City Index Spread Betting

⚡ ALL INFORMATION CLICK HERE 👈🏻👈🏻👈🏻

City Index Spread Betting

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Start Spread Betting and pay no UK stamp duty or UK Capital Gains Tax*

Create Account

About Us

StoneX

Partnerships

Affiliates

Press Releases

Careers

Sitemap

Terms and policies

Incisive market analysis into the year ahead - Your Outlook 2021 is now online. Get started by reading: End of the Brexit transition period and Market implications of C19 vaccines .

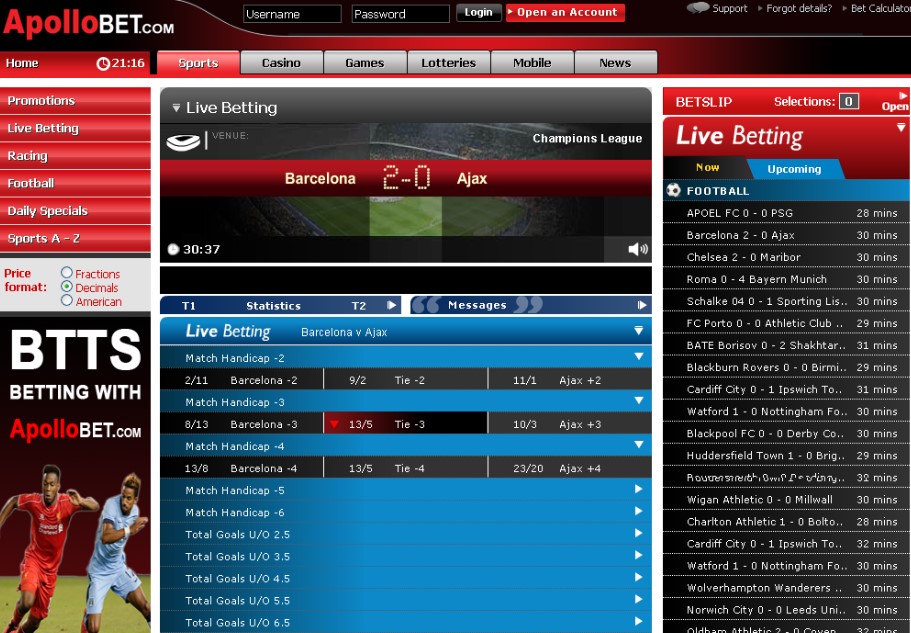

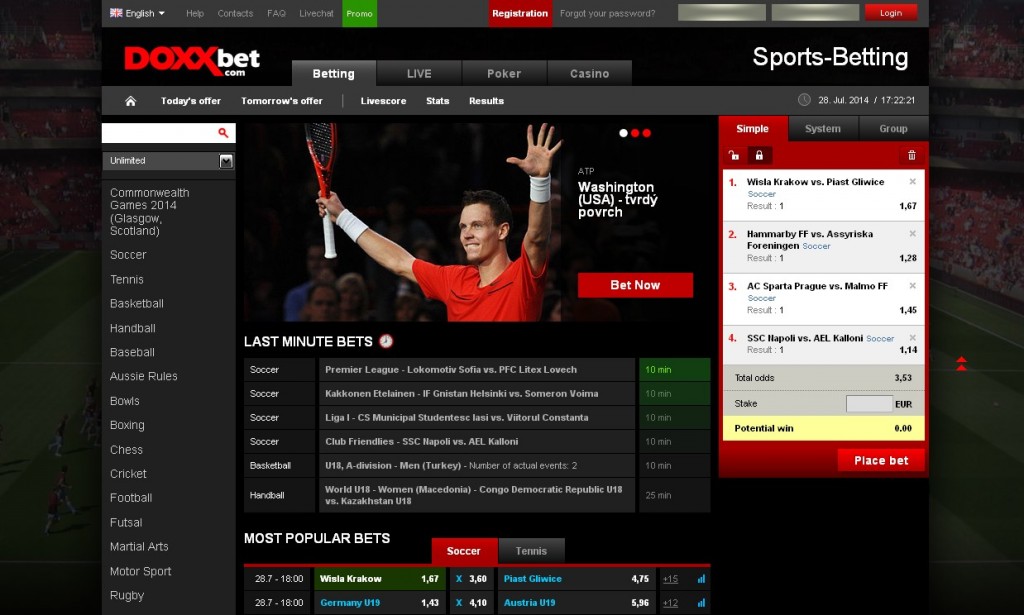

Trading the financial markets is no longer just for city professionals, bankers and brokers.

You can use Spread Betting to speculate on the future direction of market prices, enabling you to potentially profit, irrespective of whether market prices are rising or falling.

Financial Spread Betting allows investors to speculate on price movements in underlying financial markets like Forex, Indices, Shares and Commodities. When you place a financial Spread Bet, you are in essence betting on the performance of an underlying asset and speculating whether the price of that asset will rise or fall. Online financial Spread Betting has lowered the cost of entry and opened up the world of financial markets to more people than ever before.

Choose a market

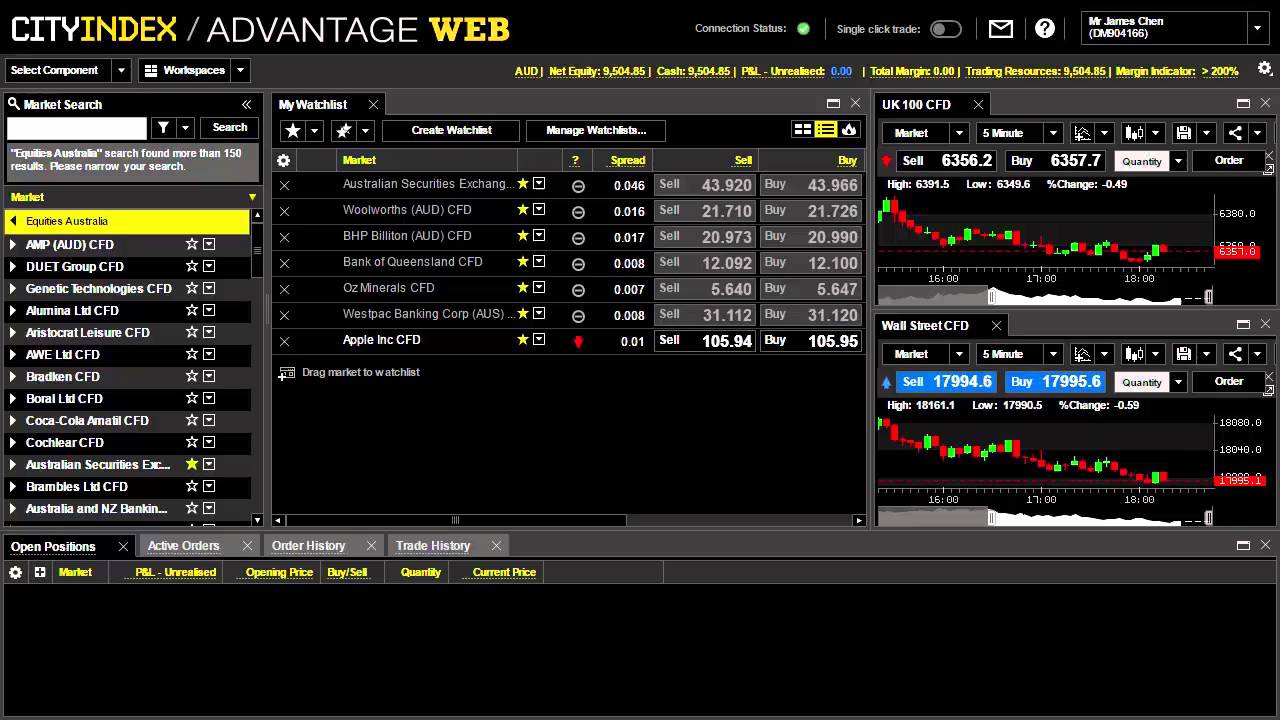

With over 4,000 Spread Betting markets to choose from across indices, shares, FX and commodities, picking a market and trading opportunity that's right for you is important.

City Index's research tools can help you spot trading opportunities that suit your trading style.

Once you have chosen the market you would like to trade on using the search function in the platform or app, it's now time to place your trade. Learn more about spotting trading opportunities .

Decide to buy or sell

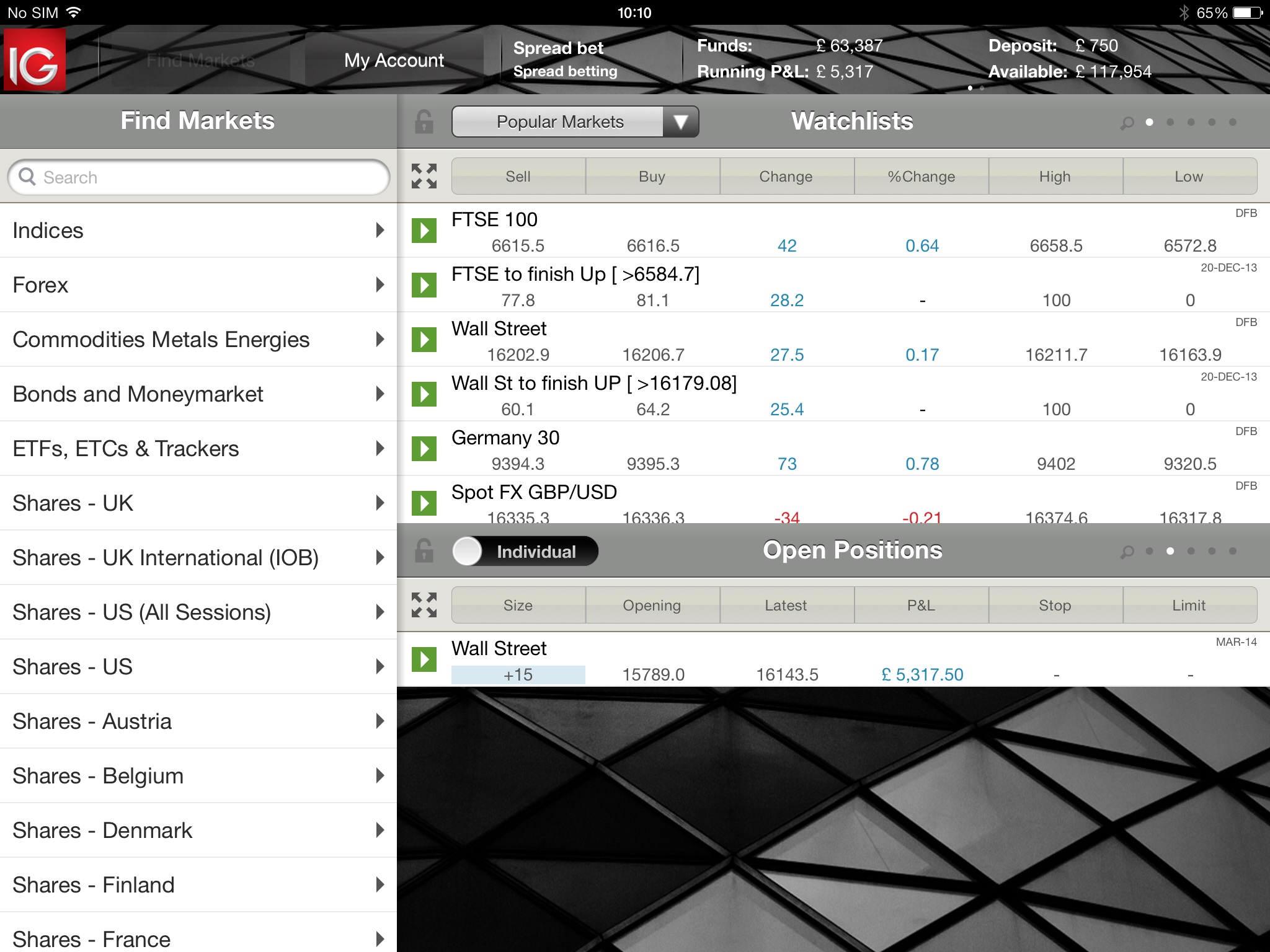

Once you have selected a market, you need to know the current price it is trading at. You can do this by bringing up an order ticket in the platform.

Market prices are always quoted with two figures, a sell and a buy price. The first price is the sell price (known as the bid) and the second price is the buy price (known as the offer). The difference between the buy price and the sell price is known as the spread. In the example below based on the UK 100, the quoted sell price is 6800.5 and the buy price is 6801.5, the difference between the two is 1pt and this reflects the current spread for this market.

Put simply, if you believe a market price will go up, you buy that market (known as going long). If you believe it will fall, you sell the market (going short).

What is a stake size?

When you spread bet you decide how many pounds you wish to stake per point movement of the market you wish to trade. For example, a stake of £5 means for every point the market moves in your favour, you make £5. Conversely, if the market moves against you, you would lose £5 for every point the market moves against you.

Spread Betting is a leveraged product which means that you are only required to initially deposit a small amount of money to place a trade. However, the higher the stake, the more money you need as a deposit (known as margin) to place that trade. It is important therefore that you make sure you have enough funds to place the trade.

For example, if the UK 100 was trading at 6801.5, retail clients would require 5% of margin to open a trade and Professional clients would require 0.25%. The margin requirement is calculated as:

This means that to trade £5 per point on the UK100 you need to have a minimum of £1700.40 in your account. It is also equally important that you have enough funds in your account to help cover any likely price moves for the duration of your trade. Learn more about how margin works .

Adding a stop loss or placing a limit order

An order is an instruction to automatically close your trade at a point in the future when prices reach a specific level predetermined by you. You can utilise stop and limit orders to help ensure that you lock in your profits and minimise your risk when your respective profit and risk targets are reached.

A stop loss order is an instruction to close out a trade at a price worse than the current market level and, as the name suggests, is used to help minimise losses. City Index offer different types of stop loss orders.

A standard stop loss order, once triggered, closes the trade at the best available price. There is a risk therefore that the closing price could be different from the order level if market prices gap.

A guaranteed stop loss however, for which a small premium is charged upon execution, guarantees to close your trade at the stop loss level you have determined, regardless of any market gapping.

A limit order is an instruction to close out a trade at a price that is better than the current market level and is used to help lock in profit targets.

Standard stop losses and limit orders are free to place and can be implemented in the dealing ticket when you first place your trade or attached to a trade after you have opened it. Learn more about risk management .

Closing your trade

When you are ready to close your trade, you need to do the opposite to what you did when you opened your position. Select the 'close position' option within the positions window. By closing the trade, your net open profit and loss will be realised and immediately reflected in your account cash balance.

This will be done for you if your stop loss or limit order is automatically triggered. Of course if you manually close your position your stop loss will be cancelled.

Review the Spread Betting examples to see how Spread Betting works in practice.

View spreads, margins and commissions for City Index products

Take control of your trading with powerful platforms and tools

View upcoming trading opportunities for the weeks ahead

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

We use cookies, and by continuing to use this site or clicking "Agree" you agree to their use. Full details are in our Cookie Policy .

Spread Betting Learn How To Spread Bet With CITY - INDEX

How to Spread Bet | Learn Spread Betting | City Index UK

Online Trading | Forex, Spread Betting & CFD Trading | City Index UK

City Index : Spread Betting , CFD and FX Trading - Apps on Google Play

Spread betting - Wikipedia

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Indices CFD

Share CFD

Forex CFD

Indices CFD

Share CFD

Forex CFD

Pricing delayed by 15 minutes. For live market pricing login

Our powerful technology is designed to suit you, whatever your level of trading expertise

Our research portal highlights trade ideas using fundamental and technical analysis

Follow the markets on native apps built specifically for your smartphone and tablet

Our charts have been designed to help you analyse the markets and identify your next trading opportunity.

Identify trends and trading opportunities through technical analysis with an extensive selection of over 65 indicators.

Identify trends and trading opportunities through technical analysis with an extensive selection of over 65 indicators.

Latest News

Is it time for bears to step in USD/JPY?

February 3, 2021 7:06 PM

Italy seeks to bring Draghi out of retirement, but it can’t help the Euro

February 3, 2021 4:23 PM

US Market Open: Retail trading frenzy comes under scrutiny

February 3, 2021 12:46 PM

Read Latest News

Best Pro Trading Platform

Online Personal Wealth Awards 2020

Best Spread Betting Provider

Shares Awards

2019

Best CFD Provider

ADVFN International Financial Awards 2020

Best Mobile Application

Online Personal Wealth Awards 2019

We will post you a welcome letter with key account information

We will contact you by phone or SMS to introduce our award-winning platform and features

We will email and call you about changes impacting your account, pricing and services

We will email you monthly market news and trends from our expert analysts

About Us

StoneX

Partnerships

Affiliates

Press Releases

Careers

Sitemap

Terms and policies

Incisive market analysis into the year ahead - Your Outlook 2021 is now online. Get started by reading: End of the Brexit transition period and Market implications of C19 vaccines .

Take a position on US tech giants ahead of key data releases this earnings season. Keep track of all the latest by visiting our Tech Stock Hub .

Find out more details, including eligibility criteria, by clicking 'Learn More'.

View the price movements of many markets by embedding multiple charts into your chosen platform layout.

Trade directly from a chart. Your positions, stops and limit orders are displayed on the chart and can be amended by dragging the lines.

Multiple chart types available, including Candlestick, Heikin-Ashi and Point & Figure to allow you to identify trends and key levels.

Use our extensive range of drawing tools including trend lines and Fibonacci retracements to identify key support and resistance levels. Save chart customisations in user profiles and apply to charts.

Compare the relative performance and price action of one or more markets with another, within a single chart.

View the price movements of many markets by embedding multiple charts into your chosen platform layout.

Trade directly from a chart. Your positions, stops and limit orders are displayed on the chart and can be amended by dragging the lines.

Multiple chart types available, including Candlestick, Heikin-Ashi and Point & Figure to allow you to identify trends and key levels.

Use our extensive range of drawing tools including trend lines and Fibonacci retracements to identify key support and resistance levels. Save chart customisations in user profiles and apply to charts.

Compare the relative performance and price action of one or more markets with another, within a single chart.

Available 24 hours Monday-Friday

Local: 0845 355 0801 (local rate)

International: +44 203 194 1801

Email: support@cityindex.co.uk

We provide detailed information about every aspect of our service with ongoing account support for every client.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

We use cookies, and by continuing to use this site or clicking "Agree" you agree to their use. Full details are in our Cookie Policy .

Spread Vk

German Slut Wife

Reverse Riding Porn

Ariana Marie Naughty America

Reality Kings Best

/female-traders.jpg)