Chet Account

👉🏻👉🏻👉🏻 ALL INFORMATION CLICK HERE 👈🏻👈🏻👈🏻

Наша команда разрабатывает ПО вкладывая все свои знания и навыки, которые в свою очередь позволяют нам реализовывать уникальные функции отличающие нас от других.

Наш продукт не оставляет следов использования и не влияет на производительность системы во время работы даже с более чем 1000 онлайна на сервере.

Вы можете принять активное участие в разработке предлагая свои идеи и другие вещи. Мы прислушиваемся к своей аудитории.

Наша служба поддержки поможет решить все возникающие проблемы.

Мы заботимся о состоянии продукта, чтобы предотвратить любые детекты.

За предоставленную функциональность цена значительно ниже чем у конкурентов.

Мы небольшая команда интузиастов, желающие максимально упростить Вам игру. Сделать времяпровождение в различных играх максимально комфортным и приносящим удовольствие!

Это сложный вопрос. Всё зависит от конкретной игры и общего времени работы над софтом. Более подробную информацию о каждом продукте можно увидеть на странице самого ПО.

Если желаемая вами игра в минимальных требованиях поддерживает 32-битную систему Windows - значит и наш софт будет работать :)

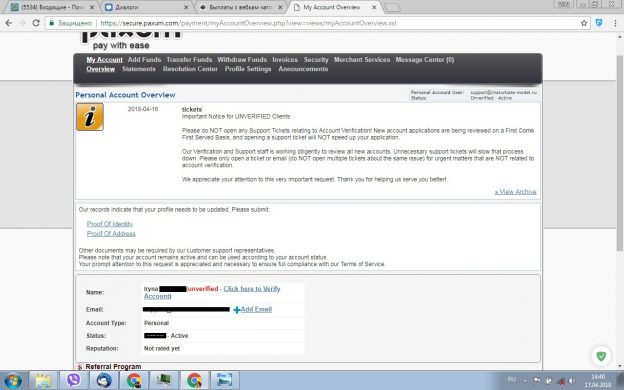

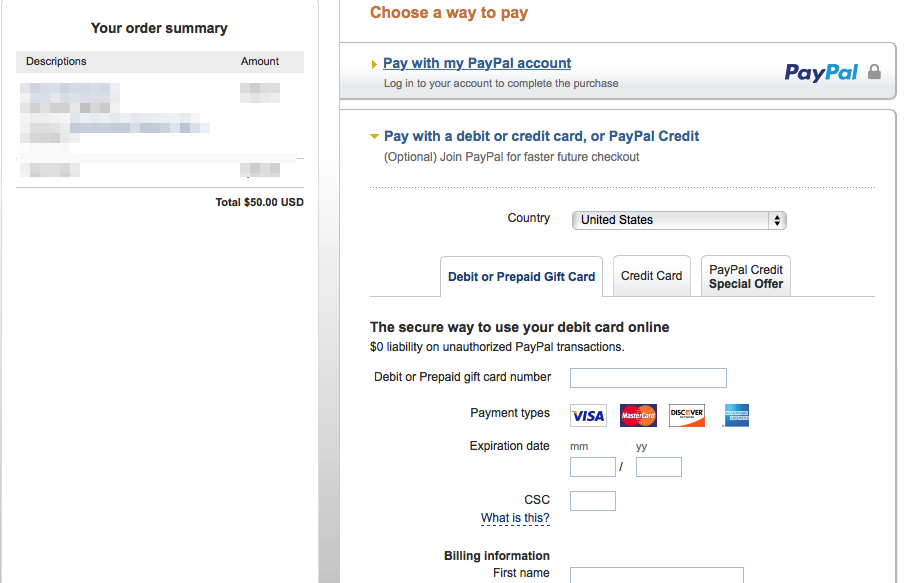

Достаточно просто зарегистрироваться на сайте, выбрать интересующий продукт из списка и следовать инструкциям для его получения.

Наше меню интуитивно понятное. Имеется поддержка нескольких языков. В случае возникновения различных вопросов Вы всегда можете обратиться к нам за помощью.

Нет. У нас действует определённое правило: Один аккаунт = Один ПК.

- За передачу выдаётся блокировка на весь аккаунт.

Эта ошибка возникает вследствии попытки запустить софт на другом ПК, либо в случае переустановки Windows / Смены комплектующих.

- Проблема решается сбросом HWID в своём профиле.

Эта ошибка возникает вследствии использования более одной учётной записи на сайте.

- Проблема решается лично через нас. Напишите в поддержку!

Эта ошибка может возникнуть при включенном Защитнике Windows / Смартскрине или любом другом антивирусе.

- Проблема решается отключением антивируса блокирующего запуск программы.

Никто не может гарантировать 100% защиты от возможных блокировок. Мы стараемся максимально огородить наших пользователей от проблем с обнаружением ПО.

Всё зависит от продукта которым Вы пользуетесь. Вся важная информация написана на странице продукта, а так же в инструкции которая загружается во время скачивания.

© 0xCheats.Net Все торговые марки, скриншоты и логотипы являются собственностью их владельцев.

Important legal information about the email you will be sending. By using this service, you agree to input your real email address and only send it to people you know. It is a violation of law in some jurisdictions to falsely identify yourself in an email. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. The subject line of the email you send will be "Fidelity.com: "

Clicking a link will open a new window.

The Connecticut Higher Education Trust 529 College Savings Program

Connecticut taxpayers could receive a state income tax deduction of up to $10,000 on contributions made to your CHET account.

Use for a wide variety of expenses at any accredited university, college, or vocational school nationwide—and many abroad.

Choose either an age-based strategy or a custom strategy based on your specific investment goals.

No annual account fees or minimums when you open a 529 account.

Call us at 888-799-CHET (2438)

If you need to reach us by phone, we recommend calling while our education planning specialists are available, Monday–Friday from 8 a.m. to 9 p.m. ET.

Learn more about the CHET transition and account activation

About the State of Connecticut and additional programs offered by CHET

Connecticut Office of the Treasurer Shawn T. Wooden

A major goal of the office is to ensure the accessibility of these programs to youth, adults across the generations and underserved populations in the state. Find out more about the state sponsor for this plan.

The Treasurer's efforts working with organizations throughout the state have helped provide programs and assistance that can empower the people of Connecticut with information and training to help them build a better future.

The CHET Baby Scholars program provides up to $250 toward a newborn's future college costs. Learn more

All qualified accounts opened on or after December 1, 2020 will receive their Baby Scholars deposit by April 2021.

CHET is dedicated to helping Connecticut families find ways to afford college. Program details coming soon.

Previous recipients of the CHET Advance Scholarship with questions about their award can contact ISTS Program Support at 855-670-ISTS (4787).

Como Ahorrar Para La Educación Superior (PDF)

Para ayuda en español a tus preguntas acerca del plan, como funciona y las opciones de inversión disponibles, por favor llama al 888-799-2438. Nuestros especialistas en planificación de la educación, con la ayuda de un traductor, están disponibles para asistirte de lunes a viernes de 8 a.m. a 9 p.m. ET.

Abre una cuenta CHET

Descarga una solicitud para abrir una cuenta del plan de ahorros universitarios CHET y un paquete con los datos del plan.

Education planning specialists are available Monday–Friday from 8 a.m. to 9 p.m. ET.

The Connecticut Higher Education Trust (CHET) 529 College Savings Plan - Direct Plan is offered by the Treasurer of the state of Connecticut and managed by Fidelity Investments. If you or the designated beneficiary is not a Connecticut resident, you may want to consider, before investing, whether your state or the beneficiary's home state offers its residents a plan with alternate state tax advantages or other state benefits such as financial aid, scholarship funds and protection from creditors.

Units of the portfolios are municipal securities and may be subject to market volatility and fluctuation.

Please carefully consider the plan's investment objectives, risks, charges, and expenses before investing. For this and other information on any 529 college savings plan managed by Fidelity, contact Fidelity for a free Fact Kit or view one online. Read it carefully before you invest or send money.

* Contributions no longer can be made once the total value of all accounts for the same beneficiary in any Connecticut 529 plan meet the account maximum.

The third-party trademarks and service marks appearing herein are the property of their respective owners.

Fidelity does not provide legal or tax advice. The information herein is general and educational in nature and should not be considered legal or tax advice. Tax laws and regulations are complex and subject to change, which can materially impact investment results. Fidelity cannot guarantee that the information herein is accurate, complete, or timely. Fidelity makes no warranties with regard to such information or results obtained by its use, and disclaims any liability arising out of your use of, or any tax position taken in reliance on, such information. Consult an attorney or tax professional regarding your specific situation.

Locate an Investor Center by ZIP Code

Learn more about the investment options available for your CHET account.

You can change the investment instructions on your future contributions at any time. But under federal tax rules governing 529 plans, you can reallocate your current plan's investments only twice per calendar year or whenever you change beneficiaries, without incurring federal taxes.

Fees vary, depending on your investment strategy:

0.11%–0.20% (Fidelity Index Funds)

0.40%–0.60% (Fidelity Blend)

0.50%–0.99% (Fidelity Funds)

0.05%–0.50% (Bank Deposit Portfolio)

For fee details, please view the plan Fact Kit (PDF), starting on page 26.

View information on the funds' short-term performance since inception date of February 2, 2021 (when the funds were established at Fidelity), or average annual total returns by month or by quarter. Portfolio composition information can currently be viewed in the plan Fact Kit (PDF), starting on page 48. Composition of the portfolio including underlying fund(s) and asset allocations will be available on the web April 15, 2021.

This guide (PDF) provides information about CHET Program investment options, transition mapping, performance details, fees and more.

Visit MSRB.orgOpens in a new window for the most recent annual report.

Money withdrawn from the 529 plan account can be used for a wide range of qualified higher education expenses, such as room and board, tuition, books, and computer equipment.

In addition to college expenses, you can also spend up to $10,000 per year on tuition expenses for elementary, middle, and high school—private, public, or religious.

Effective January 1, 2019 qualified distributions can also include repayment of up to $10,000 in qualified student loans, and expenses for certain apprenticeship programs.

Up to $10,000 over the lifetime of the beneficiary or sibling of the beneficiary.

Any earnings grow federal and Connecticut income tax-deferred.

Contributions are deductible for Connecticut income tax purposes up to $5,000 per year for a single return or $10,000 per year for a joint return. If you exceed this amount, you can carry over the excess amount for the 5 taxable years following the deduction.

Qualified withdrawals are free from both federal and Connecticut income taxes.

Virtual Assistant is Fidelity’s automated natural language search engine to help you find information on the Fidelity.com site. As with any search engine, we ask that you not input personal or account information. Information that you input is not stored or reviewed for any purpose other than to provide search results. Responses provided by the virtual assistant are to help you navigate Fidelity.com and, as with any Internet search engine, you should review the results carefully. Fidelity does not guarantee accuracy of results or suitability of information provided.

Keep in mind that investing involves risk. The value of your investment will fluctuate over time, and you may gain or lose money.

Fidelity does not provide legal or tax advice, and the information provided is general in nature and should not be considered legal or tax advice. Consult an attorney, tax professional, or other advisor regarding your specific legal or tax situation.

Fidelity Brokerage Services LLC, Member NYSE, SIPC, 900 Salem Street, Smithfield, RI 02917

How to use Toan Chet Account - YouTube

0xCheats.Net | Могу ли я использовать один аккаунт на двух ПК?

529 College Savings Plan | Connecticut Higher Education Trust (CHET)

Магазин аккаунтов, игровых вещей и валют популярных игр - Cheat-Master

myaccount.google.com

Girl Licking Pussey

Hot Girls Porno

Neve Cambell Nude Pics

Chet Account