cmc Spread Betting Review

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider . You should consider whether you understand how spread bets and CFDs work and whether you can afford to take the high risk of losing your money.

You can sell (go short or short sell) if you think the price of an instrument is going to fall You can trade on margin, so you only need to deposit a small percentage of the overall value of the trade to open your position. Remember, this means that your potential return on investment is magnified, as are your potential losses Spread betting profits are tax-free* You can trade on indices, forex, cryptocurrencies, commodities, global shares and treasuries There is no separate commission charge to pay on spread bets You get access to 24-hour markets There is no stamp duty* to pay

Join a trading community committed to your success

Create a relevant trading plan and stick to it Keep emotions aside from your trading Evaluate market analysts’ news and write-ups as part of your analysis Be aware of the macro environment through news outlets Avoid recommendations and tips from unreliable sources, such as internet forums Cut your losses short and let your profits run Test new strategies on your spread betting demo account

Open a spread betting

demo account or

live account .

Accounts can be opened via our website or mobile app. Deposit funds if you have chosen to open a live account.

Research financial instruments to trade. Browse our news and analysis section, and check the insights, market calendar and chart forum platform modules. Live account holders can also access Reuters news and Morningstar fundamental analysis for inspiration.

Go long and 'buy' or go short and 'sell'. Go ahead and ’buy’ the asset if you think the price will rise, or ’sell’ the asset if you think the price will fall.

Follow your spread betting market entry and exit strategy. Based on your trading plan, enter the market at a defined time, and use your risk mitigation strategies like stop-loss orders.

Enter your position size and place your trade. When placing a spread bet, be aware of the full trade value, and don’t forget to add stop-loss and take-profit orders.

Monitor your trade. Keep track of the open trade on your mobile or PC, and close the position as defined in your trading plan.

In this article, we’ll cover the essentials of spread betting , including strategies, tips and examples of a spread bet. This article should guide you towards understanding if spread betting is a suitable trading method for you. Watch the video below to get started.

Spread betting is a tax-efficient* way of speculating on the price movement of thousands of global financial instruments , including spread betting forex , indices, cryptocurrencies, commodities, shares and treasuries. Spread betting is one of the most common ways to trade on price action over several asset classes in the UK and Ireland. Spread betters can trade in both directions (‘buy’ or ‘sell’), and can make use of financial leverage to increase their trade exposure. With a spread betting account, you can choose between trading from home and on-the-go, as our platform is very flexible for traders of all experience levels.

With spread betting trading in the UK, you don't buy or sell the underlying instrument (for example a physical share or commodity). Instead, you place a spread bet based on whether you expect the price of an instrument to go up or down. If you expect the value of a share or commodity to rise, you would open a long position (buy). Conversely, if you expect the share or commodity to fall in value, you would take a short position (sell). You will make a profit or loss based on whether or not the market moves in your chosen direction.

With spread betting, you buy or sell a pre-determined amount per point of movement for the instrument you are trading, such as £5 per point. This is known as your spread bet 'stake' size. This means that for every point that the price of the instrument moves in your favour, you will gain multiples of your stake times the number of points by which the instrument price has moved in your favour. On the other hand, you will lose multiples of your stake for every point the price moves against you. Please note that with spread betting, losses are based on the full value of the position.

The difference between the buy price and sell price is referred to as the spread. As one of the leading providers of spread betting in the UK, we offer consistently competitive spreads. See our range of markets for more information about our spreads.

Spread betting is a leveraged product, which means you only need to deposit a small percentage of the full value of the spread bet in order to open a position (also called trading on margin ). While margined (or leveraged) trading allows you to magnify your returns, losses will also be magnified as they are based on the full value of the position.

Many investors choose to spread bet on the financial markets as there are advantages of spreading betting over buying physical assets:

Before placing your trade, remember to make sure that you have followed risk-management guidelines as part of your strategy.

A spread-betting strategy is a pre-determined plan that helps you to define your market entry and exit points, and accompanying risk-management conditions such as stop-losses. When utilising a trading plan as part of your wider trading strategy, you aim to create a process in which you can monitor and forecast trade outcomes.

When trading with a spread betting account, it’s best practice to outline and follow your own trading strategy template relative to your needs. Strategy templates define a set of rules you should follow for every trade, helping you to remove emotions and irrational responses from your trading strategy. This helps to keep consistency within your trades, and can help improve your trading mindset. Visit our article on creating a trading strategy template , where you can follow an example to help define your strategy.

Every trader utilises different methods and strategies to suit their trading style. There are, however, some common spread betting tips a trader can utilise in order to maximise their trading potential:

It's a good idea to keep up to date with current affairs and news because real-world events often influence market prices. As an example, let's look at the UK government’s help to buy housing scheme.

Many believed that this scheme would boost UK home builders' profitability. Let's say you agreed and decided to place a buy spread bet on Barratt Developments at £10 per point just before the market closed.

Let's say that Barratt Developments was trading at 255 / 256 (where 255 is the sell price and 256 is the buy price). In this example, the spread is 1.

Let's assume that you opened a long position at £10 per point because you thought the price of Barratt Developments would go up. For every point that Barratts' share price moved up or down, you would have netted a profit or loss multiplied by your stake amount.

Let's say your spread betting prediction was correct and Barratt Developments' shares then rose to 306 / 307. You decide to close your buy bet by selling at 306 (the current sell price).

The price has moved 50 points (306 sell price – 256 initial buy price) in your favour. Multiply this by your stake of £10 to calculate your profit, which is £500.

Unfortunately, your spread betting prediction was wrong and the price of Barratt Developments' shares dropped over the next month to 206 / 207. You feel that the price is likely to continue dropping, so to limit your losses you decide to sell at 206 (the current sell price) to close the bet.

The price has moved 50 points (256 – 206) against you. Multiply this by your stake of £10 to calculate your loss, which is £500.

If you're ready to trade, open an account now.

Seamlessly open and close trades, track your progress and set up alerts

Spread betting works by traders speculating on whether a financial instrument’s price will rise or fall. Spread betters can go long (buy) if they believe the price of an asset will go up, or go short (sell) if they believe the market will start a downtrend. Learn more about spread betting .

Spread betting can be profitable, depending on multiple factors, but it’s also possible to make a loss. Most successful traders manage to make profitable trades by following a systematic trading plan, including in-depth fundamental and technical analysis, risk-management systems and several years of applicable knowledge. Try out a spread betting demo account to practise your trading plan.

Is spread betting taxable in the UK?

If you’re a resident in the UK or Ireland, profits from spread betting are free from capital gains tax (CGT). Additionally, spread betting transactions are exempt from stamp duty. Please note tax treatment depends on your circumstances and tax laws are subject to change.

Spread betting providers are regulated by the Financial Conduct Authority (FCA) in the UK. It’s compulsory for all UK spread betting providers to be FCA regulated. Find out more about regulations at CMC Markets .

Losses above are based on the full value of the position. Past performance is not indicative of future performance.

^Prices are taken from our platform. Our prices may not be identical to prices for similar financial instruments in the underlying market.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

Join over 90,000 other committed traders

Complete our straightforward application form and verify your account

Deposit easily via debit card, bank transfer or PayPal

One touch, instant trading available on 9,300+ instruments

CMC Markets UK

133 Houndsditch London EC3A 7BX

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider . You should consider whether you understand how spread bets and CFDs work and whether you can afford to take the high risk of losing your money.

CMC Markets is, depending on the context, a reference to CMC Markets Germany GmbH, CMC Markets UK plc or CMC Spreadbet plc. CMC Markets Germany GmbH is a company licensed and regulated by the Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin) under registration number 154814. CMC Markets UK Plc and CMC Spreadbet plc are registered in the Register of Companies of the Financial Conduct Authority under registration numbers 173730 and 170627.

Telephone calls and online chat conversations may be recorded and monitored. Apple, iPad, and iPhone are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc. Android is a trademark of Google Inc. This website uses cookies to obtain information about your general internet usage. Removal of cookies may affect the operation of certain parts of this website. Learn about cookies and how to remove them. Portions of this page are reproduced from work created and shared by Google and used according to terms described in the Creative Commons 3.0 Attribution License .

This website uses cookies to optimise user experience. You can amend your cookie preferences by accessing our cookie policy .

What is Spread Betting and How Does it Work? | CMC Markets

What is Spread Betting | Online Trading| CMC Markets

Spread Betting UK | Spread Betting Account | CMC Markets

Spread Betting Examples | Learn To Spread Bet | CMC Markets

CMC Markets Spread Betting Reviews - www.cmcmarkets.co.uk | Review Centre

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider . You should consider whether you understand how spread bets and CFDs work and whether you can afford to take the high risk of losing your money.

Home

Spread betting

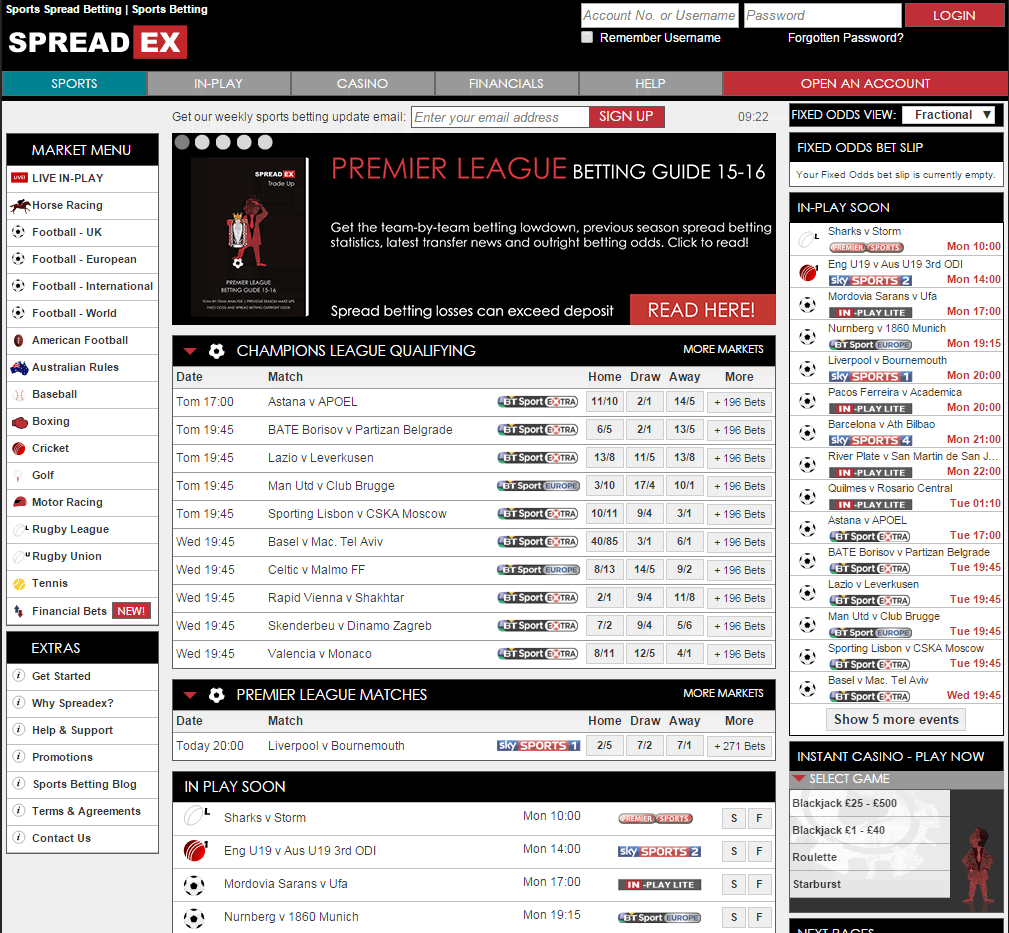

Trade with leverage on forex, indices, shares, commodities and more. Choose from over 10,000 instruments on the industry’s best platform*.

For over 30 years, we’ve been dedicated to creating the best-in-class platform for committed spread betters, with competitive spreads, advanced platform functionality and no dealer intervention regardless of your trading size.

Trade with tight spreads on over 10,000 UK and international markets

Awarded Best Platform Features & Best Mobile/Tablet App*

Our award-winning client services team is online 24/5, whenever you need us

New to spread betting? Learn more

With more forex pairs than anyone else, and a huge range of indices , commodities , shares , ETFs and rates and bonds , as well as our exclusive share baskets , you can find all your favourites in one place.

Use the search box below to find your favourite instruments from over 10,000 markets

Fast execution, precise charting and accurate insights are vital to your success as a trader. Our award-winning platform was built with the successful spread better in mind.

Our charting package ranked highest for charting in the 2019 Investment Trends survey*. Choose from over 115 technical indicators and drawing tools, more than 70 patterns and 12 in-built chart types.

We offer a range of advanced order types, including trailing and guaranteed stop-losses, partial closure, market orders and boundary orders on every trade, so you have the flexibility to trade your way.

Highest Overall Customer Satisfaction

Pay no capital gains tax or stamp duty on profits from spread betting.**

Spread bet on indices 24 hours a day, 5 days a week.

Deposit from just 3.3% of the full value of your position to open a trade.

There’s no cost when opening a live spread betting or CFD account. You can also view prices and use tools such as charts, Reuters news or Morningstar quantitative equity reports, free of charge. However, you will need to deposit funds in your account to place a trade. You can find out more about the costs of placing a trade here

Is CMC Markets regulated by the FCA?

Yes, CMC Markets UK plc (registration number 173730) and CMC Spreadbet plc (registration number 170627) are fully authorised and regulated by the Financial Conduct Authority (FCA) in the UK. Retail client money is held in segregated client bank accounts and money held on behalf of clients is distributed across a range of major banks, which are regularly assessed against our risk criteria.

Is CMC Markets covered by the FSCS?

Yes, your eligible deposits with CMC Markets are protected up to a total of 85,000 by the Financial Services Compensations Scheme (FSCS), the UK's deposit guarantee scheme. If CMC Markets ever went into liquidation, retail clients would have their share of segregated money returned, minus the administrator's costs in handling and distributing these funds. Any shortfall of funds up to 85,000 may be compensated under the FSCS.

How does CMC Markets protect my money?

As a CMC client, your money is held separately from CMC Markets' own funds, so that under property, trust and insolvency law, your money is protected. Therefore your money is unavailable to general creditors of the firm, if the firm fails.

Our automated pricing engine collates and checks thousands of prices per second, streamed from our liquidity providers. The most representative price is then used to create the quotes on our platform. Our pricing on bonds and rates aim to mirror the underlying market.

Learn more

Our income primarily comes from our spreads, while other fees, such as overnight holding costs, make a minor contribution to our overall revenue.

We never aim to profit from our clients' losses. Our aim is to build long-term relationships by providing the best possible trading experience through our technology and customer service.

You can trade on over 10,000 markets when you spread bet with CMC Markets. You can see a list of all our popular markets and instruments here

Find out how to open a spread betting account and start trading with us. Learn about our account opening process, trading platform, funding your account and more. Not sure if spread betting is right for you?

Find out more

What’s the difference between spread betting and share trading?

Spread betting on shares differs from the traditional investment approach of buying and owning shares. One difference is that when spread betting on shares you can utilise leverage, which means you only need to put up a percentage of the full value of the trade. This means any profit or loss you make is magnified, relative to a share’s price fluctuations.

Find out more

Spread betting’s unique benefit is that it is exempt from both capital gains tax and stamp duty**. When compared to conventional share trading and CFD trading, spread betting is the only trading product to offer tax-free trading in the UK and Ireland.

Find out more

Are there any risks to spread betting?

When spread betting, it’s important to understand the risks associated with financial trading in general, as well as the risks that are specific to spread betting. The main risks associated with spread betting relate to trading with leverage, account close-out, market volatility and market gapping.

Learn more

What’s the difference between spread betting and CFD trading?

Spread betting and CFD trading are margined products and can provide similar economic benefits to investments in shares, indices, commodities and currencies.

Find out more

Join 90,000 global traders with CMC – we’re committed to your success

*Awarded No.1 Web-Based Platform, ForexBrokers.com 2020; Best Overall Satisfaction, Best Platform Features, Best Mobile/Tablet App, Best Telephone Customer Service & Best Email Customer Service, rated highest for Charting, based on highest user satisfaction among spread betters, CFD and FX traders, Investment Trends 2019 UK Leverage Trading Report; Best In-House Analysts, Professional Trader Awards 2019.

**Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Get greater control and flexibility for peak performance trading when you're on the go.

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider. You should consider whether you understand how spread bets and CFDs work and whether you can afford to take the high risk of losing your money.

CMC Markets UK plc (173730) and CMC Spreadbet plc (170627) are authorised and regulated by the Financial Conduct Authority in the United Kingdom.

Telephone calls and online chat conversations may be recorded and monitored. Apple, iPad, and iPhone are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc. Android is a trademark of Google Inc. This website uses cookies to obtain information about your general internet usage. Removal of cookies may affect the operation of certain parts of this website. Learn about cookies and how to remove them. Portions of this page are reproduced from work created and shared by Google and used according to terms described in the Creative Commons 3.0 Attribution License.

This website uses cookies to optimise user experience. You can amend your cookie preferences by accessing our cookie policy .

Xhamster Uoi

Vk Com Sperm X

Nest Outdoor

Http Www Nudist

Lingerie Us