City Spread Betting

🛑 ALL INFORMATION CLICK HERE 👈🏻👈🏻👈🏻

City Spread Betting

Spread betting allows traders to bet on the direction of a financial market without actually owning the underlying security. Spread betting is sometimes promoted as a tax-free, commission-free activity that allows investors to speculate in both bull and bear markets, but this remains banned in the U.S. Like stock trades, spread bet risks can be mitigated using stop loss and take profit orders.

Sponsored

Compete Risk Free with $100,000 in Virtual Cash

Put your trading skills to the test with our

FREE Stock Simulator.

Compete with thousands of Investopedia traders and trade your way to the top! Submit trades in a virtual environment before you start risking your own money.

Practice trading strategies

so that when you're ready to enter the real market, you've had the practice you need.

Try our Stock Simulator today >>

Spread betting refers to speculating on the direction of a financial market without actually owning the underlying security.

Forex (FX) is the market where currencies are traded and is a portmanteau of "foreign" and "exchange." Forex also refers to the currencies traded there.

A bear put spread is a bearish options strategy used to profit from a moderate decline in the price of an asset. It involves the simultaneous purchase and sale of puts on the same asset at the same expiration date but at different strike prices, and it carries less risk than outright short-selling.

A cash-and-carry trade is an arbitrage strategy that exploits the mispricing between the underlying asset and its corresponding derivative.

Covered interest arbitrage is a strategy where an investor uses a forward contract to hedge against exchange rate risk. Returns are typically small but it can prove effective.

A bull spread is a bullish options strategy using either two puts or two calls with the same underlying asset and expiration.

#

A

B

C

D

E

F

G

H

I

J

K

L

M

N

O

P

Q

R

S

T

U

V

W

X

Y

Z

Investopedia is part of the Dotdash publishing family.

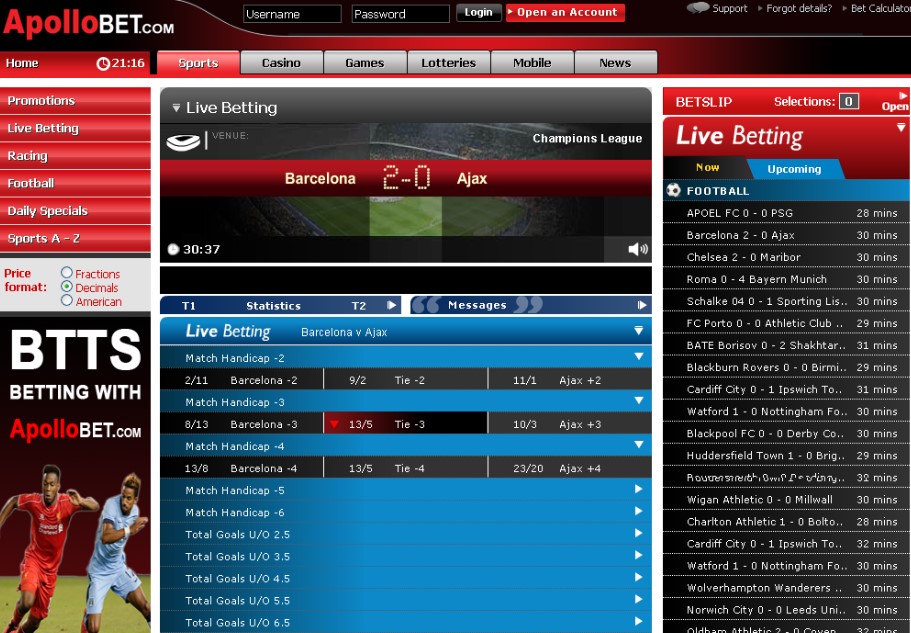

Spread betting is a derivative strategy, in which participants do not own the underlying asset they bet on, such as a stock or commodity. Rather, spread bettors simply speculate on whether the asset's price will rise or fall, using the prices offered to them by a broker.

As in stock market trading, two prices are quoted for spread bets—a price at which you can buy (bid price) and a price at which you can sell (ask price). The difference between the buy and sell price is referred to as the spread. The spread-betting broker profits from this spread, and this allows spread bets to be made without commissions, unlike most securities trades.

Investors align with the bid price if they believe the market will rise and go with the ask if they believe it will fall. Key characteristics of spread betting include the use of leverage, the ability to go both long and short, the wide variety of markets available, and tax benefits.

If spread betting sounds like something you might do in a sports bar, you're not far off. Charles K. McNeil, a mathematics teacher who became a securities analyst—and later a bookmaker—in Chicago during the 1940s has been widely credited with inventing the spread-betting concept. But its origins as an activity for professional financial-industry traders happened roughly 30 years later, on the other side of the Atlantic. A City of London investment banker, Stuart Wheeler, founded a firm named IG Index in 1974, offering spread betting on gold. At the time, the gold market was prohibitively difficult to participate in for many, and spread betting provided an easier way to speculate on it.

Despite its American roots, spread betting is illegal in the United States.

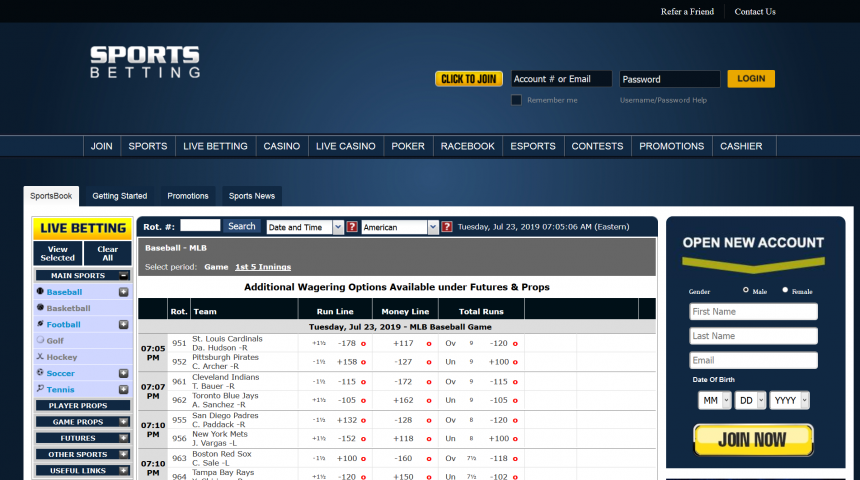

Let's use a practical example to illustrate the pros and cons of this derivative market and the mechanics of placing a bet. First, we'll take an example in the stock market, and then we'll look at an equivalent spread bet.

For our stock market trade, let's assume a purchase of 1,000 shares of Vodafone (LSE: VOD ) at £193.00. The price goes up to £195.00 and the position is closed, capturing a gross profit of £2,000 and having made £2 per share on 1,000 shares. Note here several important points. Without the use of margin, this transaction would have required a large capital outlay of £193k. Also, normally commissions would be charged to enter and exit the stock market trade. Finally, the profit may be subject to capital gains tax and stamp duty.

Now, let's look at a comparable spread bet. Making a spread bet on Vodafone, we'll assume with the bid-offer spread you can buy the bet at £193.00. In making this spread bet, the next step is to decide what amount to commit per "point," the variable that reflects the price move. The value of a point can vary.

In this case, we will assume that one point equals a one pence change, up or down, in the Vodaphone share price. We'll now assume a buy or "up bet" is taken on Vodaphone at a value of £10 per point. The share price of Vodaphone rises from £193.00 to £195.00, as in the stock market example. In this case, the bet captured 200 points, meaning a profit of 200 x £10, or £2,000.

While the gross profit of £2,000 is the same in the two examples, the spread bet differs in that there are usually no commissions incurred to open or close the bet and no stamp duty or capital gains tax due. In the U.K. and some other European countries, the profit from spread betting is free from tax.

However, while spread bettors do not pay commissions, they may suffer from the bid-offer spread, which may be substantially wider than the spread in other markets. Keep in mind also that the bettor has to overcome the spread just to break even on a trade. Generally, the more popular the security traded, the tighter the spread, lowering the entry cost .

In addition to the absence of commissions and taxes, the other major benefit of spread betting is that the required capital outlay is dramatically lower. In the stock market trade, a deposit of as much as £193,000 may have been required to enter the trade. In spread betting, the required deposit amount varies, but for the purpose of this example, we will assume a required 5% deposit. This would have meant that a much smaller £9,650 deposit was required to take on the same amount of market exposure as in the stock market trade.

The use of leverage works both ways, of course, and herein lies the danger of spread betting. As the market moves in your favor, higher returns will be realized; on the other hand, as the market moves against you, you will incur greater losses. While you can quickly make a large amount of money on a relatively small deposit, you can lose it just as fast.

If the price of Vodaphone fell in the above example, the bettor may eventually have been asked to increase the deposit or even have had the position closed out automatically. In such a situation, stock market traders have the advantage of being able to wait out a down move in the market, if they still believe the price is eventually heading higher.

Despite the risk that comes with the use of high leverage, spread betting offers effective tools to limit losses .

Risk can also be mitigated by the use of arbitrage, betting two ways simultaneously.

Arbitrage opportunities arise when the prices of identical financial instruments vary in different markets or among different companies. As a result, the financial instrument can be bought low and sold high simultaneously. An arbitrage transaction takes advantage of these market inefficiencies to gain risk-free returns.

Due to widespread access to information and increased communication, opportunities for arbitrage in spread betting and other financial instruments have been limited. However, spread betting arbitrage can still occur when two companies take separate stances on the market while setting their own spreads.

At the expense of the market maker, an arbitrageur bets on spreads from two different companies. When the top end of a spread offered by one company is below the bottom end of another’s spread, the arbitrageur profits from the gap between the two. Simply put, the trader buys low from one company and sells high in another. Whether the market increases or decreases does not dictate the amount of return.

Many different types of arbitrage exist, allowing for the exploitation of differences in interest rates, currencies, bonds, and stocks, among other securities. While arbitrage is typically associated with risk-less profit, there are in fact risks associated with the practice, including execution , counterparty, and liquidity risks. Failure to complete transactions smoothly can lead to significant losses for the arbitrageur. Likewise, counterparty and liquidity risks can come from the markets or a company’s failure to fulfill a transaction.

Continually developing in sophistication with the advent of electronic markets, spread betting has successfully lowered the barriers to entry and created a vast and varied alternative marketplace.

Arbitrage, in particular, lets investors exploit the difference in prices between two markets, specifically when two companies offer different spreads on identical assets.

The temptation and perils of being overleveraged continue to be a major pitfall in spread betting. However, the low capital outlay necessary, risk management tools available, and tax benefits make spread betting a compelling opportunity for speculators.

Options Trading Strategy & Education

Spread betting - Wikipedia

What Is Spread Betting ?

15 Best Spread Betting Brokers 2021 - Comparebrokers.co

What is Spread Betting and How Does it Work? | IG UK

What is Spread Betting and How Does it Work? | CMC Markets

Top Spread Betting Brokers for 2021 Review by Andrew Blumer

last updated on

January 31, 2021

IC Markets was established in 2007 and is used

by over 60000+ traders. Losses can exceed deposits IC Markets offers Forex, CFDs, Spread Betting, Share dealing, Cryptocurrencies.

Cryptocurrency availability with IC Markets is subject to regulation.

Funding methods

Bank transfer

Credit Card

Paypal

Platforms

MT4, MT5, Mirror Trader, ZuluTrade, Web Trader, cTrader, Mac

Customer support

Live chat Phone support Email support

Account Types

Micro account

Standard account

Islamic account

VIP account

Regulated by Australian Securities and Investments Commission (ASIC), Financial Services Authority (FSA), Cyprus Securities and Exchange Commission (CySEC)

Pepperstone was established in 2010 and is used

by over 10000+ traders. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 79.3% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money Pepperstone offers Forex, CFDs, Social Trading.

Funding methods

Bank transfer

Credit Card

Paypal

Platforms

MT4, MT5, Mac, ZuluTrade, Web Trader, cTrader, Tablet & Mobile apps

Customer support

Live chat Phone support Email support

Account Types

Micro account

Standard account

Islamic account

VIP account

Regulated by Financial Conduct Authority (FCA), Australian Securities and Investments Commission (ASIC), Federal Financial Supervisory Authority (BaFin), Dubai Financial Services Authority (DFSA), Capital Markets Authority of Kenya (CMA), Pepperstone Markets Limited is incorporated in The Bahamas (number 177174 B), Licensed by the Securities Commission of the Bahamas (SCB) number SIA-F217

SpreadEx was established in 1999 and is used

by over 10000+ traders. Losses can exceed deposits SpreadEx offers Forex, CFDs, and spread betting.

Funding methods

Bank transfer

Credit Card

Paypal

Platforms

Web Trader, Tablet & Mobile apps

Customer support

Live chat Phone support Email support

Account Types

Micro account

Standard account

Islamic account

VIP account

Regulated by Financial Conduct Authority (FCA)

City Index was established in 1983 and is used

by over 14000+ traders. 75% of retail investor accounts lose money when trading CFDs with this provider City Index offers Forex, CFDs, Spread Betting.

Funding methods

Bank transfer

Credit Card

Paypal

Platforms

MT4, Web Trader, Tablet & Mobile apps

Customer support

Live chat Phone support Email support

Account Types

Micro account

Standard account

Islamic account

VIP account

Regulated by Financial Conduct Authority (FCA), Australian Securities and Investments Commission (ASIC), Monetary Authority of Singapore (MAS)

Markets.com was established in 2008 and is used

by over 10000+ traders. 84% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Markets.com offers Forex, CFDs and Spread Bets. Spread Bets are only available to UK customers.

Funding methods

Bank transfer

Credit Card

Paypal

Platforms

MT4, MT5, Web Trader, Tablet & Mobile apps

Customer support

Live chat Phone support Email support

Account Types

Micro account

Standard account

Islamic account

VIP account

Regulated by Cyprus Securities and Exchange Commission (CySEC), Financial Sector Conduct Authority (FSCA), Financial Conduct Authority (FCA), Australian Securities and Investments Commission (ASIC)

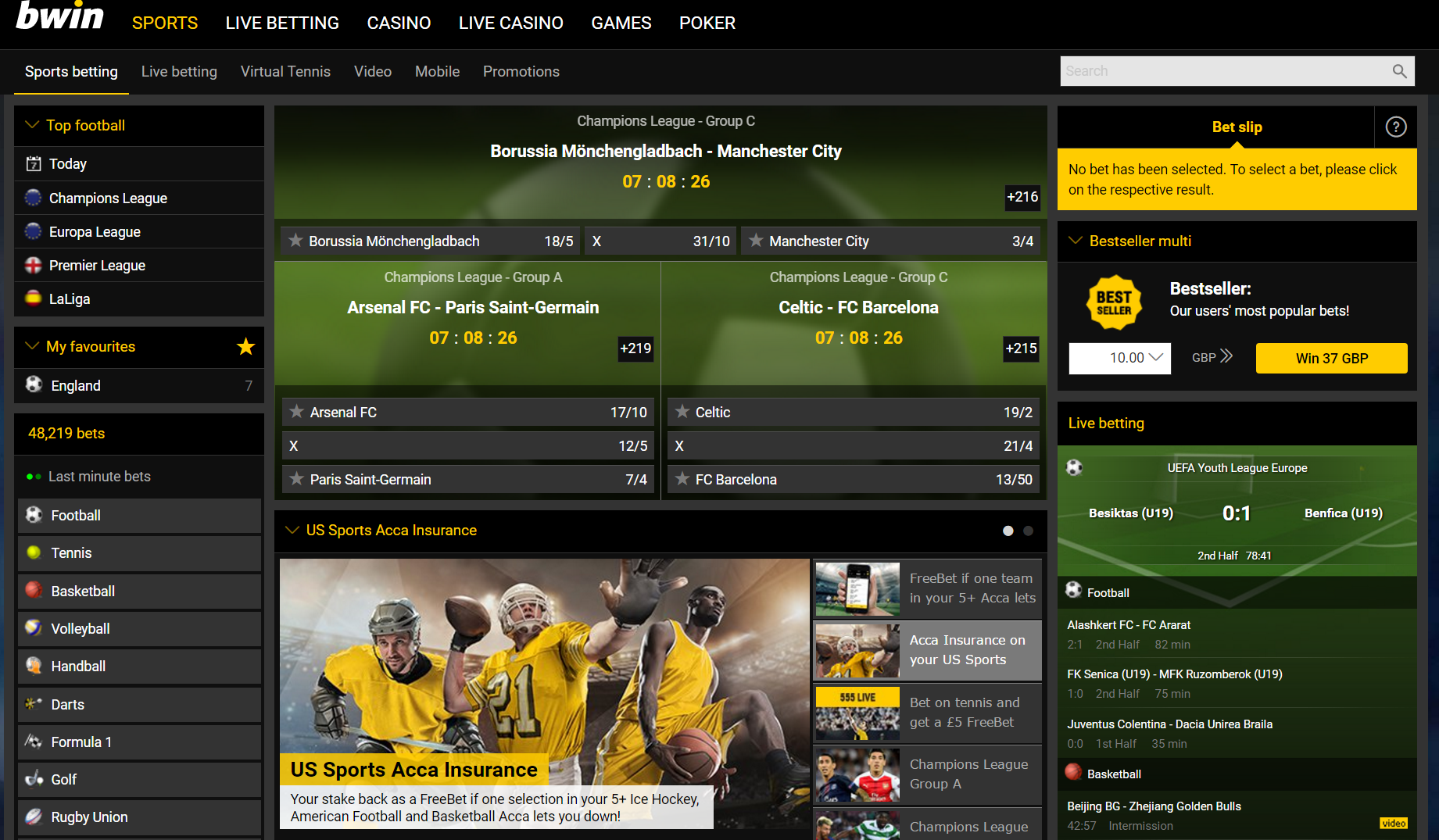

IG was established in 1974 and is used

by over 239000+ traders. Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money. IG offers Forex, CFDs, Spread Betting, Share dealing.

Funding methods

Bank transfer

Credit Card

Paypal

Platforms

MT4, Mac, Web Trader, L2 Dealer, Tablet & Mobile apps

Customer support

Live chat Phone support Email support

Account Types

Micro account

Standard account

Islamic account

VIP account

Regulated by Financial Conduct Authority (FCA), Australian Securities and Investments Commission (ASIC)

AvaTrade was established in 2006 and is used

by over 200000+ traders. 79% of retail investor accounts lose money when trading CFDs with this provider AvaTrade offers Forex, CFDs, Spread Betting, Social Trading.

Funding methods

Bank transfer

Credit Card

Paypal

Platforms

MT4, Mac, Mirror Trader, ZuluTrade, Web Trader, Tablet & Mobile apps

Customer support

Live chat Phone support Email support

Account Types

Micro account

Standard account

Islamic account

VIP account

Regulated by Central Bank of Ireland, Australian Securities and Investments Commission (ASIC), Financial Services Authority (FSA), Financial Stability Board (FSB), British Virgin Islands Financial Services Commission (BVI)

FxPro was established in 2006 and is used

by over 10000+ traders. Your capital is at risk FxPro offers Forex trading, Share Dealing, Spot Indices, Futures, Spot Metals and Spot Energies.

Funding methods

Bank transfer

Credit Card

Paypal

Platforms

MT4, MT5, cTrader, Tablet & Mobile apps

Customer support

Live chat Phone support Email support

Account Types

Micro account

Standard account

Islamic account

VIP account

Regulated by Financial Conduct Authority (FCA), Cyprus Securities and Exchange Commission (CySEC), Financial Sector Conduct Authority (FSCA), Securities Commission of the Bahamas (SCB)

Phoenix Markets was established in 2013 and is used

by over 10000+ traders. Your capital is at risk Phoenix Markets offers Forex trading, CFD trading, Spread Betting, Social trading, Share Dealing.

Funding methods

Bank transfer

Credit Card

Paypal

Platforms

MT4,mac,Android.iPhone/iPad

Customer support

Live chat Phone support Email support

Account Types

Micro account

Standard account

Islamic account

VIP account

Regulated by Cyprus Securities and Exchange Commission (CySEC)

ETFinance was established in 2018 and is used

by over 10000+ traders. Trading leverage products may not be suitable for all traders. 71% of retail CFD accounts lose money. ETFinance offers Forex trading, Spread Betting, Share Dealing.

Funding methods

Bank transfer

Credit Card

Paypal

Customer support

Live chat Phone support Email support

Account Types

Micro account

Standard account

Islamic account

VIP account

Regulated by Cyprus Securities and Exchange Commission (CySEC)

Oinvest was established in 2019 and is used

by over 10000+ traders. Your capital is at risk Oinvest offers Forex trading, Spread Betting, Share Dealing.

Funding methods

Bank transfer

Credit Card

Paypal

Customer support

Live chat Phone support Email support

Account Types

Micro account

Standard account

Islamic account

VIP account

Regulated by Southern African Financial Sector Conduct Authority (FSCA)

We found 11 online brokers that are appropriate for Trading Spread Betting.

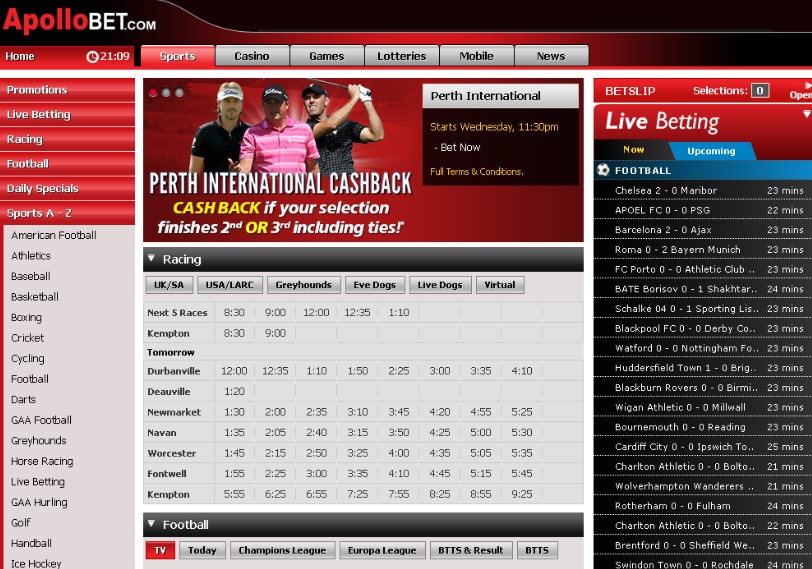

Spread betting is considered a revolution among traders and spread betting brokers play important roles

in helping traders with the perfect speculation on various trading platforms in the financial markets.

Started in the 1970s in the United Kingdom, spread betting is a unique format of trading facilities in which

the risk is directional and available for a wide audience who were earlier not able to take part in major market

moves.

Today, there are several spread betting brokers and with their help you can choose trading in

commodities, bonds, cryptocurrencies, equities, Forex currency pairs and cryptocurrencies.

Some of the best spread betting brokers in the industry

are those who understand MT4 spread betting (the best spread betting platform) and the financial markets

better than most of the experts and experienced traders in the financial market.

They can easily guide traders to take a risk, inform you

with perfection about the major market moves and help in spread betting tax too.

The million-dollar question would arise, how to

choose the best spread betting broker for you.

The first thing to take note of here, while selecting

from the list of spread betting companies is to check whether it is regulated with a regulatory Financial

Conduct

Authority (commonly known as FCA). Regulation

means your investment has a level of protected.

Next check whether the broker is using the MT4

spread betting platform. Look for a broker that offers the MT4 spread betting software as it is the most

popular and most successful one, used by tens of thousands of traders around the world.

Check your broker has a wide range of investment

diversification. This diversifies risk and maximizes your investment opportunities. Make sure your spread

betting broker offers MT4 spread betting on a wide range of indices, equities, commodities and Forex.

The best forex spread betting brokers will take

extreme care in making sure your money is safe. Regulation protects clients funds from the broker becoming

insolvent. All attempts are taken to make trading safe for both clients as well as dealers. Take note here that

all of the top spread betting brokers will always act quickly and work with you to resolve any issues.

While choosing for the spread betting brokers it is suggested to check for the proper regulations. Check

for strict local regulation or regulation in a major EU economy like the UK or Germany. In the United Kingdom,

the Financial Conduct Authority regulates spread better brokers to provide protection to the funds of

clients.

Regulated spread betting brokers are required to keep funds of clients separate from their own. This

prevents the spread betting brokers from withdrawing the money of traders or using utilizing it for the firm's

operational expenses.

Spread betting brokers in the UK are not allowed to offer traders financial advice. They can only advise

on a suitable spread bet. So, they cannot recommend either when to liquidate or when to reap a profit.

If spread betting brokers are found offering financial advice, it means they are not following the FCA

guidelines.

If you are a long-term trader, you can benefit from leverages that spread betting brokers offer. In a simple

definition, it means the brokerage firm lends you capital for trading.

There will be some interest charged on the borrowed capital and it may either be in your favor or else

slash down your profit. So, it is suggested to take a deeper look at the interest policy of the spread betting

brokers.

The deep knowledge and expertise of spread betting brokers play important roles in maximizing

opportunities and diversifying the risk of traders. However, the brokerage firms need to provide spread

betting on Forex currency pairs, commodities, equities, indices and more.

While choosing spread betting brokers it is important to check how good they are in their customer

service. This is an important factor and the broker or any representative should always be available to serve

you. The availability is more required when you quickly need to withdraw from a position or if the trading

platform goes down while you are trading.

It is an important step when choosing the best and most professional spread betting brokers in the

industry. It is suggested to do some research and compare the tools and educational resources your spread

betting brokers are able to offer you. Don't forget to check whether the broker is well regulated by a local

regulatory authority. Check out our spread betting broker comparisons further below this guide.

We've collected thousands of datapoints and written a guide to help you find the best Spread Betting Brokers for you. We hope this guide helps you find a reputable broker that matches what you need.

We list the what we think are the best spread betting brokers below. You can go straight to the broker list here .

There are a number of important factors to consider when picking an online Spread Betting trading brokerage.

Our team have listed brokers that match your criteria for you below. All brokerage data has been summarised into a comparison table. Scroll down .

We compare these features to make it easier for you to make a more informed choice.

Here are the top Spread Betting Brokers.

Compare Spread Betting Brokers min deposits, regulation, headquarters, benefits, funding methods and fees side by side.

All brokers below are spread betting brokers. Learn more about what they offer below.

You can scroll left and right on the comparison table below to see more spread betting brokers that accept spread betting clients

You can compare Spread Betting Brokers ratings, min deposits what the the broker offers, funding methods, platforms, spread types, customer support options,

regulation and account types side by side.

We also have an indepth Top Spread Betting Brokers for 2021 article further below. You can see it now by clicking here

We have listed top Spread betting brokers below.

Spread Betting Brokers Table of Contents

Trading the financial markets with Spread Betting Brokers when conditions are volatile can be difficult, even for experienced traders.

Apart from the educational and other resources made available online, another important factor for traders to consider when looking for Spread Betting Brokers

is the platform that a Spread Betting Brokers offer.

Choose Spread Betting Brokers that's at the forefront of innovation and generally considered an industry-leader.

To gain access to the financial markets, you'll need Spread Betting Brokers that you can rely on.

Follow these five rules for selecting a broker that's right for you:

Look for a broker that has a good track record/longevity in the market so that your strategy is your primary concern for navigating the markets.

The top rated Spread Betting broker is

IC Markets .

Established in 2007, and in operation for 12 years

IC Markets

have a head office in Australia.

IC Markets

is regulated. This means IC Markets are supervised by and is checked for conduct by

Australian Securities and Investments Commission (ASIC), Financial Services Authority (FSA), Cyprus Securities and Exchange Commission (CySEC) regulatory bodies.

Another top rated broker is

Pepperstone .

Pepperstone

was established 2010, and in operation for 8 years

Pepperstone

have a head office in Australia.

Pepperstone

is regulated. This means Pepperstone are supervised by and is checked for conduct by

Australian Securities and Investments Commission (ASIC), Financial Services Authority (FSA), Cyprus Securities and Exchange Commission (CySEC) regulatory bodies.

Choose a broker that's at the forefront of innovation and generally considered an industry-leader.

IC Markets Segregates clients funds and offers over 232 instruments.

IC Markets offers both an online trading platform as well as a mobile platform giving clients easy access to markets.

In addition, IC Markets supports many popular third-party trading platforms enabling access to a

variety of markets worldwide that can be traded with the assistance of expert advisors or a customizable automatic trading strategy.

IC Markets is a world-leader when it comes to innovation and they are always looking at ways to improve

and to maintain their competitive advantage.

Another good choice when looking for Spread Betting Brokers is

Pepperstone .

Pepperstone Segregates clients funds and offers over 100 instruments.

Ensure that your broker is transparent with fees and those dues are competitive.

The best rated Spread Betting broker IC Markets

offers competitive offers for Forex, CFDs, Spread Betting, Share dealing, Cryptocurrencies. IC Markets minimum deposit is 200.

Another top rated Spread Betting broker Pepperstone offers

Forex, CFDs, Social Trading. Pepperstone minimum deposit is 200.

Please note that any cryptocurrency availability with any broker is subject to regulation.

When dealing with Spread Betting Brokers having convenient funding and withdrawl facilities makes the trading process and your trading experience smoother.

Customer service is very important when dealing with Spread Betting Brokers.

When investing and dealing with brokers customer support can be a range of customer services to assist customers in making cost effective and correct use the brokers services.

It can include assistance in installation, training, troubleshooting, upgrading, and cancelation of a product or service.

Spread Betting Brokers customer support can include Phone answering services, Live chat support and Email customer service support.

IC Markets support a wide range of languages including English, Japanese, Chinese, Polish, Afrikans, Danish, Dutch, German and more

Pepperstone support a wide range of languages including English, Spanish, Polish, Chinese, Japanese, Korean, Vietnamese, and Arabic

IC Markets and Pepperstone offer support where clients are able to call or contact the helpdesk via email or a chat service.

Make sure your broker offers free resources like analysis, education and risk-management tools.

With a wealth of knowledge from top analysts, IC Markets and

Pepperstone work together to bring the latest news and insights to traders.

For most traders, the first – and sometimes only – concern is pursuing their 'edge'. While that is surely important,

along with sound money management habits, to navigating the markets; that step alone does not represent the full preparation.

As each trader dives into this important venture, it is important not to forget the most rudimentary yet crucial steps such as

selecting the best broker to access the markets.

A regulated Spread Betting broker lowers your risk.

Broker regulation protects consumers. Too little broker regulation can lead to poor services and possibly financial harm.

Spread Betting brokers are regulated to stop fraud. The agent's working capital and clients funded account have to be separated.

This amounts to fraud if client money is used to conduct the business.

Regulation is required to make sure this does not happen.

The best Spread betting brokers that are regulated are

The best Spread betting broker is IC Markets. We consider

IC Markets one of the best Spread betting brokers because IC Markets is actively

used by over 60000 active traders.

IC Markets ia regulated by tier 1 financial regulators including Australian Securities and Investments Commission (ASIC), Financial Services Authority (FSA), Cyprus Securities and Exchange Commission (CySEC). IC Markets were founded in 2007 and have a headquarters in Australia. You can open a live trading account with IC Markets with as little as a 200 min deposit.

Read our reviews on our Spread Betting Brokers listed above. You can read our indepth Spread Betting Brokers reviews below.

If you feel some of the above Spread Betting Brokers are not quiet what you are looking for or perhaps you would just like to see some alternatives.

See our highly rated list of Spread Betting Brokers alternatives below.

You can read some of our Spread Betting Brokers comparisons.

We compare side by side some of our top rated Spread Betting Brokers .

Read some Spread Betting Brokers VS pages below.

Please note that Comparebrokers.co may have financial relationships with some of the merchants mentioned here and may be compensated

if consumers choose to click the links located throughout the content on this site.

RISK WARNING: Your capital is at risk. Trade with caution,

these products might not be suitable for everyone so make sure you understand the risks involved.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 74-89% of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Some of the links on this websites articles and comparison tables are affiliate links, which means we receive a commission should open an active account.

This does not increase the cost to you for using a broker and is how the site is funded and covers the costs of running this website.

The information contained in this website is for informational purposes only and does not constitute financial advice.

The material does not contain (and should not be construed as containing) investment advice or an investment recommendation, or, an offer of or solicitation for, a transaction in any financial instrument.

Australian Securities and Investments Commission (ASIC), Financial Services Authority (FSA), Cyprus Securities and Exchange Commission (CySEC)

Financial Conduct Authority (FCA), Australian Securities and Investments Commission (ASIC), Federal Financial Supervisory Authority (BaFin), Dubai Financial Services Authority (DFSA), Capital Markets Authority of Kenya (CMA), Pepperstone Markets Limited is incorporated in The Bahamas (number 177174 B), Licensed by the Securities Commission of the Bahamas (SCB) number SIA-F217

Financial Conduct Authority (FCA), Australian Securities and Investments Commission (ASIC), Monetary Authority of Singapore (MAS)

Cyprus Securities and Exchange Commission (CySEC), Financial Sector Conduct Authority (FSCA), Financial Conduct Authority (FCA), Australian Securities and Investments Commission (ASIC)

Financial Conduct Authority (FCA), Australian Securities and Investments Commission (ASIC)

Central Bank of Ireland, Australian Securities and Investments Commission (ASIC), Financial Services Authority (FSA), Financial Stability Board (FSB), British Virgin Islands Financial Services Commission (BVI)

Financial Conduct Authority (FCA), Cyprus Securities and Exchange Commission (CySEC), Financial Sector Conduct Authority (FSCA), Securities Commission of the Bahamas (SCB)

Cyprus Securities and Exchange Commission (CySEC)

Cyprus Securities and Exchange Commission (CySEC)

Southern African Financial Sector Conduct Authority (FSCA)

Bank transfer

Credit Card

Paypal

Bank transfer

Credit Card

Paypal

Bank transfer

Credit Card

Paypal

Bank transfer

Credit Card

Paypal

Bank transfer

Credit Card

Paypal

Bank transfer

Credit Card

Paypal

Bank transfer

Credit Card

Paypal

Bank transfer

Credit Card

Paypal

Bank transfer

Credit Card

Paypal

Bank transfer

Credit Card

Paypal

Bank transfer

Credit Card

Paypal

Allows scalping Allows hedging Low min deposit Offers Negative Balance Protection

Allows scalping Allows hedging Offers STP Low min deposit Offers Negative Balance Protection

Allows scalping Allows hedging Low min deposit Guaranteed stop loss

Allows hedging Offers STP Low min deposit Guaranteed stop loss Offers Negative Balance Protection

Allows scalping Allows hedging Low min deposit Guaranteed stop loss Offers Negative Balance Protection

Allows scalping Allows hedging Offers STP Low min deposit Guaranteed stop loss Offers Negative Balance Protection

Allows scalping Allows hedging Low min deposit

Allows scalping Allows hedging Low min deposit Offers Negative Balance Protection

Allows scalping Allows hedging Low min deposit

Allows scalping Allows hedging Low min deposit

Demo account Mini account Standard account Zero spread account

Raw Spread account

Islamic account

Demo account Mini account Standard account ECN account Islamic account

Demo account Micro account Mini account Standard account Managed account

Demo account Mini account Standard account Islamic account

Demo account Mini account Standard account

Demo account Micro account Mini account Standard account Islamic account

Demo account Mini account Islamic account

Demo account Standard account ECN account Islamic account

Demo account Standard account Islamic account

Demo account Standard account Islamic account

MT4, MT5, Mirror Trader, ZuluTrade, Web Trader, cTrader, Mac

MT4, MT5, Mac, ZuluTrade, Web Trader, cTrader, Tablet & Mobile apps

MT4, Web Trader, Tablet & Mobile apps

MT4, MT5, Web Trader, Tablet & Mobile apps

MT4, Mac, Web Trader, L2 Dealer, Tablet & Mobile apps

MT4, Mac, Mirror Trader, ZuluTrade, Web Trader, Tablet & Mobile apps

MT4, MT5, cTrader, Tablet & Mobile apps

Live chat

Phone support

Email support

Live chat

Phone support

Email support

Live chat

Phone support

Email support

Live chat

Phone support

Email support

Live chat

Phone support

Email support

Live chat

Phone support

Email support

Live chat

Phone support

Email support

Live chat

Phone support

Email support

Live chat

Phone support

Email support

Live chat

Phone support

Email support

Live chat

Phone support

Email support

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 79.3% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money

75% of retail investor accounts lose money when trading CFDs with this provider

84% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

79% of retail investor accounts lose money when trading CFDs with this provider

Trading leverage products may not be suitable for all traders. 71% of retail CFD accounts lose money.

AF, GN, SL, BW, IR, SY, MM, IQ, TG, KH, LS, YE, CI , LR, ZW, CU, LY, TZ, CG, ML, BO, LR, NE, AO, GM, NG, AG, GH, KR, KG, GN, SN, NA

US, CF, TD, CG, CG, CI, CU, GN, ER, GN, FR, GW, HT, IR, IQ, KR, LB, LR, LY, MM, NZ, NG, SL, SO, SD, SY, TM, UZ, VE, EH, YE, ZW

RU, BR, CH, ZA, SG, JP, US, CA, BE, IL, TR, NZ, MY, SY, TH, ID, IR, IQ, HK, PH, PR

BE, CA, IR, JP, KP, US, BA, ET, IQ, UG, VU, YE, AF, LA, TR, SY, IL

Australian Securities and Investments Commission (ASIC), Financial Services Authority (FSA), Cyprus Securities and Exchange Commission (CySEC)

Financial Conduct Authority (FCA), Australian Securities and Investments Commission (ASIC), Federal Financial Supervisory Authority (BaFin), Dubai Financial Services Authority (DFSA), Capital Markets Authority of Kenya (CMA), Pepperstone Markets Limited is incorporated in The Bahamas (number 177174 B), Licensed by the Securities Commission of the Bahamas (SCB) number SIA-F217

Financial Conduct Authority (FCA), Australian Securities and Investments Commission (ASIC), Monetary Authority of Singapore (MAS)

Cyprus Securities and Exchange Commission (CySEC), Financial Sector Conduct Authority (FSCA), Financial Conduct Authority (FCA), Australian Securities and Investments Commission (ASIC)

Financial Conduct Authority (FCA), Australian Securities and Investments Commission (ASIC)

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 79.3% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money

75% of retail investor accounts lose money when trading CFDs with this provider

84% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

MT4, MT5, Mirror Trader, ZuluTrade, Web Trader, cTrader, Mac

MT4, MT5, Mac, ZuluTrade, Web Trader, cTrader, Tablet & Mobile apps

MT4, Web Trader, Tablet & Mobile apps

MT4, MT5, Web Trader, Tablet & Mobile apps

MT4, Mac, Web Trader, L2 Dealer, Tablet & Mobile apps

US, CF, TD, CG, CG, CI, CU, GN, ER, GN, FR, GW, HT, IR, IQ, KR, LB, LR, LY, MM, NZ, NG, SL, SO, SD, SY, TM, UZ, VE, EH, YE, ZW

RU, BR, CH, ZA, SG, JP, US, CA, BE, IL, TR, NZ, MY, SY, TH, ID, IR, IQ, HK, PH, PR

Cryptocurrencies (availability subject to regulation)

Live chat

Phone support

Email support

Live chat

Phone support

Email support

Live chat

Phone support

Email support

Live chat

Phone support

Email support

Live chat

Phone support

Email support

Live chat

Phone support

Email support

English, Japanese, Chinese, Polish, Afrikans, Danish, Dutch, German and more

English, Spanish, Polish, Chinese, Japanese, Korean, Vietnamese, and Arabic

English, Spanish, German, Arabic, Polish, and Chinese

Arabic, Chinese, Dutch, English, French, German, Italian, Japanese, Norwegian, Polish, Romanian, Russian, Spanish, and Turkish

English, French, German, Spanish, and Portuguese

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 79.3% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money

75% of retail investor accounts lose money when trading CFDs with this provider

84% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

Slut Wife Polaroids

Japan Femdom Pee

Dirty Hard Sex

Schoolgirls Sperm

Miss Nudist Video